- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Sustainable Aviation Fuel Market

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3035 | Industry : Energy & Power | Available Format :

|

Page : 220 |

Global Sustainable Aviation Fuel Market – Analysis and Forecast (2025-2030)

Industry Insight by Platform (commercial aviation, military aviation, business & general aviation, and unmanned aerial vehicle), Fuel Type ( bio-fuel, hydrogen fuel, power-to-liquid fuel, and gas-to-liquid fuel), and Biofuel Blending Capacity (below 30%, between 30-50%, and above 50%)), by Technology (HEFA-SPK, FT-SPK, HFS-SIP, and ATJ-SPK) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Sustainable Aviation Fuel Market was worth USD 1.2 billion in 2023 and is expected to reach USD 17.10 billion by 2030 with a CAGR of 47.8% during the forecast period.

Sustainable Aviation Fuel (SAF) is an eco-friendly alternative to traditional aviation fuels. It is a derivative of renewable resources like biomass, waste oils, or hydrogen. It aims to decrease the aviation industry's carbon footprint by offering a cleaner-burning choice with lower greenhouse gas emissions, flawlessly integrating into current aircraft and infrastructure. It contributes to mitigating climate change and aligns with worldwide efforts towards carbon neutrality, playing a vital role in endorsing greener air travel and a sustainable future.

The global sustainable aviation fuel market is segmented by platform, with commercial aviation taking the lead due to its substantial carbon footprint and commitment to sustainability. Airlines, under regulatory pressure and corporate responsibility, heavily invest in SAF. Among fuel types, biofuel dominates as it's renewable and compatible with existing infrastructure.

Further categorizing by biofuel blending capacity, the 30-50% segment prevails for its sustainability and compatibility with current aircraft. In terms of technology, HEFA-SPK leads due to its versatility and infrastructure compatibility, exemplified by Chevron and Delta Air Lines' collaboration driving sustainability initiatives.

Sustainable Aviation Fuel Market Segmentation

Insight by Platform

The global sustainable aviation fuel market is divided by platform into commercial aviation, military aviation, business & general aviation, and unmanned aerial vehicles (UAVs). Out of these, the commercial aviation led the market due to its significant carbon footprint and commitment to sustainability. Airlines, pressured by regulations and corporate responsibility, are heavily investing in SAF.

Insight by Fuel Type

The global sustainable aviation fuel market categorizes fuel into biofuel, hydrogen fuel, power-to-liquid fuel, and gas-to-liquid fuel. Among these segments, the biofuel segment dominated due to its renewable nature and compatibility with existing infrastructure. A collaboration between Boeing and Embraer emphasized biofuel's significance, showcasing industry commitment to immediate emission reduction solutions.

Insight by Biofuel Blending Capacity

The global sustainable aviation fuel market segments by biofuel blending capacity as below 30%, between 30-50%, and above 50%. Among these subsections, the 30-50% segment dominated due to its sustainability and compatibility with current aircraft. Airbus partnered with Air France-KLM to promote 30% SAF usage, highlighting the industry's commitment to this blending ratio for sustainable aviation.

Insight by Technology

The global sustainable aviation fuel market is divided by technology into HEFA-SPK, FT-SPK, HFS-SIP, and ATJ-SPK. The HEFA-SPK segment led due to its versatility and compatibility with existing infrastructure compared to the other segments. Chevron and Delta Air Lines' collaboration showcased HEFA-SPK's viability, driving the aviation industry towards sustainability.

Global Sustainable Aviation Fuel Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 1.2 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 17.10 Billion |

|

Growth Rate |

47.8%% |

|

Segments Covered in the Report |

By Platform, By Fuel Type, By Biofuel Blending Capacity and By Technology |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Sustainable Aviation Fuel Industry Trends

These following trends are collectively influencing the growing momentum of the global sustainable aviation fuel market towards a more sustainable aviation industry with reduced carbon emissions to mitigate climate change.

Airlines, manufacturers of fuel, and governments are increasingly investing in SAF production facilities and forming partnerships to scale up production and distribution networks.

Governments worldwide are implementing regulations and offering incentives to promote the use of SAF.

Continuous research and development efforts are underway to improve SAF production processes, increase feedstock diversity, and enhance fuel efficiency.

Airlines are facing increasing pressure to reduce carbon emissions, leading to a rising demand for SAF.

Environmentally conscious consumers are showing a preference for airlines offering sustainable travel options.

Airlines are exploring higher blending ratios of SAF in traditional jet fuel, such as 30-50% blends, to further reduce carbon emissions while ensuring compatibility with existing aircraft and infrastructure.

Efforts are being made to diversify feedstock sources for SAF production, including biomass, waste oils, algae, and synthetic pathways like power-to-liquid and gas-to-liquid processes, enhancing sustainability and supply chain resilience.

Collaboration among airlines, fuel producers, governments, and research institutions is increasing to address technological challenges, improve supply chain efficiency, and promote sustainable aviation practices.

Sustainable Aviation Fuel Market Growth Drivers

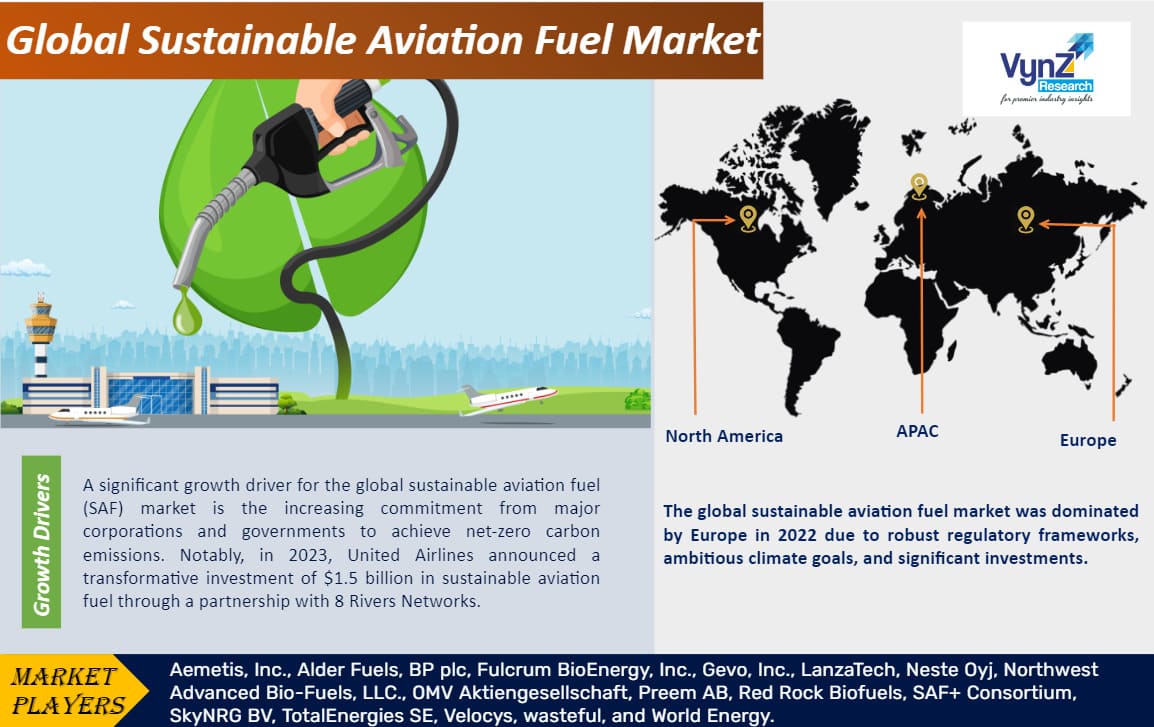

A significant driver for the global sustainable aviation fuel (SAF) market is the growing commitment from key corporations and governments to achieve net-zero carbon emissions.

The rising emphasis on sustainable biofuels, such as waste-to-jet fuel initiatives drive the adoption of SAF.

Government regulations and incentives aimed at reducing carbon emissions in the aviation industry encourages airlines and fuel manufacturers to invest in SAF production and adoption, driving market growth.

Major corporations, including airlines and aircraft manufacturers, are setting ambitious sustainability goals, driving demand for SAF and inspiring investments in sustainable aviation practices.

