- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Automotive Wire Harness Market

| Status : Published | Published On : Dec, 2023 | Report Code : VRAT9604 | Industry : Automotive & Transportation | Available Format :

|

Page : 150 |

Global Automotive Wire Harness Market – Analysis and Forecast (2025-2030)

Industry Insight by Component Type (Electric Wire, Connectors, Terminals and Others), by Application (Body, Chassis, Engine, HVAC, and Sensors), by Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Electric Vehicles), by Material Type (Metallic and Optic Fiber), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Automotive Wire Harness Market is anticipated to rise to USD 75 billion by 2030, with a compound annual growth rate of 25.6% during the forecast period 2025-2030. The automotive wire harness is the car’s nervous system. The major reason behind the growth is the increase in investment opportunities for automotive exploration and the inclination towards the quality aspects of vehicles. Today, the automotive wire harness is a requirement as it is implemented in the electrification of vehicles. It also requires less space and is lighter in weight. As a result, vendors in the automotive wire harness market are using high-quality conductors, insulators, and sheaths of wires and cables to withstand all weather conditions.

An automotive wire harness is used to prevent hazards, provide system reliability, and improve vehicle performance. Asia Pacific has a lot of growth opportunities because of growing infrastructure, low labor costs, demand for safety, and the growth in automotive manufacturing. However, the COVID-19 pandemic has caused a severe impact on the automotive sector and the wire harness market. There are a lot of disruptions in the supply chain halting the production and fall in demand. Moreover, changes in consumer behavior due to uncertain surroundings may have serious implications for the industry’s future growth. Thus, the market reflects an uncertain recovery timeline.

Automotive Wire Harness Market Segmentation

Insight by Component Type

Based on component type, the market is divided into electric wires, connectors, terminals, and others. Other segment includes protectors, sheaths, grommet, convoluted tubes, and clamps. Among these component types, the terminal segment captures the highest market share and is expected to grow at a faster rate, owing to the use of advanced technologies such as self-driving vehicles and safety features. Connectors used in wiring harnesses have an integrated safety system that reduces vehicle theft. These connectors are integrated with airbags, an anti-lock braking system (ABS), and vehicle immobilizers.

Insight by Application

Based on application, the market is segmented into body, chassis, engine, HVAC, and sensors. The chassis and safety segment will remain a key beneficiary in terms of revenue and includes fog lamps, headlamps, fuel flaps, and turn indicators. However, the sensor segment is growing rapidly in technologically advanced vehicles and is expected to capture a decent share of the automotive wire harness market in years to come.

Insight by Vehicle Type

Based on vehicle type, the market is subdivided into passenger vehicles, commercial vehicles, and electric vehicles. A passenger vehicle is expected to have a high CAGR during the forecast period with the adoption of safety features, vehicle comfort, and entertainment accessories. Commercial vehicle is anticipated to grow at a substantial rate due to increasing government investments in public transportation along with rising construction and manufacturing facilities in emerging markets. The electric vehicle segment will grow at a significant pace because of increased government initiatives, infrastructure, and a decrease in battery prices.

Insight by Material Type

Based on material type, the market is bifurcated into metallic and optic fiber. Technological development has increased the complexity of vehicles which requires high-speed data transmission. So, many manufacturers have started using optic fiber cables that increase the speed of data transmission. But the price is so high of optic fiber, as a result, the metallic material is anticipated to hold the largest share in the automotive wire harness market. Copper is used in wire harnesses as it has high thermal capacity and conductivity.

Global Automotive Wire Harness Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. XX Billion |

|

Revenue Forecast in 2030 |

U.S.D. 75 Billion |

|

Growth Rate |

25.6% |

|

Segments Covered in the Report |

By Component Type,By Application,By Vehicle Type,By Material Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America,Europe,Asia-Pacific (APAC),Rest of the World (RoW) |

Industry Dynamics

Automotive Wire Harness Industry Trends

One of the important trends existing in the wire harness market is a continuous increase in the number of industry players and there is a lot of investment in the automotive industry. Also, a wire harness is the nervous system of any automobile. Thus, technology advancement and optimization are the key factors that should be focused on by the manufacturers. Tie-ups with tier-one OEMs and making long-term contracts will be the key strategies of market players.

