Industry Overview

Food processing is the transformation of agricultural products into food. The food processing turns the ingredients into familiar foods. The increasing demand for processed food and an upsurge in the requirement for natural ingredients are the major factors driving the growth of the Food Processing Ingredients Market. The market has witnessed high demand for modified starch & starch derivatives due to the upsurge in population, ample accessibility of raw materials such as corn and wheat, and an escalation in the requirement for processed food products.

Food Processing Ingredients Market Segmentation

Insight by Type

Based on type, the food processing ingredients market is categorized into modified starch & starch derivatives, enzymes, yeast, proteins, antioxidants, emulsifiers, food stabilizers, acidity regulators, and release agents. Among all types, the modified starch & starch derivatives segment accounted for the largest share in the market due to the upsurge in population, ample accessibility of raw materials such as corn and wheat, and an escalation in the requirement for processed food products.

In addition, the yeast segment is expected to grow at the fastest rate in the market due to the evolution in the brewery and bakery industries, the upsurge in consumer demand for innovative tastes of wine, and technological advancements such as reverse osmosis and spinning cone column in the wine market.

Insight by Form

Based on form, the market is subdivided into dry ingredients and liquid ingredients. Among both forms, the dry ingredients segment accounted for the larger share of the market due to the easiness of handling, anticipation of improved stability in food processing techniques, and specialty to minimal thermal damage.

Insight by Source

Based on source, the market is subdivided into the natural sources and synthetic sources. Among both sources, the natural source segment accounted for the largest share and is expected to grow at the fastest rate in the market due to busy lifestyles, consumption models in urban areas, and improved requirements for food products with health advantages.

Insight by Application

Based on application, the market is subdivided into dairy & frozen desserts, beverages, convenience foods, bakery & confectionery products, and others. Among all the applications, the beverages segment is expected to grow at the fastest rate in the food processing ingredients market due to the mounting demand for nutritious food.

Global Food Processing Ingredients Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. XX Billion