Continuous advancements in SAF production technologies, such as alternative feedstocks and production processes, contribute to the market's growth by improving efficiency and reducing costs.

Sustainable Aviation Fuel Market Challenges

Scaling up production poses a significant challenge for the global sustainable aviation fuel (SAF) market growth. This is exacerbated by limited capacity and delays in major production facilities, high production costs, uncertain regulatory frameworks, feedstock availability, and technological limitations.

Sustainable Aviation Fuel Market Opportunities

The drive to reduce carbon emissions in aviation creates a growth opportunity for the global sustainable aviation fuel (SAF) market facilitating investments and expansion. Technological innovations reduce cost and improve efficiency, which also creates growth opportunities. Also, strategic partnerships among industry stakeholders, supportive regulatory frameworks and incentives, increasing consumer demand for eco-friendly travel options further bolster opportunities for growth.

Sustainable Aviation Fuel Market Geographic Overview

The global sustainable aviation fuel market spans North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Europe dominates the market due to robust regulations, ambitious climate goals, and significant investments and partnerships.

North America and the Asia-Pacific regions are also significant markets, with growing regulatory support and investments driving SAF adoption. As governments and aviation stakeholders prioritize sustainability, these regions are poised for growth, nurturing innovation and promoting eco-friendly aviation practices.

Sustainable Aviation Fuel Market Competitive Insight

Neste, a Finnish company, is a leading player in the global sustainable aviation fuel (SAF) market. Renowned for its advanced refining capabilities, Nestle has secured a strong market position. In October 2023, Nestle announced a collaboration with Shell Aviation to increase the availability of SAF at key airports, underscoring its commitment to industry partnerships. This move aligns with Nestle's strategy to expand SAF production and distribution networks, solidifying its role in driving the aviation sector toward greener alternatives and meeting the increasing demand for sustainable solutions.

Gevo, a U.S.-based renewable chemicals and advanced biofuels company, holds a significant position in the global SAF market. Leveraging its innovative technology, Gevo focuses on producing low-carbon, sustainable biofuels. In a recent development in September 2023, Gevo entered into a collaboration with Delta Air Lines and Air BP to supply SAF for flights departing from Los Angeles. This partnership demonstrates Gevo's commitment to expanding its market presence by working closely with major industry players, contributing to the growth and adoption of sustainable aviation fuel in the competitive global market.

Recent Development by Key Players

Boeing and Zero Petroleum announced a collaboration at the Dubai Airshow to test and analyze next-gen sustainable aviation fuel (SAF) technologies. The partnership entails Boeing establishing a testing program for Zero's SAF at the University of Sheffield's Energy Innovation Centre, where Boeing is a founding member, showcasing a commitment to advancing eco-friendly aviation solutions.

Advanced Refining Technologies LLC, a joint venture between Chevron and specialty chemicals leader W. R. Grace & Co., introduced ENDEAVOR – a hydroprocessing catalyst solution designed to produce renewable diesel (RD) and sustainable aviation fuel (SAF) using 10% renewable sources like vegetable oils, refined oils, animal fats, and greases. The launch aligns with the surging demand for renewable transportation fuels, emphasizing the industry's commitment to innovative solutions for cleaner energy production.

Key Players Covered in the Report

Aemetis, Inc., Alder Fuels, BP plc, Fulcrum BioEnergy, Inc., Gevo, Inc., LanzaTech, Neste Oyj, Northwest Advanced Bio-Fuels, LLC., OMV Aktiengesellschaft, Preem AB, Red Rock Biofuels, SAF+ Consortium, SkyNRG BV, TotalEnergies SE, Velocys, wasteful, and World Energy.

