Industry Overview

Biodegradable polymers are an important step toward sustainable materials and are frequently sourced from natural sources like plants or algae. These materials have minimal influence on the environment as they decompose spontaneously, unlike typical polymers. Numerous industries, including packaging, agriculture, and medicine, use these polymers for various purposes. One well-known example of biodegradable polymer is PLA (Polylactic Acid), which is known for its adaptability and compostability. Another biodegradable polymer with great biocompatibility polyhydroxyalkanoates (PHA) and it is very useful in medical implants.

Global biodegradable polymers market was worth USD 8.2 billion in 2023 and is expected reach USD 22.3 billion by 2030 with a CAGR of 20.40% during the forecast period, i.e., 2025-2030. The growing demand for biodegradable polymers is driven by the global transition towards more sustainable resources. Biodegradable substitutes are becoming more popular due to environmental awareness and governmental pressure to eliminate plastic waste. Sustainable solutions are sought after by the packaging, agricultural, and medical industries and biodegradable polymers, such as PLA and PHA, are proving to be suitable alternative to their non-biodegradable counterparts.

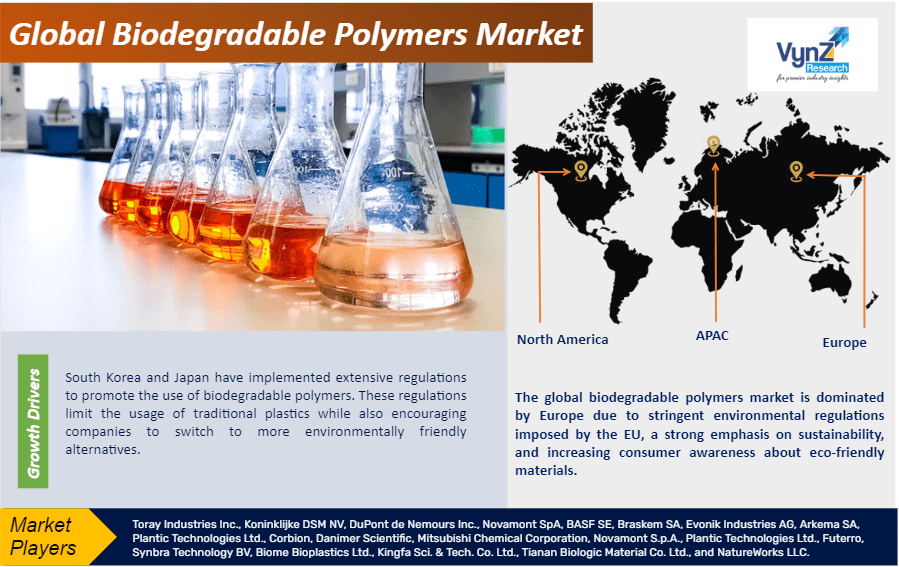

Geographically, the market is expanding rapidly in North America, Europe, and the Asia Pacific, as a result of the presence of large companies, huge investment in the R&D, and high awareness among end-users; however, the market confronts constraints such as cost-effectiveness and scalability of polymer production process. Overall, the biodegradable polymers market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including packaging, food and beverages, healthcare/pharmaceutical, and other industries.

Biodegradable Polymers Market Segmentation

Insight by Material Type

Based on the material type, the global biodegradable polymers market is segmented into polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, polyester (PBS, PBAT, and PCL), and other biodegradable polymers. PLA dominated the market in 2023 owing to its versatility and eco-friendliness. PLA is widely used in packaging, textiles, and medical applications as its compostable nature aligns with sustainability goals, driving its widespread adoption. PLA is also being seen as an excellent alternative to the single-use plastics, and all these factors support the dominate share of PLA in the global biodegradable polymers market.

Insight by End-User

Based on the end-use industry, the global biodegradable polymers market is segmented into packaging, consumer goods, agriculture, healthcare/pharmaceutical, textile, and others. Packaging industry dominated the global biodegradable polymers market in 2023 owing to growing environmental awareness and manufacturers such as NatureWorks, Carbion, BASF, and Toray, have been at the forefront of using PLA (polylactic acid) as a packaging material. Consumer packaged goods (CPPG) companies such as Nestlé, Coca-Cola, and Danone have included biodegradable polymers in their packaging to achieve sustainability targets.

The use of biodegradable alternatives is also being accelerated by stringent regulations that are being enforced by governments around the world to reduce the usage of single-use plastics. The demand for biodegradable polymers is expanding significantly as a result of this collective move toward environment-friendly packaging materials, a deliberate effort to reduce plastic pollution, and it is driving the extensive adoption of biodegradable polymers.

Global Biodegradable Polymers Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. Billion

|

|

Revenue Forecast in 2030

|

U.S.D. Billion

|

|

Growth Rate

|

%

|

|

Segments Covered in the Report

|

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

|

Industry Dynamics

Biodegradable Polymers Market Growth Drivers

Regulatory support from the government and authorities

Regulatory support from the governing authorities is one of the major factors driving the growth of the global biodegradable polymers market. Stringent laws are being implemented by governments all over the world to minimize the environmental impact of traditional plastics. For instance, the ‘Single-Use Plastics Directive’ of the European Union, which come into force on 3 July 2021, encourages the use of biodegradable substitutes for single-use plastics such as cotton buds, straws, and silverware. Comparably, in the US, certain states – such as California – have passed laws requiring the use of biodegradable or compostable materials in specific applications.

