- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Automotive Seats Market

| Status : Published | Published On : Mar, 2024 | Report Code : VRAT4086 | Industry : Automotive & Transportation | Available Format :

|

Page : 191 |

Global Automotive Seats Market – Analysis and Forecast (2025-2030)

Industry Insights by Seat Type (Bucket, Bench/Split Bench), by Technology (Standard, Powered, Heated, Heated & Memory, Heated & Ventilated, Heated, Ventilated, and Memory), by Trim Material (Fabric, Synthetic Leather, Genuine Leather), by Component (Armrest, Pneumatic system, Seat belt, Seat frame & structure, Seat headrest, Seat height adjuster, Seat recliner, Seat track), by Vehicle (Passenger Car, Light Commercial Vehicle, Truck, Bus), by Off-Highway Vehicle (Construction/Mining Trucks, Agriculture Tractors)

Industry Overview

The Global Size of the Automotive Seat Market is expected to rise from USD 52 billion in 2023 to USD 62 billion by 2030, at a CAGR of 3.3%.

There is a growing demand for high-value or luxury cars among consumers today, which, in turn, raises the demand for high-end sets. Higher disposable income and improved lifestyles of middle-class people in particular drive the demand for luxury cars.

The automotive seats industry is therefore rising in parallel, especially in the developed countries.

Modern automotive seats are better designed and often come with useful features such as comfortable seating, lightweight frames, and climate control. These advanced seats have a significant positive impact on the global automotive seat market.

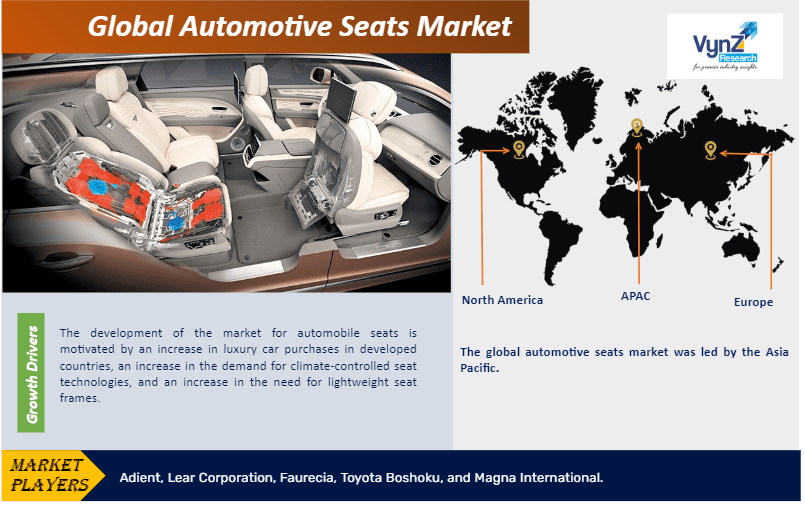

The development of the market for automobile seats is motivated by an increase in luxury car purchases in developed countries, an increase in the demand for climate-controlled seat technologies, and an increase in the need for lightweight seat frames. In addition, factors such as the rise in sales of passenger vehicles due to the improved lifestyle of middle-class families coupled with an increase in disposable income and an increase in demand for features allowed advanced seats to boost the growth of the market for automotive seat market.

Automotive Seats Market Segmentation

By Seat Type

• Bucket

• Bench/Split Bench

According to the seat types, the global automotive seat market is divided into bucket seats, and bench or split bench seats. Out of these two segments, the bucket seats hold a larger market share and are expected to grow significantly during the forecast period in terms of volume due to the growing demand for vehicles.

These seats are more spacious than the bench seats and also have a better appearance. The driver's seat of this type offers a much stronger grip than the bench seats despite being thinner. All these features push this segment higher up.

By Technology

• Standard

• Powered

• Heated

• Heated & Memory

• Heated & Ventilated

• Heated, Ventilated, and Memory

On the basis of technology, the global automotive seat market is divided into standard, powered, heated, heated & memory, heated & ventilated, heated, ventilated, and memory segments. However, it is the regular seat segment that is expected to grow significantly during the forecast period for the global automotive seat industry. The most significant factor that will drive the growth is the affordability of these seats.

