| Status : Published | Published On : Dec, 2024 | Report Code : VRHC1070 | Industry : Healthcare | Available Format :

|

Page : 162 |

Global Image-Guided Surgery Devices Market – Analysis and Forecast (2025-2030)

Industry Insights by Product (X-Ray Fluoroscopy, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Endoscopes, Single-Photon Emission Computed Tomography (SPECT), and Positron Emission Tomography (PET)), Application (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Urology, Gastroenterology, Oncology Surgery, and Others), and by End User (Hospitals, Ambulatory Surgical Centers (ASCs), and Others), and by Geography (North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World)

Industry Overview

The Global Image-Guided Surgery Devices Market is predicted to grow at 7.3% CAGR during the forecast period with the market size reaching USD 9.3 billion by 2030. Image-guided surgery is also known as navigation surgery, it visually correlates intraoperative anatomy with a preoperative CT scan. Image-guided surgery devices are used for guiding surgeons during surgery. It enhances accuracy during the surgery, decreases procedure time, reduces complexity, and insignificant surgical scars.

Different products such as x-ray fluoroscopy, computed tomography, single-photon emission computed tomography, magnetic resonance imaging, and ultrasound are majorly contributing to the image-guided surgery devices' market size. The market has witnessed significant demand for computed tomography over the last few years as it is used for diagnosing vascular diseases, cancer, and skeletal abnormalities.

Image Guided Surgery Devices Market Segmentation

Insight by Product

Based on product, the image-guided surgery devices market is categorized into x-ray fluoroscopy, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, endoscopes, single-photon emission computed tomography (SPECT), and positron emission tomography (PET), of which computed tomography holds the largest share in the image-guided surgery devices market, globally.

The upsurge in the precision of the operating procedure has led to the fastest growth of the magnetic resonance imaging segment during the historical period, which is also predicted to continue during the forecast period.

Insight by Application

On the basis of the application, the image-guided surgery devices market is subdivided into cardiac surgery, urology, neurosurgery, oncology surgery, orthopedic surgery, gastroenterology, and others. Of all, the orthopedic surgery category is predicted to witness the highest CAGR during the forecast period due to expanding the geriatric population, and the mounting occurrence of road accidents. Moreover, of all applications, the neurosurgery category accounted for the largest share in the image-guided surgery devices market due to an upsurge in the precision of the operating procedure, the mounting occurrence of neurological disorders and diseases, and the least threat of injury to non-surgical sites in the brain.

Insight by End User

On the basis of the end user, the market is segmented into hospitals, ambulatory surgical centers (ASCs), and others. Of all, the image-guided surgery devices market size for ASCs is expected to grow at the fastest CAGR of 8.3% during the forecast period, globally. In addition, of all end users, hospitals accounted for the largest share of the market.

Global Image Guided Surgery Devices Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. Billion |

|

Revenue Forecast in 2030 |

U.S.D. 9.3 Billion |

|

Growth Rate |

7.3% |

|

Segments Covered in the Report |

By Product, Application and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World |

Industry Dynamics

Image Guided Surgery Devices Market Growth Drivers

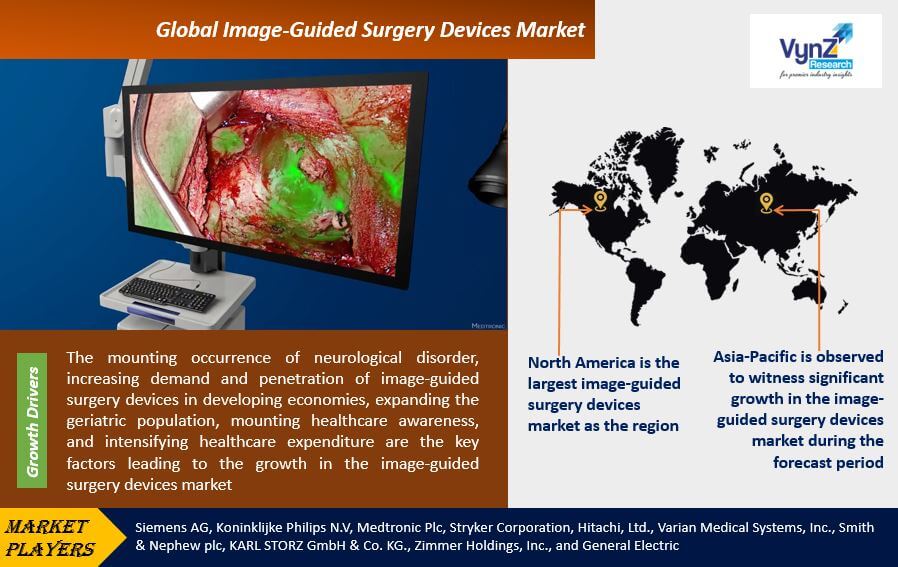

The mounting occurrence of neurological disorders, increasing demand and penetration of image-guided surgery devices in developing economies, expanding the geriatric population, mounting healthcare awareness, and intensifying healthcare expenditure are the key factors leading to the growth in the image-guided surgery devices market, globally.

The advancements in imaging technology have also contributed to the growth of the IGS Devices market. High-resolution imaging modalities, such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound, have become more accessible and sophisticated. These imaging techniques provide detailed anatomical information and help surgeons visualize the internal structures and target areas during surgical procedures. Image-guided surgery devices integrate with these imaging technologies, allowing surgeons to precisely navigate through the patient's anatomy and perform precise interventions.

The geriatric population is susceptible to neurological disorders moreover, the low immunity makes it problematic for them to recover from the side effects of invasive treatments, thus image-guided surgery devices are escalating demand for non-invasive surgery. Some of the other key factors driving the growth of the industry are the mounting occurrence of chronic diseases such as cancer, and technological developments in medical imaging.

Image Guided Surgery Devices Market Challenges

Key factors hindering the growth of the image-guided surgery devices market are the high cost of imaging techniques and strict regulatory requirements. In addition, the lack of awareness is also having a negative impact on the growth of the image-guided surgery devices market.

Interoperability and compatibility issues can also pose challenges in the image-guided surgery devices market. These devices often rely on integrating various imaging modalities, tracking systems, and software platforms. Ensuring seamless interoperability between different components and systems can be a technical challenge. In some cases, the lack of standardized protocols and interfaces can hinder the integration of image-guided surgery devices with existing hospital infrastructure, such as picture archiving and communication systems (PACS) or electronic medical record (EMR) systems. Compatibility issues can create inefficiencies, increase costs, and impact the usability of image-guided surgery devices.

Recent Developments By the Key Players

Siemens Energy has entered into an exclusive agreement with Rolls-Royce SMR to supply conventional technology, including steam turbines and generators, for future small modular nuclear reactors (SMRs). This collaboration focus to advance nuclear energy solutions and is expected to create job opportunities and manufacturing prospects in the UK

KARL STORZ expanded its surgical robotics division by acquiring Asensus Surgical, a U.S.-based company specializing in robotic-assisted surgery. This acquisition aims to advance Performance-Guided Surgery solutions.

Image Guided Surgery Devices Market Geographic Overview

Geographically, North America is the largest image-guided surgery devices market as the region is home to a large number of industry players and has a high frequency of acceptance of novel technologies. In addition, expanding geriatric population, escalating demand for non-invasive surgery, obtainability of skilled professionals, mounting healthcare awareness, intensifying demand of minimally invasive surgery, the mounting occurrence of neurological disorders, and escalating healthcare expenditure are also fueling the growth of the North American image-guided surgery devices market.

Asia-Pacific is observed to witness significant growth in the image-guided surgery devices market during the forecast period, as the region comprises of a large population, and refining healthcare infrastructure. Moreover, expanding the geriatric population, intensifying demand for minimally invasive surgery, mounting healthcare awareness, and speedily increasing medical tourism are also facilitating the significant growth of Asia-Pacific image-guided surgery devices industry.

Image Guided Surgery Devices Market Competitive Insight

Market players in the image-guided surgery devices industry are investing capital to develop technologically advanced systems.

Key players offering solutions for image-guided surgery devices include :

- Siemens AG

- Koninklijke Philips N.V

- Medtronic Plc

- Stryker Corporation

- Hitachi Ltd.

- Varian Medical Systems Inc.

- Smith & Nephew Plc

- KARL STORZ GmbH & Co. KG.

- General Electric Company

- Zimmer Holdings Inc.

The Image Guided Surgery Devices Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Product

- X-Ray Fluoroscopy

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Endoscopes

- Single-Photon Emission Computed Tomography (SPECT)

- Positron Emission Tomography (PET)

- By Application

- Cardiac Surgery

- Neurosurgery

- Orthopedic Surgery

- Urology

- Gastroenterology

- Oncology Surgery

- Others

- By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Others

Image Guided Surgery Devices Market by Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- U.A.E

- Other countries

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Image Guided Surgery Devices Market