- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Automotive Suspension Market

| Status : Published | Published On : Mar, 2024 | Report Code : VRAT9628 | Industry : Automotive & Transportation | Available Format :

|

Page : 194 |

Automotive Suspension Market – Analysis and Forecast (2025-2030)

Industry Insights By Vehicle Type (Passenger Cars, Two-Wheelers, Electric Vehicles and Commercial Vehicles), By Suspension (Air Suspension, Hydraulic Suspension and Electromagnetic Suspension), By System (Active System, Semi Active and Passive system), By OE Component (Air Spring, Shock, Struts, Control Arms, Air Compressor, Leaf Spring, Dampener and Ball Joint), By Distribution Channel (OEM and Aftermarket) and By Geography (North America, Asia-Pacific, Europe and Rest of the World)

Industry Overview

Global Automotive Suspension Market is projected from USD 47.6 billion in 2023 to be USD 74.8 billion by 2030 with a CAGR of 2.9 % during the forecast period 2025 - 2030.

Elastic cushion like members which are fitted into the portion of an automotive vehicle to save from the impact of road irregularities is known as automobile suspension. The suspended portion consists of struts, ball joints, control arms, shock absorbers and springs. Comfort, steering stability and good handling of car ride is mainly based on the suspensions. The vehicle is protected from damage by suspension system which further provides isolation to the vehicle from high-frequency vibrations. There is crucial need for ambulance suspension to prevent injury to the ill passengers. Driving comfort is maintained only because of use of the automotive suspension which indirectly support in the growth of the global automotive suspension market.

Market Segmentation

Insight by Vehicle type

Based on vehicle type, the Automotive Suspension Market is segregated into Passenger Cars, Two-Wheelers, Electric Vehicles and Commercial Vehicles. The passenger cars segment is projected to dominate the market share with the highest CAGR during the forecast period due to its seating capacity of nine people at a time.

Insight by Suspension

The Automotive Suspension Market is segmented by suspension type as Air, Hydraulic and Electromagnetic Suspension. The hydraulic segment is to dominate the market as these systems are widely employed in the global automotive industry.

Insight by System

On the basis of system, the Automotive Suspension Market is segregated into Active System, Semi Active and Passive system. Passive suspension segment is anticipated to dominate the automotive suspension market as the properties of the components are fixed compared to active and semi-active systems.

Insight by OE Component

Based on OE component, the Automotive Suspension Market is segmented into Air Spring, Shock, Struts, Control Arms, Air Compressor, Leaf Spring, Dampener and Ball Joint. The air spring segment dominated the market as its role is to bear the load of an air suspension system of buses, cars and machinery.

Insight by Distribution Channel

The Automotive Suspension Market is segmented by distribution channel as OEM and Aftermarket. The OEM segment is anticipated to dominate the market as this segment can customize designs frequently whenever demanded by the customers.

Global Automotive Suspension Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 47.6 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 74.8 Billion |

|

Growth Rate |

2.9% |

|

Segments Covered in the Report |

By Vehicle Type, By Suspension, By System, By OE Component and By Distribution Channel |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia-Pacific, Europe and Rest of the World |

Industry Dynamics

Growth Drivers

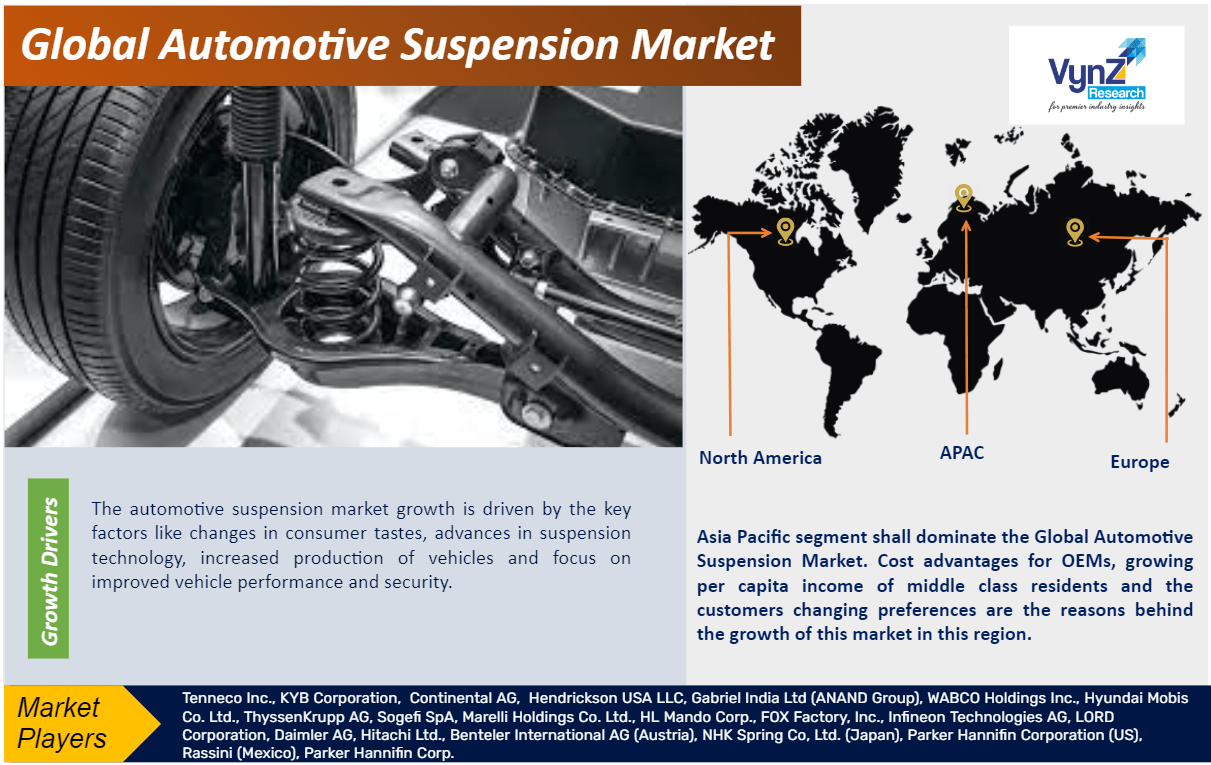

There is a growing trend to use higher quality materials and technologies which make driving more comfortable and flexible. These advancements have not only improved vehicle quality but also contribute to lower the consumption of fuel and emissions for better environment concerns and regulations. The automotive suspension market growth is driven by the key factors like changes in consumer tastes, advances in suspension technology, increased production of vehicles and focus on improved vehicle performance and security. Moreover, people move to cities, which has led to increased road congestion and the need for vehicles with improved suspension systems to ensure a comfortable and safe ride. Advanced technology and materials are used in order to provide a personalized and healthier driving experience. The sale of luxury cars is projected to increase due to advancement in vehicle technology and growth in the economy.

Restraint

Installation of new and suspension systems with advancement has lead to the high cost that shall hinder the growth of the automotive suspension market. Additional expenses are to be paid by consumers in the form of applications, hardware and telecom service charges that limits growth of automotive suspension due to the finest features in vehicles provided. Life of vehicles is reduced by the complex structure of systems. Hence due to complex structure and soaring initial cost the growth of the global automotive suspension market shall be hampered.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World

Geographically, Asia Pacific segment shall dominate the Global Automotive Suspension Market. Cost advantages for OEMs, growing per capita income of middle class residents and the customers changing preferences are the reasons behind the growth of this market in this region. As the automotive OEMs are present in this region with higher vehicle sales, a huge amount of vehicle production capacity and outsize customer base, the region is accounted for the largest share in the automotive suspension market.

Competitive Insights

KYB's global production system meets the need of customers everywhere by timely providing high performance, high quality products that satisfy customer requirements. KYB Corporation offers a variety of products with hydraulic technology.

