Industry Overview

The global dental implants and prosthetics market is expected to grow from USD 10.7 billion in 2023 to USD 16.7 billion by 2030 at a CAGR of 7.6% during the forecast period ranging from 2025 to 2030.

Dental implant refers to the artificial tooth inserted into the jawbone strategically. It acts as a tooth root and is restored by a crown, bridge or denture. Dental prosthetics, on the other hand, refers to the restoration of intraoral defects. Typically, dental implants and prosthetics is a significant aspect of modern dentistry that provides advanced and better solutions to tooth loss, decay, and other concerns and regaining the functionality of a tooth and improving the smile.

The dental implants and prosthetics market encompasses a wide range of products and services and is growing at a significant rate due to the growing prevalence of dental issues. It is also attributed to the technological development in dental products and the growing demand for cosmetic dentistry and alternative tooth as well as the cost effectiveness.

The high cost of dental implant and prosthetic products and high capital requirements for the new entrants prevents the growth and expansion of the global dental implant and prosthetic market. However, the higher adoption and the growing affordability and accessibility of dental implants and prosthetics are presenting novel growth opportunities.

Market Segmentation

Insight by Type

The dental implants and prosthetics market is divided by type into dental crowns, dentures, dental bridges, abutments and other segments. Out of all these segments, the dental bridge segment is expected to grow more due to cost effectiveness and the ability to be used as an alternative to the single tooth implant.

Insight by Material

The global dental implant has also been categorized by material into titanium implants and zirconium implants. Out of these segments, the titanium implants segment accounts for the largest share of the market due to growing adoption of titanium implants for significant beneficial properties like high biocompatibility, rigidity, greater strength and corrosion properties, and greater stress-bearing ability.

Insight by Type of Facility

The dental implants and prosthetics market is divided by type of facility into hospitals and clinics, dental laboratories and other segments where the hospitals and clinics segment are expected to hold the largest share in the market due to growing number of dental hospitals and clinics in emerging countries the rise in number of group dental practice.

Insight by Design

The dental implants and prosthetics market is divided by design into fixed and removal dental implant segments. Out of them, the fixed dental prosthetic segment will hold the largest market share during the forecast period due to the organic look, durability, and efficiency. The removable dental implants segment will also grow due to the ability to stop bone loss and a relatively higher stability and support compared to detachable implants.

Insight by End User

The dental implants and prosthetics market is divided by end users into dental hospital & clinics, dental laboratories, and other segments. Out of them, the dental hospital & clinics segment will hold the larger market share during the forecast period due to higher number of such clinics and higher preference by the patients. On the other hand, the laboratories segment will also grow due to higher reliability due to the use of cutting-edge technology.

Global Dental Implant and Prosthetic Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 10.7 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 16.7 Billion

|

|

Growth Rate

|

7.6%

|

|

Segments Covered in the Report

|

By Type, By Material, By Type of Facility, By Design and By End User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World

|

Industry Dynamics

Industry Trends

A significant development in technology is noticed within the industry which facilitates innovation and launch or newer and more efficient products. There is also a significant rise in the demand for cosmetic dentistry, which is a major trend of the dental implant and prosthetic market. In addition, the CAD technology is seen to be widely adopted by the dentists and dental laboratories for creating or restoring tooth.

