- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Air Purification Systems Market

| Status : Published | Published On : Dec, 2023 | Report Code : VRCG7001 | Industry : Consumer Goods | Available Format :

|

Page : 200 |

Global Air Purification Systems Market – Analysis and Forecast (2025-2030)

Industry Insights by Product (Dust Collectors, Fume & Smoke Collectors, Vehicle Exhaust, Mist Eliminators, Fire/Emergency Exhaust, Others), by Technology (HEPA, Electrostatic Precipitator, Activated Carbon, Ionic Filters, Others), by Industry (Automotive, Construction, Healthcare & Medical, Energy & Utilities, Manufacturing, Others), by Geography (U.S., Canada, U.K., Germany, France, Italy, Spain, Russia, China, Japan, India, South Korea, Indonesia, Thailand, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, U.A.E., South Africa, Nigeria), by Geography (U.S., Canada, U.K., Germany, France, Italy, Spain, Russia, China, Japan, India, South Korea, Indonesia, Thailand, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, U.A.E., South Africa, Nigeria)

Industry Overview

The Air Purification Systems Market is anticipated to reach 29.62 billion USD by 2030 from USD 16.12 billion in 2023, growing at a CAGR of 10.38%. The air purification system is gaining a significant increase in demand due to increasing pollution, particularly in developing countries, accelerated industrialization, and regulations regarding industrial emissions.

An air purification system is a device that helps remove pollutants from the air and is beneficial for people suffering from allergies and asthma as it makes the air clean for breathing. The device is also beneficial in clearing off second-hand smoke and the target audience usually comprises people who smoke. Thus, there is an increase in the number of people suffering from respiratory diseases as there is a fall in air quality, an increase in income level led to the smart technology’s popularity, rising geriatric population, technological development, coronavirus impact, and economic growth in emerging markets are some of the factors contributing to the growth of air purification system market. Poor indoor air quality (IAQ) is one of the concerns to schools, buildings, hospitals, and the workers on these premises as it can adversely impact their health. This, in turn, increases the demand for air purification systems globally.

The COVID-19 outbreak has resulted in an increase in demand owing of the healthcare sector has increased its spending on installing high-grade air purifiers for treat the environment pathogen-free. There is a huge potential in the air purification system market owing to the rising popularity of UV-based purification. The U.S. Environmental Protection Agency (Environmental Protection Agency) reports that air purifiers can help reduce air pollutants, including viruses, in homes or confined spaces if used properly. However, portable air filters alone are not enough to protect people from COVID-19.

Air Purification Systems Market Segmentation

Insight by Product

Based on product, the air purification systems market is categorized into dust collectors, fume and smoke collectors, vehicle exhaust, mist eliminators, fire/emergency exhaust, and others (including air cleaners, industrial UV systems, and commercial kitchen ventilation systems). Of all product categories, dust collectors are expected to hold the largest market share during the forecast period. Dust collectors are used to remove dust impurities and other allergic particles from the environment. Increasing awareness of the air quality among consumers leads to an increase in the demand for dust collectors as it helps in making the indoor environment dust-free from impurities.

Insight by Technology

Based on the technology, the air purification systems market is segmented into HEPA, electrostatic precipitators, activated carbon, ionic filters, and others (ultraviolet light air filters and ozone generators). In this market, the high-efficiency particulate air (HEPA) purifier is predicted to be the most widely accepted segment followed by activated carbon and electrostatic precipitator globally. HEPA is anticipated to be the fastest-growing segment as they are highly efficient in removing airborne particles including pollen, dust, smoke, and bio-contaminants. The increasing prominence of smart homes and the rising demand for proper ambient-based living are the major reasons for the growth of HEPA technology.

Activated carbon filters the carbon surface area and makes it porous, resulting in its ability to trap airborne particles and make them effective. Electrostatic precipitator technology is anticipated to be the fastest-growing segment as it handles a large volume of gas, heavy dust loads, and corrosive materials. They are mainly found in public places.

Insight by Industry

Based on industry, the air purification systems market is segmented into Automotive, Construction, Healthcare & Medical, Energy & Utilities, Manufacturing, and Others (residential, education, aviation, and hospitality sectors). The automotive sector dominates the market in 2020 and is anticipated to be the fastest-growing segment during the forecast period owing to the increasing demand for automobiles globally and rising concern for indoor air quality of automobiles. The construction and healthcare & medical sector is anticipated to have a high CAGR during the forecast period owing to the widespread use of air purifiers in hospitals, laboratories, retail stores, supermarkets, etc. where a lot of people gather and the chances of respiratory infections are more.

Moreover, air purifier serves both the residential as well as commercial needs of their consumers. However, in the case of serving commercial needs, air purifiers serve the needs of several industrial, commercial, and medical industries. The implementation of an air purifier is also helping its user to preserve room décor, helps in reducing maintenance and housekeeping, protects furnishings, and even from the hazards of fire from the heating equipment.

Hospitals are the primary end-user in the immunoassay industry. With a projected 81% market share for diagnostic testing at hospitals, hospitals are expected to dominate. The tests at hospitals give the best time and cost savings, and they also have a straightforward method. It is projected that the widespread use of ELISA in blood banks to treat infectious diseases would lead to an increase in immunoassay testing in hospitals. The blood bank sector will benefit from the increase in blood transfusions.

Global Air Purification Systems Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 16.12 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 29.62 Billion |

|

Growth Rate |

10.38% |

|

Segments Covered in the Report |

By Product, By Technology and By Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific and Japan and Rest of the World |

Industry Dynamics

Air Purification Systems Market Trends

The rising prominence of smart air purifiers and energy-efficient appliances to reduce their environmental footprint and enable energy savings for consumers are the major trend prevailing in the air purification system market.

Air Purification Systems Market Drivers

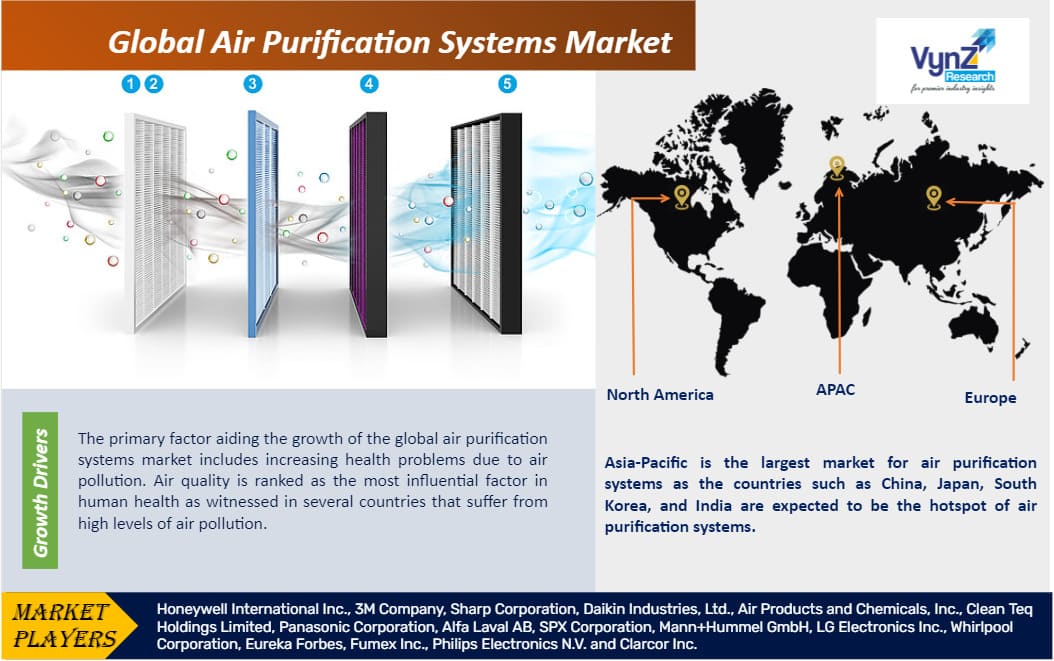

The primary factor aiding the growth of the global air purification systems market includes increasing health problems due to air pollution. Air quality is ranked as the most influential factor in human health as witnessed in several countries that suffer from high levels of air pollution. Air pollution is considered to be very hazardous to health as the human body cannot detect the level of contamination in the air that they breathe and as a result, they cannot adopt measures to eradicate it. The human body is exposed to small amounts of carcinogens, organic pollutants, and toxins that can adversely affect the human body and can lead to an increased risk of exposure to hazardous diseases. Moreover, the implementation of air purifiers helps consumers to reap the benefit of healthy living and breathe fresh and purified air at the home and even at the workplace. Additionally, the increasing awareness and accessibility of air purifiers are increasing the demand for this market globally.

The rising health awareness, technological development, rising prevalence of respiratory diseases, rising geriatric population, economic growth in emerging economies, high incidence of allergies, rapid urbanization and industrialization, coronavirus impact, increasing prominence of obstructive sleep apnea are some of the other drivers that contribute to the growth of the air purification system market.

Air Purification Systems Market Challenges

The rising environmental concerns, high initial cost, high maintenance cost, counterfeit products, ozone emissions, underperformance, and release of a harmful by-product for air purification system are some of the challenges that may hamper the growth of the air purification system market.

Air Purification Systems Market Opportunities

The growing environmental concern and the emerging Asia-Pacific market are creating greater opportunities for the air purification systems market globally. The amount of air pollution is extremely high in the emerging economies of Asia-Pacific such as India. The sale of air purifiers is generally enhanced in the country with the onset of winters and the aftermath of firecrackers that are burnt at the time of Diwali. Furthermore, the increasing attention on rising air pollution in urban centers is expected to increase the sales of air purification devices in the countries of Asia-Pacific on annual basis. The high pricing of products limiting the consumption and positioning of air purification systems as luxury goods is the major restraint observed in the growth of the global air purification systems market. Moreover, the growing interest in electronic gadgets, the rising prominence of smart homes, and increasing cases of respiratory diseases will create promising opportunities for the air purification system market.

Air purification devices comprise high-efficiency particulate air (HEPA) filters that help the users in purifying the air that is revolving around any particular individual. The device also helps people in getting rid of the contaminants and impurities from their surroundings and provides healthy and fresh air to people. It has also been observed that the HEPA filter is used for removing the dust molecules that are larger than 0.3 microns which are assumed to be the standard measure for the microns molecule. HEPA filter also helps in cleaning the dust in the air, pollen, smoke, pet dander, and the majority of particles available in the air around people.

Air Purification Systems Market Geography Overview

Geographically, Asia-Pacific is the largest market for air purification systems as the countries such as China, Japan, South Korea, and India are expected to be the hotspot of air purification systems. The increasing urbanization and industrialization, rising population, increasing disposable income, and growing smog, and air pollution cases are the key driving factors contributing to the growth of the air purification system market in this region.

Air Purification Systems Market Competitive Insight

Key players are adopting various strategies to expand their product portfolio with innovative technologies through sustainable investment, mergers & acquisitions, and distribution network expansion. These players are improving their product performance, quality, price, technical competence, and corporate reputation to have a competitive edge among competitors.

Daikin Industries Ltd. invested US$ 2 million in U.S-based start-up company Locix Inc. to leverage its spatial intelligence solutions for furthering its AC solutions business.

Aurabeat Technology Limited, a Hong Kong-based company, introduced the Aurabeat AG+ Silver Ion Plasma Sterilization Air Purifier, which can eliminate more than 99.9% of COVID-19 within 30 minutes.

Some of the key players operating in the global air purification system market are Honeywell International Inc., 3M Company, Sharp Corporation, Daikin Industries, Ltd., Air Products and Chemicals, Inc., Clean Teq Holdings Limited, Panasonic Corporation, Alfa Laval AB, SPX Corporation, Mann+Hummel GmbH, LG Electronics Inc., Whirlpool Corporation, Eureka Forbes, Fumex Inc., Philips Electronics N.V. and Clarcor Inc.

The Air Purification System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Product

- Dust Collectors

- Fume And Smoke Collectors

- Vehicle Exhaust

- Mist Eliminators

- Fire/Emergency Exhaust

- Others

- By Technology

- HEPA

- Electrostatic Precipitator

- Activated Carbon

- Ionic Filters

- Others

- By Industry

- Automotive

- Construction

- Healthcare & Medical

- Energy & Utilities

- Manufacturing

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Product

1.2.2. By Technology

1.2.3. By Industry

1.2.4. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Product

5.1.1. Dust Collectors

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Fume and Smoke Collectors

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Vehicle Exhaust

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Mist Eliminators

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.1.5. Fire/Emergency Exhaust

5.1.5.1. Market Definition

5.1.5.2. Market Estimation and Forecast to 2030

5.1.6. Others

5.1.6.1. Market Definition

5.1.6.2. Market Estimation and Forecast to 2030

5.2. By Technology

5.2.1. HEPA

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Electrostatic Precipitator

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Activated Carbon

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Ionic Filters

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Others

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.3. By Industry

5.3.1. Automotive

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Construction

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Healthcare & Medical

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Energy & Utilities

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Manufacturing

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Others

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Product

6.2. By Technology

6.3. By Industry

6.4. By Country

6.4.1. U.S. Market Estimate and Forecast

6.4.2. Canada Market Estimate and Forecast

6.4.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Product

7.2. By Technology

7.3. By Industry

7.4. By Country

7.4.1. Germany Market Estimate and Forecast

7.4.2. France Market Estimate and Forecast

7.4.3. U.K. Market Estimate and Forecast

7.4.4. Italy Market Estimate and Forecast

7.4.5. Spain Market Estimate and Forecast

7.4.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Product

8.2. By Technology

8.3. By Industry

8.4. By Country

8.4.1. China Market Estimate and Forecast

8.4.2. Japan Market Estimate and Forecast

8.4.3. India Market Estimate and Forecast

8.4.4. South Korea Market Estimate and Forecast

8.4.5. Singapore Market Estimate and Forecast

8.4.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Product

9.2. By Technology

9.3. By Industry

9.4. By Country

9.4.1. Brazil Market Estimate and Forecast

9.4.2. Saudi Arabia Market Estimate and Forecast

9.4.3. South Africa Market Estimate and Forecast

9.4.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Honeywell International Inc.

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. 3M Company

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Sharp Corporation

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Daikin Industries, Ltd.

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Air Products and Chemicals, Inc.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Clean Teq Holdings Limited

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Panasonic Corporation

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Alfa Laval AB

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. SPX Corporation

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Mann+Hummel GmbH

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. LG Electronics Inc.

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

10.12. Whirlpool Corporation

10.12.1. Snapshot

10.12.2. Overview

10.12.3. Offerings

10.12.4. Financial Insight

10.12.5. Recent Developments

10.13. Eureka Forbes

10.13.1. Snapshot

10.13.2. Overview

10.13.3. Offerings

10.13.4. Financial Insight

10.13.5. Recent Developments

10.14. Fumex Inc.

10.14.1. Snapshot

10.14.2. Overview

10.14.3. Offerings

10.14.4. Financial Insight

10.14.5. Recent Developments

10.15. Philips Electronics N.V.

10.15.1. Snapshot

10.15.2. Overview

10.15.3. Offerings

10.15.4. Financial Insight

10.15.5. Recent Developments

10.16. Clarcor Inc.

10.16.1. Snapshot

10.16.2. Overview

10.16.3. Offerings

10.16.4. Financial Insight

10.16.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Air Purification Systems Market Size, By Product, 2018-2023 (USD Billion)

Table 5 Global Air Purification Systems Market Size, By Product, 2025 – 2030 (USD Billion)

Table 6 Global Air Purification Systems Market Size, By Technology, 2018-2023 (USD Billion)

Table 7 Global Air Purification Systems Market Size, By Technology, 2025 – 2030 (USD Billion)

Table 8 Global Air Purification Systems Market Size, By Industry, 2018-2023 (USD Billion)

Table 9 Global Air Purification Systems Market Size, By Industry, 2025 – 2030 (USD Billion)

Table 10 Global Air Purification Systems Market Size, By Region, 2018-2023 (USD Billion)

Table 11 Global Air Purification Systems Market Size, By Region, 2025 – 2030 (USD Billion)

Table 12 North America Air Purification Systems Market Size, By Product, 2018-2023 (USD Billion)

Table 13 North America Air Purification Systems Market Size, By Product, 2025 – 2030 (USD Billion)

Table 14 North America Air Purification Systems Market Size, By Technology, 2018-2023 (USD Billion)

Table 15 North America Air Purification Systems Market Size, By Technology, 2025 – 2030 (USD Billion)

Table 16 North America Air Purification Systems Market Size, By Industry, 2018-2023 (USD Billion)

Table 17 North America Air Purification Systems Market Size, By Industry, 2025 – 2030 (USD Billion)

Table 18 North America Air Purification Systems Market Size, By Region, 2018-2023 (USD Billion)

Table 19 North America Air Purification Systems Market Size, By Region, 2025 – 2030 (USD Billion)

Table 20 Europe Air Purification Systems Market Size, By Product, 2018-2023 (USD Billion)

Table 21 Europe Air Purification Systems Market Size, By Product, 2025 – 2030 (USD Billion)

Table 22 Europe Air Purification Systems Market Size, By Technology, 2018-2023 (USD Billion)

Table 23 Europe Air Purification Systems Market Size, By Technology, 2025 – 2030 (USD Billion)

Table 24 Europe Air Purification Systems Market Size, By Industry, 2018-2023 (USD Billion)

Table 25 Europe Air Purification Systems Market Size, By Industry, 2025 – 2030 (USD Billion)

Table 26 Europe Air Purification Systems Market Size, By Region, 2018-2023 (USD Billion)

Table 27 Europe Air Purification Systems Market Size, By Region, 2025 – 2030 (USD Billion)

Table 28 Asia-Pacific Air Purification Systems Market Size, By Product, 2018-2023 (USD Billion)

Table 29 Asia-Pacific Air Purification Systems Market Size, By Product, 2025 – 2030 (USD Billion)

Table 30 Asia-Pacific Air Purification Systems Market Size, By Technology, 2018-2023 (USD Billion)

Table 31 Asia-Pacific Air Purification Systems Market Size, By Technology, 2025 – 2030 (USD Billion)

Table 32 Asia-Pacific Air Purification Systems Market Size, By Industry, 2018-2023 (USD Billion)

Table 33 Asia-Pacific Air Purification Systems Market Size, By Industry, 2025 – 2030 (USD Billion)

Table 34 Asia-Pacific Air Purification Systems Market Size, By Region, 2018-2023 (USD Billion)

Table 35 Asia-Pacific Air Purification Systems Market Size, By Region, 2025 – 2030 (USD Billion)

Table 36 RoW Air Purification Systems Market Size, By Product, 2018-2023 (USD Billion)

Table 37 RoW Air Purification Systems Market Size, By Product, 2025 – 2030 (USD Billion)

Table 38 RoW Air Purification Systems Market Size, By Technology, 2018-2023 (USD Billion)

Table 39 RoW Air Purification Systems Market Size, By Technology, 2025 – 2030 (USD Billion)

Table 40 RoW Air Purification Systems Market Size, By Industry, 2018-2023 (USD Billion)

Table 41 RoW Air Purification Systems Market Size, By Industry, 2025 – 2030 (USD Billion)

Table 42 RoW Air Purification Systems Market Size, By Region, 2018-2023 (USD Billion)

Table 43 RoW Air Purification Systems Market Size, By Region, 2025 – 2030 (USD Billion)

Table 44 Snapshot – Honeywell International Inc.