Continental is a specialist in suspension and anti-vibration solutions for machines, automobiles and ships. Systems are developed customised for a wide range of uses. Continental develops suspension solutions for all kinds of commercial vehicle applications. The company's air spring portfolio ranges from powertrain components to chassis and body solutions and vibration reduction elements for the automotive interior.

Key Players Covered in the Report

The key players of the global Automotive Suspension market are Tenneco Inc., KYB Corporation, Continental AG, Hendrickson USA LLC, Gabriel India Ltd (ANAND Group), WABCO Holdings Inc., Hyundai Mobis Co. Ltd., ThyssenKrupp AG, Sogefi SpA, Marelli Holdings Co. Ltd., HL Mando Corp., FOX Factory, Inc., Infineon Technologies AG, LORD Corporation, Daimler AG, Hitachi Ltd., Benteler International AG (Austria), NHK Spring Co, Ltd. (Japan), Parker Hannifin Corporation (US), Rassini (Mexico), Parker Hannifin Corp.

Recent Development by Key Players

Continental and Infineon have joined hands to develop high-performance vehicle architectures. This partnership shall develop server-based vehicle architectures that will aspire to create an organized and efficient electrics/electronics (E/E) architecture with central high-performance computers (HPC). Continental shall support the diverge requirements of automobile OEMs that shall make the vehicle fit for the coming years.

Recently, with an investment of 180 crore, Gabriel India has collaborated with Netherlands-based Inalfa Roof Systems to manufacture sunroofs for passenger vehicles in Chennai. AatmaNirbhar, a government manufacturing drive is supported by this collaboration. Further, it provides OEM customers in India with a domestic and flexible supply chain for sunroofs.

The global Automotive Suspension Market report offers a comprehensive market segmentation analysis along with estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Vehicle type

- Two wheelers

- Passeger cars

- Commercial vehicles

- By Suspension

- Air

- Hydraulic

- Electromagnetic

- By System

- Active

- Semi active

- Passive

- By OEM Component

- Shock

- Spring

- Struts

- Control arms

- Air compressor

- Leaf spring

- Dampener

- Ball joint.

- By Distribution Channel

- OEM

- Aftermarket

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- Rest of the World

- Brazil

- SaudiArabia

- South Africa

- U.A.E

- Other Countries

.png)

To explore more about this report - Request a free sample copy

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Vehicle type

1.2.2. By Suspension

1.2.3. By System

1.2.4. By OE Component

1.2.5. By Distribution Channel

1.2.6. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Vehicle Type

5.1.1. Passenger Cars

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Two-Wheelers

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Electric Vehicles and Commercial Vehicles

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.2. By Suspension

5.2.1. Air Suspension

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Hydraulic Suspension

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Electromagnetic Suspension

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.3 By System

5.3.1. Active System

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Semi-Active

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Passive system

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By OE Component

5.4.1. Air Spring

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Shock, Struts

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Control Arms

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Air Compressor

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5 Leaf Spring

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Dampener and Ball Joint

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Vehicle type

6.2. By Suspension

6.3. By System

6.4. By OE Component

6.5. By Distribution Channel

6.6.1. U.S. Market Estimate and Forecast

6.6.2. Canada Market Estimate and Forecast

6.6.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Vehicle type

7.2. By Suspension

7.3. By System

7.4. By OE Component

7.5. By Distribution Channel

7.6.1. Germany Market Estimate and Forecast

7.6.2. France Market Estimate and Forecast

7.6.3. U.K. Market Estimate and Forecast

7.6.4. Italy Market Estimate and Forecast

7.6.5. Spain Market Estimate and Forecast

7.6.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Vehicle type

8.2. By Suspension

8.3. By System

8.4. By OE Component

8.5 By Distribution Channel

8.6. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

8.6.1. China Market Estimate and Forecast

8.6.2. Japan Market Estimate and Forecast

8.6.3. India Market Estimate and Forecast

8.6.4. South Korea Market Estimate and Forecast

8.6.5. Singapore Market Estimate and Forecast

8.6.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Vehicle type

9.2. By Suspension

9.3. By System

9.4. By Technology

9.5. By Distribution Channel

9.6. By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

9.6.1. Brazil Market Estimate and Forecast

9.6.2. Saudi Arabia Market Estimate and Forecast

9.6.3. South Africa Market Estimate and Forecast

9.6.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Tenneco Inc.

