Industry Overview

The India Electric Two-Wheeler Market is predicted to grow at 45.0% CAGR during the forecast period with its fleet size reaching 635.9 thousand units by 2030.

The Indian market is primarily driven by the as large population and supportive government regulations. Different products including e-scooters and e-bikes are majorly contributing to the electric two-wheeler market size in India. The market has witnessed significant demand for these products over the last few years with the increasing per capita income, increasing awareness for curbing vehicular emissions, and the development of smart cities.

India Electric Two-Wheeler Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. xx Units

|

|

Revenue Forecast in 2030

|

U.S.D. 635.9 thousand units Units

|

|

Growth Rate

|

45.0%

|

|

Segments Covered in the Report

|

By Product, By Battery Type, By Battery Technology, and By Voltage

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

India

|

India Electric Two-Wheeler Industry Dynamics

India Electric Two-Wheeler Market Trends/ Growth Drivers

The electric two-wheeler (e2W) market in India is experiencing significant growth, driven by a combination of policy support, changing consumer preferences, environmental concerns, and advancements in technology. The Indian government has introduced an initiative the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme, that offers subsidies to reduce the upfront cost of electric vehicles (EVs). The key trends and growth drivers in the Indian electric two-wheeler market are GST reduction, State-specific policies, environmental awareness and sustainability, rising awareness of environmental issues, government commitment to net-zero emissions by 2070, lower operating costs, cost parity with internal combustion engine (ICE) and rising fuel prices, battery swapping models, consumer preferences and urbanization and battery Technological improvements are contributing to longer ranges, faster charging times, and improved durability of electric two-wheelers.

India Electric Two-Wheeler Market Restraints

However, the high cost of the battery and thus of electric vehicles, and comparatively poor performance of electric vehicles for Indian roads when compared to conventional fuel-operated vehicles are the major factors hindering the growth of the Indian electric two-wheelers market.

India Electric Two-Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the India Electric Two-Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, battery type, battery technology and voltage.

Insight by Product

- E-scooters

- E-bikes

- E-motorcycles

- Others

Based on product, the market is categorized into e-scooters, e-bikes, e-motorcycles, and others. E-scooters hold the largest share in the Indian market, in terms of revenue as well as fleet size. E-motorcycles are anticipated to witness the fastest growth during the forecast period. E-motorbikes also called electric motorcycles are plug-in electric vehicles, that function similarly to a traditional motorcycle but make use of electricity in place of gasoline. The e-motorbikes have a slightly higher speed compared to e-bikes and e-scooters, which are generally more than 50km/hr.

Insight by Battery Type

- Sealed Lead Acid

- Li-ion

- NiMH

Based on battery type, the market is segmented into sealed lead acid, Li-ion, and NiMH. Of all, sealed lead acid is the most common type of battery used in electric two-wheelers in India. Lower prices are the primary reason behind the highest share of sealed lead acid batteries in the Indian electric two-wheelers market.

Insight by Battery Technology

- Removable Batteries

- Non-Removable Batteries

Based on battery technology, the market is categorized into removable batteries and non-removable batteries. Of both categories, non-removable batteries are majorly used in the market as it is convenient for electric two-wheelers to plug in and charge batteries instead of removing and charging indoors.

Insight by Voltage

Based on voltage, the market is segmented into 24V, 36V, 48V, 60V, 72V. Of all, 48V electric two-wheelers hold the largest share in the Indian electric two-wheeler market, followed by 36V two-wheelers. Most of the e-scooters run with a battery of 48V which provides optimum power to perform better in the congested metropolitan cities of the country.

India Electric Two-Wheeler Market: Geographic Overview

There is high adoption in metropolitan cities of India. The market in tier 2 and 3 cities is also seen growing due to affordability and increasing awareness among the consumers. In rural areas, there is gradual adoption which is driven by affordable models and subsidies.

India Electric Two-Wheeler Market Competitive Insight

- Yadea Technology Group

- Hero Electric Vehicles Pvt. Ltd.

- Okinawa Autotech Pvt. Ltd.

- Ather Energy

- Spero Electric

- Lohia Auto Industries

HERO Electric is a pioneer and market leader in the Indian Electric Two- Wheeler Industry that provides Eco-friendly and Cost-effective mode of personalized transportation with its diverse range of Electric Two-Wheelers. These High Range and High Speed Electric Two-Wheelers are manufactured in its state-of-the-art manufacturing facility at Ludhiana and has a widespread network of Exclusive Sales and Service outlets all over the country.

Okinawa Autotech is an Indian electric vehicle company that is headquartered in Gurgaon, Haryana.

The India Electric Two-Wheeler Market report offers a comprehensive market segmentation analysis and estimates for the forecast period 2025–2030.

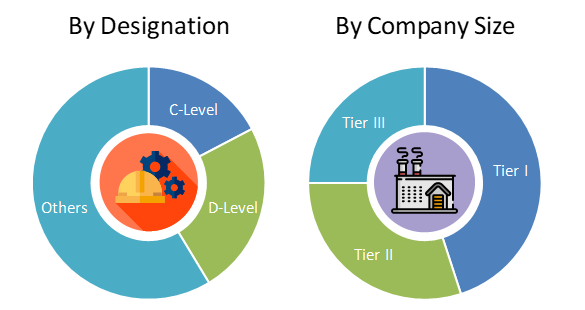

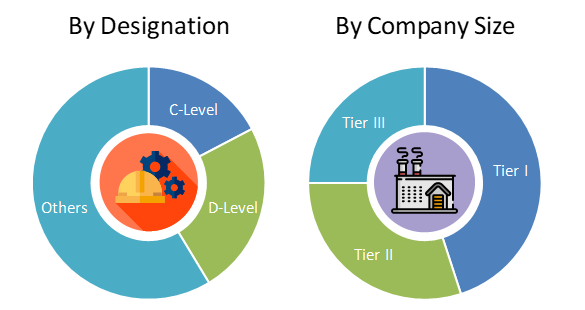

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN