Industry Overview

The global printing ink market is valued at USD 21.3 billion in 2023 and is expected to reach USD 28.2 billion by 2030. The market for printing ink is observing significant growth due to its increasing demand in domestic applications, metal cans, and packaging application offerings such as labels and tags. This market is expected to witness a CAGR of 4.6% during 2025–2030. owing to the robust scope for advertisement expenditure and incremental growth in label printing and packaging.

Printing Ink Market Segmentation

Insight by Product

On the basis of product, the printing ink market is segmented into lithographic inks, flexographic inks, gravure inks, digital inks, letterpress inks, and other products. Of all these products lithographic ink will become the largest market by 2024 owing to its advantages that are observed by the manufacturers such as printing flexibility, quick process, and superior quality. Moreover, digital ink is expected to witness the highest growth worldwide due to the extensive shifting trend of key industry players into digital fields. As a result, digital ink is expected to witness the fastest growth during 2025–2030.

Lithographic inks are further segmented into three types: sheetfed offset inks, heatset web offset inks, and coldest web offset inks.

Also, digital inks are further segmented into two types: electrography, and inkjet.

Insight by Application

On the basis of application, the printing ink market is segmented into labels and packaging, publication, commercial printing, and other applications. The publication is further segmented into newspapers, books magazines, and other publications. Amongst all the applications labels and packaging holds the largest market and is also expected to witness the fastest growth during the forecast period. Packaging is considered to be the most crucial aspect in marketing of products as it helps in effectively positioning the products in the minds of the consumers and also helps in influencing their purchasing decisions. The packaging industry in North America is observed to be a foremost customer of printing inks. Furthermore, accelerating demand for flexible packaging and expansion of the food and beverage industry is expected to strengthen the growth of the printing ink market globally.

Insight by Formulations

The global printing ink market has also been segmented by formulations into oil-based, solvent-based, water-based, and other formulations. Amongst all the segments oil-based formulations are the largest revenue holder and water-based formulations are expected to witness the fastest growth during 2025–2030. The oil-based formulation is expected to hold the leading spot across the globe as compared to others due to its widespread application for publication purposes and commercial areas.

Global Printing Ink Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 21.3 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 28.2 Billion