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. KYB Corporation

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Continental AG

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Hendrickson USA LLC

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Gabriel India Ltd (ANAND Group)

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. WABCO Holdings Inc.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. OMV AktiengesellschaftHyundai Mobis Co. Ltd.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. ThyssenKrupp AG

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Sogefi SpA

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Marelli Holdings Co. Ltd.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. HL Mando Corp.

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

10.12. FOX Factory

10.12.1. Snapshot

10.12.2. Overview

10.12.3. Offerings

10.12.4. Financial Insight

10.12.5. Recent Developments

10.13. Infineon Technologies AG

10.13.1. Snapshot

10.13.2. Overview

10.13.3. Offerings

10.13.4. Financial Insight

10.13.5. Recent Developments

10.14. LORD Corporation

10.14.1. Snapshot

10.14.2. Overview

10.14.3. Offerings

10.14.4. Financial Insight

10.14.5. Recent Developments

10.15 Daimler AG

Overview

10.15.1. Snapshot

10.15.2. Overview

10.15.3. Offerings

10.15.4. Financial Insight

10.15.5. Recent Developments

10.16 Hitachi Ltd.

10.16.1. Snapshot

10.16.2. Overview

10.16.3. Offerings

10.16.4. Financial Insight

10.16.5. Recent Developments

10.17 Benteler International AG (Austria)

10.17.1. Snapshot

10.17.2. Overview

10.17.3. Offerings

10.17.4. Financial Insight

10.17.5. Recent Developments

10.18 NHK Spring Co, Ltd

10.18.1. Snapshot

10.18.2. Overview

10.18.3. Offerings

10.18.4. Financial Insight

10.18.5. Recent Developments

10.19 Parker Hannifin Corporation (US)

10.19.1. Snapshot

10.19.2. Overview

10.19.3. Offerings

10.19.4. Financial Insight

10.19.5. Recent Developments

10.20 Rassini (Mexico)

10.20.1. Snapshot

10.20.2. Overview

10.20.3. Offerings

10.20.4. Financial Insight

10.20.5. Recent Developments

10.21 Parker Hannifin Corp

10.21.1. Snapshot

10.21.2. Overview

10.21.3. Offerings

10.21.4. Financial Insight

10.21.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Vehicle types

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Automotive Suspension Market Size, by Vehicle type, 2018-2023 (USD Billion)

Table 5 Global Automotive Suspension Market Size, by Vehicle type, 2025-2030 (USD Billion)

Table 6 Global Automotive Suspension Market Size, by Suspension, 2018-2023 (USD Billion)

Table 7 Global Automotive Suspension Market Size, by Suspension, 2025-2030 (USD Billion)

Table 8 Global Automotive Suspension Market Size, by System, 2018-2023 (USD Billion)

Table 9 Global Automotive Suspension Market Size, by System, 2025-2030 (USD Billion)

Table 8 Global Automotive Suspension Market Size, by OE Component, 2018-2023 (USD Billion)

Table 9 Global Automotive Suspension Market Size, by OE Component, 2025-2030 (USD Billion)

Table 8 Global Automotive Suspension Market Size, by Distribution Channel, 2018-2023 (USD Billion)

Table 9 Global Automotive Suspension Market Size, by Distribution Channel, 2025-2030 (USD Billion)

Table 10 Global Automotive Suspension Market Size, by Region, 2018-2023 (USD Billion)

Table 11 Global Automotive Suspension Market Size, by Region, 2025-2030 (USD Billion)

Table 12 North America Automotive Suspension Market Size, by Vehicle type, 2018-2023 (USD Billion)

Table 13 North America Automotive Suspension Market Size, by Vehicle type, 2025-2030 (USD Billion)

Table 14 North America Automotive Suspension Market Size, by Suspension, 2018-2023 (USD Billion)

Table 15 North America Automotive Suspension Market Size, by Suspension, 2025-2030 (USD Billion)

Table 16 North America Automotive Suspension Market Size, by System, 2018-2023 (USD Billion)

Table 17 North America Automotive Suspension Market Size, by System, 2025-2030 (USD Billion)

Table 18 North America Automotive Suspension Market Size, by OE Component, 2018-2023 (USD Billion)

Table 19 North America Automotive Suspension Market Size, by OE Component, 2025-2030 (USD Billion)

Table 20 North America Automotive Suspension Market Size, by Distribution Channel, 2018-2023 (USD Billion)

Table 21 North America Automotive Suspension Market Size, by Distribution Channel, 2025-2030 (USD Billion)

Table 22 North America Automotive Suspension Market Size, by Country, 2018-2023 (USD Billion)

Table 23 North America Automotive Suspension Market Size, by Country, 2025-2030 (USD Billion)

Table 24 Europe Automotive Suspension Market Size, by Vehicle type, 2018-2023 (USD Billion)

Table 25 Europe Automotive Suspension Market Size, by Vehicle type, 2025-2030 (USD Billion)

Table 26 Europe Automotive Suspension Market Size, by Suspension, 2018-2023 (USD Billion)

Table 27 Europe Automotive Suspension Market Size, by Suspension, 2025-2030 (USD Billion)

Table 28 Europe Automotive Suspension Market Size, by System, 2018-2023 (USD Billion)

Table 29 Europe Automotive Suspension Market Size, by System, 2025-2030 (USD Billion)

Table 30 Europe Automotive Suspension Market Size, by OE Component, 2018-2023 (USD Billion)

Table 31 Europe Automotive Suspension Market Size, by OE Component, 2025-2030 (USD Billion)

Table 32 Europe Automotive Suspension Market Size, by Distribution Channel, 2018-2023 (USD Billion)

Table 33 Europe Automotive Suspension Market Size, by Distribution Channel, 2025-2030 (USD Billion)

Table 34 Europe Automotive Suspension Market Size, by Country, 2018-2023 (USD Billion)

Table 35 Europe Automotive Suspension Market Size, by Country, 2025-2030 (USD Billion)

Table 36 Asia-Pacific Automotive Suspension Market Size, by Vehicle type, 2018-2023 (USD Billion)

Table 37 Asia-Pacific Automotive Suspension Market Size, by Vehicle type, 2025-2030 (USD Billion)

Table 38 Asia-Pacific Automotive Suspension Market Size, by Suspension, 2018-2023 (USD Billion)

Table 39 Asia-Pacific Automotive Suspension Market Size, by Suspension, 2025-2030 (USD Billion)

Table 40 Asia-Pacific Automotive Suspension Market Size, by System, 2018-2023 (USD Billion)

Table 41 Asia-Pacific Automotive Suspension Market Size, by System, 2025-2030 (USD Billion)

Table 42 Asia-Pacific Automotive Suspension Market Size, by OE Component, 2018-2023 (USD Billion)

Table 43 Asia-Pacific Automotive Suspension Market Size, by OE Component, 2025-2030 (USD Billion)

Table 44 Asia-Pacific Automotive Suspension Market Size, by Distribution Channel, 2018-2023 (USD Billion)

Table 45 Asia-Pacific Automotive Suspension Market Size, by Distribution Channel, 2025-2030 (USD Billion)

Table 46 Asia-Pacific Automotive Suspension Market Size, by Country, 2018-2023 (USD Billion)

Table 47 Asia-Pacific Automotive Suspension Market Size, by Country, 2025-2030 (USD Billion)

Table 48 RoW Automotive Suspension Market Size, by Vehicle type, 2018-2023 (USD Billion)

Table 49 RoW Automotive Suspension Market Size, by Vehicle type, 2025-2030 (USD Billion)

Table 50 RoW Automotive Suspension Market Size, by Suspension, 2018-2023 (USD Billion)

Table 51 RoW Automotive Suspension Market Size, by Suspension, 2025-2030 (USD Billion)

Table 52 RoW Automotive Suspension Market Size, by System, 2018-2023 (USD Billion)

Table 53 RoW Automotive Suspension Market Size, by System, 2025-2030 (USD Billion)

Table 54 Asia-Pacific Automotive Suspension Market Size, by Distribution Channel, 2018-2023 (USD Billion)

Table 55 Asia-Pacific Automotive Suspension Market Size, by Distribution Channel, 2025-2030 (USD Billion)

Table 56 RoW Automotive Suspension Market Size, by OE Component, 2018-2023 (USD Billion)

Table 57 RoW Automotive Suspension Market Size, by OE Component, 2025-2030 (USD Billion)

Table 58 RoW Automotive Suspension Market Size, by Country, 2018-2023 (USD Billion)

Table 59 RoW Automotive Suspension Market Size, by Country, 2025-2030 (USD Billion)

Table 60 Snapshot – Tenneco Inc.

Table 61 Snapshot – KYB Corporation

Table 62 Snapshot – Continental AG

Table 63 Snapshot – Hendrickson USA LLC

Table 64 Snapshot – Gabriel India Ltd (ANAND Group)

Table 65 Snapshot – WABCO Holdings Inc.

Table 66 Snapshot – Hyundai Mobis Co. Ltd.

Table 67 Snapshot – ThyssenKrupp AG

Table 68 Snapshot – Sogefi SpA

Table 69 Snapshot – Marelli Holdings Co. Ltd.

Table 70 Snapshot – HL Mando Corp.

Table 71 Snapshot – FOX Factory

Table 72 Snapshot – Infineon Technologies AG

Table 73 Snapshot – LORD Corporation

Table 74 Snapshot – Daimler AG

Table 75 Snapshot – Hitachi Ltd

Table 76 Snapshot – Benteler International AG (Austria)

Table 77 Snapshot – NHK Spring Co, Ltd.

Table 78 Snapshot – Parker Hannifin Corporation (US)

Table 79 Snapshot – Rassini (Mexico)

Table 80 Snapshot – Parker Hannifin Corp.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Vehicle Types for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Automotive Suspension Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Automotive Suspension Market Highlight

Figure 12 Global Automotive Suspension Market Size, by Vehicle Type, 2018 – 2030 (USD Billion)

Figure 13 Global Automotive Suspension Market Size, by Suspension 2018 – 2030 (USD Billion)

Figure 14 Global Automotive Suspension Market Size, by System 2018 – 2030 (USD Billion)

Figure 15 Global Automotive Suspension Market Size, by OE Component 2018 – 2030 (USD Billion)

Figure 16 Global Automotive Suspension Market Size, by Region, 2018 – 2030 (USD Billion)

Figure 17 North America Automotive Suspension Market Highlight

Figure 18 North America Automotive Suspension Market Size, by Vehicle Type, 2018 – 2030 (USD Billion)

Figure 19 North America Automotive Suspension Market Size, by Suspension 2018–2030 (USD Billion)

Figure 20 North America Automotive Suspension Market Size, by System 2018–2030 (USD Billion)

Figure 21 North America Automotive Suspension Market Size, by OE Component 2018–2030 (USD Billion)

Figure 22 North America Automotive Suspension Market Size, by Distribution Channel 2018–2030 (USD Billion)

Figure 23 North America Automotive Suspension Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 24 Europe Automotive Suspension Market Highlight

Figure 25 Europe Automotive Suspension Market Size, by Vehicle Type, 2018 – 2030 (USD Billion)

Figure 26 Europe Automotive Suspension Market Size, by Suspension 2018 – 2030 (USD Billion)

Figure 27 Europe Automotive Suspension Market Size, by System 2018 – 2030 (USD Billion)

Figure 28 Europe Automotive Suspension Market Size, by OE Component 2018 – 2030 (USD Billion)

Figure 29 Europe Automotive Suspension Market Size, by Distribution Channel 2018 – 2030 (USD Billion)

Figure 30 Europe Automotive Suspension Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 31 Asia-Pacific Automotive Suspension Market Highlight

