Industry Overview

The global dental adhesive market was valued at USD 2.4 billion in 2023 and is anticipated to grow to USD 3.42 billion by 2030, thus growing at a CAGR of 6.1% during the forecast period 2025-2030.

Dental adhesives are defined as non-toxic and water-soluble material that can be placed on the gums and dentures to hold them in place in the mouth, thus enhancing the normal physiological forces. It helps to reduce the movement and slippage of dentures in the mouth while eating, speaking, laughing, coughing, and other similar activities.

The global dental adhesive market has witnessed healthy growth in recent years, due to the increase in the geriatric population having conditions such as dry mouth (xerostomia), periodontitis, root, and coronal caries, unhealthy food habits in the young population, and other factors. Various types of adhesives for dental use are available in the market that provide superior bond strength, versatility, and ease of use for dental bonding.

Global Dental Adhesive Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 2.4 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 3.42 Billion

|

|

Growth Rate

|

6.1%

|

|

Segments Covered in the Report

|

By Type, By Etching Technique, By Application, By Technology, and By End-User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Dental Adhesive Market Segmentation

Insight by Type

On the basis of type, the dental adhesive market is bifurcated into cream-based and powder-based. Among these two segments, cream-based adhesives also known as paste adhesives or denture glue are presumed to be the fastest and highest growing sub-segment in the market, owing to their easy application and property of making a strong bond. Hence, cream adhesives are anticipated to have a high CAGR in the overall market. Cream adhesives can be easily applied to dry dentures or wet dentures. However, it tends to ooze, if not applied perfectly.

Insight by Application

On the basis of application, the dental adhesive market is divided into denture, fit and fissure, restorative, and others. Of all these categories, the fit and fissures application category is anticipated to be the largest segment during the forecast period. This is attributed to various factors such as budget-friendly dental filling and effectiveness in filling the cavities. The younger generation is prone to dental cavities and thus forms the main consumer base for this application.

Insight by Etching Technique

On the basis of the etching technique, the dental adhesive market is divided into total-etch, self-etch, and selective etch. Among all these categories, self-etch adhesive dominates the market, owing to the rising demand for reduced technique sensitivity, less-time time-consuming clinical application, and reduced incidences of post-operative sensitivity.

Insight by Technology

On the basis of technology, the dental adhesive market is classified into water-based, solvent-based, radiation-cured, and others. Water-based technology holds the largest share owing to the rise in the geriatric population, shift in consumer habits, and advancement of new products.

Insight by End-User

On the basis of end-users, the dental adhesive market is categorized into dental hospitals and clinics, dental academics and research institutes, laboratories, and others. Among all these categories, dental hospitals and clinics hold the largest share of the market and are also anticipated to witness the fastest growth in the coming years. This can be attributed to the rising patient population, rising adoption of innovative and advanced dental technologies, and an increasing number of hospitals and clinics, particularly in emerging countries to meet the needs of the rising population.

Industry Dynamics

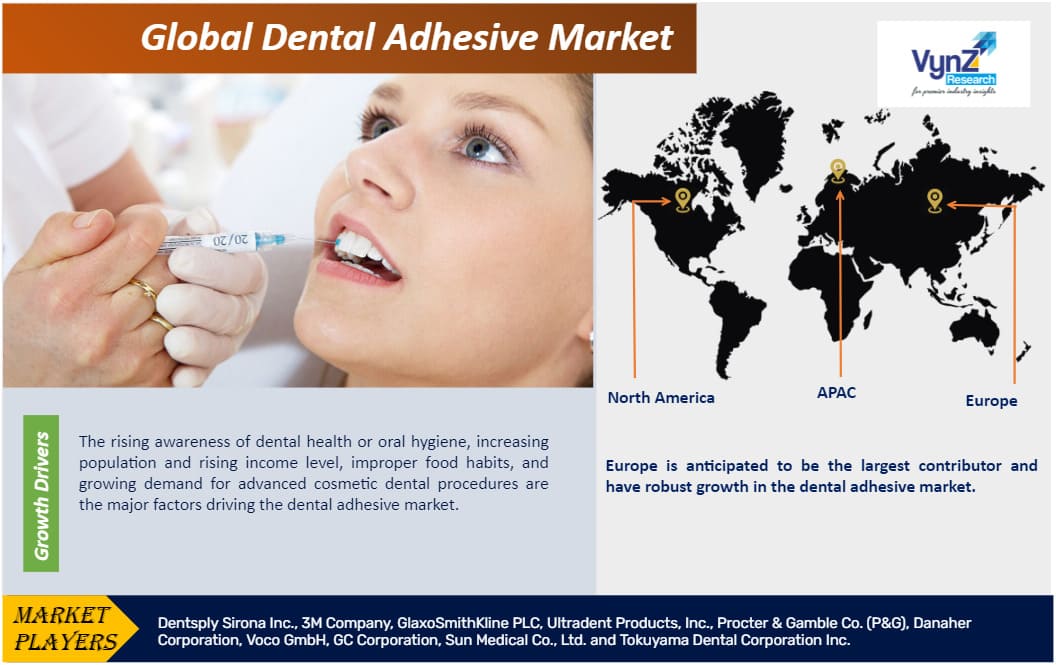

Dental Adhesive Market Growth Drivers

The rising awareness of dental health or oral hygiene, increasing population and rising income level, improper food habits, and growing demand for advanced cosmetic dental procedures are the major factors driving the dental adhesive market. The awareness about dental health is growing across the world. According to a study conducted by the U.S. Centers for Disease Control and Prevention, the population, especially the young people with cavities in the country has dropped, due to the increase in awareness for early care, resulting in market growth.

Dental Adhesive Market Challenges

High prices of dental care treatment and the lack of dental professionals are the major restraints in the dental adhesive market. The people are not interested in spending on dental treatment except when necessary as they do not consider it important and consider it as an extra cost. Moreover, the growing regulations by FDA on zinc usage causing nerve damage, numbness or tingling sensations act as a restraint for the dental adhesive market.

Recent Developments By the Key Players

Ultradent Products, Inc., a leading developer and manufacturer of high-tech dental materials, announces the release of Opalescence Home Advanced prefilled whitening trays, combining at-home teeth whitening capabilities with professional-grade results and unmatched convenience.

Danaher has partnered with Innovaccer Inc. Innovaccer has built a suite of software solutions designed to create a unified patient record to identify gaps in care and patients at risk, as well as appropriate interventions to improve patient outcomes. As part of the investment partnership, Danaher, along with Innovaccer and its network of healthcare systems, seeks to accelerate the adoption of precision diagnostics both by clinicians and population health teams, facilitating value-based care.

Dental Adhesive Market Industry Ecosystem

An increasing number of dentists are establishing hospitals in developing countries such as China and India to respond to the growing demand for dental services. Moreover, the growing population and increasing dental and oral diseases are encouraging people to choose it as a profession, resulting in market growth.

Dental Adhesive Market Geographic Overview

Europe is anticipated to be the largest contributor and have robust growth in the dental adhesive market. There are various factors contributing toward the market growth such as a rise in the geriatric populace, increasing incidences of dental diseases, growing dental tourism in selected European countries, rising government expenditure on oral healthcare across Europe, and high reimbursement rates for dental procedures in Europe as compared to other regions. However, Asia-Pacific is expected to witness the fastest growth in the dental adhesive market during the forecast period owing to the rising rate of road accidents in the region which has propelled the growth of dental reconstruction surgeries.

Dental Adhesive Market Competitive Insight

The companies are focusing on strategic alliances via mergers and acquisitions, partnerships, collaborations, joint ventures, and government, and corporate deals. There are numerous opportunities for start-ups in the industry to develop innovative products and technology.

The Dental Adhesive Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Type

- Application

- Denture

- Fit and fissure

- Restorative

- Others

- Etching Technology

- Total-etch

- Self-etch

- Selective-etch

- Technology

- Water

- Solvent

- Radiation-Cured

- Others

- End-User

- Dental Hospitals and Clinics

- Dental academics and Research institutes

- Laboratories

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

.png)

Source:VynZ Research

.png)