- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Food Encapsulation Market

| Status : Published | Published On : Dec, 2023 | Report Code : VRFB11016 | Industry : Food & Beverage | Available Format :

|

Page : 280 |

Global Food Encapsulation Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Microencapsulation, Nanoencapsulation, Hybrid Technology, and Macro Encapsulation), by Shell Material (Polysaccharides, Proteins, Lipids, Emulsifiers, and Others), by Application (Dietary Supplements, Functional Food Products, Bakery Products, Confectionery, Beverages, Frozen Products, Dairy Products, and Others), by Method (Physical Processes (Atomization and Fluid Bed) and Chemical Processes(Polymerization, Sol-Gel Method, Physicochemical, Co-Acervation, Evaporation-Solvent Diffusion, Layer-By-Layer Encapsulation, Cyclodextrins, Liposomes, and Other Physicochemical Methods (Co-Crystallization and Micelles))) by Core Phase (Vitamins (Fat-Soluble Vitamins and Water-Soluble Vitamins), Organic Acids (Citric Acid, Lactic Acid, Fumaric Acid, Malic Acid, and Others), Minerals, Enzymes, Flavors & Essences, Preservatives, Sweeteners, Colors, Prebiotics, Probiotics, Essential Oils, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The global Food Encapsulation Market is expected to grow from USD 10.4 billion in 2023 to USD 16.1 billion by 2030, registering a CAGR of 8.1% during the projected period 2025-2030. Food encapsulation is the process of covering individual ingredient particles with a coating to protect them from a wide range of environmental factors like water, oxygen, and light and avoid any reaction on the core phase.

Furthermore, the growth in demand for natural flavors and clean label products is a major concern for manufacturers, resulting in the advancement of new products that cater to the specific needs of consumers like uniform taste, time-release taste, smell, and color, long shelf life, enhances the taste and act as a shield against harsh conditions like heat during the production of the finished product. Factors attributing to the growth of the food encapsulation market are the increased awareness about health, the mounting demand for convenience and fortified food, busy routines, continuous technological development, and increased investment in the food preservation industry will boost the market during the forecast period.

The COVID-19 outbreak has had a significant impact on the food encapsulation market owing to disruption in the supply chain as the food encapsulation market is highly dependent on raw materials and formulations like proteins, lipids, polysaccharides, etc. Owing to closure of international borders and trade barriers has resulted in the stoppage of imports and exports, resulting in an adverse impact on the food encapsulation market. However, there is an increase in the development of food and dietary supplements owing to health benefits to prevent COVID-19 infection.

Food Encapsulation Market Segmentation

Insight by Type

Based on type, the global encapsulation market is segregated into microencapsulation, nanoencapsulation, hybrid technology, and macro encapsulation. The microencapsulation segment dominates the food encapsulation market as it increases the quality of ingredients in food products., Thus protecting it from the external environment and acting as a shield for the core ingredients to interact with other ingredients during the entire process of food products. Moreover, it covers the unwanted taste of nutrients like minerals and allows the production of nutrient-fortified foods with the necessary sensory properties. Different techniques are used for microencapsulation like spray drying, spray chilling, freeze-drying, fluid bed cooling, liposome entrapment, emulsion, polymerization, conservation, etc.

Insight by Shell Material

Based on shell material, the global food encapsulation market is divided into polysaccharides, proteins, lipids, emulsifiers, and others. The Polysaccharides segment is anticipated to witness the largest market share during the forecast period as they are easily chemically adjustable and offer several textures and viscosities. Polysaccharides are the building blocks for delivery systems as it has huge molecular structures and are bioactive, resulting in wide acceptance as an inexpensive and safe shell material for encapsulation. There are several types of polysaccharides available in markets like methylcellulose and hydroxypropyl methylcellulose that have superior film, forming ability, and enhanced chemical stability for improved stabilization and protection.

Insight by Application

Based on application, the global food encapsulation market is segregated into dietary supplements, functional food products, bakery products, confectionery, beverages, frozen products, dairy products, and others. The dietary supplements have significant growth during the forecast period owing to preventive health management practices, and the mounting burden of lifestyle diseases. Dietary supplements like vitamins, minerals, Omega 3, enzymes, etc. are growing tremendously due to the increasing health consciousness among consumers. The ingredients that are difficult to get via food, can be taken through supplements and meet the dietary requirements, thus encapsulation plays an important role and maintains taste, color, preservation, and provides nutrition to the product.

Insight by Method

Based on the method, the global food encapsulation market is divided into physical processes and chemical processes. The physical process is subdivided into atomization which includes spraying drying, spray chilling, spinning disk, and fluid bed which includes extrusion and others (freeze-drying, pan coating, and electro-spraying). The chemical process includes polymerization, sol-gel method, physicochemical, co-acervation, evaporation-solvent diffusion, layer-by-layer encapsulation, cyclodextrins, liposomes, and other physicochemical methods (co-crystallization and micelles). The atomization process is a widely adopted process for food ingredients encapsulation. Owing to the benefits associated with it i.e., the possibility to employ a wide range of encapsulating agents, accessibility of large equipment having large-scale production, increased efficiency, and less transport, storage, and process costs.

Insight by Core Phase

Based on the core phase, the global encapsulation market is divided into vitamins, organic acids, minerals, enzymes, flavors & essences, preservatives, sweeteners, colors, prebiotics, probiotics, essential oils, and others. The vitamins are further sub-divided into fat-soluble vitamins which include Vitamin A, Vitamin D, Vitamin E, and Vitamin K, and water-soluble vitamins which include Vitamin B Complex, and Vitamin C. Organic acids are further subdivided into citric acid, lactic acid, fumaric acid, malic acid, and others. The rising demand for fat-soluble vitamins in the food & beverage industry will propel the growth of the food encapsulation market as encapsulation will increase the bioavailability of ingredients and will release them at the required time.

The probiotics segment is anticipated to have a high CAGR during the forecast period as it offers health benefits like prevention from diarrhea among children, increases nutrient bioavailability and lactose intolerance, enhances immunity levels by regulating lymphocytes and antibodies, and helps in the prevention of cancer.

Global Food Encapsulation Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 10.4 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 16.1 Billion |

|

Growth Rate |

8.1% |

|

Segments Covered in the Report |

By Type,By Application,By Method,ByCore Phase |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America,Europe,Asia-Pacific (APAC)Rest of the World (RoW) |

Industry Dynamics

Food Encapsulation Industry Trends

The main aspects of improved heat & oxidative resistance, enhancement of end-product quality, and help in providing flavors and odor masking along with the delivery of the specified levels of nutrients are the key trends in the global food encapsulation market.