Figure 32 Asia-Pacific Automotive Suspension Market Size, by Vehicle Type, 2018 – 2030 (USD Billion)

Figure 33 Asia-Pacific Automotive Suspension Market Size, by Suspension 2018 – 2030 (USD Billion)

Figure 34 Asia-Pacific Automotive Suspension Market Size, by System 2018 – 2030 (USD Billion)

Figure 35 Asia-Pacific Automotive Suspension Market Size, by OE Component 2018 – 2030 (USD Billion)

Figure 36 Asia-Pacific Automotive Suspension Market Size, by Distribution Channel 2018 – 2030 (USD Billion)

Figure 37 Asia-Pacific Automotive Suspension Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 38 RoW Automotive Suspension Market Highlight

Figure 39 RoW Automotive Suspension Market Size, by Vehicle Type, 2018 – 2030 (USD Billion)

Figure 40 RoW Automotive Suspension Market Size, by Suspension 2018 – 2030 (USD Billion)

Figure 41 RoW Automotive Suspension Market Size, by System 2018 – 2030 (USD Billion)

Figure 42 RoW Automotive Suspension Market Size, by OE Component 2018 – 2030 (USD Billion)

Figure 43 RoW Automotive Suspension Market Size, by Distribution Channel 2018 – 2030 (USD Billion)

Figure 44 RoW Automotive Suspension Market Size, by Country, 2018 – 2030 (USD Billion)

Automotive Suspension Market Coverage

Vehicle type Insight and Forecast 2025-2030

- Passenger Cars

- Two-Wheelers

- Electric Vehicles and Commercial Vehicles

Suspension Type Insight and Forecast 2025-2030

- Air Suspension

- Hydraulic Suspension

- Electromagnetic Suspension

System Type Insight and Forecast 2025-2030

- Active System

- Semi-Active

- Passive system

OE Component Type Insight and Forecast 2025-2030

- Air Spring

- Shock

- Struts

- Control Arms

- Air Compressor

- Leaf Spring

- Dampener and Ball Joint

Distribution Channel Insight and Forecast 2025-2030

- OEM and Aftermarket

Global Automotive Suspension Market by Region

North America

- By Vehicle Type

- By Suspension

- By System

- By OE Component

- By Country – U.S., Canada, and Mexico

Europe

- By Vehicle Type

- By Suspension

- By System

- By OE Component

By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Vehicle Type

- By Suspension

- By System

- By OE Component

By Country – China, Japan, India, South Korea, and the Rest of Asia-Pacific

Rest of the World (RoW)

- By Vehicle Type

- By Suspension

- By System

- By OE Component

By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Tenneco Inc.

- KYB Corporation

- Continental AG

- Hendrickson USA LLC

- Gabriel India Ltd (ANAND Group)

- WABCO Holdings Inc.

- Hyundai Mobis Co. Ltd.

- ThyssenKrupp AG

- Sogefi SpA

- Marelli Holdings Co. Ltd.

- HL Mando Corp.

- FOX Factory Inc.

- Infineon Technologies AG

- LORD Corporation

- Daimler AG Hitachi Ltd.

- Benteler International AG (Austria)

- NHK Spring Co Ltd. (Japan)

- Parker Hannifin Corporation (US)

- Rassini (Mexico)

- Parker Hannifin Corp

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Suspension Market – Analysis and Forecast (2025-2030)

- The global automotive suspension market promises a growth from USD 47.6 billion in 2023 to USD 74.8 billion by 2030 at a rate of 2.9%.

- The automotive suspension market is segregated by vehicle type, by suspension, by system, by OE component and by distribution channel where every segment promises speedy growth during the forecast period.

- The market is propelling due to changes in consumer tastes, advances in suspension technology, increased production of vehicles and focus on improved vehicle performance and security.

- Installation of new and suspension systems with advancement has led to the high cost that may hamper the growth of the automotive suspension market.

- Asia Pacific dominated the market during the forecast period as cost advantages for OEMs, growing per capita income of middle class residents and the customers changing preferences in this region.