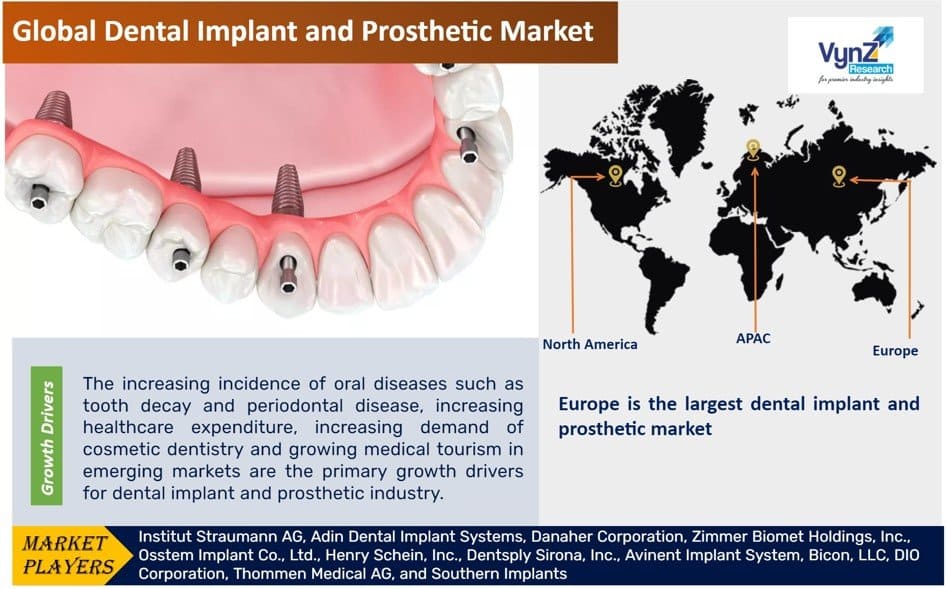

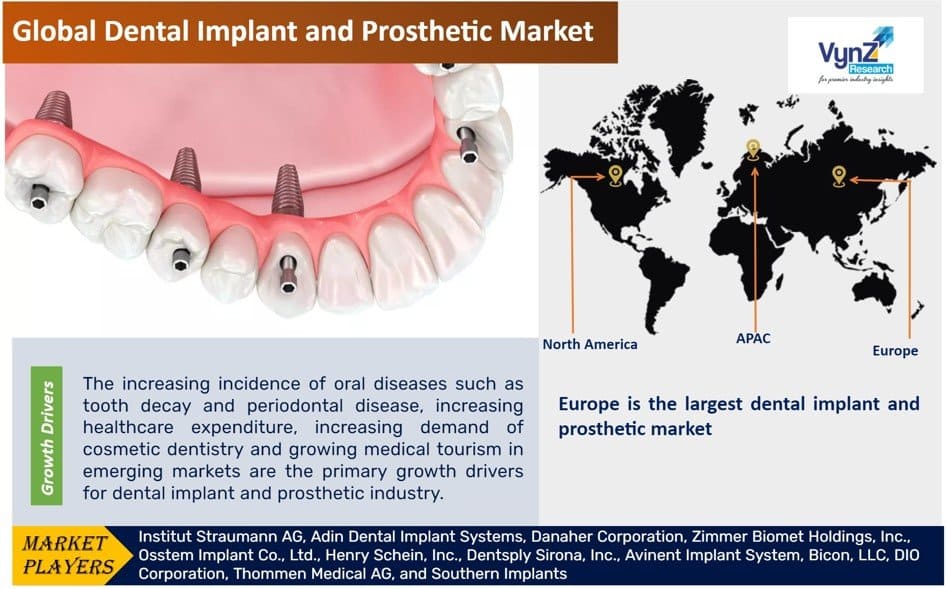

Growth Drivers

The primary growth driver of the global dental implant and prosthetic market is the growing incidence of oral or periodontal diseases and higher adoption of dental implants and prosthetics. It is also attributed to the growing disposable and higher affordability of people to bear the cost of such treatments. The increasing healthcare expenditure is also fueling the market growth. Another significant factor that pushes the market forward is the growing medical or dental tourism in emerging markets. Also, the growing awareness programs for treatment and management and the need to maintain a good oral health and hygiene pushes the market forward. Other factors for the growth of the market include increasing geriatric population, and favorable reimbursement policies to promote the use of dental implants and prosthesis by more people.

Challenges

The high risk of tooth loss related to dental bridges and stringent regulatory requirements for the approval of products are the major challenges for the growth of the dental implant and prosthetic market. In addition, the highly consolidated nature of the market due to few major players holding the major share in the market prevents entry and survival of small players and new entrants, hindering market expansion.

Opportunities

The developing markets are witnessing a significant growth opportunity due to the expansion of healthcare infrastructure and growing disposable income levels. Moreover, growing dental health awareness is also creating growth opportunities for the market. In addition, recent developments in materials and methods are also creating new avenues for market growth.

Geographic Overview

Europe holds the largest share of the dental implant and prosthetic market due to the rising aging population, higher government expenditure on oral healthcare, growing adoption of dental cosmetic treatments, higher prevalence of dental problems, growing awareness and concern about oral hygiene, and the high reimbursement rate on prosthetic products.

The North American market will grow at a significant CAGR during the forecast period due to rise in the number of accidents and sports injuries, growing intake of junk food, rapid growth of the geriatric population, and increasing demand for dental implants and prosthetics.

The Asia-Pacific market will also grow at the fastest rate due to a large population, growing awareness, rise in medical tourism, increase in disposable income, improvement in healthcare infrastructure, growing demand for cosmetic dentistry, and higher prevalence of dental problems in the region.

Competitive Insight

Key players in the dental implant and prosthetic market are investing in the development of innovative and advance products, which is strengthening their position in the market.

Danaher Corporation is an American global conglomerate founded by brothers Steven and Mitchell Rales in 1984. Headquartered in Washington, D.C. designs, manufactures, and markets medical, industrial, and commercial products and services.

Zimmer Biomet is a global medical technology leader offering innovative implants and digital technologies across all stages of the patient journey.

Institut Straumann AG, Adin Dental Implant Systems, Danaher Corporation, Zimmer Biomet Holdings, Inc., Osstem Implant Co., Ltd., Henry Schein, Inc., Dentsply Sirona, Inc., Avinent Implant System, Bicon, LLC, DIO Corporation, Thommen Medical AG, and Southern Implants are the key players offering dental implant and prosthetic products.

Recent Developments by Key Players

Adin Dental Implant Systems, an Israeli company specialising in the production of medical products specialising into dental implants shall establish an unit in the special economic zone of Mihan.

Zimmer Biomet has acquired medical device company OSSIS. Company provides personalised 3D printed implants and complex hip replacements such as second-time hip replacements and those involving bone tumours and trauma.

Industry Dynamics

The Dental Implant and Prosthetic Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

The company offers rapid design and manufacturing of personalised implants. Zimmer Biomet is focused on delivering personalised experiences to enhance patient outcomes.

Segments Covered in the Report

- By Type

- Dental crowns

- Dentures

- Dental bridges

- Abutments

- Others

- By Material

- Titanium implants

- Zirconium implants

- By Type of Facility

- Hospitals and clinics

- Dental laboratories

- Others

Geographical Segmentation

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)