Food Encapsulation Market Growth Drivers

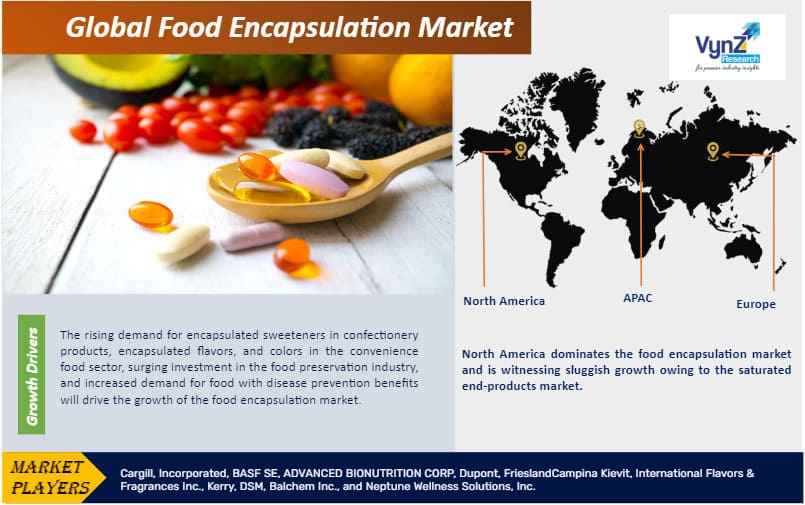

The rising demand for encapsulated sweeteners in confectionery products, encapsulated flavors, and colors in the convenience food sector, surging investment in the food preservation industry, and increased demand for food with disease prevention benefits will drive the growth of the food encapsulation market. Moreover, the food & beverage industry adopts encapsulating techniques to uphold the color, taste, and nutritional value of food products and long shelf-life. In addition, the rising health awareness among consumers, rising demand for packaged food, changing lifestyle, and increased application of food encapsulation in various industries like meat, poultry, beverages, and seafood are anticipated to boost global market growth. Nevertheless, the benefits associated with encapsulation like the controlled release of ingredients at a specific temperature or at a required time after consumption will propel the business expansion of the global food encapsulation market.

Food Encapsulation Market Challenges

The difficulty in maintaining the stability of food during processing and packaging, the size of the capsule, high cost associated with food encapsulation technologies will create challenges for the growth of the food encapsulation market. Moreover, lack of commercialization in the European market as there is no particular legislation that may hamper the growth of the food encapsulation market.

Food Encapsulation Market Opportunities

The technological development to bridge gaps in the food industry and to provide controlled delivery and release systems will create promising opportunities in the food encapsulation market.

Food Encapsulation Market Geographic Overview

The Asia Pacific will witness the fastest-growing region in the food encapsulation industry due to the increased disposable income, rising adoption of encapsulated flavors and color in the food & beverage industry, and the robust growth of food processing companies.

North America dominates the food encapsulation market and is witnessing sluggish growth owing to the saturated end-products market. Moreover, the presence of industry players, rising demand for functional food products, packaged products, nutraceutical products, and product innovation related to quality, application, and product development will boost the growth of the food encapsulation market in the region. Europe is anticipated to witness steady growth during 2025-2030 due to technological development in the processed food industry in the region.

Food Encapsulation Market Competitive Insight

The presence of MNC food ingredient manufacturers and local producers makes the global food encapsulation market highly competitive. In addition, food and beverage manufacturers tend to introduce encapsulation into a variety of products due to their competitive advantage. The industry players are expanding their production capacity and adopting growth strategies like product launches, mergers, licensing, acquisitions, and collaborations to have a competitive edge in the market.

Dupont Tyvek helps in protecting food quality and increases shelf life by adopting active and intelligent packaging. They are developing innovative solutions to protect perishables and reduce spoilage of food via wrapping, bagging, covering, encapsulating, interleaving, and protecting.

FrieslandCampina Kievit is a recognized professional in emulsifying, spray drying, micro-encapsulation, and agglomeration. By using the latest micro-encapsulation technology, they can turn liquid into powder and tailor its characteristics.

Caldic announced the expansion of its long-standing collaboration with FrieslandCampina Professional. Caldic and FrieslandCampina Professional worked closely over the past 20 years to distribute the DMV portfolio, which includes a variety of dairy protein products, as well as the Kievit range in the Netherlands and also distributing DMV range in the Belgian market. Due to the partnership's success, it has expanded to include the entire Kievit range in the Belgian market, encompassing the entire Benelux region as of April 2023.

IFF reported their encapsulating success in soft gel dietary supplement applications with high-viscosity liquid and semi-liquid nutritious components in March 2023. This technological discovery, a first in the industry, enables producers to create strong, high-quality plant-based soft-shell capsules that outperform traditional animal-based gelatin for complex ingredients, while also meeting expanding customer demand for plant-based supplements.

IFF's latest ability to encapsulate AQUANOVA AG's NovaSOL® Curcumin and NovaSOL® Curcumin/Boswellia, a German-based B2B manufacturer of liquid colloidal formulations, highlights the company's unrelenting dedication to addressing soft gel technology problems for nutritional supplements. This is AQUANOVA's first successful vegan soft gel encapsulation.

In August 2021, International Flavors & Fragrances Inc. (IFF) will expand its CAPLOCK production line at the European Center of Excellence for Flavor Delivery Systems and Encapsulation in Haverhill, UK. The enhanced capacity will increase the company’s strategic investment to approximately USD 10 million.

Some of the key players operating in the food encapsulation market: are Cargill, Incorporated, BASF SE, ADVANCED BIONUTRITION CORP, Dupont, FrieslandCampina Kievit, International Flavors & Fragrances Inc., Kerry, DSM, Balchem Inc., and Neptune Wellness Solutions, Inc.

The Food Encapsulation Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Type Insight and Forecast 2025-2030

- Microencapsulation

- Nanoencapsulation

- Hybrid Technology

- Macro Encapsulation

- Shell Material Insight and Forecast 2025-2030

- Polysaccharides

- Proteins

- Lipids

- Emulsifiers

- Others

- Application

- Dietary Supplements

- Functional Food Products

- Bakery Products

- Confectionery

- Beverages

- Frozen Products

- Dairy Products

- Others

- Method

- Physical Processes

- Atomization

- Fluid Bed

- Chemical Processes

- Polymerization

- Sol-Gel Method

- Physicochemical

- Co-Acervation

- Evaporation-Solvent Diffusion

- Layer-By-Layer Encapsulation

- Cyclodextrins

- Liposomes

- Other Physicochemical Methods (Co-Crystallization and Micelles)