The sustainable aviation fuel market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

By Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

By Fuel Type

- Bio-Fuel

- Hydrogen Fuel

- Power-to-Liquid Fuel

- Gas-to-Liquid Fuel

By Biofuel Blending Capacity

- Below 30%

- Between 30-50%

- Above 50%

By Technology

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

Region Covered in the Report

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

Middle East and Africa (MEA)

- Saudi Arabia

- U.A.E

- South Africa

- Rest of MEA

South America

- Argentina

- Brazil

- Chile

- Rest of South America

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Platform

1.2.2. By Fuel Type

1.2.3. By Biofuel Blending Capacity

1.2.4. By Technology

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Platform

5.1.1. Commercial Aviation

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Military Aviation

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Business & General Aviation

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Unmanned Aerial Vehicle

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.2. By Fuel Type

5.2.1. Bio-Fuel

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Hydrogen Fuel

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Power-to-Liquid Fuel

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Gas-to-Liquid Fuel

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.3 By Biofuel Blending Capacity

5.3.1. Below 30%

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Between 30-50%

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Above 50%V

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Technology

5.4.1. HEFA-SPK

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. FT-SPK

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Platform

6.2. By Fuel Type

6.3. By Biofuel Blending Capacity

6.4. By Technology

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Platform

7.2. By Fuel Type

7.3. By Biofuel Blending Capacity

7.4. By Technology

7.5. By Country-

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Platform

8.2. By Fuel Type

8.3. By Biofuel Blending Capacity

8.4. By Technology

8.5. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Platform

9.2. By Fuel Type

9.3. By Biofuel Blending Capacity

9.4. By Technology

9.6. By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

9.6.1. Brazil Market Estimate and Forecast

9.6.2. Saudi Arabia Market Estimate and Forecast

9.6.3. South Africa Market Estimate and Forecast

9.6.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Aemetis Inc

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Alder FuelBPs plc

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Fulcrum BioEnerg Inc.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Gevo Inc. LanzaTech

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Neste Oyj

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Northwest Advanced Bio-Fuels LLC.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. OMV Aktiengesellschaft

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Preem AB

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Red Rock Biofuels

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. SAF+ Consortium

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.11. SkyNRG BV

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.12. TotalEnergies

10.12.1. Snapshot

10.12.2. Overview

10.12.3. Offerings

10.12.4. Financial Insight

10.13. Velocys SE

10.13.1. Snapshot

10.13.2. Overview

10.13.3. Offerings

10.13.4. Financial Insight

10.14. Wasteful

10.14.1. Snapshot

10.14.2. Overview

10.14.3. Offerings

10.14.4. Financial Insight

10.15. World Energy

10.15.1. Snapshot

10.15.2. Overview

10.15.3. Offerings

10.15.4. Financial Insight

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 PlatFuel Types

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2018 – 2023 (USD Billion)

Table 5 Global Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2025-2030 (USD Billion)

Table 6 Global Sustainable Aviation Fuel Market Size, by Fuel Type, 2018 – 2023 (USD Billion)

Table 7 Global Sustainable Aviation Fuel Market Size, by Fuel Type, 2025-2030 (USD Billion)

Table 8 Global Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2018 – 2023 (USD Billion)

Table 9 Global Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2025-2030 (USD Billion)

Table 8 Global Sustainable Aviation Fuel Market Size, by Technology, 2018 – 2023 (USD Billion)

Table 9 Global Sustainable Aviation Fuel Market Size, by Technology, 2025-2030 (USD Billion)

Table 10 Global Sustainable Aviation Fuel Market Size, by Region, 2018 – 2023 (USD Billion)

Table 11 Global Sustainable Aviation Fuel Market Size, by Region, 2025-2030 (USD Billion)

Table 12 North America Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2018 – 2023 (USD Billion)

Table 13 North America Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2025-2030 (USD Billion)

Table 14 North America Sustainable Aviation Fuel Market Size, by Fuel Type, 2018 – 2023 (USD Billion)

Table 15 North America Sustainable Aviation Fuel Market Size, by Fuel Type, 2025-2030 (USD Billion)

Table 16 North America Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2018 – 2023 (USD Billion)

Table 17 North America Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2025-2030 (USD Billion)

Table 16 North America Sustainable Aviation Fuel Market Size, by Technology, 2018 – 2023 (USD Billion)

Table 17 North America Sustainable Aviation Fuel Market Size, by Technology, 2025-2030 (USD Billion)

Table 18 North America Sustainable Aviation Fuel Market Size, by Country, 2018 – 2023 (USD Billion)

Table 19 North America Sustainable Aviation Fuel Market Size, by Country, 2025-2030 (USD Billion)

Table 20 Europe Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2018 – 2023 (USD Billion)

