Industry Overview

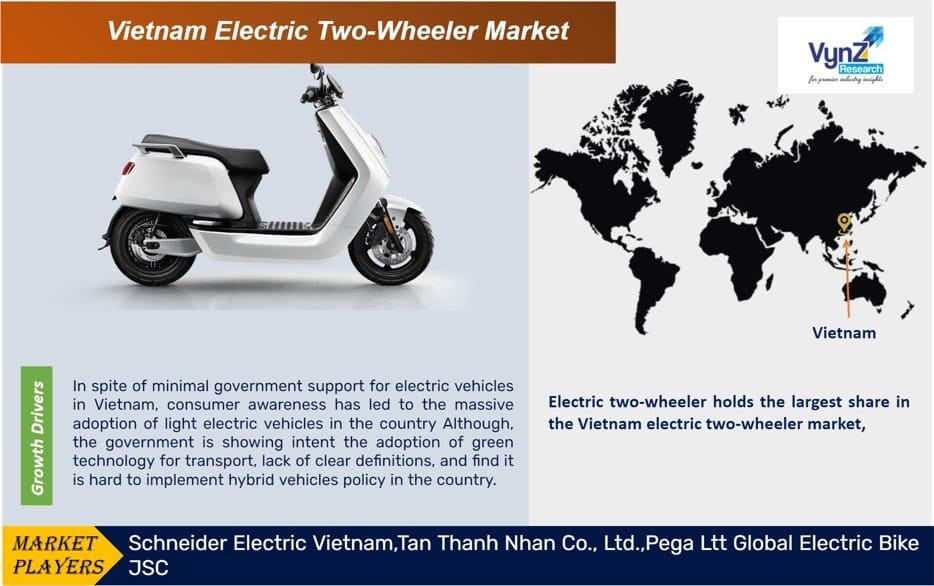

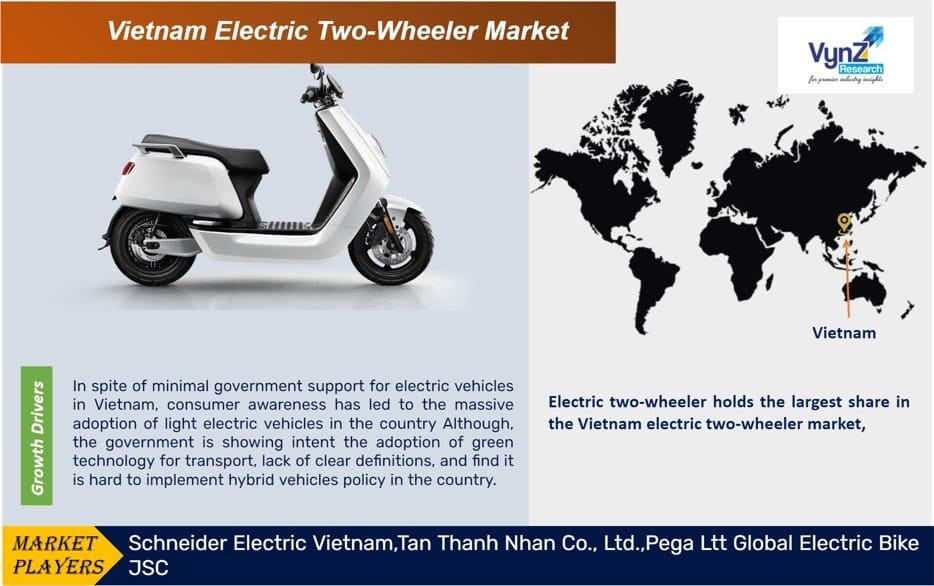

The Vietnam electric two-wheeler market is predicted to grow at 6.8% CAGR during the forecast period in terms of its revenue size.

The Vietnam market is primarily driven by supportive government regulations and increasing awareness regarding the use of electric vehicles. Different products including e-scooters and e-bikes are majorly contributing to the electric two-wheeler market size in Vietnam. The market has witnessed significant demand for these products over the last few years with the increasing per capita income and developing transport infrastructure.