By Trim Material

• Fabric

• Synthetic Leather

• Genuine Leather

Based on the trim material, the global automotive seat market is divided into fabric, genuine leather, and synthetic leather. Out of these three segments, it is the synthetic leather segment that is expected to grow quickly at a high CAGR over the forecast period. This is mainly due to the growing concern of people about cruelty to animals to procure leather, especially in the vegan population.

By Component

• Armrest

• Pneumatic system

• Seat belt

• Seat frame & structure

• Seat headrest

• Seat height adjuster

• Seat recliner

• Seat track

According to the different components, the global automotive seat market is divided into armrests, pneumatic systems, seat belts, seat frames & structures, seat headrests, seat height adjusters, seat recliners, and seat tracks. And more. Out of all these segments, the seat frames and structures segment of the global automotive seat market is expected to be the largest and grow significantly during the forecast period. Ideally, the demand for them will grow due to high automotive output and several government policies. Also, the frames play a significant role in making the seats as it is the support for the entire mechanism, the structure, and other elements.

By Vehicle

• Passenger Car

• Light Commercial Vehicle

• Truck

• Bus

Based on vehicle type, the global automotive seat market is divided into passenger cars, light commercial vehicles, trucks, and buses. Out of all these segments, the market share of passenger cars will be substantial during the projected period. This is mainly due to the rise in demand for different types of passenger vehicles, such as mid-range sedans, sedans, and luxury sedans, apart from others. In addition, the growing disposable income among people will also push the growth of this specific segment further during the forecast period which is mainly due to the lucrative prospects for cloth fabrics for passenger vehicles.

The global automotive seat market is also divided into two other specific vehicle types mainly, agricultural tractors, and construction or mining trucks.

Global Automotive Seats Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 52 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 62 Billion |

|

Growth Rate |

3.3% |

|

Segments Covered in the Report |

By Seat Type, By Technology, By Trim Material, By Component, By Vehicle, and By Off-Highway Vehicle |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Latin America and Rest of the World |

Industry Dynamics

Automotive Seats Industry Trends

The growing production across the globe and aggressive pricing of automobiles are the two significant trends noticed in the global automotive seat market, especially in the passenger cars segment. Also, higher disposable income and much-improved road networks in developed countries fuel the rise in demand for passenger cars. Over the projected period, it is also expected that the electric vehicle segment will grow significantly. There is also a significant growth in the demand for MPVs and SUVs all over the world.

All these significantly push the demand for related items of a vehicle such as the seats, upholstery, and others.

Automotive Seats Market Growth Drivers

Production of automobiles has surged over the past couple of years which results in a directly proportional increase in the demand for automotive seats.

The notable improvement in automotive seat design and technology will also drive market growth. This is done to meet the changing consumer preferences for comfortable and ergonomic seats with better features, materials, and customized smart seats for varied cabin configurations.

The rise in demand for premium vehicles also drives market growth due to the growing need for aesthetically pleasing and comfortable seats in these cars.

In addition, there is also a rise in the investment by manufacturers in research and development for incorporating newer and better features in the seats. This not only differentiates their seats but also drives the market growth.

The high standard requirement and stringent government regulations also propel the growth of the market to ensure robust and safe seat structures, airbag compatibility, and efficient restraint systems. These compliance requirements encourage automotive manufacturers to collaborate with seat manufacturers to develop more reliable and safer seating solutions. This induces market growth.

Increasing awareness among consumers about vehicle safety also forces manufacturers to produce more advanced and safer seating systems, thereby stimulating market growth. Also, rapid growth in the electric vehicle (EV) industry that needs seats with unique designs and construction and rising awareness and demand for ergonomic designs according to the seating posture and human anatomy that reduce fatigue and offer spinal support fuels the growth of the global automotive seat market.

Automotive Seats Market Challenges

The gradual change in the manufacturing process by the OEMs to meet the growing need for customized cars in the market may hinder the growth of the global automotive seat market. Also, there do not seem to be adequate cost-effective methods available to meet this demand. It is a significant challenge for manufacturers to design lightweight, comfortable, and technologically advanced seats that will result in fuel and cost efficiency.

However, manufacturers are trying to come up with better solutions to overcome these challenges and are offering and promoting driven, heated, and ventilated applications in mid-end SUVs, and even massage seats in high-end cars.

Automotive Seats Market Opportunities

People are now looking for autonomous cars. Therefore, manufacturers now emphasize advanced driver assistance technologies apart from mobility-on-demand technologies. There is also a growth in the demand for ride-sharing and vehicle-sharing among consumers. All these create more opportunities for growth in the global automotive seat market.

Automotive Seats Market Geographic Overview

The global automotive seat market is divided into Europe, Asia-Pacific, America, Middle East & Africa. Out of these, the Asia-Pacific region is the largest contributor with China contributing to the bulk of it. This trend is expected to continue during the projected period and grow at the highest rate. This is mainly due to the huge market and the significant rise in the demand for passenger vehicles among people with higher disposable income in developing Asia-Pacific countries like China, India, and Japan.

The European market is also expected to grow during the projected period due to the existence of major players and a higher emphasis on safety standards, quality, comfort, and technological features and innovations.

In North America, the automotive seat market will also grow significantly in the forecast period due to the rising need among consumers for spacious and comfortable seating, and better features. The growing emphasis on safety and technological advancements by the manufacturers also propels market growth.

Key Market Players

Some of the key players are Adient, Lear Corporation, Faurecia, Toyota Boshoku, Magna International,

Recent Development by Key Players

Lear Corporation has opened a connection systems plant in Morocco that will manufacture injection moulded parts and engineered plastics for automakers, suppliers and Lear's E-Systems and Seating business units.

The Automotive Seats Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Seat Type

- Bucket

- Bench/Split Bench

- Technology

- Standard

- Powered

- Heated

- Heated & Memory

- Heated & Ventilated

- Heated, Ventilated, and Memory

- Trim Material

- Fabric

- Synthetic Leather

- Genuine Leather

- Component

- Armrest

- Pneumatic system

- Seat belt

- Seat frame & structure

- Seat headrest

- Seat height adjuster

- Seat recliner

- Seat track

- Vehicle

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

- Off-Highway Vehicle

- Construction /Mining Trucks

- Agriculture Tractors

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source:VynZ Research

.png)

Source:VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Seat Type

1.2.2. By Technology

1.2.3. By Trim Material

1.2.4. By Component

1.2.5. By Vehicle

1.2.6. By Off-Highway Vehicle

1.3. Research Phases

1.4. Limitations

1.5. Research Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

4. Global Automotive Seats Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Seat Type

5.1.1. Bucket

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Bench/Split Bench

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Technology

5.2.1. Standard

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Powered

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Heated

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Heated & Memory

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Heated & Ventilated

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.2.6. Heated, Ventilated, and Memory