- Physical Processes

- Core Phase

- Vitamins

- Fat-Soluble Vitamins

- Water-Soluble Vitamins

- Organic Acids

- Citric Acid

- Lactic Acid

- Fumaric Acid

- Malic Acid

- Others

- Minerals

- Enzymes

- Flavors & Essences

- Preservatives

- Sweeteners

- Colors

- Prebiotics

- Probiotics

- Essential Oils

- Others

- Vitamins

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Type

1.2.2. By Shell Material

1.2.3. By Application

1.2.4. By Method

1.2.5. By Core Phase

1.2.6. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Type

5.1.1. Microencapsulation

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Nanoencapsulation

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Hybrid Technology

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Macro Encapsulation

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.2. By Shell Material

5.2.1. Polysaccharides

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Proteins

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Lipids

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Emulsifiers

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Others

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.3. By Application

5.3.1. Dietary Supplements

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Functional Food Products

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Bakery Products

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Confectionery

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Beverage

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.6. Frozen Products

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.7. Dairy Products

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.8. Others

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.4. By Method

5.4.1. Physical Processes

5.4.1.1. Atomization

5.4.1.1.1. Market Definition

5.4.1.1.2. Market Estimation and Forecast to 2030

5.4.1.2. Fluid Bed

5.4.1.2.1. Market Definition

5.4.1.2.2. Market Estimation and Forecast to 2030

5.4.2. Chemical Processes

5.4.1.1. Polymerization

5.4.1.1.1. Market Definition

5.4.1.1.2. Market Estimation and Forecast to 2030

5.4.1.2. Sol-Gel Method

5.4.1.2.1. Market Definition

5.4.1.2.2. Market Estimation and Forecast to 2030

5.4.1.3. Physicochemical

5.4.1.3.1. Market Definition

5.4.1.3.2. Market Estimation and Forecast to 2030

5.4.1.4. Co-Acervation

5.4.1.4.1. Market Definition

5.4.1.4.2. Market Estimation and Forecast to 2030

5.4.1.5. Evaporation-Solvent Diffusion

5.4.1.5.1. Market Definition

5.4.1.5.2. Market Estimation and Forecast to 2030

5.4.1.6. Layer-By-Layer Encapsulation

5.4.1.6.1. Market Definition

5.4.1.6.2. Market Estimation and Forecast to 2030

5.4.1.7. Cyclodextrins

5.4.1.7.1. Market Definition

5.4.1.7.2. Market Estimation and Forecast to 2030

5.4.1.8. Liposomes

5.4.1.8.1. Market Definition

5.4.1.8.2. Market Estimation and Forecast to 2030

5.4.1.9. Other Physicochemical Methods (Co-Crystallization and Micelles)

5.4.1.9.1. Market Definition

5.4.1.9.2. Market Estimation and Forecast to 2030

5.5. By Core Phase

5.5.1. Vitamins

5.5.1.1. Fat-Soluble Vitamins

5.5.1.1.1. Market Definition

5.5.1.1.2. Market Estimation and Forecast to 2030

5.5.1.2. Water-Soluble Vitamins

5.5.1.2.1. Market Definition

5.5.1.2.2. Market Estimation and Forecast to 2030

5.5.2. Organic Acids

5.5.2.1. Citric Acid

5.5.2.1.1. Market Definition

5.5.2.1.2. Market Estimation and Forecast to 2030

5.5.2.2. Lactic Acid

5.5.2.2.1. Market Definition

5.5.2.2.2. Market Estimation and Forecast to 2030

5.5.2.3. Fumaric Acid

5.5.2.3.1. Market Definition

5.5.2.3.2. Market Estimation and Forecast to 2030

5.5.2.4. Malic Acid

5.5.2.4.1. Market Definition

5.5.2.4.2. Market Estimation and Forecast to 2030

5.5.1.2. Others

5.5.1.2.1. Market Definition

5.5.1.2.2. Market Estimation and Forecast to 2030

5.5.3. Minerals

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2030

5.5.4. Enzymes

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2030

5.5.5. Flavors & Essences

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.6. Preservatives

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.7. Sweeteners

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.8. Colors

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.9. Prebiotics

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.10. Probiotics

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.11. Essential Oils

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.12. Others

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Type

6.2. By Shell Material

6.3. By Application

6.4. By Method

6.5. By Core Phase

6.6. By Country

6.6.1. U.S. Market Estimate and Forecast

6.6.2. Canada Market Estimate and Forecast

6.6.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Type

7.2. By Shell Material

7.3. By Application

7.4. By Method

7.5. By Core Phase

7.6. By Country

7.6.1. Germany Market Estimate and Forecast

7.6.2. France Market Estimate and Forecast

7.6.3. U.K. Market Estimate and Forecast

7.6.4. Italy Market Estimate and Forecast

7.6.5. Spain Market Estimate and Forecast

7.6.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Type

8.2. By Shell Material

8.3. By Application

8.4. By Method

8.5. By Core Phase

8.6. By Country

8.6.1. China Market Estimate and Forecast

8.6.2. Japan Market Estimate and Forecast

8.6.3. India Market Estimate and Forecast

8.6.4. South Korea Market Estimate and Forecast

8.6.5. Singapore Market Estimate and Forecast

8.6.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Type

9.2. By Shell Material

9.3. By Application

9.4. By Method

9.5. By Core Phase

9.6. By Country

9.6.1. Brazil Market Estimate and Forecast

9.6.2. Saudi Arabia Market Estimate and Forecast

9.6.3. South Africa Market Estimate and Forecast

9.6.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Cargill, Incorporated

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. BASF SE

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. ADVANCED BIONUTRITION CORP

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Dupont

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. FrieslandCampina Kievit

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. International Flavors & Fragrances Inc.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Kerry

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. DSM

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Balchem Inc.