Vietnam Electric Two Wheeler Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. XX Billion

|

|

Revenue Forecast in 2030

|

U.S.D. XX Billion

|

|

Growth Rate

|

6.8%

|

|

Segments Covered in the Report

|

Product, Battery Type, Battery Technology, Voltage

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

Vietnam

|

Vietnam Electric Two Wheeler Industry Dynamics

Vietnam Electric Two Wheeler Market Growth Drivers:

People are looking for more environmentally friendly forms of transportation, as they have become aware of the bad effects of greenhouse gas emissions and pollution. As compared to conventional engine, Electric two-wheelers (E2Ws) are quieter and cleaner.

The government is too promoting eco-friendly transportation, by passing legislation and taking action. Two-wheelers cost is reasonable in many places in this region. Middle class is into expansion due to the raised earnings due to Vietnam's robust economic expansion, which has ultimately increased consumer buying power. Motorbikes are now more accessible because to the upgraded infrastructure, especially in rural regions. The market is expanding due to technological developments in battery and motor efficiency.

Leading domestic producers of E2Ws include VinFast, Selex, and Pega Motors. Despite minimal government support for electric vehicles in Vietnam, consumer awareness has led to the massive adoption of light electric vehicles in the country Although, the government is showing intent the adopt green technology for transport, lack of clear definitions. However, Vietnam's electric vehicles are immune from tariffs as the country is a signatory to free trade agreements such as the ASEAN Trade in Goods Agreement (ATIGA), and the ASEAN-Republic of Korea FTA.

Vietnam Electric Two Wheeler Market Constraints:

Some of the factors that are hindering the growth of the Vietnam two-wheeler market consists of the high cost of batteries and lack of proper charging infrastructure. The other factors include, the safety standards, regulations related to emissions, and vehicle registration.

Recent Developments by Key Players

VinFast Auto Ltd, the electric vehicle (EV) manufacturer under Vingroup is one of the largest private conglomerates in Vietnam, has initiated the construction of a new integrated manufacturing facility in the southern state of Tamil Nadu.

Dat Bike (Vietnam’s domestic electric two- wheeler manufacturer) has launched its first electric scooter to accelerate green mobility adoption in the country. The Thenew model, Quantum is featured by a contemporary design and engineered with breakthrough technology for high performance at a competitive price point.

Vietnam Electric Two Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the Vietnam Electric Two Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, battery type, battery technology and voltage.

Insight by Product

- E scooters

- E-bikes

- E-motorcycles

- Others

Based on product, the market is categorized into e-scooters, e-bikes, e-motorcycles, and others. E-scooters hold the largest share in the Vietnam market, in terms of revenue as well as fleet size. E-motorcycles are anticipated to witness the fastest growth of 19.1% in terms of fleet size during the forecast period.

Insight by Battery Type

- Sealed Lead Acid

- Li-ion

- Ni-MH

Based on battery type, the market is segmented into sealed lead acid, Li-ion, and NiMH. Of all, sealed lead acid is the most common type of battery used in electric two-wheelers in Vietnam. Lower prices are the primary reason behind the highest share of sealed lead acid batteries in the Vietnam electric two-wheelers market.

Insight by Battery Technology

- Removable Battery

- Non-removable Battery

Based on battery technology, the market is categorized into removable batteries and non-removable batteries. Of both categories, non-removable batteries are majorly used in the market as it is convenient for electric two-wheelers to plug in and charge batteries instead of removing and charging indoors.

Insight by Voltage

Based on voltage, the market is segmented into 24V, 36V, 48V, 60V, 72V. Of all, 48V electric two-wheelers hold the largest share in the Vietnam electric two-wheeler market, followed by 36V two-wheelers.

Vietnam Electric Two Wheeler Market: Geographic Overview

Northern region of Vietnam dominates the market as large urban population drives demand for compact and efficient vehicles like electric two-wheelers.

Vietnam Electric Two Wheeler Market Competitive Insight

- Schneider Electric Vietnam

- Tan Thanh Nhan Co. Ltd.

- Dat Bike

- VinFast

- Pega Ltt Global Electric Bike JSC

Pega Ltt Global Electric Bike Jsc from Hanoi, Ha Noi, Vietnam is a supplier of scooter electric bicycle, bintelli fusion & scooter electric bicycle. The company is one of the finest parts & spares manufacturer too.

TAN THANH NHAN CO.,LTD is a specialized manufacturer of motorbike from Hanoi, Vietnam, established in 2002.

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN