- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Digital Health Market

| Status : Published | Published On : Jun, 2024 | Report Code : VRHC1096 | Industry : Healthcare | Available Format :

|

Page : 200 |

Global Digital Health Market – Analysis and Forecast (2025–2030)

Industry Insights by Technology (mHealth [Services, mHealth Apps, Connected Devices], Electronic Health Record {EHR} [On-Premise, Web/Cloud-Based], Healthcare Analytics [Predictive, Prescription, Description], Telemedicine [Teletraining, Teleconsulting, Tele-Education, Telemonitoring, Others]), by Component (Hardware, Software, Services), by Application (Obesity, Diabetes, Cardiovascular, Respiratory Diseases, Other), by End User (Hospitals, Clinics, Individual), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

From USD 182.4 billion in 2023, the Global Digital Health Market is predicted to grow to USD 610.4 billion by 2030, registering a CAGR of 28.0% during the forecast period (2025 –2030). The global digital health market is growing at a significant rate, due to the growing penetration of smartphone and tablet users, and the increasing occurrence of chronic and lifestyle-associated diseases such as cardiovascular diseases.

Digital health refers to the online care services provided to patients. It also includes digital diagnostic processes. Some of the most common digital health technologies are wireless technologies, digital diagnostic systems, and electronic health records. Typically, these include a wide range of data and information such as the history of the patient, medication records and treatment plans, allergies and diagnosis, laboratory test results, and radiology images. With all the features and benefits of digital health systems, they have the potential to transform healthcare by enhancing accessibility and facilitating proactive health management. In addition, it reduces the costs of healthcare and improves patient outcomes. Typically, these systems and solutions help patients monitor their health, stick to the prescribed treatment plans, and communicate with the care providers as and when required promptly and effectively.

A large number of factors, such as the growing number of wearable device producers, telehealth platform developers, e-prescription systems, and mHealth app providers, drive the growth of the digital health market. The rate of growth is quite significant due to the higher number of users of smartphones and tablets. It is also attributed to the growing incidents of chronic diseases and other ailments related to the lifestyle of people, such as cardiovascular diseases.

Digital Health Market Segmentation

Insight by Technology

The Global Digital Health Market is divided by technology into health, electronic health records (EHR), healthcare analytics, telemedicine, mHealth devices, mHealth apps, and telehealth segments. Out of these segments, the health segment is expected to contribute the largest share of the market due to the widespread application of technologically advanced wearables and apps. The mHealth segment is further divided into services, health apps, and connected devices, where the connected devices will contribute the largest share due to higher adoption. The telemonitoring subsegment under the telemedicine segment will grow at a faster rate due to the low doctor-to-patient ratio, busy lifestyles, and increase in IT infrastructure.

Insight by Component

The Global Digital Health Market is divided by components into hardware, software, and services segments. Out of them, the services segment leads the market with the largest revenue share due to higher demand for specific types of services such as installation, training, upgrading, staffing, maintenance, allocation of resources, and more. These services are offered by the market players either in packages or individually. The software segment will grow at a higher CAGR due to growing adoption by healthcare facilities and by care providers, insurance payers, and patients. In addition, the rising healthcare expenses and digitalization trend, the preference for personalized medicine, the shift towards value-based care, and the need to streamline workflows and increase efficiency and financial outcomes also contribute to the growth of the software segment.

Insight by Application

The Global Digital Health Market is divided by applications into obesity, diabetes, cardiovascular, respiratory diseases, and other segments. Among them, the diabetes segment is expected to grow at a high CAGR due to higher prevalence and inherent complications. Digital health systems allow tracking diabetes with wearable devices or monitoring systems to offer real-time data. This allows active and immediate response and simplifies remote patient monitoring by providing timely data to healthcare providers, allowing effective diabetes management. The obesity segment will also grow significantly due to high prevalence, growing need for more effective solutions for weight management, and preference for customized approaches.