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Neptune Wellness Solutions, Inc.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Food Encapsulation Market, Insight by Type, 2018-2023 (USD Billion)

Table 5 Global Food Encapsulation Market, Insight by Type, 2025-2030 (USD Billion)

Table 6 Global Food Encapsulation Market, Insight by Shell Material, 2018-2023 (USD Billion)

Table 7 Global Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 8 Global Food Encapsulation Market, Insight by Application, 2018-2023 (USD Billion)

Table 9 Global Food Encapsulation Market, Insight by Application, 2025-2030 (USD Billion)

Table 10 Global Food Encapsulation Market, Insight by Method, 2018-2023 (USD Billion)

Table 11 Global Food Encapsulation Market, Insight by Method, 2025-2030 (USD Billion)

Table 12 Global Food Encapsulation Market, Insight by Core Phase, 2018-2023 (USD Billion)

Table 13 Global Food Encapsulation Market, Insight by Core Phase, 2025-2030 (USD Billion)

Table 14 Global Food Encapsulation Market, Insight by Region, 2018-2023 (USD Billion)

Table 15 Global Food Encapsulation Market, Insight by Region, 2025-2030 (USD Billion)

Table 16 North America Food Encapsulation Market, Insight by Type, 2018-2023 (USD Billion)

Table 17 North America Food Encapsulation Market, Insight by Type, 2025-2030 (USD Billion)

Table 18 North America Food Encapsulation Market, Insight by Shell Material, 2018-2023 (USD Billion)

Table 19 North America Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 20 North America Food Encapsulation Market, Insight by Application, 2018-2023 (USD Billion)

Table 21 North America Food Encapsulation Market, Insight by Application, 2025-2030 (USD Billion)

Table 22 North America Food Encapsulation Market, Insight by Method, 2018-2023 (USD Billion)

Table 23 North America Food Encapsulation Market, Insight by Method, 2025-2030 (USD Billion)

Table 24 North America Food Encapsulation Market, Insight by Core Phase, 2018-2023 (USD Billion)

Table 25 North America Food Encapsulation Market, Insight by Core Phase, 2025-2030 (USD Billion)

Table 26 North America Food Encapsulation Market, Insight by Region, 2018-2023 (USD Billion)

Table 27 North America Food Encapsulation Market, Insight by Region, 2025-2030 (USD Billion)

Table 28 Europe Food Encapsulation Market, Insight by Type, 2018-2023 (USD Billion)

Table 29 Europe Food Encapsulation Market, Insight by Type, 2025-2030 (USD Billion)

Table 30 Europe Food Encapsulation Market, Insight by Shell Material, 2018-2023 (USD Billion)

Table 31 Europe Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 32 Europe Food Encapsulation Market, Insight by Application, 2018-2023 (USD Billion)

Table 33 Europe Food Encapsulation Market, Insight by Application, 2025-2030 (USD Billion)

Table 34 Europe Food Encapsulation Market, Insight by Method, 2018-2023 (USD Billion)

Table 35 Europe Food Encapsulation Market, Insight by Method, 2025-2030 (USD Billion)

Table 36 Europe Food Encapsulation Market, Insight by Core Phase, 2018-2023 (USD Billion)

Table 37 Europe Food Encapsulation Market, Insight by Core Phase, 2025-2030 (USD Billion)

Table 38 Europe Food Encapsulation Market, Insight by Region, 2018-2023 (USD Billion)

Table 39 Europe Food Encapsulation Market, Insight by Region, 2025-2030 (USD Billion)

Table 40 Asia-Pacific Food Encapsulation Market, Insight by Type, 2018-2023 (USD Billion)

Table 41 Asia-Pacific Food Encapsulation Market, Insight by Type, 2025-2030 (USD Billion)

Table 42 Asia-Pacific Food Encapsulation Market, Insight by Shell Material, 2018-2023 (USD Billion)

Table 43 Asia-Pacific Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 44 Asia-Pacific Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 45 Asia-Pacific Food Encapsulation Market, Insight by Application, 2018-2023 (USD Billion)

Table 46 Asia-Pacific Food Encapsulation Market, Insight by Application, 2025-2030 (USD Billion)

Table 47 Asia-Pacific Food Encapsulation Market, Insight by Method, 2018-2023 (USD Billion)

Table 48 Asia-Pacific Food Encapsulation Market, Insight by Method, 2025-2030 (USD Billion)

Table 49 Asia-Pacific Food Encapsulation Market, Insight by Core Phase, 2018-2023 (USD Billion)

