- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Hybrid Vehicle Market

| Status : Published | Published On : Apr, 2024 | Report Code : VRAT4003 | Industry : Automotive & Transportation | Available Format :

|

Page : 228 |

Global Hybrid Vehicle Market – Analysis and Forecast (2025-2030)

Industry Insights by Component (Electric Motor, Battery, and Transmission), by Electric Power Train Type (Parallel Hybrid and Series Hybrid), by Propulsion (Hybrid Electric Vehicles (HEV), Natural Gas Vehicles (NGV), and Plug-In Hybrid Electric Vehicles (PHEV)), by Degree of Hybridization (Micro-Hybrid, Full Hybrid, and Mild Hybrid), by Vehicle Type (Passenger Cars and Commercial Vehicles) and by Geography (North America, Europe, Asia-Pacific, Middle East, and the Rest of the World)

Industry Overview

The Global Market for Hybrid Vehicles is anticipated to reach 8696 thousand units by 2030. During the projected period 2023 to 2030, the market is expected to grow by an anticipated CAGR of 8.12%. currently 5773 thousand units in 2030 Stricter pollution regulatory rules and rising demand for low- or zero-emission vehicles, drive growth in the hybrid vehicles market. Additionally, governments in many nations offer tax breaks and grants for the purchase of hybrid vehicles, including HEVs and PHEVs.

The market for hybrid vehicles will be significantly influenced by expanding eco-friendly policies regarding fuel emissions. As a result of the growing emphasis on electric and hybrid vehicles over the past few years, customer demand for green automobiles has been rising across the U.S. Electric. Hybrid variants of well-known conventional automobile models are now being introduced as a result of consumers' increased emphasis on improved fuel efficiency and demand for environmentally friendly vehicles. Green vehicles are getting an exponential drive in the commercial transportation sector. The potential for efficiency gains from hybrid drives in big vehicles is being investigated by manufacturers.

Covid-19 Outbreak

The COVID-19 pandemic, which has resulted in ongoing lockdowns and a global economic slump, impeded the expansion of the hybrid vehicle market. Additionally, because cost-conscious customers find traditional IC engine vehicles affordable, the expense of hybrid vehicles and a lack of charging infrastructure slow down the market's growth pace in emerging economies. However, the forecast period of the hybrid vehicle market is expected to improve by expanding parallel electric powertrain technology adoption, rising global auto production, rising disposable income in populous nations like China and India, and a preference for hybrid vehicles.

Market Segment

Insight by Component

The global hybrid vehicle market based on components is bifurcated into the electric motor, battery, and transmission. However, the market is dominated by the electric vehicle battery market. The battery market has shared leadership in 2020, and the market cap of this segment was USD 69.84 billion. The segment with a CAGR of 12.0% during the projected period is contributing to the growth of the global hybrid vehicle market as hybrid vehicles need batteries as they store a lot of energy for a long duration.

Insight by Electric Powertrain Type

The hybrid electric vehicle market has been divided into parallel and series hybrids based on the electric powertrain type. During the projection period, it is predicted that the parallel hybrid segment will account for the biggest market share in terms of volume. Due to the growing popularity of regenerative braking technology, this market is most likely to expand. When the brakes are engaged, the energy needed to recharge the battery is restored through regenerative braking technology. As a result, less external electric infrastructure is needed. The most typical hybrid vehicle technology is the regenerative braking system. The demand for parallel hybrids will increase due to the utilization of regenerative braking and mild hybrids' lower cost as compared to plug-in hybrids.

Insight by Propulsion

The market is divided into HEV, PHEV, NGV, and Others based on the kind of propulsion. Due to excellent fuel efficiency, HEV has a larger market share than other environmentally friendly vehicles and is estimated to contribute the highest to the global hybrid vehicle market. Hybrid electric vehicles are those that are propelled by both internal combustion engines and electric motors (HEV). Due to the huge sales volume in the US, Japan, and China, the market for HEV is expanding. The segment of hybrid electric vehicles is anticipated to account for a sizable revenue share of the global market for hybrid automobiles throughout the forecast period.

Insight by a degree of hybridization

The global market for hybrid vehicles is segmented into three categories: micro-hybrid, full hybrid, and mild hybrid. However, the full-hybrid segment, which accounted for the biggest market share and the highest valuation during the forecast period, dominates the market. This segment's growth is mostly fueled by consumer demand for automobiles with greater power, better fuel economy, and lower emissions. During the forecast period, the mild-hybrid market is anticipated to expand at a faster CAGR. The expansion of the full hybrid market can be ascribed to ongoing technological advancements that have improved fuel economy and decreased emissions.