Moreover, several countries such as South Korea and Japan have implemented extensive regulations to promote the use of biodegradable polymers. These regulations limit the usage of traditional plastics while also encouraging companies to switch to more environmentally friendly alternatives. Through its Clean Seas campaign, the United Nations Environment Program (UNEP) has also been pushing for a decrease in single-use plastics on a global scale, which obliquely encourages the use of biodegradable materials.

Due of these regulations, manufacturers are investing towards the R&D of new biodegradable polymers and cost-friendly manufacturing processes, which in turn drive the growth of the biodegradable polymers market.

Extensive demand from healthcare industry

The global biodegradable polymers market is growing owing to the rising demand from the healthcare sector. Biodegradable polymers manufacturers, such as NatureWorks, have seen growing demand from the healthcare industry due to the excellent compatible nature of biodegradable polymers with biological systems. Additionally, biodegradable polymers break down in a harmless way in the body, promoting their widespread use in medical devices, medication delivery systems, sutures, and tissue engineering.

Furthermore, the requirement for cost-effectiveness and infection control has led to a boom in demand for single-use medical equipment, which has created a growing demand for the biodegradable polymers. Manufacturers specializing in biodegradable resins and polymers, such as Corbion, have registered an increased interest from the healthcare industry. For instance, surgical meshes and wound care products made with NatureWorks' Ingeo biopolymer are used in a variety of medical applications and Carbion’s renewable resource-based Luminy PLA resins are used in medication delivery systems and medical implants.

Biodegradable Polymers Market Challenge

High manufacturing cost

The cost element is one of the major challenges for the growth of the global biodegradable polymers market. The production of these environmentally friendly materials is typically more expensive than that of ordinary plastics, despite great promise offered for minimizing environmental impact. Higher production costs are a result of the procurement of bio-based feedstocks, refining procedures, and specialized manufacturing methods.

Biodegradable polymer goods are less competitive in today’s price-sensitive markets because of this cost discrepancy, which frequently results in higher costs for these polymers. The biodegradable polymer industry is yet to completely realize economies of scale, which exacerbates the already existing cost discrepancy.

Biodegradable Polymers Market Geographic Overview

The global biodegradable polymers market is segmented into North America, Europe, the Asia-Pacific, Latin America, and the Middle East and Africa region. The global biodegradable polymers market is dominated by Europe due to stringent environmental regulations imposed by the EU, a strong emphasis on sustainability, and increasing consumer awareness about eco-friendly materials. Additionally, presence of a developed chemical industry in Germany and other countries in the region along with large end-user base supports the dominant share of the region in the global biodegradable polymers market.

Biodegradable Polymers Market Competitive Insight

BASF SE – a global chemical giant – is a major player in the biodegradable polymers market. One prominent example of their contributions is their "Ecoflex" product line, a line of compostable and biodegradable co-polyesters. These polymers are made from renewable resources and have a wide range of uses, such as agricultural films and packaging materials. Owing to its significant R&D and sustainability initiatives, BASF has established itself as a major force in the plastics industry's advancement of environmentally responsible products and the creative efforts made by BASF are driving the demand and applications of biodegradable polymers across industries.

Toray Industries, Inc. is another prominent player in the biodegradable polymers market with its 'Ecodear' product line. Toray's strategy emphasis on sustainable materials is in line with the growing demand for environment-friendly substitutes of traditional non-biodegradable polymers and "Ecodear" is a unique biodegradable polyester that comes from plant sources and has a wide range of uses in various sectors. Toray's leading position in the development of biodegradable polymer solutions is strengthened by their expertise in advanced polymer science.

Recent Development by Key Players

In October 2023, Senbis, the Netherlands Organisation for Applied Scientific Research (TNO), Wageningen Food & Biobased Research, the University of Groningen, and NHL Stenden Universit have formed a consortium to develop a new biodegradable polyester. The consortium will develop the biodegradable polyester under the project named ‘Biottek’, which started in September 2023 and will run for the next 3-years. The European Commission has provided a grant of €3.3 million to the consortium and partners will contribute the remaining €3.3 million.

In April 2023, Amazon partnered with the US Department of Energy’s BOTTLE Consortium to develop a new recovery and recycling process for mixed plastic waste stream and to find a solution for plastics to biodegrade in the environment. The collaboration between Amazon and BOTTLE Consortium will focus to develop an economically-viable process for the recycling and recovery of biodegradable polymers.

Key Players Covered in the Report

Toray Industries Inc., Koninklijke DSM NV, DuPont de Nemours Inc., Novamont SpA, BASF SE, Braskem SA, Evonik Industries AG, Arkema SA, Plantic Technologies Ltd., Corbion, Danimer Scientific, Mitsubishi Chemical Corporation, Novamont S.p.A., Plantic Technologies Ltd., Futerro, Synbra Technology BV, Biome Bioplastics Ltd., Kingfa Sci. & Tech. Co. Ltd., Tianan Biologic Material Co. Ltd., and NatureWorks LLC.

The biodegradable polymers market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

Polylactic acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Starch blends

-

Polyester (PBS, PBAT, and PCL)

-

Other biodegradable polymers

Region Covered in the Report

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)