|

|

Growth Rate

|

4.6%

|

|

Segments Covered in the Report

|

By Product, By Application, and By Formulation

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Printing Ink Growth Drivers

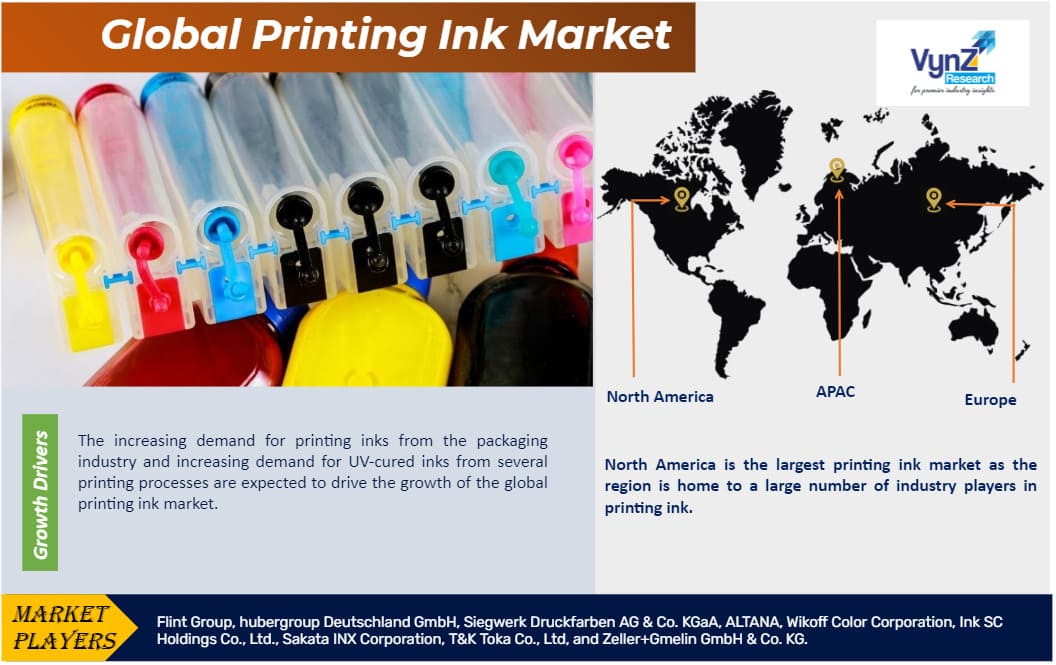

The increasing demand for printing inks from the packaging industry and increasing demand for UV-cured inks from several printing processes are expected to drive the growth of the global printing ink market. According to a recent study, it has been observed that the packaging segment has been experiencing enormous growth and it is expected to follow a similar trend in the near future. The packaging sector plays a crucial role in several numbers of industries such as food and beverages, manufacturing, consumer goods and electronics. The unparalleled demand from these industries is rampant due to the proliferating demand for high-quality packaging. Moreover, with the gaining momentum of paperboard packaging, the demand for printing ink has immensely advanced.

The results of the study conducted by Hochschule der Medien (HdM), Stuttgart, Germany, state that the packaging sector has been witnessing considerable savings with higher print quality by using printing inks. Moreover, the continuously evolving lifestyle, demand for packaged food, and increasing disposable income are further contributing to the growth of the global printing ink market.

Furthermore, UV curving (Ultraviolet curing) is used for instantaneously curing dry inks, adhesives, and coatings. It acts as a replacement to the traditional drying methods and helps in significantly speeding up the production process, improves solvent resistance and scratches, and helps in reducing rejection rates for the manufacturers. Additionally, continuous improvement and innovation in printing ink technologies are further anticipated to drive the market for printing ink globally.

Printing Ink Challenges

Implementation of stringent government regulations is anticipated to be the major hindrance to the growth of the global printing ink market. There have been growing concerns for the release of toxic metals such as lead, cadmium, mercury hexavalent chromium, and volatile organic compounds that exist in certain printing inks which has forced government organizations to implement regulations on manufacturers for using bio-friendly substitutes. Moreover, the increasing trend for the adoption of e-books and digital books is expected to further restrain the growth of the global printing ink market in the near future.

Printing Ink Industry Ecosystem

Globally industry players are leveraging market growth by employing inkjet competencies along with a new trend that is gaining momentum shifting into the digital arena. Moreover, the industry is observing the number of cases of acquisitions that are particularly driven by geographic opportunities and product lines.

Recent Developments By the Key Players

Flint Group is expanding its manufacturing capabilities in India with a new state-of-the-art facility focused on producing water-based inks and coatings for the paper and packaging industry. The company aims to enhance its sustainability efforts and strengthen its presence in the growing Indian market.

ALTANA has acquired Silberline Group. The U.S. company specializes in developing and manufacturing effect pigments utilized in various applications, ranging from automotive coatings and printing inks to plastics, protective coatings, and packaged consumer goods.

Printing Ink Geographic Overview

Geographically, North America is the largest printing ink market as the region is home to a large number of industry players in printing ink. Moreover, the increasing demand for UV-cured ink, expansion in the population base, and growing trend of consumer spending on several products are further strengthening the growth of the printing ink market in this region. The most crucial factor driving the growth of this market is the prices of crude oil and growth of renewable energy in this region.

Asia-Pacific is observed to witness the fastest growth in this market. As the region comprises of largest population, an increase in disposable income and accelerating demand for packaged products is contributing significantly towards the growth of this market. Additionally, the increasing application of printing ink in several industries such as printing, packaging and publication, food, and beverages are expected to drive the demand of printing ink in Asia-Pacific.

Printing Ink Competitive Insight

Market players in the printing ink industry are seeking ample opportunities in the publishing and packaging industry that comprises commercial printing such as magazines and newspapers.

The Printing Ink Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Product

- Lithographic Inks

- Sheetfed Offset Inks

- Heatset Web Offset Inks

- Coldset Web Offset Inks

- Flexographic Inks

- Gravure Inks

- Digital Inks

- Letterpress Inks

- Others

- Application

- Labels and Packaging

- Publication

- Newspaper

- Books and Magazine

- Others

- Commercial Printing

- Others

- Formulation

- Oil-based

- Solvent-based

- Water-based

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

Primary Research Interviews – Breakdown

.png)

.png)