|

|

Revenue Forecast in 2030

|

U.S.D. XX Billion

|

|

Growth Rate

|

XX%

|

|

Segments Covered in the Report

|

By Type, By Form, By Source and By Application

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

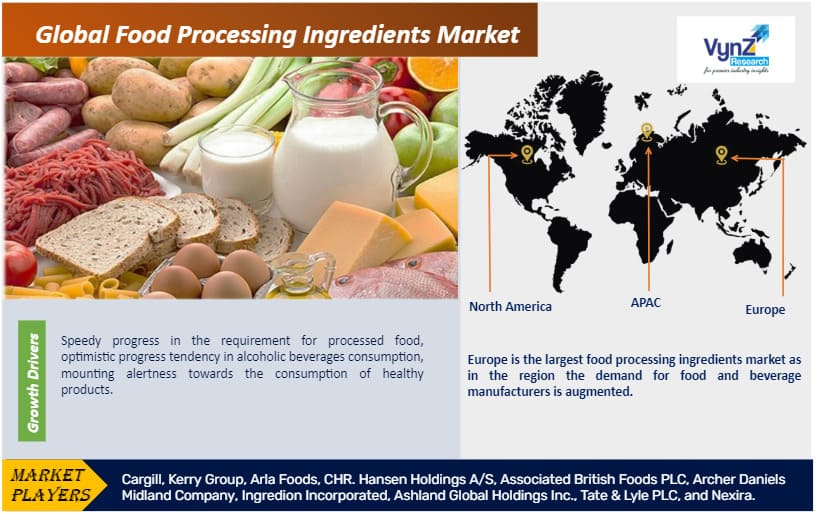

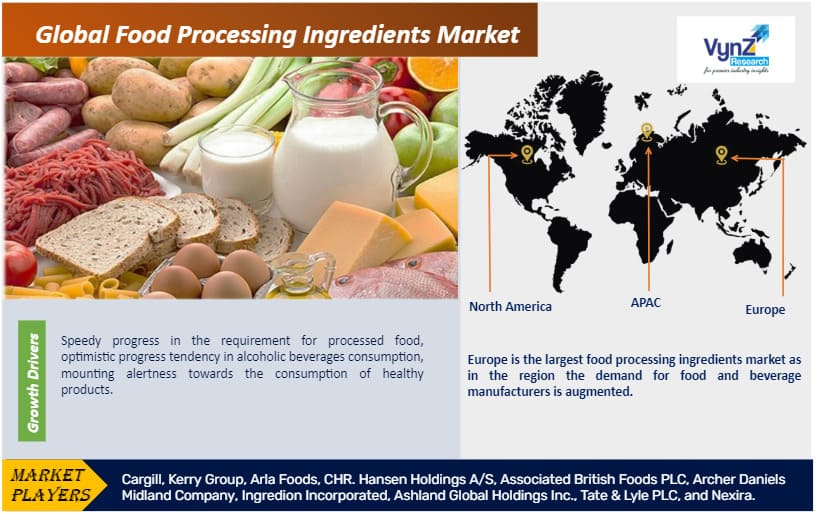

Food Processing Ingredients Market Growth Drivers

Speedy progress in the requirement for processed food, optimistic progress tendency in alcoholic beverages consumption, mounting alertness towards the consumption of healthy products, the upsurge in the requirement for natural ingredients, and supplementary health advantages of food processing ingredients are the primary growth drivers for the food processing ingredients industry.

In addition, changing lifestyles, a growing tendency to accept clean labels, the working women population, mounting demand for protein and antioxidant products, and an upsurge in the number of dual-income households are also facilitating the growth of the global food processing ingredients market.

Food Processing Ingredients Market Challenges

An increase in occurrences of food-related frauds and changeable costs of raw materials are the major challenges for the growth of the food processing ingredients market.

Food Processing Ingredients Market Industry Ecosystem

Globally, the manufacturing companies trying to enter the food processing ingredients market must maintain stringent regulatory standards. This offers an edge to the established players in the industry competition. Moreover, the high level of capital requirement also poses a major barrier to the entry of new players.

Food Processing Ingredients Market Geographic Overview

Geographically, Europe is the largest food processing ingredients market as in the region the demand for food and beverage manufacturers is augmented. In addition, mounting urbanization and standards of living, the mounting need for a wide range of food products, and increasing requirements for bakery products, fast food products, meat, confectionery products, and beverages have boosted the demand for the food processing ingredients market in the European region.

Asia-Pacific is observed to witness the fastest growth in the market, due to increasing demand for enhanced food quality and transformed consumer perception. In addition, enhanced lifestyle, a large population base, and mounting disposable income are also creating a positive impact on the food processing ingredients market growth in the region.

Food Processing Ingredients Market Competitive Insight

Key players in the food processing ingredients industry are catering to the demand by investing in new product launches in their product portfolios across the globe. In July 2018, Archer Daniels Midland Company and Aston Foods and Food Ingredients launched a 50-50 joint venture to provide sweeteners and starches to customers in Russia. Cargill, Kerry Group, Arla Foods, CHR. Hansen Holdings A/S, Associated British Foods PLC, Archer Daniels Midland Company, Ingredion Incorporated, Ashland Global Holdings Inc., Tate & Lyle PLC, and Nexira are the key players offering food processing ingredients.

Recent Developments by Key Players

Kerry Group (Taste and nutrition company) has partnered with Unigrain (an Australian producer of plant-based food and beverage ingredients). This partnership shall also enhance market growth for the plant-based category in the region to provide food and beverage brands and manufacturers access to a unique combination of processing ingredients and R&D solutions that shall help them craft oat milk and other applications using Australian-grown oats.

Arla Foods Ingredients has signed an agreement to acquire Volac’s Whey Nutrition business. Through this deal, Arla Foods Ingredients will purchase the Whey Nutrition division of Volac’s business through a purchase of the shares in Volac Whey Nutrition Holdings and its subsidiaries, Volac Whey Nutrition and Volac Renewable Energy.