| Status : Published | Published On : Dec, 2023 | Report Code : VREP3033 | Industry : Energy & Power | Available Format :

|

Page : 190 |

Global Sodium-Ion Battery Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Sodium-Sulfur Batteries, Sodium-Salt Batteries, and Sodium-Oxygen Batteries), End-use Industry (transportation, energy storage, consumer electronics, industrial, residential, and other end-use industry) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Sodium Ion Battery Market was worth USD 0.85 billion in 2023 and is expected to reach USD 4.80 billion by 2030 with a CAGR of 25.85% during the forecast period.

Sodium-ion batteries, similar to lithium-ion counterparts, use sodium ions for energy storage, transferring them between electrodes during charging and discharging. These batteries are low cost and comes with ample sodium resources compared to lithium-ion batteries. They typically exhibit lower energy density. Research activities are on to enhance their performance for applications in electric vehicles and renewable energy storage, potentially replacing current battery technologies.

The global sodium-ion battery market encompasses Sodium-Sulfur, Sodium-Salt, and Sodium-Oxygen batteries where Sodium-Sulfur batteries lead the market. It is also divided into transportation, energy storage, electronics, industrial, residential, and others, where energy storage emerges as dominant segment.

Sodium-Ion Battery Market Segmentation

Insight by Product

The global sodium-ion battery market is divided into Sodium-Sulfur Batteries, Sodium-Salt Batteries, and Sodium-Oxygen Batteries based on the product types. Out of these segments, the Sodium-sulfur (Na-S) batteries lead the market due to their remarkable energy density and efficiency, making them ideal for grid-scale energy storage. Regulatory support for renewable energy integration and the demand for reliable energy storage systems have accelerated their adoption.

Insight by End-use Industry

The global sodium-ion battery market is also divided into transportation, energy storage, consumer electronics, industrial, residential, and other industries. Out of these segments, the energy storage emerged as the dominant sector driven by increasing reliance on renewables and sodium batteries' applications. Regulations and incentives promoting grid modernization and decarbonization fuel demand for efficient energy storage systems. Collaborations between utilities and battery manufacturers emphasize the significance of sodium-ion batteries in large-scale energy storage projects.

Global Sodium-Ion Battery Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 0.85 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 4.80 Billion |

|

Growth Rate |

25.85%% |

|

Segments Covered in the Report |

By Technology and By End-use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Sodium-Ion Battery Industry Trends

Manufacturers and research institutions are allocating significant resources to R&D efforts aimed at enhancing sodium-ion battery performance, including energy density, lifespan, and safety features.

Continuous advancements in battery materials, such as cathodes, anodes, and electrolytes, are driving improvements in sodium-ion battery performance.

Innovations are made to develop materials that offer higher energy density, faster charging capabilities, and increased stability.

Battery manufacturers are scaling up production capacity and establishing new manufacturing facilities to meet the rising demand for sodium-ion batteries.

The transportation sector, particularly electric vehicle manufacturers, is increasingly incorporating sodium-ion batteries into their product offerings due to their potential for cost savings and environmental benefits.

Sodium-ion batteries are gaining traction in renewable energy storage applications, where they can store excess energy generated from sources like solar and wind power.

Government initiatives and regulations promoting clean energy and decarbonization efforts are providing incentives for the adoption of sodium-ion batteries.

Strategic partnerships between battery manufacturers, technology companies, and end-users are facilitating the development and commercialization of sodium-ion battery solutions.

There is a growing emphasis on sustainability and the circular economy within the sodium-ion battery industry.

Sodium-Ion Battery Market Growth Drivers

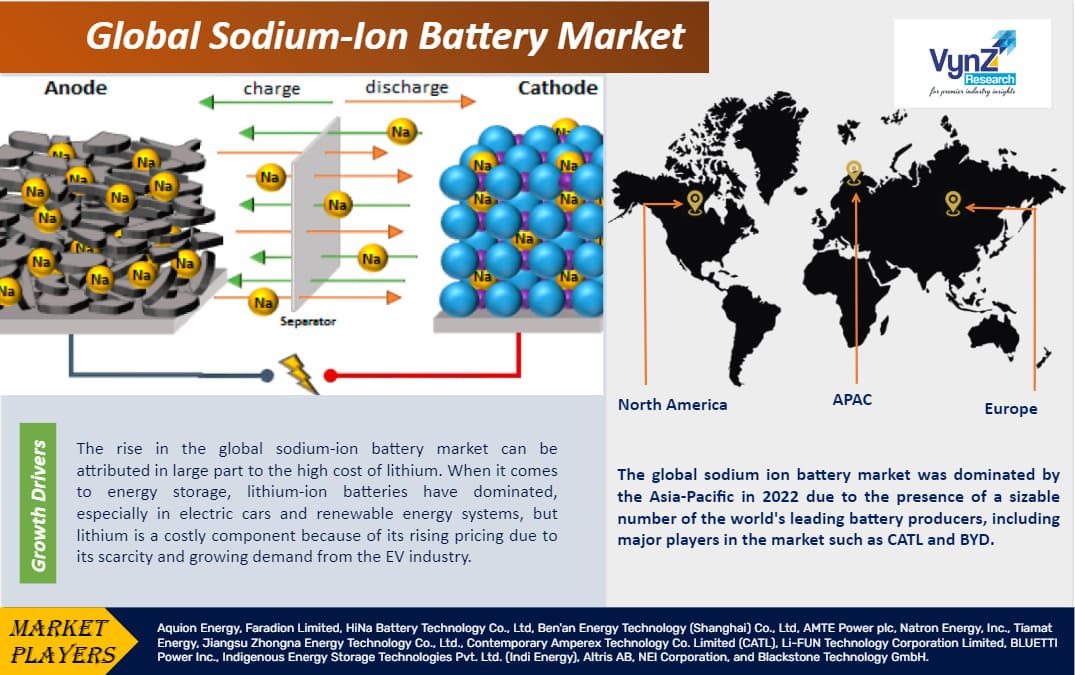

The soaring costs of lithium propel the demand for sodium-ion batteries as a cost-effective alternative due to the abundant and economical availability of sodium. This shift is particularly significant in sectors requiring large-scale energy storage, where sodium-ion batteries offer reduced production costs and competitive pricing.