Insight by vehicle

The global market for hybrid vehicles is segmented into two categories based on the type of vehicle: passenger automobiles and commercial vehicles. Due to the increased need for personal mobility, changing lifestyles, rising demand for mid and large-sized automobiles, and rising per capita income, passenger vehicles accounted for the bigger share of these two vehicle categories in the hybrid vehicle market. Additionally, due to advantages offered by commercial vehicles like increased driving range, ease of application of hybrid vehicle technology, and the increased emphasis of OEMs to decrease emissions and fuel efficacy, the commercial vehicle segment is predicted to grow at a faster rate during the forecast period.

Global Hybrid Vehicle Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 5773 Units |

|

Revenue Forecast in 2030 |

U.S.D. 8696 Units |

|

Growth Rate |

8.12% |

|

Segments Covered in the Report |

By Component, By Electric Powertrain Type, By Propulsion, By Degree of Hybridization, and By Vehicle |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and the Rest of the World |

Industry Dynamics

Industry Trends

Governments from all over the world offer a variety of subsidies (in the form of tax breaks and incentives) to people who buy electric and hybrid vehicles. Global industry firms are launching new items to capitalize on the market expansion. In addition, small and medium-sized businesses lack the resources and finance necessary to create a hybrid vehicle production facility. A variety of players are investing in the creation of new battery technologies to lower the price of hybrid vehicles so they can compete with gasoline-powered vehicles on both the performance and pricing fronts. Industry leaders are anticipated to drastically lower the price of these vehicles and enhance their performance during the following few years, resulting in widespread acceptance.

Growth Drivers

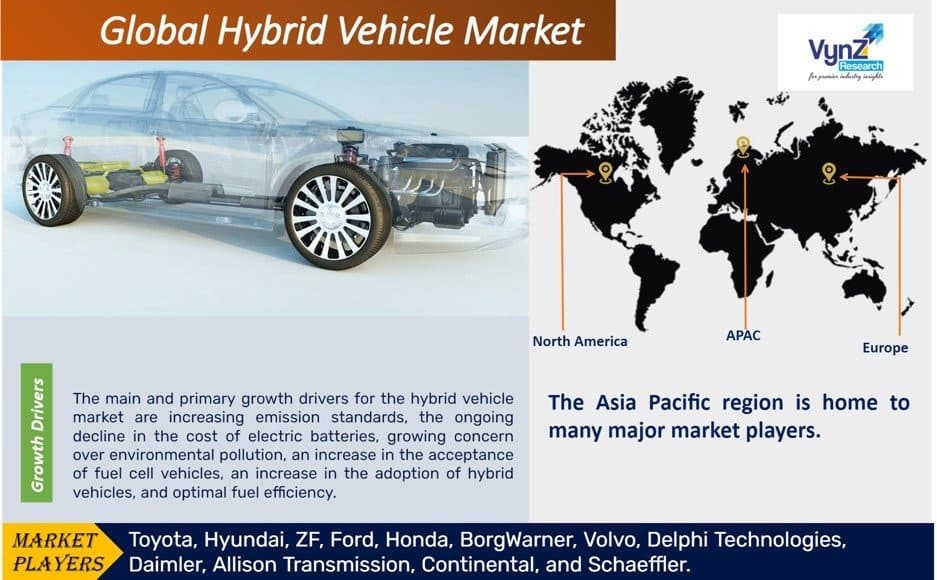

The main and primary growth drivers for the hybrid vehicle market are increasing emission standards, the ongoing decline in the cost of electric batteries, growing concern over environmental pollution, an increase in the acceptance of fuel cell vehicles, an increase in the adoption of hybrid vehicles, and optimal fuel efficiency. The market for hybrid vehicles is expected to grow due to the significant increase in the demand for green automobiles in industrialized nations like the US and Canada during the next years. For instance, the World Health Organization (WHO) estimates that exposure to ambient air pollution causes 4.2 million fatalities worldwide each year. In addition, 91% of people on the planet live in areas where air quality is worse than what is recommended by the WHO. The market for hybrid vehicles is expanding as a result of government initiatives and programs as well as the high demand for battery electric vehicles.

Challenges

One of the main obstacles to the development of hybrid vehicles will be the rising demand for Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). In the passenger automobile market, there are numerous different BEV models and types, including hatchbacks, sedans, and SUVs. BYD (China), Tesla (US), and Volkswagen (Germany) are a few of the key automakers putting more of emphasis on BEV development.

