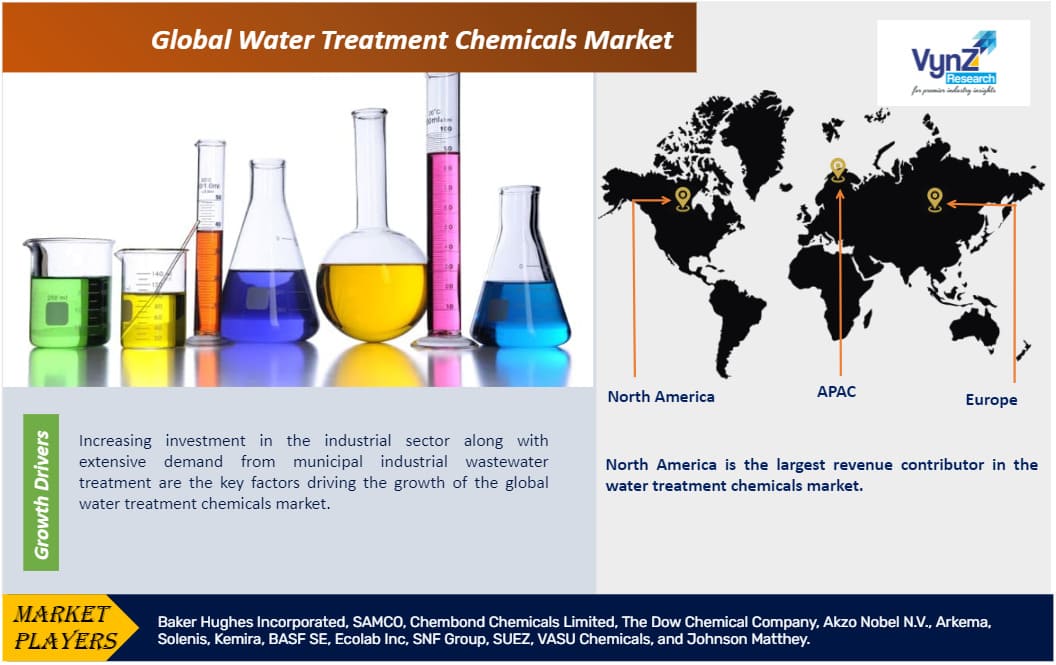

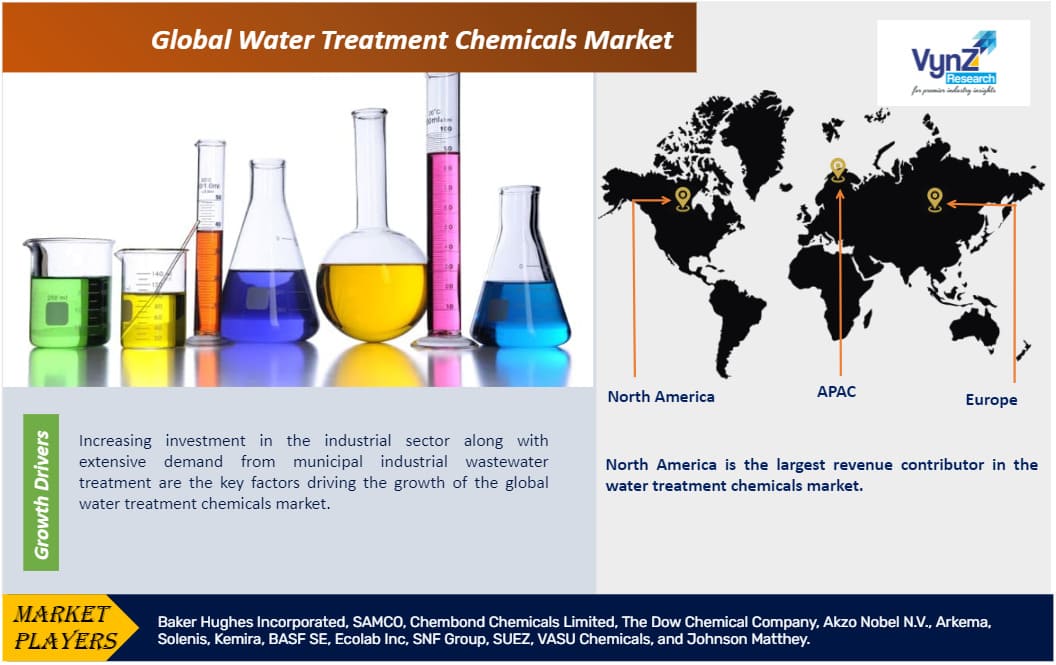

Industry Overview

The global water treatment chemicals market is expected to grow from USD 30.9 billion to USD 38.5 billion at a CAGR of 4.1% during the forecast period ranging from 2025 to 2030.

Water treatment chemicals comprise coagulants, flocculants, and disinfectants like chlorine, and pH adjusters. These chemicals are extensively used for purifying water by eliminating contaminants. It helps in improving water quality to ensure it is safe for drinking. It is also used extensively in wastewater treatments and protection of industrial equipment from corrosion and scaling.

The growth of the global water treatment chemicals market is attributed to the growing incidents of contamination in surface and groundwater needing efficient treatments. The growing investment in the industrial sector is another significant growth factor of the market. On significant reason for the market growth is the higher adoption to maintain environmental sustainability.

