Industry Overview

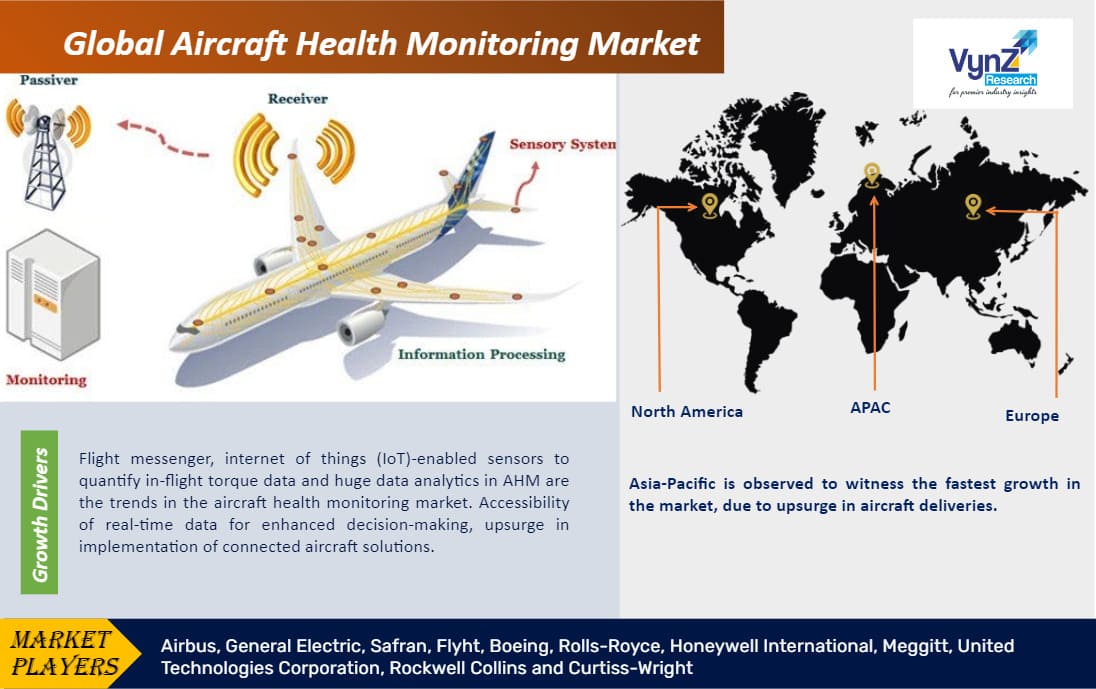

Aircraft Health Monitoring (AHM) is a complete range of tools, and solutions of hardware and software, which executes remote monitoring of aeroplane data. The employment of an AHM system enhances the safety of an aircraft and decreases maintenance and operational costs. The global aircraft health monitoring market is growing at a significant rate, due to an upsurge in implementation of connected aircraft solutions and an escalating number of aviation accidents. Different solutions contributed to the aircraft health monitoring market size. The market has witnessed high demand for hardware due to the amplified implementation of avionics systems, connected aircraft solutions and sensors in an aircraft.

Aircraft Health Monitoring Market Segmentation

Insight by Aircraft Type

On the basis of aircraft type, the aircraft health monitoring market is subdivided into commercial, rotatory wing, business jets and military. Of all aircraft types, the commercial segment is expected to grow at the fastest rate in the market due to an upsurge in aircraft deliveries, mounting disposable income and the budding tourism industry. The commercial segment is further subdivided into narrow body, medium wide body, very large body, regional and small wide body.

Insight by Fit

On the basis of fit, the market is subdivided into linefit and retrofit. Upsurge in retrofit by airlines in the current fleet of aircraft is the factor responsible for the growth of the retrofit. Among the two, the retrofit is expected to grow at a faster rate in the market.

Insight by Installation

On the basis of installation, the market is subdivided into on ground and onboard. Mounting fitting of several health monitoring systems in aircraft such as communication systems, sensors, and flight data management systems, and upsurge in need for highly connected aircraft systems are the factors growing the demand of onboard installation in AHM. Among the all installation, the onboard is expected to grow at fastest rate in the aircraft health monitoring market.

Insight by Operation Time

On the basis of operation time, the market is sub divided into real-time and non-real-time. Mounting requirement for e-enabled connected aircraft is the factor growing the demand of real time segment. Among the all operation time, the real-time segment is expected to grow at fastest rate in the aircraft health monitoring market.

Insight by Solution

On the basis of solution, the market is subdivided into software, services and hardware. Amplified implementation of, avionics systems, connected aircraft solution and sensors in an aircraft are the factors growing the demand of hardware segment in the market. Among the all solution, the hardware segment accounted the largest share in the aircraft health monitoring market.

The hardware segment is further subdivided into avionics, ground servers, sensors, flight data management systems and connected aircraft solutions. In addition, the services segment is further subdivided into flight data monitoring (FDM) and flight health data transmission. Moreover, the software segment is further subdivided into diagnostic flight data analysis, onboard software and prognostic flight data analysis.

Global Aircraft Health Monitoring Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. XX Billion

|

|

Revenue Forecast in 2030

|

U.S.D. XX Billion

|

|

Growth Rate

|

XX%

|

|

Segments Covered in the Report

|

By Aircraft Type, By Fit, By Installation, By Operation Time, and By Solution

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Flight messenger, internet of things (IoT)-enabled sensors to quantify in-flight torque data and huge data analytics in AHM are the trends in the aircraft health monitoring market. Accessibility of real-time data for enhanced decision-making, upsurge in implementation of connected aircraft solutions, upsurge in situational attentiveness and cost-effective maintenance, augmented requirement for alerting & analysis solutions and escalating number of aviation accidents are the primary growth drivers for aircraft health monitoring industry.

Mounting up gradation and replacement of outdated aircraft with innovative generation aircraft, mounting disposable income of middle class, advance in aerospace IT expenditure and usage of wireless sensors in AHMs are also facilitating the growth for the aircraft health monitoring market.

Data bus restrictions, regulatory consent, hazards related with cybersecurity agreement with strict aviation regulations, difficulties in conquering high-quality and precise information from aircraft systems and lack of skilled professionals are the major challenges for the growth of aircraft health monitoring market.

Globally, the manufacturing companies trying to enter the aircraft health monitoring market are required to maintain stringent regulatory standards. Moreover, the high level of capital requirement also poses a major barrier for the entry of new players. This offers an edge to the established players in the industry competition.

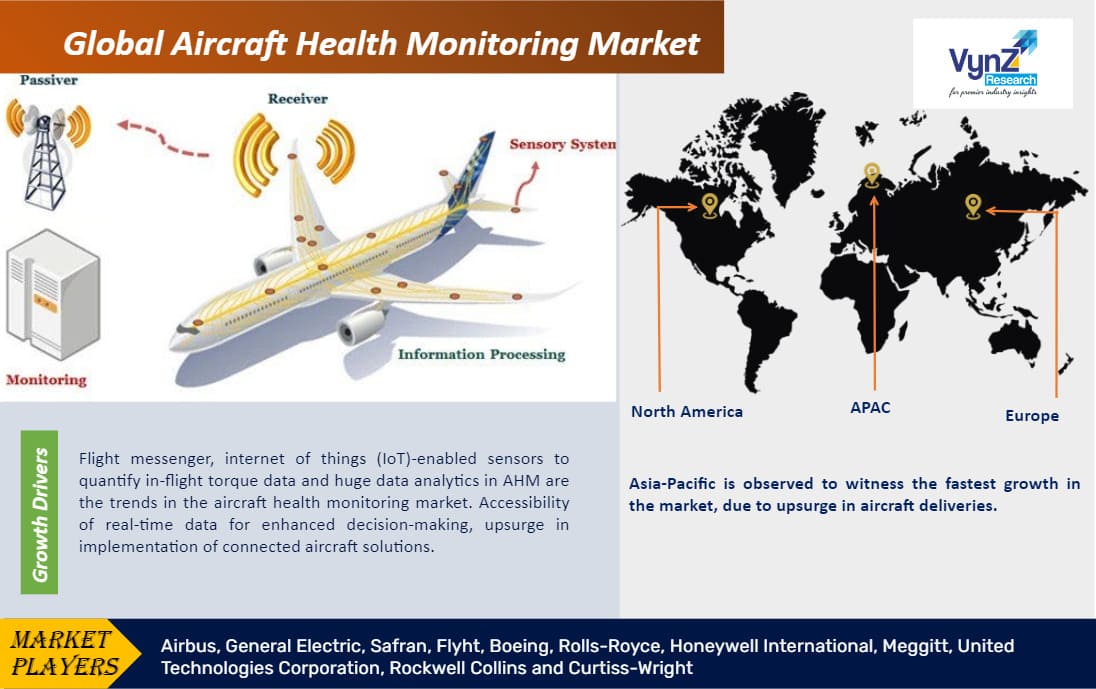

Aircraft Health Monitoring Market Geographic Overview

Geographically, Asia-Pacific is observed to witness the fastest growth in the market, due to upsurge in aircraft deliveries. In addition, mounting military expenditure in countries such as China and India, and mounting disposable income of middle class are also creating a positive impact on the aircraft health monitoring market growth in the region.

Aircraft Health Monitoring Market Competitive Insight

Key players in the aircraft health monitoring market are catering the demand of these devices by investing on technologically advanced products in their product portfolio across the globe.

Recent Developments By the Key Players

Airbus’ S. Fleet Performance + (S.FP+) suite have been selected by Philippine Airlines (PAL) and its subsidiary, PAL Express, to support predictive maintenance and health monitoring across their entire Airbus fleet.

FLYHT Aerospace Solutions Ltd. and One Stop Systems, Inc. collaborated for FLYHT's automated flight information reporting systems (AFIRS™) Edge family, including its new AFIRS Edge+. This partnership ensures that FLYHT has access to OSS's scaled capabilities as it launches the aviation industry's first-to-market 5G-enabled avionics solutions.