5.2.6.1. Market Definition

5.2.6.2. Market Estimation and Forecast to 2030

5.3. By Trim Material

5.3.1. Fabric

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Synthetic Leather

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Genuine Leather

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.4. By Component

5.4.1. Armrest

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Pneumatic system

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Seat belt

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Seat frame & structure

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Seat headrest

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Seat height adjuster

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Seat recliner

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

5.4.8. Seat track

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2030

5.5. By Vehicle

5.5.1. Passenger Car

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2030

5.5.2. Light Commercial Vehicle

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2030

5.5.3. Truck

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2030

5.5.4. Bus

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2030

5.6. By Off-Highway Vehicle

5.6.1. Construction /Mining Trucks

5.6.1.1. Market Definition

5.6.1.2. Market Estimation and Forecast to 2030

5.6.2. Agriculture Tractors

5.6.2.1. Market Definition

5.6.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Seat Type

6.2. By Technology

6.3. By Trim Material

6.4. By Component

6.5. By Vehicle

6.6. By Off-Highway Vehicle

6.7. By Country

6.3.1. U.S. Market Estimate and Forecast

6.3.2. Canada Market Estimate and Forecast

6.3.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Seat Type

7.2. By Technology

7.3. By Trim Material

7.4. By Component

7.5. By Vehicle

7.6. By Off-Highway Vehicle

7.7. By Country

7.7.1. Germany Market Estimate and Forecast

7.7.2. France Market Estimate and Forecast

7.7.3. U.K. Market Estimate and Forecast

7.7.4. Italy Market Estimate and Forecast

7.7.5. Spain Market Estimate and Forecast

7.7.6. Russia Market Estimate and Forecast

7.7.7. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Seat Type

8.2. By Technology

8.3. By Trim Material

8.4. By Component

8.5. By Vehicle

8.6. By Off-Highway Vehicle

8.7. By Country

8.7.1. China Market Estimate and Forecast

8.7.2. Japan Market Estimate and Forecast

8.7.3. India Market Estimate and Forecast

8.7.4. South Korea Market Estimate and Forecast

8.7.5. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Seat Type

9.2. By Technology

9.3. By Trim Material

9.4. By Component

9.5. By Vehicle

9.6. By Off-Highway Vehicle

9.7. By Country

9.7.1. Brazil Market Estimate and Forecast

9.7.2. Saudi Arabia Market Estimate and Forecast

9.7.3. South Africa Market Estimate and Forecast

9.7.4. U.A.E. Market Estimate and Forecast

9.7.5. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Adient

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Lear Corporation

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Faurecia

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Toyota Boshoku

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Magna International

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Automotive Seats Market Size, by Seat Type, 2018–2023 (USD Billion)

Table 5 Global Automotive Seats Market Size, by Seat Type, 2025–2030 (USD Billion)

Table 6 Global Automotive Seats Market Size, by Technology, 2018–2023 (USD Billion)

Table 7 Global Automotive Seats Market Size, by Technology, 2025–2030 (USD Billion)

Table 8 Global Automotive Seats Market Size, by Trim Material, 2018–2023 (USD Billion)

Table 9 Global Automotive Seats Market Size, by Trim Material, 2025–2030 (USD Billion)

Table 10 Global Automotive Seats Market Size, by Component, 2018–2023 (USD Billion)

Table 11 Global Automotive Seats Market Size, by Component, 2025–2030 (USD Billion)

Table 12 Global Automotive Seats Market Size, by Vehicle, 2018–2023 (USD Billion)

Table 13 Global Automotive Seats Market Size, by Vehicle, 2025–2030 (USD Billion)

Table 14 Global Automotive Seats Market Size, by Off-Highway Vehicle, 2018–2023 (USD Billion)

Table 15 Global Automotive Seats Market Size, by Off-Highway Vehicle, 2025–2030 (USD Billion)

Table 16 Global Automotive Seats Market Size, by Region, 2018–2023 (USD Billion)

Table 17 Global Automotive Seats Market Size, by Region, 2025–2030 (USD Billion)

Table 18 North America Automotive Seats Market Size, by Seat Type, 2018–2023 (USD Billion)

Table 19 North America Automotive Seats Market Size, by Seat Type, 2025–2030 (USD Billion)

Table 20 North America Automotive Seats Market Size, by Technology, 2018–2023 (USD Billion)

Table 21 North America Automotive Seats Market Size, by Technology, 2025–2030 (USD Billion)

Table 22 North America Automotive Seats Market Size, by Trim Material, 2018–2023 (USD Billion)

Table 23 North America Automotive Seats Market Size, by Trim Material, 2025–2030 (USD Billion)

Table 24 North America Automotive Seats Market Size, by Component, 2018–2023 (USD Billion)

Table 25 North America Automotive Seats Market Size, by Component, 2025–2030 (USD Billion)

Table 26 North America Automotive Seats Market Size, by Vehicle, 2018–2023 (USD Billion)

Table 27 North America Automotive Seats Market Size, by Vehicle, 2025–2030 (USD Billion)