The high costs involved in using advanced treatment chemicals typically restricts widespread adoption, particular in emerging economies causing significant growth hindrance to the market. Also, the growing health concerns and apprehensions regarding chemical residues in treated water poses serious challenge to market growth. Opportunities are however presented by the intensifying water scarcity and environmental compliance requirements.

Water Treatment Chemicals Market Segmentation

Insight by Type

Based on type, the global water treatment chemicals market is categorized into biocides & disinfectants, pH adjusters & softeners, scale inhibitors & dispersants, flocculants, coagulants, corrosion inhibitors, and others. Among all these segments, the corrosion inhibitors segment is expected to witness a higher growth rate during the forecast period due to rapid technological advancement in the water treatment industry as well as higher utilization of treatment equipment.

Insight by End Use

The global water treatment chemicals market is also divided on the basis of end uses into municipal water and industrial water. The industrial water segment is further subdivided into pulp & paper, food & beverages, refineries, oil & gas, power generation, sugar, metal & mining, and others. Among the two major sections, the industrial water segment is expected to grow at a higher rate during the forecast period due to higher demand from the power generation sector.

Insight by Application

Different applications also divide the global water treatment chemicals market into raw water treatment, water desalination, cooling, boiler, effluent water treatment, and other segments. Out of all these segments, the raw water treatment segment will hold the largest market revenue share during the forecast period due to higher use for purification of water for product formulations, rinsing, cooling, and even human consumption. The boiler segment is also expected to grow at a higher CAGR due to higher application in the petrochemical industry to protect the boiler components and piping from damage by the contaminants present in the boiler or feeds.

Global Water Treatment Chemicals Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 30.9 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 38.5 Billion

|

|

Growth Rate

|

4.1%

|

|

Segments Covered in the Report

|

By Type, By End Use and By Application

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Industry Trends

Higher focus on sustainability is the key trend witnessed in the industry which is driving the adoption of eco-friendly water treatment chemicals and processes. In addition, development in technologies and integrating them in the process is revolutionizing operations and optimizing efficiency and cost-effectiveness. It is also noted that circular economy initiatives are gaining traction thereby promoting the recycling and reuse of water and chemicals to reduce waste.

Water Treatment Chemicals Market Growth Drivers

The rise in demand from municipal industrial wastewater treatment is one of the key factors that drives the growth of the global water treatment chemicals market. The significant rise in industrial activities all over the globe as well as the growing global population are also increasing the demand for clean water and water treatment chemicals to ensure it is suitable for human consumption, which is also fueling the market growth. In addition, the strict regulations imposed by the government authorities towards total suspension of solid levels of the water and reuse of water is also promoting the growth of the global water treatment chemicals market.

Water Treatment Chemicals Market Challenges

The occurrence and easy availability of alternative water treatment methods is a significant growth challenge to the global water treatment chemicals market. In addition, the complex global regulations pose significant compliance challenges to the market players hindering the market growth, which is further accentuated by the infrastructure limitations in water treatment in a few regions.

Water Treatment Chemicals Market Opportunities

Growth opportunities however lie in the rapid urbanization drives needing improved water treatment infrastructure as well as the significant developments in technology to develop more efficient water treatment processes and chemicals.

Recent Developments By the Key Players

Argent LNG has selected Baker Hughes, an energy technology company, as the service provider for its proposed LNG export facility in Port Fourchon, Louisiana.

Baker Hughes will supply liquefaction solutions, power generation equipment, and gas compression systems for the facility, which is set to deliver approximately 24 million tpy of LNG.

Water Treatment Chemicals Market Geographic Overview

North America leads the market and will grow significantly during the forecast period due to strict regulations by the government authorities to ensure reuse and recycling of wastewater. In addition, the higher demand and popularity of water treatment chemicals in oil & gas and mining industries in the region for cleaning contaminated wastewater at low cost is also fueling the market growth.

Asia-Pacific also shows significant growth potential due to rise in the living standards of the population and growing demand for safe and high-quality water. It is also attributed to the stringent government regulations to protect the environment and higher investments in such initiatives as well as rapid industrialization and urbanization in developing countries such as India, China, and Japan.

Water Treatment Chemicals Market Competitive Insight

Key players operating in the water treatment chemicals market are emphasizing their efforts upon strategic acquisitions in order to strengthen capabilities of research & development that support them in providing innovative solutions to the users and thus gain competitive advantage.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data, and have key opinions from industry experts. The key profiles approached within the industry include, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads, and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behavior.

The Water Treatment Chemicals Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Type

- Biocides & Disinfectants

- pH Adjusters & Softeners

- Scale Inhibitors & Dispersants

- Flocculants

- Coagulants

- Corrosion Inhibitors

- Others

- End Use

- Municipal Water

- Industrial Water

- Pulp & Paper

- Food & Beverages

- Refineries

- Oil & Gas

- Power Generation

- Sugar

- Metal & Mining

- Others

Region Covered in the Report

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

China

-

Japan

-

Vietnam

-

India

-

South Korea

-

Rest of Asia-Pacific

-

UAE

-

Saudi Arabia

-

South Africa

-

Rest of MEA

-

Argentina

-

Brazil

-

Chile

-

Rest of LATAM

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)