Automotive Wire Harness Market Growth Drivers

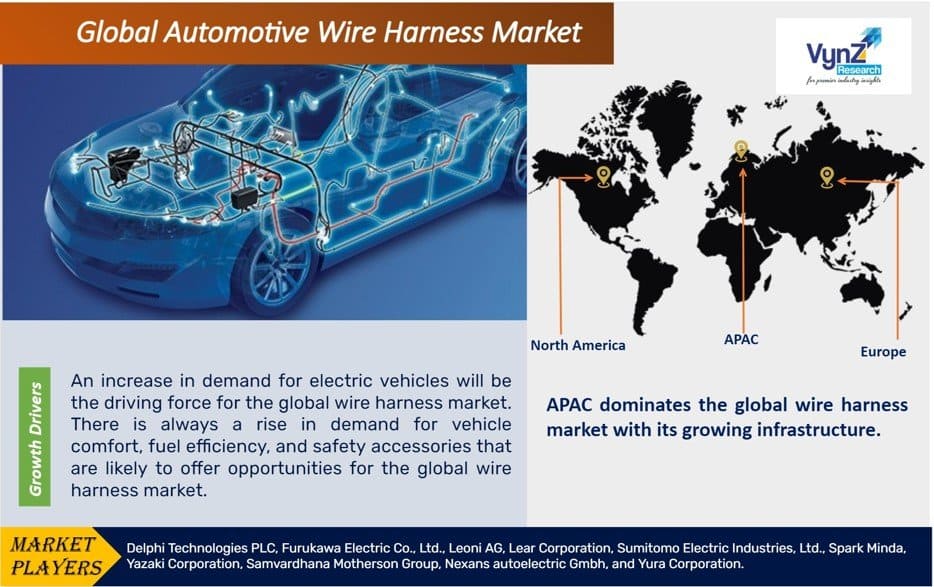

An increase in demand for electric vehicles will be the driving force for the global wire harness market. There is always a rise in demand for vehicle comfort, fuel efficiency, and safety accessories that are likely to offer opportunities for the global wire harness market. Wire harness provides easy use and a well-organized flow of electric supply from the primary wiring harness to electronic and electrical components. All these factors will impact the automotive wire harness progression in the market shortly.

Automotive Wire Harness Market Challenges

High initial deployment, as well as, maintenance cost may obstruct the growth of the automotive wire harness market. Technology within the sector keeps on changing every year which makes the automotive OEMs difficult to switch and therefore, restricts the automotive wire harness market growth.

Automotive Wire Harness Market Opportunities

There is an opportunity in emerging economies to have an infrastructure for electric vehicles such as charging stations. Moreover, the government is providing subsidiaries to create opportunities for electric vehicle production and other development activities. All these advancements in the field of the automotive industry will bring numerous new opportunities for the wire harness market.

Automotive Wire Harness Market Geographic Overview

Geographically, APAC dominates the global wire harness market with its growing infrastructure, rising demand for safety, low labor cost, and growth in automotive manufacturing. Further growth in automotive production and a higher level of automation are expected to shape the American market.

Within the EU, Germany is the major importer of automotive wire harnesses. Though it has a high-cost labor market, still many companies’ headquarters, design and testing labs, and logistical centers are in Germany.

Automotive Wire Harness Market Competitive Insight

The automotive wire harness market is a competitive market where the key players are offering cost-competitive products. Companies are focusing on strategic collaborations with end-users and regional distributors to expand their customer base. Suppliers are aiming at acquisitions and regional expansion strategies to establish their business. Brand building through strategic marketing strategies makes it a challenge for new entrants in the automotive wire harness market. Thus, companies are sustaining their position in a competitive market and are providing a competitive edge.

Key players in the automotive wire harness market include automotive OEMs as well as cybersecurity service providers in general. Further, mergers and acquisitions are the major strategies adopted by the OEMs in the automotive wire harness market.

Delphi (a PHINIA brand) leads the global Aftermarket with next-gen talent, innovations, products, and smart services, shaping a connected future.

Leoni AG (based in Nuremberg, Germany) is a cable and harnessing manufacturing firm with branches throughout the world. It is listed on the Frankfurt Stock Exchange and is a member of the mid-cap MDAX index. It is a global leader of cable.