Table 28 North America Automotive Seats Market Size, by Off-Highway Vehicle, 2018–2023 (USD Billion)

Table 29 North America Automotive Seats Market Size, by Off-Highway Vehicle, 2025–2030 (USD Billion)

Table 30 North America Automotive Seats Market Size, by Country, 2018–2023 (USD Billion)

Table 31 North America Automotive Seats Market Size, by Country, 2025–2030 (USD Billion)

Table 32 Europe Automotive Seats Market Size, by Seat Type, 2018–2023 (USD Billion)

Table 33 Europe Automotive Seats Market Size, by Seat Type, 2025–2030 (USD Billion)

Table 34 Europe Automotive Seats Market Size, by Technology, 2018–2023 (USD Billion)

Table 35 Europe Automotive Seats Market Size, by Technology, 2025–2030 (USD Billion)

Table 36 Europe Automotive Seats Market Size, by Trim Material, 2018–2023 (USD Billion)

Table 37 Europe Automotive Seats Market Size, by Trim Material, 2025–2030 (USD Billion)

Table 38 Europe Automotive Seats Market Size, by Component, 2018–2023 (USD Billion)

Table 39 Europe Automotive Seats Market Size, by Component, 2025–2030 (USD Billion)

Table 40 Europe Automotive Seats Market Size, by Vehicle, 2018–2023 (USD Billion)

Table 41 Europe Automotive Seats Market Size, by Vehicle, 2025–2030 (USD Billion)

Table 42 Europe Automotive Seats Market Size, by Off-Highway Vehicle, 2018–2023 (USD Billion)

Table 43 Europe Automotive Seats Market Size, by Off-Highway Vehicle, 2025–2030 (USD Billion)

Table 44 Europe Automotive Seats Market Size, by Country, 2018–2023 (USD Billion)

Table 45 Europe Automotive Seats Market Size, by Country, 2025–2030 (USD Billion)

Table 46 Asia-Pacific Automotive Seats Market Size, by Seat Type, 2018–2023 (USD Billion)

Table 47 Asia-Pacific Automotive Seats Market Size, by Seat Type, 2025–2030 (USD Billion)

Table 48 Asia-Pacific Automotive Seats Market Size, by Technology, 2018–2023 (USD Billion)

Table 49 Asia-Pacific Automotive Seats Market Size, by Technology, 2025–2030 (USD Billion)

Table 50 Asia-Pacific Automotive Seats Market Size, by Trim Material, 2018–2023 (USD Billion)

Table 51 Asia-Pacific Automotive Seats Market Size, by Trim Material, 2025–2030 (USD Billion)

Table 52 Asia-Pacific Automotive Seats Market Size, by Component 2018–2023 (USD Billion)

Table 53 Asia-Pacific Automotive Seats Market Size, by Component, 2025–2030 (USD Billion)

Table 54 Asia-Pacific Automotive Seats Market Size, by Vehicle, 2018–2023 (USD Billion)

Table 55 Asia-Pacific Automotive Seats Market Size, by Vehicle, 2025–2030 (USD Billion)

Table 56 Asia-Pacific Automotive Seats Market Size, by Off-Highway Vehicle, 2018–2023 (USD Billion)

Table 57 Asia-Pacific Automotive Seats Market Size, by Off-Highway Vehicle, 2025–2030 (USD Billion)

Table 58 Asia-Pacific Automotive Seats Market Size, by Country, 2018–2023 (USD Billion)

Table 59 Asia-Pacific Automotive Seats Market Size, by Country, 2025–2030 (USD Billion)

Table 60 RoW Automotive Seats Market Size, by Seat Type, 2018–2023 (USD Billion)

Table 61 RoW Automotive Seats Market Size, by Seat Type, 2025–2030 (USD Billion)

Table 62 RoW Automotive Seats Market Size, by Technology, 2018–2023 (USD Billion)

Table 63 RoW Automotive Seats Market Size, by Technology, 2025–2030 (USD Billion)

Table 64 RoW Automotive Seats Market Size, by Trim Material, 2018–2023 (USD Billion)