Insight by End Users

The Global Digital Health Market is divided by end users into patients, providers, payers, and other segments. Out of these, the patient segment will grow at a higher CAGR due to the growing preference for and prevalence of patient-centric care, higher awareness among individuals about the benefits of managing health, the development of health technologies that allow self-management, access to health information, and remote monitoring. The providers segment will also grow due to the higher adoption of innovative technologies and digital solutions to provide customized care plans, remote consultations, and proven therapies beyond conventional care settings, which helps improve patient outcomes.

Global Digital Health Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 182.4 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 610.4 Billion |

|

Growth Rate |

28.0% |

|

Segments Covered in the Report |

By Technology, By Component, By Application and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World |

Industry Dynamics

Industry Trends

One of the most notable trends in the digital health market is the rapid advancement in cloud computing and its extensive use in healthcare delivery. This has promoted remote patient monitoring promoting telemedicine using connected devices. The use of different health and wellness passes is another significant trend that leverages data received from wearable devices and provides customized recommendations. The use of Electronic Health Records (EHRs) has also increased to maintain and access medical records easily, quickly, and securely. Innovative technologies such as AI, data analytics, sensors, wearable devices, and even blockchain are also integrated with healthcare delivery to improve patient outcomes.

Digital Health Market Growth Drivers

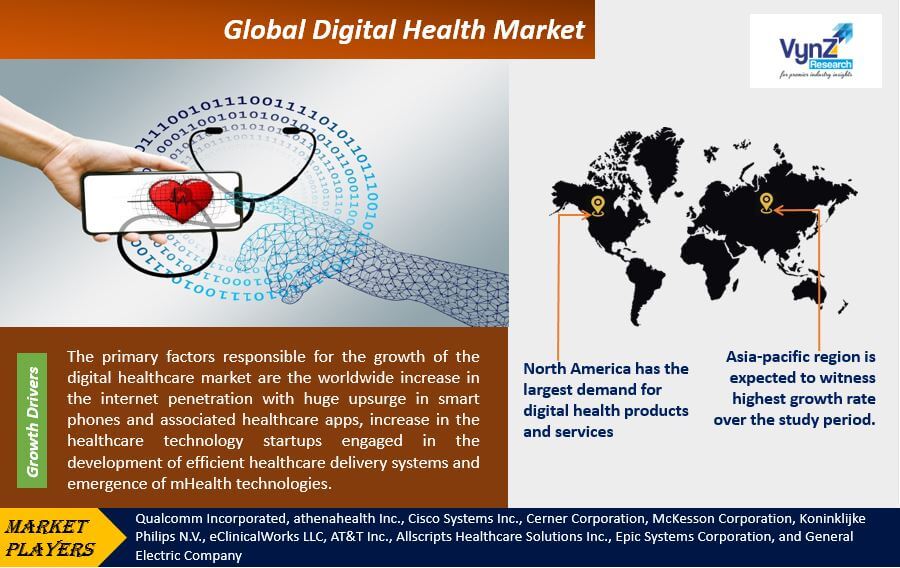

The primary growth driver of the digital health market is the rising internet penetration worldwide that allows extensive use of healthcare apps and wearable devices. This facilitates prompt intervention and remote patient monitoring. It is also attributed to technological developments and an increase in healthcare technology startups. Another significant growth driver is the increasing healthcare costs, which calls for cost-effective solutions to provide healthcare services such as digital health solutions. The growing aging population has a higher propensity of developing chronic diseases that need these solutions for proactive health management and prompt intervention. Along with that, the growing demand for accessible and convenient health care and favorable government initiatives support the market growth.

Digital Health Market Challenges

The growth of the digital health market is inhibited by the lower adoption and use of the devices. Technical complexities and data privacy concerns also prevent the market from growing extensively. Moreover, there is an immediate need for amendments to the traditional payment and reimbursement models in healthcare that do not accommodate these solutions adequately.

Digital Health Market Opportunities

Opportunities for growth of the digital health market lie in the ability of wearable devices to empower patients to manage their health promptly and proactively and to leverage remote monitoring. It also promotes adherence to care plans through timely reminders and tailored coaching apps that keep patients on track and promote health outcomes through improved communications and timely consultations.

Digital Health Market Geographic Overview

North America contributes the largest share of the market due to the high demand for such solutions and services. It is mainly attributed to the growth of chronic diseases and lifestyle-related diseases among the population. Favorable government initiatives and efforts by companies to promote innovative healthcare delivery digital models, along with rapid digitalization of healthcare, result in higher growth in the region.

Asia-Pacific market will also grow due to a rise in the number of consumers and a lower doctor-to-patient ratio in developing countries like India and China. Higher growth is also attributed to the rise in the adoption of eHealth platforms, healthcare expenditure, remote patient monitoring, and telehealth services, and government investments in healthcare.

Digital Health Market Competitive Insights

Oracle Cerner or Oracle Health, formerly Cerner Corporation, is a US-based, multinational provider of health information technology (HIT) platforms and services.

Epic Systems Corporation is an American privately held healthcare software company. According to the company, hospitals that use its software hold medical records of 78% of patients in the United States and over 3% of patients worldwide.

Key players in the digital health market are catering to the demand for these devices by investing in technologically advanced products in their product portfolios across the globe. Qualcomm Incorporated, athenahealth Inc., Cisco Systems Inc., Cerner Corporation, McKesson Corporation, Koninklijke Philips N.V., eClinicalWorks LLC, AT&T Inc., Allscripts Healthcare Solutions Inc., Epic Systems Corporation, and General Electric Company are the key players offering digital health.

Recent Developments by Key Players

Qualcomm collaborates with a variety of organizations, through the Qualcomm Wireless Reach initiative, to help close the global digital divide. Qualcomm is working with George Washington University Medical Faculty Associates to reduce the digital divide in healthcare by providing Medicaid patients with digital literacy skills and remote patient monitoring devices.

Microsoft and Epic expand AI collaboration to accelerate generative AI’s impact in healthcare, addressing the industry’s most pressing needs, including Azure OpenAI Service into Epic’s EHR to automatically draft message responses, as well as a solution that will bring natural language queries and interactive data analysis to SlicerDicer, Epic’s self-service reporting tool.

Forecast Parameters

- - Identifying variables and establishing market impact.

- - Establishing market trends regionally.

- - Analyzing opportunities and market penetration rates by understanding product commercialization, and regional expansion.

- - Analyzing demand and supply trends and changes in industry dynamics to establish future growth.

- - Analyzing sustainability strategies adhered to by market participants in an attempt to determine the future course of the market.

- - Analyzing historical market trends and super-imposing them on the current and future variables to determine year-on-year trends.

- - Understanding adoption, production, export, import, and regulatory framework.

Data Validation

- - Estimated and forecasted data was validated through industry experts.

- - Apart from industry experts, data triangulation methods were used for validation.

- - The bottom-up and top-down approaches have been used for the estimation and forecast of market data, whereas the top-down approach was used for validation.

- - Demand, as well as supply-side surveys, were conducted to understand the industry dynamics and data validation.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data, and have key opinions from industry experts. The key profiles approached within the industry include, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads, and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behavior.

The Digital Health Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Technology

- mHealth

- Connected Devices

- Services

- mHealth Apps

- EHR

- Web/cloud-Based

- On-Premise

- Healthcare Analytics

- Descriptive

- Predictive

- Prescriptive

- Telemedicine

- Teleconsulting

- Telemonitoring

- Tele-Education

- Teletrainings

- Others

- mHealth

- By Component

- Hardware

- Software

- Services

- By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Other

- By End User

- Hospitals

- Clinics

- Individual

Digital Health Market by Region

- North America

- By Technology

- By End User

- By Country – U.S., Canada, and Mexico

- Europe

- By Technology

- By End User

- By Country – Germany, U.K., France, Italy, Spain, Russia, The Netherlands, Poland, and Rest of Europe

- Asia-Pacific (APAC)

- By Technology

- By End User

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

- Rest of the World (RoW)

- By Technology

- By End User

- By Country – Brazil, Argentina, Saudi Arabia, South Africa, Nigeria, U.A.E., and Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Technology

