| Status : Published | Published On : Dec, 2023 | Report Code : VRCH2030 | Industry : Chemicals & Materials | Available Format :

|

Page : 165 |

Global Alkylate Market – Analysis and Forecast (2025-2030)

Industry Insights by Production Process Type (Sulfuric Acid Alkylation, Hydrofluoric Acid Alkylation, and Others), and by Application Type (Solvents, Surfactants & Synthetic Sulfonates, Specialty Lubricants, Functional Fluids, Additives and Others)

Industry Overview

In the forecast period of 2025 to 2030, the Global Alkylate Market is projected to expand at a CAGR of 3.1%, reaching USD 98.08 billion by 2030, up from USD 83.65 billion in 2023.

Over the projected period, the global alkylate demand is expected to be hampered by the rise of electric cars and renewable fuels. The global alkylate industry, on the other hand, is expected to be driven by a rise in demand for alkylate as additives in fuel and agrochemical formulations over the next decade, as alkylate is widely used in the manufacture of fuel, lubricants, solvents, and agrochemicals. For the manufacture of refining materials, the market for alkylate has been increasing. This is expected to drive the alkylate market during the forecast era, as alkylates are commonly used in the refining industry for fuel production due to their high-octane content, which is achieved by transforming low molecular weight alkenes into alkylates in the presence of sulfuric or hydrofluoric acid.

Alkylates are used as gasoline additives to achieve high octane and low vapor pressure. Light olefins (such as butylene) are primarily processed into high-quality gasoline blend stock by reacting them with isobutene in alkylate processing. The global market for high-efficiency fuel in the automobile industry is expected to increase alkylate demand. During the forecast era, this trend is expected to propel the global alkylate demand.

Global Alkylate Market - Impact due to COVID-19

Since December 2019, the COVID-19 pandemic has had a major global effect. According to a WHO survey, the United States, India, Russia, Brazil, Italy, France, Argentina, Spain, Colombia, the United Kingdom, Germany, and Mexico are among the countries most affected by COVID-19. The pandemic is stifling global economic activity, and it is expected to continue in 2021. Manufacturing, construction, automobiles, textiles, plastics, cosmetics, tourism, hotels, consumer products, shipping, IT and telecom, pharmaceutical, and other sectors are all affected by the epidemic. This causes many bottlenecks in the raw material supply chain for packaging, resulting in demand-supply differences. The global alkylate market is expected to be significantly impacted by this scenario.

Alkylate Market Segmentation

Insight by Production Process Type

On the basis of production process, the global alkylation market is classified into sulfuric acid alkylation, hydrofluoric acid alkylation, and others.

Insight by Application Type

Based on end-user type, the Global Alkylate Market is segregated into Solvents, Surfactants & Synthetic Sulfonates, Specialty Lubricants, Functional Fluids, Additives and Others.

Global Alkylate Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 83.65 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 98.05 Billion |

|

Growth Rate |

3.1% |

|

Segments Covered in the Report |

By Production Process Type, and By Application Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

By Region

• North America

• Europe

• Asia-Pacific (APAC)

• Rest of the World

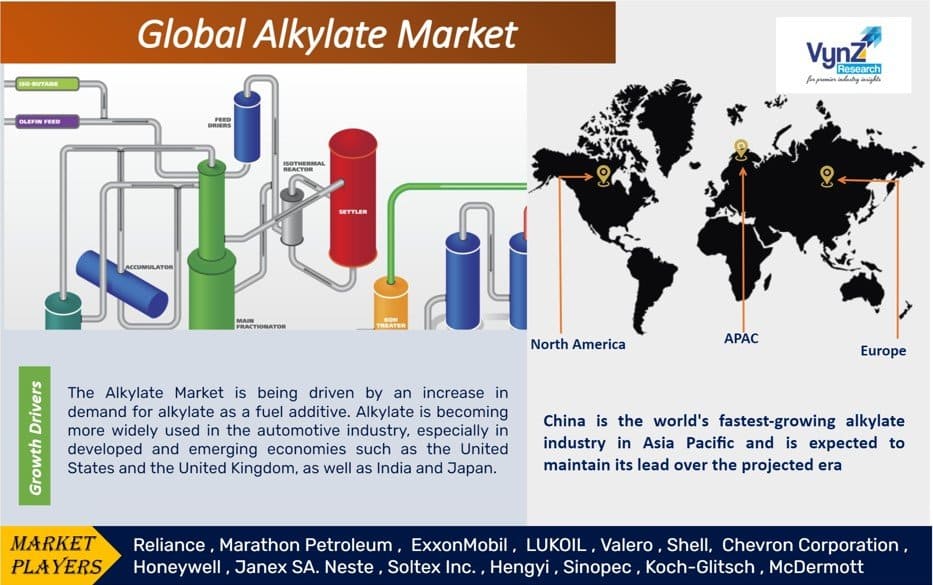

China is the world's fastest-growing alkylate industry in Asia Pacific and is expected to maintain its lead over the projected era. The country's market is being bolstered by demand from advanced automotive and aviation industries.