Table 65 RoW Automotive Seats Market Size, by Trim Material, 2025–2030 (USD Billion)

Table 66 RoW Automotive Seats Market Size, by Component, 2018–2023 (USD Billion)

Table 67 RoW Automotive Seats Market Size, by Component, 2025–2030 (USD Billion)

Table 68 RoW Automotive Seats Market Size, by Vehicle, 2018–2023 (USD Billion)

Table 69 RoW Automotive Seats Market Size, by Vehicle, 2025–2030 (USD Billion)

Table 70 RoW Automotive Seats Market Size, by Off-Highway Vehicle, 2018–2023 (USD Billion)

Table 71 RoW Automotive Seats Market Size, by Off-Highway Vehicle, 2025–2030 (USD Billion)

Table 72 RoW Automotive Seats Market Size, by Country, 2018–2023 (USD Billion)

Table 73 RoW Automotive Seats Market Size, by Country, 2025–2030 (USD Billion)

Table 74 Snapshot – Adient

Table 75 Snapshot – Lear Corporation

Table 76 Snapshot – Faurecia

Table 77 Snapshot – Toyota Boshoku

Table 78 Snapshot – Magna Internationa

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Executive Summary

Figure 9 Global Automotive Seats Market - Growth Drivers and Restraints

Figure 10 Porte’s Five Forces Analysis

Figure 11 Competitive Benchmark

Figure 12 Global Automotive Seats Market Highlight

Figure 13 Global Automotive Seats Market Size, by Seat Type, 2018 - 2030 (USD Billion)

Figure 14 Global Automotive Seats Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 15 Global Automotive Seats Market Size, by Trim Material, 2018 - 2030 (USD Billion)

Figure 16 Global Automotive Seats Market Size, by Component, 2018 - 2030 (USD Billion)

Figure 17 Global Automotive Seats Market Size, by Vehicle, 2018 - 2030 (USD Billion)

Figure 18 Global Automotive Seats Market Size, by Off-Highway Vehicle, 2018 - 2030 (USD Billion)

Figure 19 Global Automotive Seats Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 20 North America Automotive Seats Market Highlight

Figure 21 North America Automotive Seats Market Size, by Seat Type, 2018 - 2030 (USD Billion)

Figure 22 North America Automotive Seats Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 23 North America Automotive Seats Market Size, by Trim Material, 2018 - 2030 (USD Billion)

Figure 24 North America Automotive Seats Market Size, by Component, 2018 - 2030 (USD Billion)

Figure 25 North America Automotive Seats Market Size, by Vehicle, 2018 - 2030 (USD Billion)

Figure 26 North America Automotive Seats Market Size, by Off-Highway Vehicle, 2018 - 2030 (USD Billion)

Figure 27 North America Automotive Seats Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 28 Europe Automotive Seats Market Highlight

Figure 29 Europe Automotive Seats Market Size, by Seat Type, 2018 - 2030 (USD Billion)

Figure 30 Europe Automotive Seats Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 31 Europe Automotive Seats Market Size, by Trim Material, 2018 - 2030 (USD Billion)

Figure 32 Europe Automotive Seats Market Size, by Component, 2018 - 2030 (USD Billion)

Figure 33 Europe Automotive Seats Market Size, by Vehicle, 2018 - 2030 (USD Billion)

Figure 34 Europe Automotive Seats Market Size, by Off-Highway Vehicle, 2018 - 2030 (USD Billion)

Figure 35 Europe Automotive Seats Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 36 Asia-Pacific Automotive Seats Market Highlight

Figure 37 Asia-Pacific Automotive Seats Market Size, by Seat Type, 2018 - 2030 (USD Billion)

Figure 38 Asia-Pacific Automotive Seats Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 39 Asia-Pacific Automotive Seats Market Size, by Trim Material, 2018 - 2030 (USD Billion)

Figure 40 Asia-Pacific Automotive Seats Market Size, by Component, 2018 - 2030 (USD Billion)

Figure 41 Asia-Pacific Automotive Seats Market Size, by Vehicle, 2018 - 2030 (USD Billion)

Figure 42 Asia-Pacific Automotive Seats Market Size, by Off-Highway Vehicle, 2018 - 2030 (USD Billion)

Figure 43 Asia-Pacific Automotive Seats Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 44 RoW Automotive Seats Market Highlight

Figure 45 RoW Automotive Seats Market Size, by Seat Type, 2018 - 2030 (USD Billion)

Figure 46 RoW Automotive Seats Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 47 RoW Automotive Seats Market Size, by Trim Material, 2018 - 2030 (USD Billion)

Figure 48 RoW Automotive Seats Market Size, by Component, 2018 - 2030 (USD Billion)

Figure 49 RoW Automotive Seats Market Size, by Vehicle, 2018 - 2030 (USD Billion)

Figure 50 RoW Automotive Seats Market Size, by Off-Highway Vehicle, 2018 - 2030 (USD Billion)

Figure 51 RoW Automotive Seats Market Size, by Country, 2018 - 2030 (USD Billion)

Global Automotive Seats Market Coverage

Seat Type Insight and Forecast 2025 - 2030

- Bucket

- Bench/Split Bench

Technology Insight and Forecast 2025 - 2030

- Standard

- Powered

- Heated

- Heated & Memory

- Heated & Ventilated

- Heated, Ventilated, and Memory

Trim Material Insight and Forecast 2025 - 2030

- Fabric

- Synthetic Leather

- Genuine Leather

Component Insight and Forecast 2025 - 2030

- Armrest

- Pneumatic system

- Seat belt

- Seat frame & structure

- Seat headrest

- Seat height adjuster

- Seat recliner

- Seat track

Vehicle Insight and Forecast 2025 - 2030

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

Off-Highway Vehicle Insight and Forecast 2025 - 2030

- Construction /Mining Trucks

- Agriculture Tractors

Geographical Segmentation

Global Automotive Seats Market by Region

North America

- By Seat Type

- By Technology

- By Trim Material

- By Component

- By Vehicle

- By Off-Highway Vehicle

- By Country – U.S., Canada, and Mexico

Europe

- By Seat Type

- By Technology

- By Trim Material

- By Component

- By Vehicle

- By Off-Highway Vehicle

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Seat Type

- By Technology

- By Trim Material

- By Component

- By Vehicle

- By Off-Highway Vehicle

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Seat Type

- By Technology

- By Trim Material

- By Component

- By Vehicle

- By Off-Highway Vehicle

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countriesr Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Adient

- Lear Corporation

- Faurecia

- Toyota Boshoku

- Magna Internationa

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Automotive Seats Market – Analysis and Forecast (2025-2030)

- The global automotive seat market, valued at USD 52 billion is forecasted to reach USD 62 billion by 2030, with a CAGR of 3.3%.

- Segmented by seat types into bucket seats and bench/split bench seats, with bucket seats expected to grow significantly due to their better appearance and grip. Technology division includes standard, powered, heated, memory, ventilated, and more, with the regular seat segment anticipated to grow due to affordability. Trim material segmented into fabric, genuine leather, and synthetic leather, with synthetic leather projected to grow rapidly due to concerns over animal cruelty. Vehicle type division includes passenger cars, light commercial vehicles, trucks, and buses, with passenger cars expected to dominate due to rising demand and disposable income.

- Increased automobile production, advancements in design and technology catering to consumer preferences for comfort and ergonomics, demand for premium vehicles, investment in R&D by manufacturers to incorporate newer features. stringent safety regulations, growing consumer awareness about vehicle safety, rapid growth in the electric vehicle industry, and rising demand for ergonomic designs fuel market expansion.

- OEMs adapting manufacturing processes to meet demand for customized cars pose challenges, but advancements like heated and ventilated applications offer opportunities. Growing demand for autonomous cars and ride-sharing creates further growth opportunities in the automotive seat market.

- Asia-Pacific, led by China, is the largest contributor to the global automotive seat market, driven by rising demand for passenger vehicles. Europe and North America also expected to grow significantly due to the presence of major players and emphasis on safety standards and technological innovations.