Table 50 Asia-Pacific Food Encapsulation Market, Insight by Core Phase, 2025-2030 (USD Billion)

Table 51 Asia-Pacific Food Encapsulation Market, Insight by Region, 2018-2023 (USD Billion)

Table 52 Asia-Pacific Food Encapsulation Market, Insight by Region, 2025-2030 (USD Billion)

Table 53 RoW Food Encapsulation Market, Insight by Type, 2018-2023 (USD Billion)

Table 54 RoW Food Encapsulation Market, Insight by Type, 2025-2030 (USD Billion)

Table 55 RoW Food Encapsulation Market, Insight by Shell Material, 2018-2023 (USD Billion)

Table 56 RoW Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 57 RoW Food Encapsulation Market, Insight by Shell Material, 2025-2030 (USD Billion)

Table 58 RoW Food Encapsulation Market, Insight by Application, 2018-2023 (USD Billion)

Table 59 RoW Food Encapsulation Market, Insight by Application, 2025-2030 (USD Billion)

Table 60 RoW Food Encapsulation Market, Insight by Method, 2018-2023 (USD Billion)

Table 61 RoW Food Encapsulation Market, Insight by Method, 2025-2030 (USD Billion)

Table 62 RoW Food Encapsulation Market, Insight by Core Phase, 2018-2023 (USD Billion)

Table 63 RoW Food Encapsulation Market, Insight by Core Phase, 2025-2030 (USD Billion)

Table 64 RoW Food Encapsulation Market, Insight by Region, 2018-2023 (USD Billion)

Table 65 RoW Food Encapsulation Market, Insight by Region, 2025-2030 (USD Billion)

Table 66 Snapshot – Cargill, Incorporated

Table 67 Snapshot – BASF SE

Table 68 Snapshot – ADVANCED BIO NUTRITION CORP

Table 69 Snapshot – Dupont

Table 70 Snapshot – FrieslandCampina Kievit

Table 71 Snapshot – International Flavors & Fragrances Inc.

Table 72 Snapshot – Kerry

Table 73 Snapshot – DSM

Table 74 Snapshot – Balchem Inc.

Table 75 Snapshot – Neptune Wellness Solutions

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Food Encapsulation Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Food Encapsulation Market Highlight

Figure 12 Global Food Encapsulation Market, Insight by Type, 2018 - 2030 (USD Billion)

Figure 13 Global Food Encapsulation Market, Insight by Shell Material, 2018 - 2030 (USD Billion)

Figure 14 Global Food Encapsulation Market, Insight by Application, 2018 - 2030 (USD Billion)

Figure 15 Global Food Encapsulation Market, Insight by Method, 2018 - 2030 (USD Billion)

Figure 16 Global Food Encapsulation Market, Insight by Core Phase, 2018 - 2030 (USD Billion)

Figure 17 Global Food Encapsulation Market, Insight by Region, 2018 - 2030 (USD Billion)

Figure 18 North America Food Encapsulation Market Highlight

Figure 19 North America Food Encapsulation Market, Insight by Type, 2018 - 2030 (USD Billion)

Figure 20 North America Food Encapsulation Market, Insight by Shell Material, 2018 - 2030 (USD Billion)

Figure 21 North America Food Encapsulation Market, Insight by Application, 2018 - 2030 (USD Billion)

Figure 22 North America Food Encapsulation Market, Insight by Method, 2018 - 2030 (USD Billion)

Figure 23 North America Food Encapsulation Market, Insight by Core Phase, 2018 - 2030 (USD Billion)

Figure 24 North America Food Encapsulation Market, Insight by Region, 2018 - 2030 (USD Billion)

Figure 25 Europe Food Encapsulation Market Highlight

Figure 26 Europe Food Encapsulation Market, Insight by Type, 2018 - 2030 (USD Billion)

Figure 26 Europe Food Encapsulation Market, Insight by Shell Material, 2018 - 2030 (USD Billion)

Figure 27 Europe Food Encapsulation Market, Insight by Application, 2018 - 2030 (USD Billion)

Figure 28 Europe Food Encapsulation Market, Insight by Method, 2018 - 2030 (USD Billion)

Figure 29 Europe Food Encapsulation Market, Insight by Core Phase, 2018 - 2030 (USD Billion)

Figure 30 Europe Food Encapsulation Market, Insight by Region, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Food Encapsulation Market Highlight

Figure 32 Asia-Pacific Food Encapsulation Market, Insight by Type, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Food Encapsulation Market, Insight by Shell Material, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Food Encapsulation Market, Insight by Application, 2018 - 2030 (USD Billion)

Figure 35 Asia-Pacific Food Encapsulation Market, Insight by Method, 2018 - 2030 (USD Billion)

Figure 36 Asia-Pacific Food Encapsulation Market, Insight by Core Phase, 2018 - 2030 (USD Billion)

Figure 37 Asia-Pacific Food Encapsulation Market, Insight by Region, 2018 - 2030 (USD Billion)

Figure 38 RoW Food Encapsulation Market Highlight

Figure 39 RoW Food Encapsulation Market, Insight by Type, 2018 - 2030 (USD Billion)

Figure 40 RoW Food Encapsulation Market, Insight by Shell Material, 2018 - 2030 (USD Billion)

Figure 41 RoW Food Encapsulation Market, Insight by Application, 2018 - 2030 (USD Billion)

Figure 42 RoW Food Encapsulation Market, Insight by Method, 2018 - 2030 (USD Billion)

Figure 43 RoW Food Encapsulation Market, Insight by Core Phase, 2018 - 2030 (USD Billion)

Figure 44 RoW Food Encapsulation Market, Insight by Region, 2018 - 2030 (USD Billion)

Global Food Encapsulation Market Coverage

Type Insight and Forecast 2025-2030

- Microencapsulation

- Nanoencapsulation

- Hybrid Technology

- Macro Encapsulation

Shell Material Insight and Forecast 2025-2030

- Polysaccharides

- Proteins

- Lipids

- Emulsifiers

- Others

Application Insight and Forecast 2025-2030

- Dietary Supplements

- Functional Food Products

- Bakery Products

- Confectionery

- Beverages

- Frozen Products

- Dairy Products

- Others

Method Insight and Forecast 2025-2030

- Physical Processes

- Atomization

- Fluid Bed

- Chemical Processes

- Polymerization

- Sol-Gel Method

- Physicochemical

- Co-Acervation

- Evaporation-Solvent Diffusion

- Layer-By-Layer Encapsulation

- Cyclodextrins

- Liposomes

- Other Physicochemical Methods (Co-Crystallization and Micelles)

Core Phase Insight and Forecast 2025-2030

- Vitamins

- Fat-Soluble Vitamins

- Water-Soluble Vitamins

- Organic Acids

- Citric Acid

- Lactic Acid

- Fumaric Acid

- Malic Acid

- Others

- Minerals

- Enzymes

- Flavors & Essences

- Preservatives

- Sweeteners

- Colors

- Prebiotics

- Probiotics

- Essential Oils

- Others

Geographical Segmentation

Food Encapsulation Market by Region

North America

- By Type

- By Shell Material

- By Application

- By Method

- By Core Phase

- By Country – U.S., Canada, and Mexico

Europe

- By Type

- By Shell Material

- By Application

- By Method

- By Core Phase

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Type

- By Shell Material

- By Application

- By Method

- By Core Phase

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Type

- By Shell Material

- By Application

- By Method

- By Core Phase

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- MoveGB

- Cargill, Incorporated

- BASF SE

- ADVANCED BIONUTRITION CORP

- Dupont

- FrieslandCampina Kievit

- International Flavors & Fragrances Inc.

- Kerry

- DSM

- Balchem Inc.

- Neptune Wellness Solutions, Inc.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com