- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Fungicides Market

| Status : Published | Published On : Sep, 2024 | Report Code : VRCH2107 | Industry : Chemicals & Materials | Available Format :

|

Page : 190 |

Global Fungicides Market Size & Share | Growth Forecast Report 2030

Industry Insights By Product Type (Chemical Fungicides and Biological Fungicides), By Application (Agriculture, Horticulture, Turf, and Ornamentals), By Formulation Type (Liquid, Powder, And Granules), By Crop Type (Cereals, Fruits and Vegetables, Oilseeds, and others) and By Geography (North America, Europe, Asia Pacific, Middle East and Africa)

Industry Overview

The global fungicides market size was valued at USD 23.6 billion in 2023. It is expected to reach up to USD 33.8 billion by 2030 registering a CAGR of 6.80% during the forecast period ranging between 2025 and 2030.

Fungicides refer to special types of biological or chemical agents. These are typically used to inhibit and prevent the growth of fungi or fungal spores on crops, damaging production. These agents play a crucial role in agriculture, helping the farmers to produce crops free from any fungal infection or disease such as rusts, blights, and molds. It also improves their quality and shelf life. Fungicides are available in different forms, such as sprays, dust, and seed treatments and can be used safely on vegetables, fruits, cereals, and even on ornamental plants.

The global fungicides market growth is primarily driven by the significant rise in the demand for food worldwide and the growing incidences of fungal diseases affecting crop yield. The growing world population necessitates an increase in crop production and food security demands. This results in higher adoption of fungicides to protect crops from fungal infections and diseases. Moreover, the rise in fungal diseases in crops is attributed mainly to climate change, which is now warmer and more humid, creating a perfect environment for fungi to thrive. This also results in a higher reliance on fungicides to protect crops, thereby pushing the market forward.

However, the market growth is hindered by a few specific challenges, such as the growing regulatory restrictions on the use of chemical-based fungicides due to the potential environmental impacts and health effects. Several governments and environmental agencies are imposing stern regulations on the use of synthetic fungicides, which restricts market growth. Manufacturers, as a result, now focus on producing bio-based fungicides to meet the growing consumer demand for eco-friendly and sustainable products. These organic and biologically derived fungicides, due to the shift toward bio-based alternatives, have opened new growth opportunities for the market.

Global Fungicides Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 23.6 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 33.8 Billion |

|

Growth Rate |

6.80% |

|

Segments Covered in the Report |

Product Type, Application, Formulation Type and Crop Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Middle East and Africa |

Global Fungicides Industry Dynamics

Global Fungicides Market Trends/ Growth Drivers:

Move Toward Biopesticides

A notable trend in the global fungicides market is the higher preference and shift toward environmentally friendly biopesticides. These products help meet the rising demand from regulators and consumers for natural and organic fungicides derived from biological sources that prioritize sustainability. Additionally, a broader movement is also reflected by the move toward integrated pest management practices. These approaches minimize the usage of chemical pesticides while controlling fungal diseases most effectively. The significant developments in biotechnology and the creation of innovative biopesticides with higher efficiency and safety profiles to address environmental concerns more effectively are also worth noting.