Table 45 Snapshot – 3M Company

Table 46 Snapshot – Sharp Corporation

Table 47 Snapshot – Daikin Industries, Ltd.

Table 48 Snapshot – Air Products and Chemicals, Inc.

Table 49 Snapshot – Clean Teq Holdings Limited

Table 50 Snapshot – Panasonic Corporation

Table 51 Snapshot – Alfa Laval AB

Table 52 Snapshot – SPX Corporation

Table 53 Snapshot – Mann+Hummel GmbH

Table 54 Snapshot – LG Electronics Inc.

Table 55 Snapshot – Whirlpool Corporation

Table 56 Snapshot – Eureka Forbes

Table 57 Snapshot – Fumex Inc.

Table 58 Snapshot – Philips Electronics N.V.

Table 59 Snapshot – Clarcor Inc.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Air Purification Systems Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Air Purification Systems Market Highlight

Figure 12 Global Air Purification Systems Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 13 Global Air Purification Systems Market Size, By Technology, 2018 - 2030 (USD Billion)

Figure 14 Global Air Purification Systems Market Size, By Industry, 2018 - 2030 (USD Billion)

Figure 15 Global Air Purification Systems Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 16 North America Air Purification Systems Market Highlight

Figure 17 North America Air Purification Systems Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 18 North America Air Purification Systems Market Size, By Technology, 2018 - 2030 (USD Billion)

Figure 19 North America Air Purification Systems Market Size, By Industry, 2018 - 2030 (USD Billion)

Figure 20 North America Air Purification Systems Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 21 Europe Air Purification Systems Market Highlight

Figure 22 Europe Air Purification Systems Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 23 Europe Air Purification Systems Market Size, By Technology, 2018 - 2030 (USD Billion)

Figure 24 Europe Air Purification Systems Market Size, By Industry, 2018 - 2030 (USD Billion)

Figure 25 Europe Air Purification Systems Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 26 Asia-Pacific Air Purification Systems Market Highlight

Figure 27 Asia-Pacific Air Purification Systems Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 28 Asia-Pacific Air Purification Systems Market Size, By Technology, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Air Purification Systems Market Size, By Industry, 2018 - 2030 (USD Billion)

Figure 30 Asia-Pacific Air Purification Systems Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 31 RoW Air Purification Systems Market Highlight

Figure 32 RoW Air Purification Systems Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 33 RoW Air Purification Systems Market Size, By Technology, 2018 - 2030 (USD Billion)

Figure 34 RoW Air Purification Systems Market Size, By Industry, 2018 - 2030 (USD Billion)

Figure 35 RoW Air Purification Systems Market Size, By Region, 2018 - 2030 (USD Billion)

Global Air Purification Systems Market Coverage

Product Insight and Forecast 2025-2030

- Dust Collectors

- Fume And Smoke Collectors

- Vehicle Exhaust

- Mist Eliminators

- Fire/Emergency Exhaust

- Others

Technology Insight and Forecast 2025-2030

- HEPA

- Electrostatic Precipitator

- Activated Carbon

- Ionic Filters

- Others

Industry Insight and Forecast 2025-2030

- Automotive

- Construction

- Healthcare & Medical

- Energy & Utilities

- Manufacturing

- Others

Geographical Segmentation

Air Purification Systems Market by Region

North America

- By Product

- By Technology

- By Industry

- By Country – U.S., Canada, and Mexico

Europe

- By Product

- By Technology

- By Industry

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Product

- By Technology

- By Industry

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Product

- By Technology

- By Industry

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Honeywell International Inc.

- 3M Company

- Sharp Corporation

- Daikin Industries, Ltd.

- Air Products and Chemicals, Inc.

- Clean Teq Holdings Limited

- Panasonic Corporation

- Alfa Laval AB

- SPX Corporation

- Mann+Hummel GmbH

- Clarcor Inc.

- LG Electronics Inc.

- Whirlpool Corporation

- Eureka Forbes

- Fumex Inc.

- Philips Electronics N.V.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Air Purification Systems Market