1.2.2. By End User

1.2.3. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Size Estimations and Forecast

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Market Definition

3.1. By Technology

3.1.1. mHealth

3.1.1.1. Connected Devices

3.1.1.2. Services

3.1.1.3. mHealth Apps

3.1.2. EHR

3.1.2.1. Web/cloud-based

3.1.2.2. On-premise

3.1.3. Healthcare Analytics

3.1.3.1. Descriptive

3.1.3.2. Predictive

3.1.3.3. Prescriptive

3.1.4. Telemedicine

3.1.4.1. Teleconsulting

3.1.4.2. Telemonitoring

3.1.4.3. Tele-education

3.1.4.4. Teletraining

3.2. By End User

3.2.1. Hospital

3.2.2. Clinics

3.2.3. Individuals

4. Industry Overview

4.1. Industry Dynamics

4.1.1. Market Growth Drivers

4.1.2. Market Growth Restraints

4.1.3. Key Market Trends

4.1.4. Major Opportunities

4.2. Industry Ecosystem

4.2.1. Porter’s Five Forces Analysis

4.2.2. Strategic Development Analysis

4.2.3. Value Chain Analysis

4.3. Competitive Insight

4.3.1. Market Share Analysis of Key Players

4.3.2. Competitive Position of Industry Players

4.3.3. Market Attractive Analysis

5. Global Market Estimate and Forecast

5.1. By Technology

5.2. By End User

5.3. By Region – North America, Europe, Asia-Pacific, Rest of the World

6. North America Market Estimate and Forecast

6.1. By Technology

6.2. By End User

6.3. By Country

6.3.1. U.S. Market Estimate and Forecast

6.3.2. Canada Market Estimate and Forecast

6.3.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Technology

7.2. By End User

7.3. By Country

7.3.1. Germany Market Estimate and Forecast

7.3.2. U.K. Market Estimate and Forecast

7.3.3. France Market Estimate and Forecast

7.3.4. Italy Market Estimate and Forecast

7.3.5. Spain Market Estimate and Forecast

7.3.6. Russia Market Estimate and Forecast

7.3.7. The Netherlands Market Estimate and Forecast

7.3.8. Poland Market Estimate and Forecast

7.3.9. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Technology

8.2. By End User

8.3. By Country

8.3.1. China Market Estimate and Forecast

8.3.2. Japan Market Estimate and Forecast

8.3.3. India Market Estimate and Forecast

8.3.4. Australia Market Estimate and Forecast

8.3.5. South Korea Market Estimate and Forecast

8.3.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Technology

9.2. By End User

9.3. By Country

9.3.1. Brazil Market Estimate and Forecast

9.3.2. Argentina Market Estimate and Forecast

9.3.3. Saudi Arabia Market Estimate and Forecast

9.3.4. U.A.E. Market Estimate and Forecast

9.3.5. South Africa Market Estimate and Forecast

9.3.6. Nigeria Market Estimate and Forecast

9.3.7. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Qualcomm Incorporated

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. athenahealth Inc.

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Cisco Systems Inc.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Cerner Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. McKesson Corporation

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Koninklijke Philips N.V.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. eClinicalWorks LLC

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. AT&T Inc.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Allscripts Healthcare Solutions Inc.

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Epic Systems Corporation

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. General Electric Company

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

Note: Financial insight and recent developments are subject to availability of information in secondary domain.

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Digital Health Market Size, by Technology, 2018 - 2023 (USD Billion)

Table 5 Global Digital Health Market Size, by Technology, 2025 - 2030 (USD Billion)

Table 6 Global Digital Health Market Size for MHealth, by Type, 2018 - 2023 (USD Billion)

Table 7 Global Digital Health Market Size for MHealth, by Type, 2025 - 2030 (USD Billion)

Table 8 Global Digital Health Market Size for EHR, by Type, 2018 - 2023 (USD Billion)

Table 9 Global Digital Health Market Size for EHR, by Type, 2025 - 2030 (USD Billion)

Table 10 Global Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2023 (USD Billion)

Table 11 Global Digital Health Market Size for Healthcare Analytics, by Type, 2025 - 2030 (USD Billion)

Table 12 Global Digital Health Market Size for Telemedicine, by Type, 2018 - 2023 (USD Billion)

Table 13 Global Digital Health Market Size for Telemedicine, by Type, 2025 - 2030 (USD Billion)

Table 14 Global Digital Health Market Size, by End User, 2018 - 2023 (USD Billion)

Table 15 Global Digital Health Market Size, by End User, 2025 - 2030 (USD Billion)

Table 16 Global Digital Health Market Size, by Region, 2018 - 2023 (USD Billion)

Table 17 Global Digital Health Market Size, by Region, 2025 - 2030 (USD Billion)

Table 18 North America Digital Health Market Size, by Technology, 2018 - 2023 (USD Billion)

Table 19 North America Digital Health Market Size, by Technology, 2025 - 2030 (USD Billion)

Table 20 North America Digital Health Market Size for MHealth, by Type, 2018 - 2023 (USD Billion)

Table 21 North America Digital Health Market Size for MHealth, by Type, 2025 - 2030 (USD Billion)

Table 22 North America Digital Health Market Size for EHR, by Type, 2018 - 2023 (USD Billion)

Table 23 North America Digital Health Market Size for EHR, by Type, 2025 - 2030 (USD Billion)

Table 24 North America Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2023 (USD Billion)

Table 25 North America Digital Health Market Size for Healthcare Analytics, by Type, 2025 - 2030 (USD Billion)

Table 26 North America Digital Health Market Size for Telemedicine, by Type, 2018 - 2023 (USD Billion)

Table 27 North America Digital Health Market Size for Telemedicine, by Type, 2025 - 2030 (USD Billion)

Table 28 North America Digital Health Market Size, by End User, 2018 - 2023 (USD Billion)

Table 29 North America Digital Health Market Size, by End User, 2025 - 2030 (USD Billion)

Table 30 North America Digital Health Market Size, by Country, 2018 - 2023 (USD Billion)

Table 31 North America Digital Health Market Size, by Country, 2025 - 2030 (USD Billion)

Table 32 Europe Digital Health Market Size, by Technology, 2018 - 2023 (USD Billion)

Table 33 Europe Digital Health Market Size, by Technology, 2025 - 2030 (USD Billion)

Table 34 Europe Digital Health Market Size for MHealth, by Type, 2018 - 2023 (USD Billion)

Table 35 Europe Digital Health Market Size for MHealth, by Type, 2025 - 2030 (USD Billion)

Table 36 Europe Digital Health Market Size for EHR, by Type, 2018 - 2023 (USD Billion)

Table 37 Europe Digital Health Market Size for EHR, by Type, 2025 - 2030 (USD Billion)

Table 38 Europe Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2023 (USD Billion)

Table 39 Europe Digital Health Market Size for Healthcare Analytics, by Type, 2025 - 2030 (USD Billion)

Table 40 Europe Digital Health Market Size for Telemedicine, by Type, 2018 - 2023 (USD Billion)

Table 41 Europe Digital Health Market Size for Telemedicine, by Type, 2025 - 2030 (USD Billion)

Table 42 Europe Digital Health Market Size, by End User, 2018 - 2023 (USD Billion)

Table 43 Europe Digital Health Market Size, by End User, 2025 - 2030 (USD Billion)

Table 44 Europe Digital Health Market Size, by Country, 2018 - 2023 (USD Billion)

Table 45 Europe Digital Health Market Size, by Country, 2025 - 2030 (USD Billion)

Table 46 Asia-Pacific Digital Health Market Size, by Technology, 2018 - 2023 (USD Billion)

Table 47 Asia-Pacific Digital Health Market Size, by Technology, 2025 - 2030 (USD Billion)

Table 48 Asia-Pacific Digital Health Market Size for MHealth, by Type, 2018 - 2023 (USD Billion)

Table 49 Asia-Pacific Digital Health Market Size for MHealth, by Type, 2025 - 2030 (USD Billion)

Table 50 Asia-Pacific Digital Health Market Size for EHR, by Type, 2018 - 2023 (USD Billion)

Table 51 Asia-Pacific Digital Health Market Size for EHR, by Type, 2025 - 2030 (USD Billion)

Table 52 Asia-Pacific Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2023 (USD Billion)

Table 53 Asia-Pacific Digital Health Market Size for Healthcare Analytics, by Type, 2025 - 2030 (USD Billion)

Table 54 Asia-Pacific Digital Health Market Size for Telemedicine, by Type, 2018 - 2023 (USD Billion)

Table 55 Asia-Pacific Digital Health Market Size for Telemedicine, by Type, 2025 - 2030 (USD Billion)

Table 56 Asia-Pacific Digital Health Market Size, by End User, 2018 - 2023 (USD Billion)

Table 57 Asia-Pacific Digital Health Market Size, by End User, 2025 - 2030 (USD Billion)

Table 58 Asia-Pacific Digital Health Market Size, by Country, 2018 - 2023 (USD Billion)

Table 59 Asia-Pacific Digital Health Market Size, by Country, 2025 - 2030 (USD Billion)

Table 60 RoW Digital Health Market Size, by Technology, 2018 - 2023 (USD Billion)

Table 61 RoW Digital Health Market Size, by Technology, 2025 - 2030 (USD Billion)

Table 62 RoW Digital Health Market Size for MHealth, by Type, 2018 - 2023 (USD Billion)

Table 63 RoW Digital Health Market Size for MHealth, by Type, 2025 - 2030 (USD Billion)

Table 64 RoW Digital Health Market Size for EHR, by Type, 2018 - 2023 (USD Billion)

Table 65 RoW Digital Health Market Size for EHR, by Type, 2025 - 2030 (USD Billion)

Table 66 RoW Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2023 (USD Billion)

Table 67 RoW Digital Health Market Size for Healthcare Analytics, by Type, 2025 - 2030 (USD Billion)

Table 68 RoW Digital Health Market Size for Telemedicine, by Type, 2018 - 2023 (USD Billion)

Table 69 RoW Digital Health Market Size for Telemedicine, by Type, 2025 - 2030 (USD Billion)

Table 70 RoW Digital Health Market Size, by End User, 2018 - 2023 (USD Billion)

Table 71 RoW Digital Health Market Size, by End User, 2025 - 2030 (USD Billion)

Table 72 RoW Digital Health Market Size, by Country, 2018 - 2023 (USD Billion)

Table 73 RoW Digital Health Market Size, by Country, 2025 - 2030 (USD Billion)

Table 74 Snapshot – Qualcomm Incorporated

Table 75 Snapshot – athenahealth Inc.

Table 76 Snapshot – Cisco Systems Inc.

Table 77 Snapshot – Cerner Corporation

Table 78 Snapshot – McKesson Corporation

Table 79 Snapshot – Koninklijke Philips N.V.

Table 80 Snapshot – eClinicalWorks LLC

Table 81 Snapshot – AT&T Inc.

Table 82 Snapshot – Allscripts Healthcare Solutions Inc.

Table 83 Snapshot – Epic Systems Corporation

Table 84 Snapshot – General Electric Company

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Digital Health Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Digital Health Market Highlight

Figure 12 Global Digital Health Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 13 Global Digital Health Market Size for MHealth, by Type, 2018 - 2030 (USD Billion)

Figure 14 Global Digital Health Market Size for EHR, by Type, 2018 - 2030 (USD Billion)

Figure 15 Global Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2030 (USD Billion)

Figure 16 Global Digital Health Market Size for Telemedicine, by Type, 2018 - 2030 (USD Billion)

Figure 17 Global Digital Health Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 18 Global Digital Health Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 19 North America Digital Health Market Highlight

Figure 20 North America Digital Health Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 21 North America Digital Health Market Size for MHealth, by Type, 2018 - 2030 (USD Billion)

Figure 22 North America Digital Health Market Size for EHR, by Type, 2018 - 2030 (USD Billion)

Figure 23 North America Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2030 (USD Billion)

Figure 24 North America Digital Health Market Size for Telemedicine, by Type, 2018 - 2030 (USD Billion)

Figure 25 North America Digital Health Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 26 North America Digital Health Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 27 Europe Digital Health Market Highlight

Figure 28 Europe Digital Health Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 29 Europe Digital Health Market Size for MHealth, by Type, 2018 - 2030 (USD Billion)

Figure 30 Europe Digital Health Market Size for EHR, by Type, 2018 - 2030 (USD Billion)

Figure 31 Europe Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2030 (USD Billion)

Figure 32 Europe Digital Health Market Size for Telemedicine, by Type, 2018 - 2030 (USD Billion)

Figure 33 Europe Digital Health Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 34 Europe Digital Health Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 35 Asia-Pacific Digital Health Market Highlight

Figure 36 Asia-Pacific Digital Health Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 37 Asia-Pacific Digital Health Market Size for MHealth, by Type, 2018 - 2030 (USD Billion)

Figure 38 Asia-Pacific Digital Health Market Size for EHR, by Type, 2018 - 2030 (USD Billion)

Figure 39 Asia-Pacific Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2030 (USD Billion)

Figure 40 Asia-Pacific Digital Health Market Size for Telemedicine, by Type, 2018 - 2030 (USD Billion)

Figure 41 Asia-Pacific Digital Health Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 42 Asia-Pacific Digital Health Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 43 RoW Digital Health Market Highlight

Figure 44 RoW Digital Health Market Size, by Technology, 2018 - 2030 (USD Billion)

Figure 45 RoW Digital Health Market Size for MHealth, by Type, 2018 - 2030 (USD Billion)

Figure 46 RoW Digital Health Market Size for EHR, by Type, 2018 - 2030 (USD Billion)

Figure 47 RoW Digital Health Market Size for Healthcare Analytics, by Type, 2018 - 2030 (USD Billion)

Figure 48 RoW Digital Health Market Size for Telemedicine, by Type, 2018 - 2030 (USD Billion)

Figure 49 RoW Digital Health Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 50 RoW Digital Health Market Size, by Country, 2018 - 2030 (USD Billion)

Global Digital Health Market Coverage

Technology Insight and Forecast 2023 – 2030

- mHealth

- Connected Devices

- Services

- mHealth Apps

- EHR

- Web/cloud-Based

- On-Premise

- Healthcare Analytics

- Descriptive

- Predictive

- Prescriptive

- Telemedicine

- Teleconsulting

- Telemonitoring

- Tele-Education

- Teletrainings

- Others

End User Insight and Forecast 2023 – 2030

- Hospitals

- Clinics

- Individual

Geographical Segmentation

Digital Health Market by Region

North America

- By Technology

- By End User

- By Country – U.S., Canada, and Mexico

Europe

- By Technology

- By End User

- By Country – Germany, U.K., France, Italy, Spain, Russia, The Netherlands, Poland, and Rest of Europe

Asia-Pacific (APAC)

- By Technology

- By End User

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Technology

- By End User

- By Country – Brazil, Argentina, Saudi Arabia, South Africa, Nigeria, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Digital Health Market – Analysis and Forecast (2025–2030)

- The Global Digital Health Market will grow from USD 182.4 billion to USD 610.4 billion at a CAGR of 28.0%.

- The market is segmented by technology, component, application, and end users, where each segment comes with different subsegments showing immense, varied growth potential during the forecast period.

- The market growth is attributed to the increase in wearable device producers, smartphone and tablet users, the number of chronic and lifestyle-related health issues and diseases, telehealth platform developers, e-prescription systems, and mHealth app providers.

- High capital requirements, data privacy issues, shortage of technologists, and unfavorable reimbursement models hinder growth. Growth prospects lie in supportive government initiatives, growth of the IT industry, higher investment, and preventive healthcare prominence.

- North America leads the market due to growing chronic and lifestyle-related diseases, favorable government initiatives, and advanced healthcare delivery digital models. The Asia-Pacific market will grow due to growing number of consumers in developing countries like China and India.