Increasing necessity for energy storage solutions, driven by the expanding use of renewable energy sources like solar and wind power, fuels the growth of sodium-ion batteries.

Global government policies and incentives supporting energy storage and renewables further stimulate market expansion, fostering a conducive environment for sodium-ion battery adoption.

Partnerships between battery manufacturers and renewable energy firms, coupled with the establishment of large and dedicated production facilities, and concerted effort to enhance production capacity anticipates and meets the escalating demand for energy storage, magnifying the growth path of the global sodium-ion battery market.

Continuing research and development efforts aimed at improving sodium-ion battery performance and longevity contribute to market growth by enhancing their competitiveness and applicability across various industries.

The growing electric vehicle market, coupled with the need for affordable and sustainable battery solutions, provides a significant opportunity for sodium-ion batteries to penetrate the transportation sector as a viable alternative to lithium-ion batteries.

The versatility of sodium-ion batteries enables their utilization across a wide range of industries beyond transportation and energy storage, including consumer electronics, industrial applications, and medical devices, encouraging market expansion.

Sodium-Ion Battery Market Challenges

Low energy density poses a significant hurdle for the sodium-ion battery market, limiting their applicability in high-capacity applications like electric vehicles and renewable energy storage. In addition, shorter cycle inconsistencies in performance and stability, and limited ability in scaling up production to meet growing demand are significant hindrances to the market expansion.

Sodium-Ion Battery Market Opportunities

Nonstop technological advancements and varied applications, coupled with concerted partnerships, are driving innovation and market growth in the sodium-ion battery industry. Additionally, regulatory support and sustainability initiatives offer a promising environment for investment and acceptance, aligning with universal clean energy goals.

Sodium-Ion Battery Market Geographic Overview

Geographically, the global sodium-ion battery market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East/Africa.

North America showcases growth potential driven by innovation and strategic alliances. It is mainly attributed to the collaborations between battery producers and automakers, fostering market growth and technological advancement.

Asia-Pacific dominated due to the region's concentration of leading battery producers, supported by government incentives and favorable regulations for renewable energy. Notable alliances, such as CATL's partnerships with Tesla and BMW, bolstered market presence, while rapid facility establishment and research initiatives in nations like China and Japan solidified Asia-Pacific's leadership.

Sodium-Ion Battery Market Competitive Insight

CATL, the biggest battery producer in the world, holds a prominent position in the global sodium-ion battery market. CATL has been aggressively exploring sodium-ion technology, despite being best known for its lithium-ion products. They have aspirations to produce sodium-ion batteries and have a strong R&D infrastructure and gained a breakthrough for sodium-ion batteries in 2021. With a wide-ranging production network throughout China and alliances with well-known manufacturers like Tesla and BMW, CATL's foray into the sodium-ion market demonstrates a significant player's desire to expand the range of batteries they offer. The company has plans to introduce sodium-ion batteries in Chery's iCar line, which is scheduled to be on sale in late 2023. This action demonstrates CATL's dedication to broadening its selection of batteries.

One of the major players in the sodium-ion battery market is the UK-based company AMTE Power plc. When it comes to the creation, development, and manufacturing of energy storage technologies, they are superior. One of their most well-known products is the Urban 24V, a sodium-ion battery system made specifically for business cars. The alliance between AMTE Power and Faradion Limited, a leader in sodium-ion technology, demonstrates the company's dedication to developing sodium-ion batteries. Furthermore, the company has announced its plans to build a multimillion-pound Gigafactory in the UK, establishing itself as a major participant in the global sodium-ion battery market.

Recent Development by Key Players

In October 2023, Peak Energy announced that it will set up to tap the domestic market for sodium-ion batteries. The company will leverage partnerships with international and domestic sodium cell manufacturers to introduce this technology to the United States while generating enough income to establish a local engineering site and gigafactory.

In August 2023, Biwatt Power, a Chinese battery manufacturer, launched new residential sodium-ion batteries with an efficiency rate of 97% and a projected lifespan of more than 3,000 cycles. The batteries have a cell capacity is 75Ah and the rated battery voltage is 48V with a maximum DC power of 6kW and a maximum input voltage of 500V.

Key Players Covered in the Report

Aquion Energy, Faradion Limited, HiNa Battery Technology Co., Ltd, Ben'an Energy Technology (Shanghai) Co., Ltd, AMTE Power plc, Natron Energy, Inc., Tiamat Energy, Jiangsu Zhongna Energy Technology Co., Ltd., Contemporary Amperex Technology Co. Limited (CATL), Li-FUN Technology Corporation Limited, BLUETTI Power Inc., Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy), Altris AB, NEI Corporation, and Blackstone Technology GmbH.

The Sodium Ion Battery Market Report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Technology

-

Sodium-Sulfur Batteries

-

Sodium-Salt Batteries

-

Sodium-Oxygen Batteries

-

End-Use Application

-

Transportation

-

Energy Storage

-

Consumer Electronics

-

Industrial

-

Residential,

-

Other End-Use Applications

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Sodium-Ion Battery Market