Some of the key players operating in the automotive wire harness market: are Delphi Technologies PLC, Furukawa Electric Co., Ltd., Leoni AG, Lear Corporation, Sumitomo Electric Industries, Ltd., Spark Minda, Yazaki Corporation, Samvardhana Motherson Group, Nexans autoelectric Gmbh, and Yura Corporation.

Recent Developments by Key Players

Yura Harness - Cambodia (a wiring harness manufacturer and a subsidiary of Korea-based Yura Harness) has started its production in Kampong Speu province. The company invested about USD 15 million to build an electronics plant to produce wires for export to Korea’s Hyundai Motors and Kia Motors.The production chains of the company in the province shall contribute to the promotion of trade between Korea and Cambodia.

Yazaki Corporation and Toray Industries, Inc. collaborated for the development of a recycled polybutylene terephthalate (PBT) resin grade. This innovative resin utilizes scrap materials from manufacturing processes to manufacture connectors for automotive wire harnesses. This resin also has the potential to reduce carbon dioxide emissions originating from connector production while maintaining equivalent performance properties to virgin materials.

The Automotive Wire Harness Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Component Type

- Electric wires

- Connectors

- Terminals

- Others

- Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

- Application

- Body

- Chassis

- Engine

- HVAC

- Sensors

- Material Type

- Metallic

- Optic Fiber

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source VynZ Research

.png)

Source VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Component Type

1.2.2. By Vehicle Type

1.2.3. By Application

1.2.4. By Material Type

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Component Type

5.1.1. Electric Wires

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Connectors

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Terminals

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Others

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.2. By Vehicle type

5.2.1. Passenger Vehicles

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.2.2. Commercial Vehicles

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.2.3. Electric Vehicles

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3. By Application

5.3.1. Body

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.3.2. Chassis

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Engine

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.3.4. HVAC

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.3.5. Sensors

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.4. By Material Type

5.4.1. Metallic

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Optic Fiber

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Component Type

6.2. By Vehicle Type

6.3. By Application

6.4 By Material Type

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Component Type

7.2. By Vehicle Type

7.3. By Application

7.4. By Material Type

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Component Type

8.2. By Vehicle Type

8.3. By Application

8.4. By Material type

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Component Type

9.2. By Vehicle Type

9.3. By Application

9.4. By Material type

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Delphi Technologies PLC

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Furukawa Electric Co., Ltd

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Leoni AG

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Lear Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Sumitomo Electric Industries, Ltd.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Spark Minda

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Yazaki Corporation

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Samvardhana Motherson Group

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Nexans Autoelectric GmbH

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Yura Corporation

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Automotive Wire Harness Market Size, By Component Type, 2018 - 2023 (USD Billion)

Table 5 Global Automotive Wire Harness Market Size, By Component Type, 2025 - 2030 (USD Billion)

Table 6 Global Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2023 (USD Billion)

Table 7 Global Automotive Wire Harness Market Size, By Vehicle Type, 2025 - 2030 (USD Billion)

Table 8 Global Automotive Wire Harness Market Size, By Application, 2018 - 2023 (USD Billion)

Table 9 Global Automotive Wire Harness Market Size, By Application, 2025 - 2030 (USD Billion)

Table 10 Global Automotive Wire Harness Market Size, By Material Type, 2018 - 2023 (USD Billion)

Table 11 Global Automotive Wire Harness Market Size, By Material Type, 2025 - 2030 (USD Billion)

Table 12 Global Automotive Wire Harness Market Size, by Region, 2018 - 2023 (USD Billion)

Table 13 Global Automotive Wire Harness Market Size, by Region, 2025 - 2030 (USD Billion)

Table 14 North America Automotive Wire Harness Market Size, By Component Type, 2018 - 2023 (USD Billion)

Table 15 North America Automotive Wire Harness Market Size, By Component Type, 2025 - 2030 (USD Billion)

Table 16 North America Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2023 (USD Billion)

Table 17 North America Automotive Wire Harness Market Size, By Vehicle Type, 2025 - 2030 (USD Billion)

Table 18 North America Automotive Wire Harness Market Size, By Application, 2018 - 2023 (USD Billion)

Table 19 North America Automotive Wire Harness Market Size, By Application, 2025 - 2030 (USD Billion)

Table 20 North America Automotive Wire Harness Market Size, By Material Type, 2018 - 2023 (USD Billion)

Table 21 North America Automotive Wire Harness Market Size, By Material Type, 2025 - 2030 (USD Billion)

Table 22 North America Automotive Wire Harness Market Size, by Region, 2018 - 2023 (USD Billion)

Table 23 North America Automotive Wire Harness Market Size, by Region, 2025 - 2030 (USD Billion)

Table 24 Europe Automotive Wire Harness Market Size, By Component Type, 2018 - 2023 (USD Billion)

Table 25 Europe Automotive Wire Harness Market Size, By Component Type, 2025 - 2030 (USD Billion)

Table 26 Europe Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2023 (USD Billion)

Table 27 Europe Automotive Wire Harness Market Size, By Vehicle Type, 2025 - 2030 (USD Billion)

Table 28 Europe Automotive Wire Harness Market Size, By Application, 2018 - 2023 (USD Billion)

Table 29 Europe Automotive Wire Harness Market Size, By Application, 2025 - 2030 (USD Billion)

Table 30 Europe Automotive Wire Harness Market Size, By Material Type, 2018 - 2023 (USD Billion)

Table 31 Europe Automotive Wire Harness Market Size, By Material Type, 2025 - 2030 (USD Billion)

Table 32 Europe Automotive Wire Harness Market Size, by Region, 2018 - 2023 (USD Billion)

Table 33 Europe Automotive Wire Harness Market Size, by Region, 2025 - 2030 (USD Billion)

Table 33 Asia-Pacific Automotive Wire Harness Market Size, By Component Type, 2018 - 2023 (USD Billion)

Table 34 Asia-Pacific Automotive Wire Harness Market Size, By Component Type, 2025 - 2030 (USD Billion)

Table 35 Asia-Pacific Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2023 (USD Billion)

Table 36 Asia-Pacific Automotive Wire Harness Market Size, By Vehicle Type, 2025 - 2030 (USD Billion)

Table 37 Asia-Pacific Automotive Wire Harness Market Size, By Application, 2018 - 2023 (USD Billion)

Table 38 Asia-Pacific Automotive Wire Harness Market Size, By Application, 2025 - 2030 (USD Billion)

Table 39 Asia-Pacific Automotive Wire Harness Market Size, By Material Type, 2018 - 2023 (USD Billion)

Table 40 Asia-Pacific Automotive Wire Harness Market Size, By Material Type, 2025 - 2030 (USD Billion)

Table 41 Asia-Pacific Automotive Wire Harness Market Size, by Region, 2018 - 2023 (USD Billion)

Table 42 Asia-Pacific Automotive Wire Harness Market Size, by Region, 2025 - 2030 (USD Billion)

Table 43 RoW Automotive Wire Harness Market Size, By Component Type, 2018 - 2023 (USD Billion)

Table 44 RoW Automotive Wire Harness Market Size, By Component Type, 2025 - 2030 (USD Billion)

Table 45 RoW Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2023 (USD Billion)

Table 46 RoW Automotive Wire Harness Market Size, By Vehicle Type, 2025 - 2030 (USD Billion)

Table 47 RoW Automotive Wire Harness Market Size, By Application, 2018 - 2023 (USD Billion)

Table 48 RoW Automotive Wire Harness Market Size, By Application, 2025 - 2030 (USD Billion)

Table 49 RoW Automotive Wire Harness Market Size, By Material Type, 2018 - 2023 (USD Billion)

Table 50 RoW Automotive Wire Harness Market Size, By Material Type, 2025 - 2030 (USD Billion)

Table 51 RoW Automotive Wire Harness Market Size, by Region, 2018 - 2023 (USD Billion)

Table 52 RoW Automotive Wire Harness Market Size, by Region, 2025 - 2030 (USD Billion)

Table 53 Snapshot – Delphi Technologies PLC

Table 54 Snapshot – Furukawa Electric Co., Ltd

Table 55 Snapshot – Leoni AG

Table 56 Snapshot – Lear Corporation

Table 57 Snapshot – Sumitomo Electric Industries, Ltd.

Table 58 Snapshot – Spark Minda

Table 59 Snapshot – Yazaki corporation

Table 60 Snapshot – Samvardhana Motherson Group

Table 61 Snapshot – Nexans Autoelectric GmbH

Table 62 Snapshot – Yura Corporation

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Automotive Wire Harness Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Automotive Wire Harness Market Highlight

Figure 12 Global Automotive Wire Harness Market Size, By Component Type, 2018 - 2030 (USD Billion)

Figure 13 Global Automotive Wire Harness Market Size, By Vehicle Type, cc (USD Billion)

Figure 14 Global Automotive Wire Harness Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 15 Global Automotive Wire Harness Market Size, By Material Type, 2018 - 2030 (USD Billion)

Figure 16 Global Automotive Wire Harness Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Automotive Wire Harness Market Highlight

Figure 18 North America Automotive Wire Harness Market Size, By Component Type, 2018 - 2030 (USD Billion)

Figure 19 North America Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2030 (USD Billion)

Figure 20 North America Automotive Wire Harness Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 21 North America Automotive Wire Harness Market Size, By Material Type, 2018 - 2030 (USD Billion)

Figure 22 North America Automotive Wire Harness Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Automotive Wire Harness Market Highlight

Figure 24 Europe Automotive Wire Harness Market Size, By Component Type, 2018 - 2030 (USD Billion)

Figure 25 Europe Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2030 (USD Billion)

Figure 26 Europe Automotive Wire Harness Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 27 Europe Automotive Wire Harness Market Size, By Material Type, 2018 - 2030 (USD Billion)

Figure 28 Europe Automotive Wire Harness Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Automotive Wire Harness Market Highlight

Figure 30 Asia-Pacific Automotive Wire Harness Market Size, By Component Type, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Automotive Wire Harness Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Automotive Wire Harness Market Size, By Material Type, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Automotive Wire Harness Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Automotive Wire Harness Market Highlight

Figure 36 RoW Automotive Wire Harness Market Size, By Component Type, 2018 - 2030 (USD Billion)

Figure 37 RoW Automotive Wire Harness Market Size, By Vehicle Type, 2018 - 2030 (USD Billion)

Figure 38 RoW Automotive Wire Harness Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 39 RoW Automotive Wire Harness Market Size, By Material Type, 2018 - 2030 (USD Billion)

Figure 40 RoW Automotive Wire Harness Market Size, by Region, 2018 - 2030 (USD Billion)

Global Automotive Wire Harness Market Coverage

Component Type Insight and Forecast 2025-2030

- Electric wires

- Connectors

- Terminals

- Others

Vehicle Type Insight and Forecast 2025-2030

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

Application Insight and Forecast 2025-2030

- Body

- Chassis

- Engine

- HVAC

- Sensors

Material Type Insight and Forecast 2025-2030

- Metallic

- Optic Fiber

Geographical Segmentation

Automotive Wire Harness Market by Region

North America

- By Component Type

- By Vehicle Type

- By Application

- By Material Type

- By Country – U.S., Canada, and Mexico

Europe

- By Component Type

- By Vehicle Type

- By Application

- By Material Type

- By Country – Germany, U.K., France, Italy, Spain, and Rest of Europe

Asia-Pacific (APAC)

- By Component Type

- By Vehicle Type

- By Application

- By Material Type

- By Country – China, Japan, India, South Korea, Singapore, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Component Type

- By Vehicle Type

- By Application

- By Material Type

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Wire Harness Market

Global Automotive Wire Harness Market – Analysis and Forecast (2025-2030)

- The Global Automotive Wire Harness market is expected to reach USD 75 billion by 2030 at a CAGR of 25.6%.

- The market is divided by component, application, vehicle type, and materials where each segment is further subdivided into subsegments. Each of these segments and subsegments will grow significantly during the forecast period.

- The market growth drivers include rise in demand for electric vehicles, requirement for enhanced features and stringent government regulations.

- The growth of the market is hindered by high cost of deployment and maintenance. However, growth opportunities are offered by the development in EV infrastructure and government support in developing countries.

- The North American market will expand due to growing automation adoption and production of vehicles. The Asia-Pacific region will grow due to the growing infrastructure and higher demand for vehicle safety.