Market Trends

The demand for alkylate has been rising for the manufacture of refinery products. This is likely to drive the alkylate market during the forecast period, as alkylate is widely employed in the refinery industry for fuel production because of its high-octane value that is attained by converting low molecular weight alkenes into alkylates in the presence of sulfuric or hydrofluoric acid. The usage of alkylates as additives in fuel allows high octane and low vapor pressure. Mainly, in alkylate production, light olefins (such as butylene) is converted into high-quality gasoline blendstock by reacting it with isobutene. The rise in demand for highly efficient gasoline in the automotive sector globally is projected to boost the demand for alkylate. This factor is likely to propel the global alkylate market during the forecast period.

Market Drivers

The Alkylate Market is being driven by an increase in demand for alkylate as a fuel additive. Alkylate is becoming more widely used in the automotive industry, especially in developed and emerging economies such as the United States and the United Kingdom, as well as India and Japan. The rise in the number of electric vehicles, as well as increased government initiatives in developing markets such as India to promote foreign investment in the local automotive industry, can be attributed to the industry's growth.

Over the next few years, the global automobile market, which includes passenger cars, buses, trucks, and heavy-duty vehicles, is expected to grow at a CAGR of 3.8%. Since 2015, the production of automobiles has risen by 15%. The passenger car market is expected to fuel the global automotive industry, owing to rising customer disposable income. Over the projected timeframe, however, the industry is expected to be hampered by rising environmental issues and emissions.

Alkylate is widely used in the addition of high-octane hydrocarbons to main fuels (including gasoline). Internal combustion engines use gasoline (petrol) as a fuel. The market for alkylate is expected to rise as demand for high-efficiency fuel grows in the automobile industry around the world. As a result, the global alkylate demand is expected to grow during the forecast period.

Alkylate Market Opportunities

Increase in Usage of Alkylate in Agrochemical Formulation to Boost Alkylate Market

• Agrochemicals are organic compounds used in fertile farmlands to make up for nitrogen deficiencies in fields or crops. They also help crops flourish by removing pests that are detrimental to them. Agrochemicals help farmers increase the quantity and quality of their produce. They are used in horticulture, dairy farming, poultry, grain farming, shifting agriculture, and commercial plantations, among other agricultural areas.

• As crop infestations have become more common, modern farming practices have become more reliant on agrochemicals. Alkylate is used for sulfonation of agrochemicals such as fertilizers, fungicides, pesticides, herbicides, and insecticides, and as the agrochemical sector expands, so does the market for alkylate.

• The agrochemicals industry is expected to benefit from increased demand for crop defense chemicals such as fertilizers, fungicides, pesticides, herbicides, and insecticides. As a result, the global alkylate demand is expected to grow during the forecast period.

Alkylate Market Challenges

The alkylation process involves high-cost regeneration. Alkylation reactions are prone to carbocation rearrangements. The entire process cycles for sulfuric acid alkylation, hydrofluoric acid alkylation, and others are complex and require expensive laboratory setups.

During the COVID-19 epidemic, the New York Harbor was less thirsty for alkylate pouring from India's Reliance refinery. The growth of the Indian alkylate industry is being hampered by such trends. The pandemic has slashed demand for premium oil, resulting in a price decrease for alkylate and a tightening of the octane spread. The growth of the alkylate industry is being hampered by excess production and thin blending margins for premium RBOB (Reformulated Gasoline Blendstock for Oxygen Blending).

During the height of the coronavirus epidemic in April, suppliers were storing surplus alkylate with the intention of keeping it there until summer 2021. Furthermore, refineries have been operating in a phased fashion, resulting in a slowdown in alkylate flows. As a result, mass vaccination of COVID-19 vaccinations and careful financial preparation of company practices are expected to boost demand growth in the third and fourth quarters of 2021.

Alkylate Market Competitive Insight

Valero Energy Corporation is an American-based downstream petroleum company mostly involved in manufacturing and marketing transportation fuels, other petrochemical products, and power. It is headquartered in San Antonio, Texas, United States.

The PJSC Lukoil Oil Company is a Russian multinational energy corporation headquartered in Moscow which specializes in the business of production, extraction, transport and sale of petroleum, petroleum products, natural gas and electricity.

Key Market Players

• Reliance

• Marathon Petroleum

• ExxonMobil

• LUKOIL

• Valero

• Shell

• Chevron Corporation

• Honeywell

• Janex SA.

• Neste

• Soltex Inc.

• Hengyi

• Sinopec

• Koch-Glitsch

• McDermott

Recent Developments by Key Players

Chevron Corp. is undertaking a project that will expand processing of light tight oil (LTO) and increase overall crude capacity at subsidiary Pasadena Refining System Inc.’s. This project shall enable the refinery to produce jet fuel, improve process safety, and reduce emissions.

Lummus Technology has opened an alkylate manufacturing unit in China for expanding its business in Asia and making it the largest alkylation plant across the globe. The move will enhance the earnings of the firm along with contributing sizably towards the global market revenue.

ExxonMobil and Axens have signed an alliance agreement for the sublicense of ExxonMobil’s Sulfuric Acid Alkylation technology. This alliance leverages collective expertise by providing a streamlined solution and proven technologies to optimize high-octane fuels production.

The Alkylate Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Application Type

- Solvents

- Surfactants & Synthetic Sulfonates

- Specialty Lubricants

- Functional Fluids

- Additives

- Others

- Product Process Type

- Sulfuric Acid Alkylation

- Hydrofluoric Acid Alkylation

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Alkylate Market