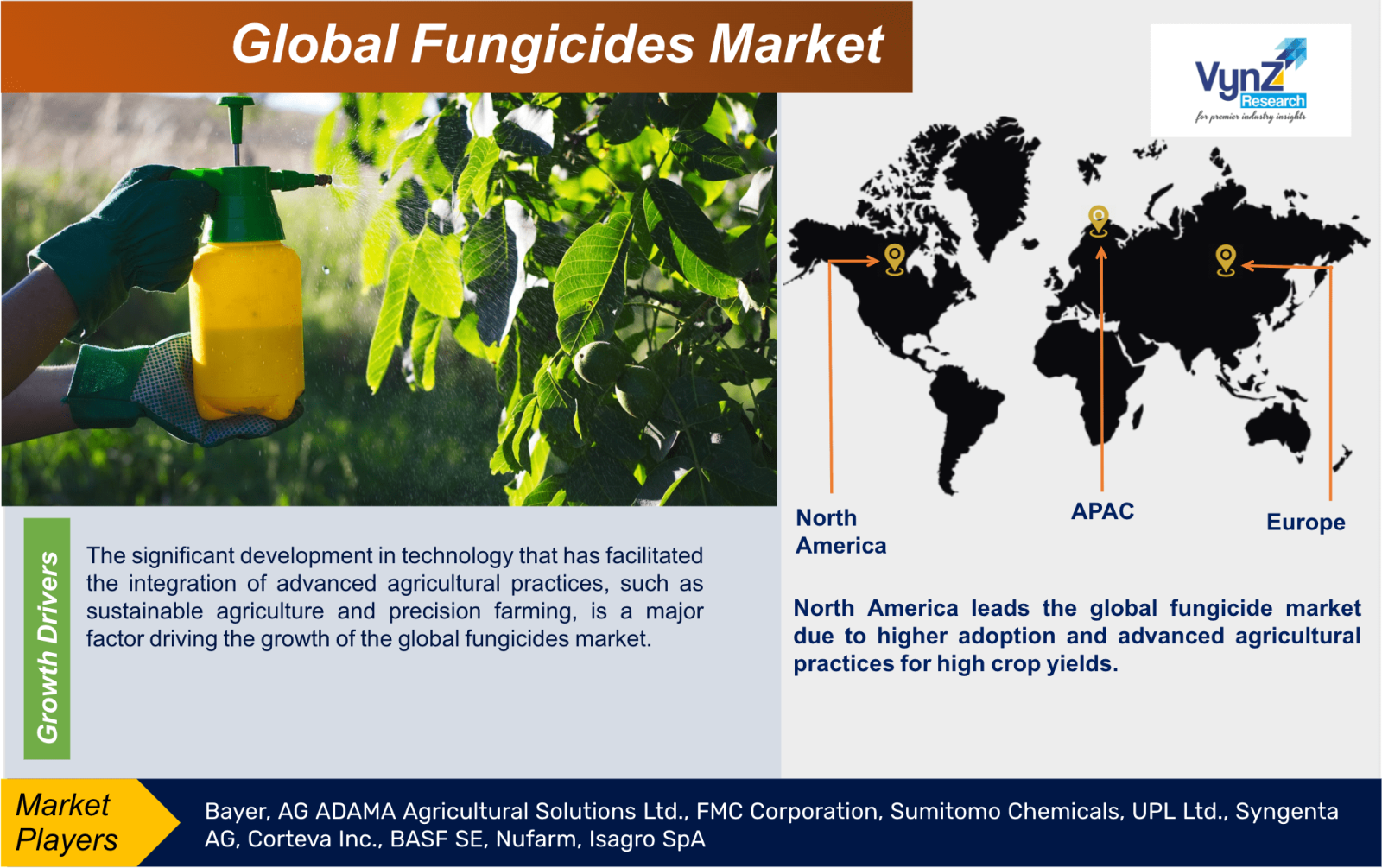

The significant development in technology that has facilitated the integration of advanced agricultural practices, such as sustainable agriculture and precision farming, is a major factor driving the growth of the global fungicides market. This has resulted in higher adoption and use of fungicides by farmers to effectively protect their crops. Target application with a minimum amount reduces waste and also enhances crop health and production.

Increasing Organic Farming

The rise in demand for bio-based fungicides, especially in organic agriculture, is also a significant factor driving the growth of the global fungicide market. Typically, these organic fungicides are made from natural ingredients and have gained significant traction due to the growing consumer preference for organic food products. These alternatives are extremely environmentally friendly and can manage fungal infections in crops without compromising organic guarantees. Since more countries are moving to sustainable farming practices, this will push the demand for organic fungicides and, thereby, the market.

Government Policies and Subsidies

Supportive government policies and subsidies encourage the use of fungicides and improve agricultural productivity. This also plays a crucial role in the market growth. Several countries in Asia-Pacific and Latin America especially have launched different programs to support and encourage farmers to adopt these solutions for crop protection and yield growth. Governments also provide technical assistance in regions where agriculture is a major economic contributor. Such initiatives increase awareness of the benefits of using fungicides, which significantly contributes to the growth of the global fungicides market.

Increase in popularity of Horticulture and Ornamental Plants

The growing popularity of horticulture and ornamental plants and their increasing demand, especially in urban areas and developing regions, also contribute to the market growth. These specific plants are more susceptible to fungal infections resulting in potential economic losses in the horticultural sector. Fungicides help protect these plants from fungal infections and diseases and promote their quality and marketability, fueling the market expansion further.

Global Fungicides Market Challenges

Increasing Resistance of Fungi

The increasing resistance of fungi to fungicides is one of the most significant challenges for the growth of the global fungicides market. The commonly used fungicides are especially ineffective due to the developed resistance of fungi, which decreases crop production. Often, higher doses or entirely new formulations are required for effectiveness and increased crop production, but it also increases the production cost for farmers and manufacturers. Furthermore, the lack of awareness among the farmers and the inappropriate use of fungicides contribute to the issue. The companies find it hard to develop new and effective products for the resistant strains, which slows down the market growth.

Global Fungicides Market Opportunities

Increasing Demand in Developing Markets

A significant growth opportunity is offered to the global fungicide market by the significant increase in the demand for fungicides in the developing agricultural sector in emerging markets, especially in the Asia-Pacific, Latin American, and African markets. This is mainly attributed to the rapid population growth as well as the consequent increased demand for food production. Moreover, the rising investments in the agricultural sector, along with the significant technological developments in the developing countries especially, are supporting higher adoption of fungicides due to their notable shift towards modern sustainable farming practices to boost productivity, creating novel growth opportunities for manufacturers to expand their presence in growing markets.

Recent Development by Key Players

BASF has introduced Aramax Intrinsic brand fungicide which is a dual-active fungicide that delivers broad-spectrum control of 26 cool and warm season turf diseases like large patch, brown patch, snow mold and dollar spot on golf course fairways. This brand fungicide combines the strength of two powerful active ingredients, triticonazole and pyraclostrobin, for long-lasting residual disease control up to 28 days.

The newly launched bio-fungicide product by Bayer has amplified quality and crop yield, that offers a safe, effective and environment-friendly crop protection solution for Vietnamese farmers, to meet stringent international standards.

Global Fungicides Market Segmentation

Insight by Product Type

- Chemical Fungicides

- Biological Fungicides

Biological fungicides segment dominates due to growing awareness of food safety and environmental sustainability

The global fungicides market is segmented by product type into Chemical Fungicides and Biological Fungicides. Among these two segments, the biological fungicides segment will dominate and grow at a rapid rate during the forecast period due to growing awareness of food safety and environmental sustainability, rising demand for sustainable agriculture practices, a shift towards organic farming, and strict regulations on using chemicals. The chemical fungicides segment, on the other hand, is also expected to grow quite significantly due to higher effectiveness, which promotes widespread adoption and use in agriculture. Furthermore, within this specific segment, azoles will be most significant due to their higher efficacy against different types of fungal pathogens.

Insight by Application

- Agriculture

- Horticulture

- Turf

- Ornamentals

Agriculture segment dominates the market due to higher adoption and crop protection needs

Diverse applications also divide the global fungicides market into different categories such as Agriculture, Horticulture, Turf, and Ornamentals. Out of all these segments, the agriculture segment holds the largest share of the market due to greater adoption and the need to protect crops from fungal infections and diseases. Furthermore, within this specific segment, the application of fungicides on cereals is most predominant mainly because these crops are indispensable for worldwide food security. The horticulture segment will also grow quite rapidly during the projected period due to higher demand for fresh produce.

Insight by Formulation Type

- Liquid

- Powder

- Granules

Liquid formulations dominate the market due to higher effectiveness and ease of application

The global fungicides market is categorized by different formulations as well into Liquid, Powder, And Granules. Among them, liquid formulations dominate the market due to their higher effectiveness and ease of application. The suspension concentrates in this specific subsegment will, however, display noteworthy growth during the forecast period due to a higher ability to deliver high performance and lower concentrations of active ingredients. However, the powder formulations segment will also grow, being a much safer alternative, especially for use in organic farming.

Insight by Crop Type

- Cereals

- Fruits and Vegetables

- Oilseeds

- others.

The cereals segment dominates due to their vital role in food supply chains

Different types of crops also divide the global fungicides market into Cereals, Fruits and Vegetables, Oilseeds, and others. Among them, the cereals segment dominates due to their crucial participation in food supply chains. However, growing health consciousness among people will drive the growth of the fruits and vegetables segment during the projected period further due to their preference for organic produce.

Global Fungicides Market: Geographic Overview

North America leads the global fungicide market due to higher adoption and advanced agricultural practices for high crop yields. It is also attributed to the higher adoption of precision farming techniques, integrated pest management strategies, stringent regulations, technological adoption, and significant investments.

The market in Europe is growing due to strict regulatory standards, a shift toward sustainable agricultural practices, growing demand for organic and bio-based fungicides, shifting consumer preferences for eco-friendly products, and increasing investments in research to develop innovative fungicide solutions.

The Asia-Pacific region will grow at a higher rate during the forecast period, being the major contributor to the market due to higher agricultural production, growing pest pressure and better management techniques, rapid population growth, higher demand for food security, and increased investment in agriculture.

The Middle East and Africa region is expected to grow due to an increase in agricultural activities, growing awareness of fungicides and crop protection, supportive government initiatives to promote sustainable farming practices, and rising investments in agricultural technology, especially in developing economies in this region.

Global Fungicides Market Competitive Insight

The report provides a comprehensive analysis of the competitive landscape in the market. Some of the key players in the market include:

- Bayer AG

- ADAMA Agricultural Solutions Ltd.

- FMC Corporation

- Sumitomo Chemicals

- UPL Ltd.

- Syngenta AG

- Corteva Inc.

- BASF SE

- Nufarm

- Isagro SpA

.png)

Source: VynZ Research

.png)

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Product Type

1.2.2. By Application

1.2.3. By Formulation Type

1.2.4. By Crop Type

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Product Type

5.1.1. Chemical Fungicides

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Biological Fungicides

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Application

5.2.1. Agriculture

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Horticulture

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Turf

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Ornamentals

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.3 By Formulation Type

5.3.1. Liquid

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Powder

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Granules

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Crop Type

5.4.1. Cereals

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Fruits and Vegetables

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Oilseeds

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Product Type

6.2. By Application

6.3. By Formulation Type

6.4. By Crop Type

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Product Type

7.2. By Application

7.3. By Formulation Type

7.4. By Crop Type

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Product Type

8.2. By Application

8.3. By Formulation Type

8.4. By Crop Type

8.5. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Product Type

9.2. By Application

9.3. By Formulation Type

9.4. By Crop Type

9.5. By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Bayer AG

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. ADAMA Agricultural Solutions Ltd.

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. ADAMA Agricultural Solutions Ltd.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. FMC Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Sumitomo Chemicals

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. UPL Ltd.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Syngenta AG

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Corteva Inc.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. BASF SE

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Nufarm

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. Isagro SpA

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Fungicides Market Size, by Product Application, 2018-2023 (USD Billion)

Table 5 Global Fungicides Market Size, by Product Application, 2025-2030 (USD Billion)

Table 6 Global Fungicides Market Size, by Application, 2018-2023 (USD Billion)

Table 7 Global Fungicides Market Size, by Application, 2025-2030 (USD Billion)

Table 8 Global Fungicides Market Size, by Formulation Type, 2018-2023 (USD Billion)

Table 9 Global Fungicides Market Size, by Formulation Type, 2025-2030 (USD Billion)

Table 10 Global Fungicides Market Size, by Crop Type 2018-2023 (USD Billion)

Table 11 Global Fungicides Market Size, by Crop Type, 2025-2030 (USD Billion)

Table 12 Global Fungicides Market Size, by Region, 2018-2023 (USD Billion)

Table 13 Global Fungicides Market Size, by Region, 2025-2030 (USD Billion)

Table 14 North America Fungicides Market Size, by Product Application, 2018-2023 (USD Billion)

Table 15 North America Fungicides Market Size, by Product Application, 2025-2030 (USD Billion)

Table 16 North America Fungicides Market Size, by Application, 2018-2023 (USD Billion)

Table 17 North America Fungicides Market Size, by Application, 2025-2030 (USD Billion)

Table 18 North America Fungicides Market Size, by Formulation Type, 2018-2023 (USD Billion)

Table 19 North America Fungicides Market Size, by Formulation Type, 2025-2030 (USD Billion)

Table 20 Global Fungicides Market Size, by Crop Type, 2018-2023 (USD Billion)

Table 21 Global Fungicides Market Size, by Crop Type, 2025-2030 (USD Billion)

Table 22 North America Fungicides Market Size, by Country, 2018-2023 (USD Billion)

Table 23 North America Fungicides Market Size, by Country, 2025-2030 (USD Billion)

Table 24 Europe Fungicides Market Size, by Product Application, 2018-2023 (USD Billion)

Table 25 Europe Fungicides Market Size, by Product Application, 2025-2030 (USD Billion)

Table 26 Europe Fungicides Market Size, by Application, 2018-2023 (USD Billion)

Table 27 Europe Fungicides Market Size, by Application, 2025-2030 (USD Billion)

Table 28 Europe Fungicides Market Size, by Formulation Type, 2018-2023 (USD Billion)

Table 29 Europe Fungicides Market Size, by Formulation Type, 2025-2030 (USD Billion)

Table 30 Global Fungicides Market Size, by Crop Type, 2018-2023 (USD Billion)

Table 31 Global Fungicides Market Size, by Crop Type, 2025-2030 (USD Billion)

Table 32 Europe Fungicides Market Size, by Country, 2018-2023 (USD Billion)

Table 33 Europe Fungicides Market Size, by Country, 2025-2030 (USD Billion)

Table 34 Asia-Pacific Fungicides Market Size, by Product Application, 2018-2023 (USD Billion)

Table 35 Asia-Pacific Fungicides Market Size, by Product Application, 2025-2030 (USD Billion)

Table 36 Asia-Pacific Fungicides Market Size, by Application, 2018-2023 (USD Billion)

Table 37 Asia-Pacific Fungicides Market Size, by Application, 2025-2030 (USD Billion)

Table 38 Asia-Pacific Fungicides Market Size, by Formulation Type, 2018-2023 (USD Billion)

Table 39 Asia-Pacific Fungicides Market Size, by Formulation Type, 2025-2030 (USD Billion)

Table 40 Global Fungicides Market Size, by Crop Type, 2018-2023 (USD Billion)

Table 41 Global Fungicides Market Size, by Crop Type, 2025-2030 (USD Billion)

Table 42 Asia-Pacific Fungicides Market Size, by Country, 2018-2023 (USD Billion)

Table 43 Asia-Pacific Fungicides Market Size, by Country, 2025-2030 (USD Billion)

Table 44 RoW Fungicides Market Size, by Product Application, 2018-2023 (USD Billion)

Table 45 RoW Fungicides Market Size, by Product Application, 2025-2030 (USD Billion)

Table 46 RoW Fungicides Market Size, by Application, 2018-2023 (USD Billion)

Table 47 RoW Fungicides Market Size, by Application, 2025-2030 (USD Billion)

Table 48 RoW Fungicides Market Size, by Formulation Type, 2018-2023 (USD Billion)

Table 49 RoW Fungicides Market Size, by Formulation Type, 2025-2030 (USD Billion)

Table 50 Global Fungicides Market Size, by Crop Type, 2018-2023 (USD Billion)

Table 51 Global Fungicides Market Size, by Crop Type, 2025-2030 (USD Billion)

Table 52 RoW Fungicides Market Size, by Country, 2018-2023 (USD Billion)

Table 53 RoW Fungicides Market Size, by Country, 2025-2030 (USD Billion)

Table 54 Snapshot – Bayer AG

Table 55 Snapshot – ADAMA Agricultural Solutions Ltd.

Table 56 Snapshot – FMC Corporation

Table 57 Snapshot – Air Product Application s and Chemicals Inc.

Table 58 Snapshot – Sumitomo Chemicals

Table 59 Snapshot – UPL Ltd.

Table 60 Snapshot – Syngenta AG

Table 61 Snapshot – Corteva Inc.

Table 62 Snapshot – BASF SE

Table 63 Snapshot – Nufarm

Table 64 Snapshot – Isagro SpA

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Product Types for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Fungicides Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Fungicides Market Highlight

Figure 12 Global Fungicides Market Size, by Product Type, 2018 – 2030 (USD Billion)

Figure 13 Global Fungicides Market Size, by Application 2018 – 2030 (USD Billion)

Figure 14 Global Fungicides Market Size, by Formulation Type 2018 – 2030 (USD Billion)

Figure 15 Global Fungicides Market Size, by Crop Type 2018 – 2030 (USD Billion)

Figure 16 Global Fungicides Market Size, by Region, 2018 – 2030 (USD Billion)

Figure 17 North America Fungicides Market Highlight

Figure 18 North America Fungicides Market Size, by Product Type, 2018 – 2030 (USD Billion)

Figure 19 North America Fungicides Market Size, by Application 2018–2030 (USD Billion)

Figure 20 North America Fungicides Market Size, by Formulation Type 2018–2030 (USD Billion)

Figure 21 North America Fungicides Market Size, by Crop Type 2018–2030 (USD Billion)

Figure 22 North America Fungicides Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 23 Europe Fungicides Market Highlight

Figure 24 Europe Fungicides Market Size, by Product Type, 2018 – 2030 (USD Billion)

Figure 25 Europe Fungicides Market Size, by Application 2018 – 2030 (USD Billion)

Figure 26 Europe Fungicides Market Size, by Crop Type 2018 – 2030 (USD Billion)

Figure 27 Europe Fungicides Market Size, by Distribution Channel 2018 – 2030 (USD Billion)

Figure 28 Europe Fungicides Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 29 Asia-Pacific Fungicides Market Highlight

Figure 30 Asia-Pacific Fungicides Market Size, by Product Type, 2018 – 2030 (USD Billion)

Figure 31 Asia-Pacific Fungicides Market Size, by Application 2018 – 2030 (USD Billion)

Figure 32 Asia-Pacific Fungicides Market Size, by Formulation Type 2018 – 2030 (USD Billion)

Figure 33 Asia-Pacific Fungicides Market Size, by Crop Type 2018 – 2030 (USD Billion)

Figure 34 Asia-Pacific Fungicides Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 35 RoW Fungicides Market Highlight

Figure 36 RoW Fungicides Market Size, by Product Type, 2018 – 2030 (USD Billion)

Figure 37 RoW Fungicides Market Size, by Application 2018 – 2030 (USD Billion)

Figure 38 RoW Fungicides Market Size, by Formulation Type 2018 – 2030 (USD Billion)

Figure 39 RoW Fungicides Market Size, by Crop Type 2018 – 2030 (USD Billion)

Figure 40 RoW Fungicides Market Size, by Country, 2018 – 2030 (USD Billion)

Global Fungicides Market Coverage

Product Type Insight and Forecast 2025-2030

- Chemical Fungicides

- Biological Fungicides

Application Insight and Forecast 2025-2030

- Agriculture

- Horticulture

- Turf

- Ornamentals

Formulation Type Insight and Forecast 2025-2030

- Liquid

- Powder

- Granules

Crop Type Insight and Forecast 2025-2030

- Cereals

- Fruits and Vegetables

- Oilseeds

- Others

Global Fungicides Market by Region

- North America

- By Product Type

- By Application

- By Formulation Type

- By Crop Type

- By Country – U.S., Canada, and Mexico

- Europe

- By Product Type

- By Application

- By Formulation Type

- By Crop Type

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

- Asia-Pacific (APAC)

- By Product Type

- By Application

- By Formulation Type

- By Crop Type

- By Country – China, Japan, India, South Korea, and the Rest of Asia-Pacific

- Rest of the World (RoW)

- By Product Type

- By Application

- By Formulation Type

- By Crop Type

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Fungicides Market Size & Share | Growth Forecast Report 2030

- The global Fungicides Market is expected to grow from its estimated value of USD 23.6 billion in 2023 to reach up to USD 33.8 billion by 2030 at a CAGR of 6.80% during the projected period 2025 to 2030.

- The market is divided into different categories and sub-categories by different product types, applications, formulations, and crop types, with each showing significant growth prospects during the forecast period.

- The growing demand for sustainable agricultural practices and food security primarily drives the growth of the fungicides market. The rise in fungal diseases in crops due to climate change is also a significant reason for the widespread adoption and growth of the market.

- The strict regulations on the use of synthetic or chemical fungicides hinder market growth. However, it also creates opportunities for manufacturers to develop bio-based alternatives and promote market growth.

- While North America leads the market due to high consumption and advancement and Europe has a higher emphasis on sustainable, bio-based products, Asia-Pacific experiences rapid growth due to greater demand and food security needs.