High driving range, quick refilling, quiet operation, and zero emissions of greenhouse gases and air pollutants are all benefits of FCEVs. The demand for FCEVs is being positively impacted by these advantages. The demand for fuel cells in the automotive and transportation sectors may also increase as a result of government initiatives and the promotion of fuel cells for transportation.

Opportunities

Because of government initiatives and backing, hybrid vehicles provide enormous growth potential in markets in emerging nations (e.g., incentives in sales and manufacturing, tax rebates, and increased focus on deploying hybrid commercial vehicles). The Indian government is offering subsidies worth roughly $446 for the purchase of hybrid and electric automobiles in India. The Brazilian government is incentivizing the purchase of hybrid vehicles by lowering the tax rate on plug-in hybrids, hybrid electric vehicles, and CNG hybrids. For the procurement of 25 Tata Starbus Diesel Series Hybrid Electric Buses, the Mumbai Metropolitan Region Development Authority (MMRDA) in India has given Tata Motors a contract.

Geographical Overview

The market for hybrid vehicles is expected to develop at the quickest rate in the Asia Pacific. Sales of hybrid vehicles have increased in nations including China, South Korea, and Japan. The Asia Pacific region is home to many major market players, including Hyundai, Nissan, Honda, and Toyota. Due to the widespread use of hybrid vehicles, nations like China and Japan have greatly boosted the industry.

Competitive Insight

Key industry players in the hybrid vehicle market are meeting demand by working with minor companies, forming new strategic partnerships, launching new products, funding R&D initiatives, and investing in a technologically cutting-edge hybrid vehicle on a worldwide scale.

The Toyota Prius was the first hybrid vehicle that was mass-produced, and since its release, 13 million hybrid vehicles have been sold by the company. The business has made a strategic decision to support hybrid automobiles as a transitional technology to fully electric vehicles.

Bayerische Motoren Werke AG, commonly abbreviated to BMW, is a German multinational manufacturer of luxury vehicles and motorcycles headquartered in Munich, Bavaria, Germany.

The leading companies that manufacture hybrid vehicles are BMW, Nissan, AVL, MAHLE, Ford motor company, Toyota, Hyundai, ZF, Ford, Honda, BorgWarner, Volvo, Delphi Technologies, Daimler, Allison Transmission, Continental, and Schaeffler.

Recent Development by Key Players

Nissan and Honda collaborated to accelerate the development and adoption of next-generation electric vehicles (EVs). This partnership encompasses technology sharing, joint research and potential vehicle complementarity strategies.

The Hybrid Vehicle Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Component

- Electric Motor

- Battery

- Transmission

- By Electric Power Train Type

- Parallel Hybrids

- Series Hybrids

- By Propulsion

- Hybrid Electric Vehicles (HEV)

- Natural Gas Vehicles (NGV)

- Plug-In Hybrid Electric Vehicles (PHEV)

- By Degree of Hybridization

- Micro-Hybrid

- Full Hybrid

- Mild Hybrid

- By Vehicle

- Passenger Cars

- Commercial Vehicles

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Component

1.2.2. By Electric Power Train Type

1.2.3. By Propulsion

1.2.4. By Degree of Hybridization

1.2.5. By Vehicle

1.2.6. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. Electric Motor

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Battery

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Transmission

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.2. By Electric Power Train

5.2.1. Parallel Hybrid

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Series Hybrid

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Propulsion

5.3.1. hybrid electric vehicles (HEV)

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Natural Gas Vehicles (NGV)

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Plug-In Hybrid Electric Vehicles (PHEV)

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Others

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.4. By Degree of Hybridization

5.4.1. Micro-Hybrid

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Full Hybrid

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Mild Hybrid

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.5. By Vehicle

5.5.1. Passenger Cars

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2030

5.5.2. Commercial Vehicles

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Component

6.2. By Electric Power Train

6.3. By Propulsion

6.4. By Degree of Hybridization

6.5. By Vehicle

6.6. By Country

6.6.1. U.S. Market Estimate and Forecast

6.6.2. Canada Market Estimate and Forecast

6.6.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Component

7.2. By Electric Power Train

7.3. By Propulsion

7.4. By Degree of Hybridization

7.5. By Vehicle

7.6. By Country

7.6.1. Germany Market Estimate and Forecast

7.6.2. France Market Estimate and Forecast

7.6.3. U.K. Market Estimate and Forecast

7.6.4. Italy Market Estimate and Forecast

7.6.5. Spain Market Estimate and Forecast

7.6.6. Russia Market Estimate and Forecast

7.6.7. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Component

8.2. By Electric Power Train

8.3. By Propulsion

8.4. By Degree of Hybridization

8.5. By Vehicle

8.6. By Country

8.6.1. China Market Estimate and Forecast

8.6.2. Japan Market Estimate and Forecast

8.6.3. India Market Estimate and Forecast

8.6.4. South Korea Market Estimate and Forecast

8.6.5. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Component

9.2. By Electric Power Train

9.3. By Propulsion

9.4. By Degree of HybridizationU.A.E.

9.5. By Vehicle

9.6. By Country

9.6.1. Brazil Market Estimate and Forecast

9.6.2. Saudi Arabia Market Estimate and Forecast

9.6.3. South Africa Market Estimate and Forecast

9.6.4. U.A.E. Market Estimate and Forecast

9.6.5. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Toyota

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Hyundai

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. ZF

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Ford

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Honda

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Borgwarner

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Volvo

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Delphi Technologies

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Daimler

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Allison Transmission

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. Continental

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

10.12. Schaeffler

10.12.1. Snapshot

10.12.2. Overview

10.12.3. Offerings

10.12.4. Financial Insight

10.12.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Hybrid Vehicle Market, By Component, 2018 - 2023 (Thousand Units)

Table 5 Global Hybrid Vehicle Market, By Component, 2025 - 2030 (Thousand Units)

Table 6 Global Hybrid Vehicle Market, By Electric Power Train, 2018 - 2023 (Thousand Units)

Table 7 Global Hybrid Vehicle Market, By Electric Power Train, 2025 - 2030 (Thousand Units)

Table 8 Global Hybrid Vehicle Market, By Propulsion, 2018 - 2023 (Thousand Units)

Table 9 Global Hybrid Vehicle Market, By Propulsion, 2025 - 2030 (Thousand Units)

Table 10 Global Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2023 (Thousand Units)

Table 11 Global Hybrid Vehicle Market, By Degree of Hybridization, 2025 - 2030 (Thousand Units)

Table 12 Global Hybrid Vehicle Market, By Vehicle, 2018 - 2023 (Thousand Units)

Table 13 Global Hybrid Vehicle Market, By Vehicle, 2025 - 2030 (Thousand Units)

Table 14 Global Hybrid Vehicle Market, by Region, 2018 - 2023 (Thousand Units)

Table 15 Global Hybrid Vehicle Market, by Region, 2025 - 2030 (Thousand Units)

Table 16 North America Hybrid Vehicle Market, By Component, 2018 - 2023 (Thousand Units)

Table 17 North America Hybrid Vehicle Market, By Component, 2025 - 2030 (Thousand Units)

Table 18 North America Hybrid Vehicle Market, By Electric Power Train, 2018 - 2023 (Thousand Units)

Table 19 North America Hybrid Vehicle Market, By Electric Power Train, 2025 - 2030 (Thousand Units)

Table 20 North America Hybrid Vehicle Market, By Propulsion, 2018 - 2023 (Thousand Units)

Table 21 North America Hybrid Vehicle Market, By Propulsion, 2025 - 2030 (Thousand Units)

Table 22 North America Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2023 (Thousand Units)

Table 23 North America Hybrid Vehicle Market, By Degree of Hybridization, 2025 - 2030 (Thousand Units)

Table 24 North America Hybrid Vehicle Market, By Vehicle, 2018 - 2023 (Thousand Units)

Table 25 North America Hybrid Vehicle Market, By Vehicle, 2025 - 2030 (Thousand Units)

Table 26 North America Hybrid Vehicle Market, by Region, 2018 - 2023 (Thousand Units)

Table 27 North America Hybrid Vehicle Market, by Region, 2025 - 2030 (Thousand Units)

Table 28 Europe Hybrid Vehicle Market, By Component, 2018 - 2023 (Thousand Units)

Table 29 Europe Hybrid Vehicle Market, By Component, 2025 - 2030 (Thousand Units)

Table 30 Europe Hybrid Vehicle Market, By Electric Power Train, 2018 - 2023 (Thousand Units)

Table 31 Europe Hybrid Vehicle Market, By Electric Power Train, 2025 - 2030 (Thousand Units)

Table 32 Europe Hybrid Vehicle Market, By Propulsion, 2018 - 2023 (Thousand Units)

Table 33 Europe Hybrid Vehicle Market, By Propulsion, 2025 - 2030 (Thousand Units)

Table 34 Europe Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2023 (Thousand Units)

Table 35 Europe Hybrid Vehicle Market, By Degree of Hybridization, 2025 - 2030 (Thousand Units)

Table 36 Europe Hybrid Vehicle Market, By Vehicle, 2018 - 2023 (Thousand Units)

Table 37 Europe Hybrid Vehicle Market, By Vehicle, 2025 - 2030 (Thousand Units)

Table 38 Europe Hybrid Vehicle Market, by Region, 2018 - 2023 (Thousand Units)

Table 39 Europe Hybrid Vehicle Market, by Region, 2025 - 2030 (Thousand Units)

Table 40 Asia-Pacific Hybrid Vehicle Market, By Component, 2018 - 2023 (Thousand Units)

Table 41 Asia-Pacific Hybrid Vehicle Market, By Component, 2025 - 2030 (Thousand Units)

Table 42 Asia-Pacific Hybrid Vehicle Market, By Electric Power Train, 2018 - 2023 (Thousand Units)

Table 43 Asia-Pacific Hybrid Vehicle Market, By Electric Power Train, 2025 - 2030 (Thousand Units)

Table 44 Asia-Pacific Hybrid Vehicle Market, By Propulsion, 2018 - 2023 (Thousand Units)

Table 45 Asia-Pacific Hybrid Vehicle Market, By Propulsion, 2025 - 2030 (Thousand Units)

Table 46 Asia-Pacific Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2023 (Thousand Units)

Table 47 Asia-Pacific Hybrid Vehicle Market, By Degree of Hybridization, 2025 - 2030 (Thousand Units)

Table 48 Asia-Pacific Hybrid Vehicle Market, By Vehicle, 2018 - 2023 (Thousand Units)

Table 49 Asia-Pacific Hybrid Vehicle Market, By Vehicle, 2025 - 2030 (Thousand Units)

Table 50 Asia-Pacific Hybrid Vehicle Market, by Region, 2018 - 2023 (Thousand Units)

Table 51 Asia-Pacific Hybrid Vehicle Market, by Region, 2025 - 2030 (Thousand Units)

Table 52 RoW Hybrid Vehicle Market, By Component, 2018 - 2023 (Thousand Units)

Table 53 RoW Hybrid Vehicle Market, By Component, 2025 - 2030 (Thousand Units)

Table 54 RoW Hybrid Vehicle Market, By Electric Power Train, 2018 - 2023 (Thousand Units)

Table 55 RoW Hybrid Vehicle Market, By Electric Power Train, 2025 - 2030 (Thousand Units)

Table 56 RoW Hybrid Vehicle Market, By Propulsion, 2018 - 2023 (Thousand Units)

Table 57 RoW Hybrid Vehicle Market, By Propulsion, 2025 - 2030 (Thousand Units)

Table 58 RoW Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2023 (Thousand Units)

Table 59 RoW Hybrid Vehicle Market, By Degree of Hybridization, 2025 - 2030 (Thousand Units)

Table 60 RoW Hybrid Vehicle Market, By Vehicle, 2018 - 2023 (Thousand Units)

Table 61 RoW Hybrid Vehicle Market, By Vehicle, 2025 - 2030 (Thousand Units)

Table 62 RoW Hybrid Vehicle Market, by Region, 2018 - 2023 (Thousand Units)

Table 62 RoW Hybrid Vehicle Market, by Region, 2025 - 2030 (Thousand Units)

Table 63 Snapshot - Toyota

Table 64 Snapshot - Hyundai

Table 65 Snapshot - ZF

Table 66 Snapshot - Ford

Table 67 Snapshot - Honda

Table 68 Snapshot - BorgWarner

Table 69 Snapshot - Volvo

Table 70 Snapshot - Delphi Technologies

Table 71 Snapshot - Daimler

Table 72 Snapshot - Allison Transmission

Table 73 Snapshot - Continental

Table 74 Snapshot - Schaeffler

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Hybrid Vehicle Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Hybrid Vehicle Market Highlight

Figure 12 Global Hybrid Vehicle Market, By Component, 2018 - 2030 (Thousand Units)

Figure 13 Global Hybrid Vehicle Market, By Electric Power Train , 2018 - 2030 (Thousand Units)

Figure 14 Global Hybrid Vehicle Market, By Propulsion, 2018 - 2030 (Thousand Units)

Figure 15 Global Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2030 (Thousand Units)

Figure 16 Global Hybrid Vehicle Market, By Vehicle, 2018 - 2030 (Thousand Units)

Figure 17 Global Hybrid Vehicle Market, by Region, 2018 - 2030 (Thousand Units)

Figure 18 North America Hybrid Vehicle Market Highlight

Figure 19 North America Hybrid Vehicle Market, By Component, 2018 - 2030 (Thousand Units)

Figure 20 North America Hybrid Vehicle Market, By Electric Power Train , 2018 - 2030 (Thousand Units)

Figure 21 North America Hybrid Vehicle Market, By Propulsion, 2018 - 2030 (Thousand Units)

Figure 22 North America Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2030 (Thousand Units)

Figure 23 North America Hybrid Vehicle Market, By Vehicle, 2018 - 2030 (Thousand Units)

Figure 24 North America Hybrid Vehicle Market, by Region, 2018 - 2030 (Thousand Units)

Figure 25 Europe Hybrid Vehicle Market Highlight

Figure 26 Europe Hybrid Vehicle Market, By Component, 2018 - 2030 (Thousand Units)

Figure 27 Europe Hybrid Vehicle Market, By Electric Power Train, 2018 - 2030 (Thousand Units)

Figure 28 Europe Hybrid Vehicle Market, By Propulsion, 2018 - 2030 (Thousand Units)

Figure 29 Europe Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2030 (Thousand Units)

Figure 30 Europe Hybrid Vehicle Market, By Vehicle, 2018 - 2030 (Thousand Units)

Figure 31 Europe Hybrid Vehicle Market, by Region, 2018 - 2030 (Thousand Units)

Figure 32 Asia-Pacific Hybrid Vehicle Market Highlight

Figure 33 Asia-Pacific Hybrid Vehicle Market, By Component, 2018 - 2030 (Thousand Units)

Figure 34 Asia-Pacific Hybrid Vehicle Market, By Electric Power Train , 2018 - 2030 (Thousand Units)

Figure 35 Asia-Pacific Hybrid Vehicle Market, By Propulsion, 2018 - 2030 (Thousand Units)

Figure 36 Asia-Pacific Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2030 (Thousand Units)

Figure 37 Asia-Pacific Hybrid Vehicle Market, By Vehicle, 2018 - 2030 (Thousand Units)

Figure 38 Asia-Pacific Hybrid Vehicle Market, by Region, 2018 - 2030 (Thousand Units)

Figure 39 RoW Hybrid Vehicle Market Highlight

Figure 40 RoW Hybrid Vehicle Market, By Component, 2018 - 2030 (Thousand Units)

Figure 41 RoW Hybrid Vehicle Market, By Electric Power Train , 2018 - 2030 (Thousand Units)

Figure 42 RoW Hybrid Vehicle Market, By Propulsion, 2018 - 2030 (Thousand Units)

Figure 43 RoW Hybrid Vehicle Market, By Degree of Hybridization, 2018 - 2030 (Thousand Units)

Global Hybrid Vehicle Market Coverage

Component Insight and Forecast 2025-2030

- Electric Motor

- Battery

- Transmission

Electric Power Train Type Insight and Forecast 2025-2030

- Parallel Hybrids

- Series Hybrids

Propulsion Insight and Forecast 2025-2030

- Hybrid Electric Vehicles (HEV)

- Natural Gas Vehicles (NGV)

- Plug-In Hybrid Electric Vehicles (PHEV)

Degree of Hybridization Insight and Forecast 2025-2030

- Micro-Hybrid

- Full Hybrid

- Mild Hybrid

Vehicle Insight and Forecast 2025-2030

- Passenger Cars

- Commercial Vehicles

Geographical Segmentation

Hybrid Vehicle Market by Region

North America

- By Component

- By Electric Power Train Type

- By Propulsion

- By Degree of Hybridization

- By Vehicle Type

- By Country – U.S., Canada, and Mexico

Europe

- By Component

- By Electric Power Train Type

- By Propulsion

- By Degree of Hybridization

- By Vehicle Type

- By Country – Germany, U.K., France, Italy, Spain, Russia, and the Rest of Europe

Asia-Pacific (APAC)

- By Component

- By Electric Power Train Type

- By Propulsion

- By Degree of Hybridization

- By Vehicle Type

- By Country – China, Japan, India, South Korea, and the Rest of Asia-Pacific

Rest of the World (RoW)

- By Component

- By Electric Power Train Type

- By Propulsion

- By Degree of Hybridization

- By Vehicle Type

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com