| Status : Published | Published On : Apr, 2024 | Report Code : VRAT9194 | Industry : Automotive & Transportation | Available Format :

|

Page : 210 |

Global Automotive Engine Management System Market – Analysis and Forecast (2025-2030)

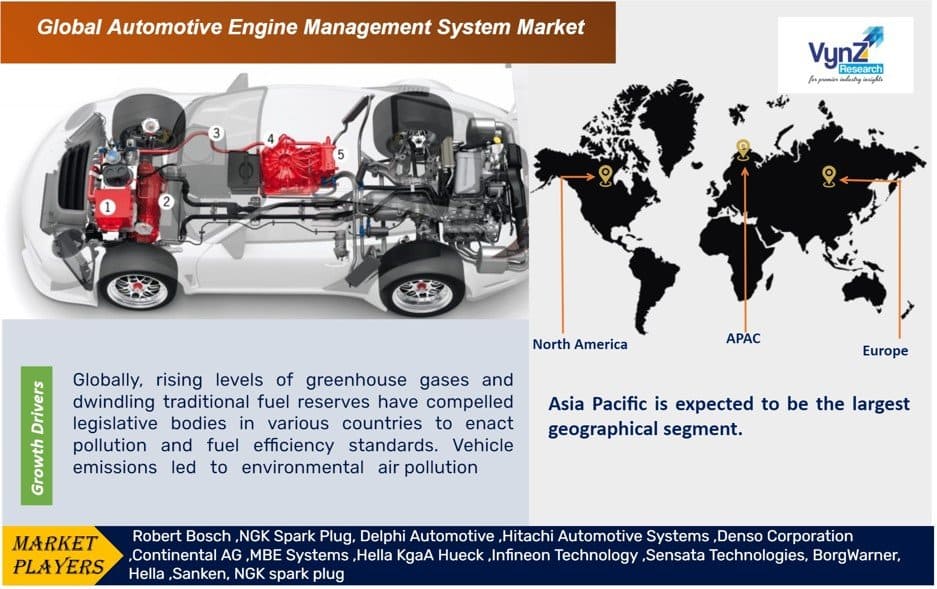

Industry Insights by Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)), by Fuel Type (Diesel, Gasoline) and By Geography (North America, Europe, Asia-Pacific (APAC) and Rest of the World (RoW))

Industry Overview

The Global Automotive Engine Management System Market is expected to rise at a CAGR of 2.7 percent to USD 65.2 billion by 2030, up from USD 59.8 billion in 2023. The introduction of stringent emission norms around the world, as well as increased vehicle production, are driving demand for engine management systems. The ignition timing of the amount of fuel pumped into the car is regulated and adjusted by the automotive engine management system. Sensors that monitor engine speed, intake air and coolant temperature, and oxygen sensors that control emissions make up the system.

Automotive Engine Management System Market Segmentation

By Vehicle Type

• Passenger Cars

• Light Commercial Vehicles (LCV)

• Heavy Commercial Vehicles (HCV)

During the forecast period, the light commercial vehicle segment is expected to be the fastest-growing segment of the automotive engine management system market by vehicle type. Rapid urbanization has created opportunities for new retail and eCommerce platforms, both of which require efficient logistics, resulting in the LCV segment's growth. LCVs are used in a variety of applications, including parcel and postal services, eCommerce, white goods, fruits and vegetables, market loads, and fast-moving consumer goods (FMCG).

By Fuel Type

• Diesel

• Gasoline

The Gasoline automotive engine management system market segment is estimated to grow at the fastest CAGR during the forecast period. Furthermore, the introduction of Euro 6 and EPA Tier 3 standards has forced Original Equipment Manufacturers (OEM) to reduce diesel passenger car demand. EV adoption, on the other hand, is hampered by issues such as reduced battery range and longer charging times. As a result, the market for gasoline passenger cars is expanding, especially in North America and Europe.

By Region

• North America

• Asia Pacific

• Europe

• Middle East & Africa

The automotive engine management system market in the Asia Pacific is expected to be the largest geographical segment. The increase in demand for vehicles, especially premium passenger cars, has accentuated the need for better emission technologies and better engine performance. As a result, in the coming years, the demand for engine management systems in the area is expected to expand significantly.

Automotive Engine Management System Market Trends

As customers become more aware of the emissions and pollution levels, automotive engine management system manufacturers are being pushed to boost fuel efficiency and increase emissions by keeping NOx and CO2 levels under control. Engine management systems use sensors mounted on the vehicle to ensure that specific quantities of fuel are combusted from the engine control unit. Advancement and steady demand for automobiles result in the selling of passenger cars and commercial vehicles fitted with engine management systems. Electronic advances that can handle anything from ignition to fuel delivery in every aspect of pollution control are delivering lower emissions and better efficiency in today's car engines.

Global Automotive Engine Management System Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 59.8 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 65.2 Billion |

|

Growth Rate |

2.7% |

|

Segments Covered in the Report |

By Vehicle Type, By Fuel Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific (APAC) and Rest of the World (RoW) |

Automotive Engine Management System Market Drivers

Globally, rising levels of greenhouse gases and dwindling traditional fuel reserves have compelled legislative bodies in various countries to enact pollution and fuel efficiency standards. Vehicle emissions led to environmental air pollution. According to a report conducted at the Massachusetts Institute of Technology, hazardous vehicle emissions cause approximately 53,000 premature deaths in the United States per year. Vehicles account for 56 percent of carbon monoxide emissions in the United States, according to the US EPA (up to 95 percent in cities).

Governments all over the world have enacted strict fuel emission and fuel efficiency regulations, and duty-bound OEMs are required to comply. OEMs have been working to build better and more reliable engine management systems to reach these standards. The EMS keeps track of the engine's performance by monitoring fuel injection to ensure proper combustion. As a result, the amount of fuel consumed and the number of emissions generated are reduced. Major automakers are working on advanced engine control systems so that cars can run on the least amount of fuel and emit the least number of emissions. Consumers are increasingly interested in buying cars that are environmentally friendly and use less gasoline, which is driving up demand for engine management systems around the world.

Automotive Engine Management System Market Opportunity

With the advent in technology, the lifetime of various vehicles is growing. Any car has a lengthy replacement period. The engine control Electronic Control Unit (ECU) replacement cycle repeats itself. As a result, the consumer must replace the item. The engine control module is very expensive in the aftermarket, which could increase market revenue. As a result, the replacement market has a lot of key players, which helps the industry to grow and generates a lot of opportunities.

Automotive Engine Management System Market Challenges

The increase in emission levels is a major factor in the decline in diesel vehicle sales. As a result, the market for alternative vehicles has risen. Electric buses are being developed in countries such as South Korea, India, and China to reduce pollution and emissions. There has been an increase in the sales of FCEVs and BEVs as a result of increased pollution issues and increased environmental awareness. Since electric vehicles do not need an engine management system, an increase in their sales would have a significant impact on the engine management system.

Automotive Engine Management System Market Competitive Insights

Hitachi Automotive Systems is the leading suppliers of automotive and services. The company designs, manufacturing, development, sales and service of a wide range of automotive equipment, transportation related systems and components along with industrial machine systems and solutions.

Continental develops pioneering technologies and services for sustainable and connected mobility of people and their goods. The company offers safe, intelligent, efficient and affordable solutions for machines, vehicles, traffic and transportation.

Key Players

• Robert Bosch

• NGK Spark Plug

• Delphi Automotive

• Hitachi Automotive Systems

• Denso Corporation

• Continental AG

• MBE Systems

• Hella KgaA Hueck

• Infineon Technology

• Sensata Technologies

• BorgWarner

• Hella

• Sanken

• NGK spark plug

Recent Developments by Key Players

Continental AG shall increase efficiency in research and development in the automotive group sector.

Infineon launches CoolGaN Drive integrated switches and half-bridges with drivers.

The Automotive Engine Management System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Vehicle

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Fuel

- Diesel

- Gasoline

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Engine Management System Market