Industry Overview

Meat testing is to identify the contamination on the surface of the tool and the meat with the help of testing. These tests are performed to improve the quality of the product and the safety of meat. The escalating international trade of meat products, mounting cases of meat adulteration are the major factors driving the growth of the meat testing market. The market has witnessed high growth for pathogen testing due to a complex process, improper storage of raw meat, and mounting matters about cross-contamination during storage, handling, transportation, and repacking.

Meat Testing Market Segmentation

Insight by Target Tested

Based on the target tested, the meat testing market is subdivided into pathogens, mycotoxins, GMOs, veterinary drug residues, species identification, heavy metals, allergens, and others. Among the all targets tested, the pathogens segment accounted for the largest share of the market due to a complex process, improper storage or raw meat, and mounting matters about cross-contamination during storage, handling, transportation, and repacking. In addition, species identification is expected to grow at the fastest rate in the market, due to the mounting need for meat authenticity and issues about adulteration

Insight by Sample Type

Based on the sample type, the market is subdivided into meat and seafood. The meat segment is further subdivided into pork, sheep & goat meat, poultry, beef, and other meat. Poultry meat accounted for the largest share in the market due to mounting consumption of poultry meat, and mounting consumer concerns regarding the safety of poultry meat products. In addition, the beef segment is expected to grow at the fastest rate in the market due to mounting food fraud incidences and to ensure the safety of the product.

Insight by Technology

On the basis of the technology, the market is subdivided into traditional testing and rapid testing. The rapid testing is further subdivided into PCR, immunoassay, spectroscopy, and chromatography. The PCR segment accounted for the largest share and is expected to grow at the fastest rate in the market due to a mechanized method for testing which is a speedy process.

Insight by Form

Based on the form, the market is subdivided into raw meat and processed meat. Among both forms, the raw meat segment accounted for the larger share of the meat testing market.

Global Meat Testing Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. XX Billion

|

|

Revenue Forecast in 2030

|

U.S.D. XX Billion

|

|

Growth Rate

|

XX%

|

|

Segments Covered in the Report

|

By Target Tested, By Sample Type, By Technology and By Form.

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Meat Testing Market Growth Drivers

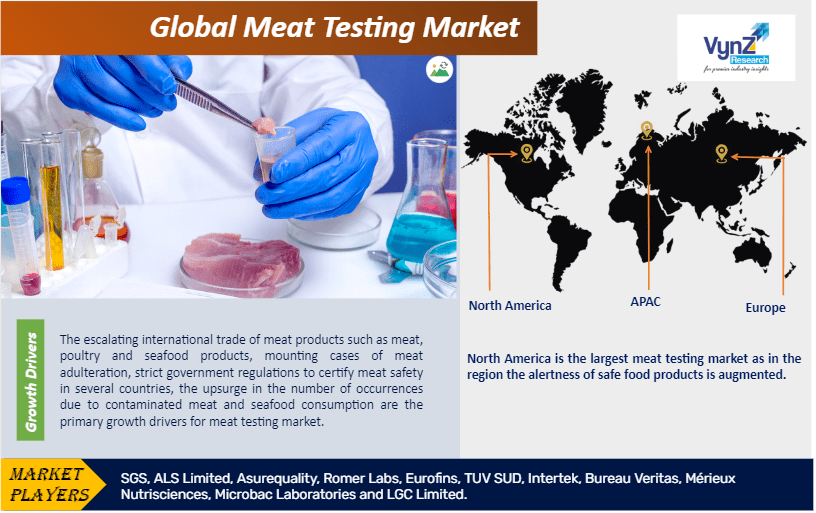

The escalating international trade of meat products such as meat, poultry and seafood products, mounting cases of meat adulteration, strict government regulations to certify meat safety in several countries, and the upsurge in the number of occurrences due to contaminated meat and seafood consumption are the primary growth drivers for meat testing market.

The launch of advanced technology, progression in R&D of testing procedures, budding consumer alertness about the safety of food, and developments in service set for meat & seafood testing are also facilitating the growth of the meat testing market.

Meat Testing Market Challenges

High capital investment, the absence of food control infrastructure in developing countries, the intricacy of testing techniques, disorganized supply chain & distribution channels in the meat processing sector, an impediment in sample collection, and preference towards meat alternatives are the major challenges for the growth of the meat testing market.

Meat Testing Market Industry Ecosystem

Globally, the manufacturing companies trying to enter the meat testing market are required to maintain stringent regulatory standards. This offers an edge to the established players in the industry competition. Moreover, the high level of capital requirement remains a major barrier to the entry of new players.

Meat Testing Market Geographic Overview

Geographically, North America is the largest meat testing market as in the region the alertness of safe food products is augmented. Stringent food safety regulations, high demand for meat products, high share in the packed food products and a mounting number of meat product recalls have boosted the demand for meat testing market in the North American region.

Asia-Pacific is observed to witness the fastest growth in the market, due to the large population base and enhancements in the food export & import industry. In addition, improving disposable income, mounting alertness of safe food products, and diseases caused by contaminated meat products are also creating a positive impact on the meat testing market growth in the region.

Meat Testing Market Competitive Insight

Key players in the meat testing market are catering to the demand by investing in new product launches in their product portfolio across the globe. In December 2017, SGS introduced its food testing and agriculture testing laboratory in Brookings, South Dakota. In addition, in August 2018, ALS Limited acquired Truesdail Laboratories, LLC, to expand its environmental, pharmaceutical, food testing capabilities, nutraceutical, and geographical coverage for the USA Life Sciences business. SGS, ALS Limited, Asurequality, Romer Labs, Eurofins, TUV SUD, Intertek, Bureau Veritas, Mérieux Nutrisciences, Microbac Laboratories, and LGC Limited are the key players offering meat testing products and services.

Recent Developments by Key Players

SGS has collaborated with Eezytrace (an innovative software solution that powers data-driven risk management and helps digitize self-check procedures in the foodservice industry) to improve food safety management.

Romer Labs, a global leader in diagnostic solutions for the food and feed industry has received approval from the USDA Federal Grain Inspection Service (FGIS) for its AgraStrip Pro Ochratoxin A WATEX test kit. This kit facilitates the quantitative determination of ochratoxin A in wheat.