Table 21 Europe Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2025-2030 (USD Billion)

Table 22 Europe Sustainable Aviation Fuel Market Size, by Fuel Type, 2018 – 2023 (USD Billion)

Table 23 Europe Sustainable Aviation Fuel Market Size, by Fuel Type, 2025-2030 (USD Billion)

Table 24 Europe Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2018 – 2023 (USD Billion)

Table 25 Europe Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2025-2030 (USD Billion)

Table 26 Europe Sustainable Aviation Fuel Market Size, by Technology, 2018 – 2023 (USD Billion)

Table 27 Europe Sustainable Aviation Fuel Market Size, by Technology, 2025-2030 (USD Billion)

Table 28 Europe Sustainable Aviation Fuel Market Size, by Country, 2018 – 2023 (USD Billion)

Table 29 Europe Sustainable Aviation Fuel Market Size, by Country, 2025-2030 (USD Billion)

Table 30 Asia-Pacific Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2018 – 2023 (USD Billion)

Table 31 Asia-Pacific Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2025-2030 (USD Billion)

Table 32 Asia-Pacific Sustainable Aviation Fuel Market Size, by Fuel Type, 2018 – 2023 (USD Billion)

Table 33 Asia-Pacific Sustainable Aviation Fuel Market Size, by Fuel Type, 2025-2030 (USD Billion)

Table 34 Asia-Pacific Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2018 – 2023 (USD Billion)

Table 35 Asia-Pacific Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2025-2030 (USD Billion)

Table 36 Asia-Pacific Sustainable Aviation Fuel Market Size, by Country, 2018 – 2023 (USD Billion)

Table 37 Asia-Pacific Sustainable Aviation Fuel Market Size, by Country, 2025-2030 (USD Billion)

Table 38 RoW Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2018 – 2023 (USD Billion)

Table 39 RoW Sustainable Aviation Fuel Market Size, by PlatFuel Type, 2025-2030 (USD Billion)

Table 40 RoW Sustainable Aviation Fuel Market Size, by Fuel Type, 2018 – 2023 (USD Billion)

Table 41 RoW Sustainable Aviation Fuel Market Size, by Fuel Type, 2025-2030 (USD Billion)

Table 42 RoW Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2018 – 2023 (USD Billion)

Table 43 RoW Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity, 2025-2030 (USD Billion)

Table 44 RoW Sustainable Aviation Fuel Market Size, by Technology, 2018 – 2023 (USD Billion)

Table 45 RoW Sustainable Aviation Fuel Market Size, by Technology, 2025-2030 (USD Billion)

Table 46 RoW Sustainable Aviation Fuel Market Size, by Country, 2018 – 2023 (USD Billion)

Table 47 RoW Sustainable Aviation Fuel Market Size, by Country, 2025-2030 (USD Billion)

Table 48 Snapshot – Aemetis Inc

Table 49 Snapshot – Alder FuelBPs plc

Table 50 Snapshot – Fulcrum BioEnerg Inc.

Table 51 Snapshot – Gevo Inc. LanzaTech

Table 52 Snapshot – Neste Oyj

Table 53 Snapshot – Northwest Advanced Bio-Fuels LLC.

Table 54 Snapshot – OMV Aktiengesellschaft

Table 55 Snapshot – Preem AB

Table 56 Snapshot – Red Rock Biofuels

Table 57 Snapshot – SAF+ Consortium

Table 58 Snapshot – SkyNRG BV

Table 59 Snapshot – TotalEnergies SE

Table 60 Snapshot – Velocys, wasteful

Table 61 Snapshot – World Energy

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Platforms for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Sustainable Aviation Fuel Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Sustainable Aviation Fuel Market Highlight

Figure 12 Global Sustainable Aviation Fuel Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 13 Global Sustainable Aviation Fuel Market Size, by Fuel Type 2018 - 2030 (USD Billion)

Figure 14 Global Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity 2018 - 2030 (USD Billion)

Figure 15 Global Sustainable Aviation Fuel Market Size, by Technology 2018 - 2030 (USD Billion)

Figure 16 Global Sustainable Aviation Fuel Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Sustainable Aviation Fuel Market Highlight

Figure 18 North America Sustainable Aviation Fuel Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 19 North America Sustainable Aviation Fuel Market Size, by Fuel Type 2018 - 2030 (USD Billion)

Figure 20 North America Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity 2018 - 2030 (USD Billion)

Figure 21 North America Sustainable Aviation Fuel Market Size, by Technology 2018 - 2030 (USD Billion)

Figure 22 North America Sustainable Aviation Fuel Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 23 Europe Sustainable Aviation Fuel Market Highlight

Figure 24 Europe Sustainable Aviation Fuel Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 25 Europe Sustainable Aviation Fuel Market Size, by Fuel Type 2018 - 2030 (USD Billion)

Figure 26 Europe Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity 2018 - 2030 (USD Billion)

Figure 27 Europe Sustainable Aviation Fuel Market Size, by Technology 2018 - 2030 (USD Billion)

Figure 28 Europe Sustainable Aviation Fuel Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Sustainable Aviation Fuel Market Highlight

Figure 30 Asia-Pacific Sustainable Aviation Fuel Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Sustainable Aviation Fuel Market Size, by Fuel Type 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Sustainable Aviation Fuel Market Size, by Technology 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Sustainable Aviation Fuel Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 35 RoW Sustainable Aviation Fuel Market Highlight

Figure 36 RoW Sustainable Aviation Fuel Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 37 RoW Sustainable Aviation Fuel Market Size, by Fuel Type 2018 - 2030 (USD Billion)

Figure 38 RoW Sustainable Aviation Fuel Market Size, by Biofuel Blending Capacity 2018 - 2030 (USD Billion)

Figure 39 RoW Sustainable Aviation Fuel Market Size, by Technology 2018 - 2030 (USD Billion)

Figure 40 RoW Sustainable Aviation Fuel Market Size, by Country, 2018 - 2030 (USD Billion)

Sustainable Aviation Fuel Market Coverage

By Platform Insight and Forecast 2025-2030

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

By Fuel Type Insight and Forecast 2025-2030

- Bio-Fuel

- Hydrogen Fuel

- Power-to-Liquid Fuel

- Gas-to-Liquid Fuel

By Biofuel Blending Capacity Insight and Forecast 2025-2030

- Below 30%

- Between 30-50%

- Above 50%

By Technology

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

Global Sustainable Aviation Fuel Market by Region

North America

- By Platform

- By Fuel Type

- By Biofuel Blending Capacity

- By Technology

- By Country – U.S., Canada, and Mexico

Europe

- By Platform

- By Fuel Type

- By Biofuel Blending Capacity

- By Technology

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Platform

- By Fuel Type

- By Biofuel Blending Capacity

- By Technology

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Platform

- By Fuel Type

- By Biofuel Blending Capacity

- By Technology

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Sustainable Aviation Fuel Market

Global Sustainable Aviation Fuel Market – Analysis and Forecast (2025-2030)

- The global sustainable aviation fuel market is expected to grow from USD 1.2 billion to USD 17.10 billion by 2030 with a CAGR of 47.8%.

- In this market, commercial aviation takes the lead, driven by its substantial carbon footprint and commitment to sustainability. Biofuels dominate among fuel types due to their renewable nature and compatibility with existing infrastructure, with the 30-50% blending ratio prevailing for its sustainability and aircraft compatibility. HEFA-SPK technology leads the market, supported by its versatility and infrastructure compatibility.

- The demand for SAF is driven by the aviation industry's commitment to reducing carbon emissions, meeting environmental regulations, and addressing climate change concerns. This commitment is reflected in the prioritization of sustainable practices by airlines and governments worldwide, necessitating cleaner alternatives like SAF for a more environmentally responsible aviation sector.

- Scaling up SAF production faces challenges including capacity limitations, delays, high costs, regulatory uncertainties, and technological constraints. However, opportunities arise from the drive to reduce aviation emissions, fostering investment, innovation, partnerships, supportive regulations, incentives, and growing consumer demand for eco-friendly travel, driving market growth.

- Europe leads the global sustainable aviation fuel market with strong regulations and investments, while North America and the Asia-Pacific regions emerge as significant markets due to increasing regulatory support and investments, fostering innovation and eco-friendly aviation practices.