- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Isolation Beds Market

| Status : Published | Published On : Dec, 2023 | Report Code : VRHC1226 | Industry : Healthcare | Available Format :

|

Page : 209 |

Global Isolation Beds Market – Analysis and Forecast (2025-2030)

Industry Insights by Type (Manual, Electric, Hydraulic, and Pneumatic), by Usage (Critical, Bariatric, Medical Surgery, Pediatric, and Maternal), by End Use (General & Acute Care Hospitals, Multi-Specialty Hospitals, Specialized Hospitals, Ambulatory Surgical Centers, and Others), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Isolation Beds Market is growing at a CAGR of 7.0% during the forecast period (2025–2030). The primary driver impacting the growth of the global isolation beds market is the rapid surge in infectious diseases across the globe. In recent times, several countries have witnessed outbreaks of viral diseases such as severely acquired respiratory syndrome (SARS), E-Bola, H1N1 virus, and COVID-19 (coronavirus). The death rate of COVID-19 appears to be higher in comparison to normal seasonal flu, and it differs with respect to location. For instance, at the epicenter (Hubei province, China) the death rate was 2.9%, whereas at other provinces it was 0.4%.

To contain these outbreaks in hospitals, and other health centers, these facilities need to follow preventive measures of isolating infected patients. Viral infections can spread rapidly to other healthcare workers, visitors, and doctors. So there is a necessity to have separate isolation wards with the proper medical facility and preventive personal equipment for nurses and doctors. For these highly contagious diseases, isolation is the primary step, this is why specialized cabins or isolation wards have been created within the hospital settings.

Isolation Beds Market Segmentation

Insight by Type

Based on type, the global isolation beds market is categorized into manual, electric, hydraulic, and pneumatic. Of all, the manual segment held the largest share of the global market in 2019, owing to the growing awareness pertaining to the protection of healthcare workers. Usually, the isolation beds across the world in use are the traditional hospital bed placed in isolation wards. Such beds are often equipped with other necessities such as respiratory equipment.

There is a huge demand for smart isolation beds. In this direction, Get to Sleep Easy, Hoana Medical Inc. are Australia-based, potential medical startup. They had created a Smart Inclining Bed solution, at an affordable price, equipped with smart sensors installed in the bed to track patient movement and alert in case of emergency.

Insight by End Use

On the basis of end-use, the isolation beds market is categorized into general & acute care hospitals, multi-specialty hospitals, and specialized hospitals. The general & acute care hospitals segment is expected to contribute the largest revenue by 2030, owing to the growing need for intensive care units from the COVID-19 pandemic. The presence of general hospitals as compared to specialized and multi-specialty hospitals is the primary contributing factor.

Global Isolation Beds Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. xx.x Billion |

|

Revenue Forecast in 2030 |

U.S.D. xx.x Billion |

|

Growth Rate |

7.0% |

|

Segments Covered in the Report |

By Type, By Usage and By End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World |

Industry Dynamics

Industry Trends

According to the standard, manufacturing requires strict labeling, test method, and classification for isolation beds. This innovation is our most important in the situation where coronavirus is at its peak globally and is further expected to prevail for which vital safety measures are to be implemented. As a result, in the current situation, low-cost isolation beds across the globe is witnessing significant growth to cater to its huge demand across several countries.

Technological advancements: The isolation beds market has seen advancements in technology to improve patient comfort and safety. This includes features like adjustable height, patient monitoring systems, built-in communication systems, and remote control operation.

Focus on infection control: Infection control has become a critical concern in healthcare facilities. Isolation beds with features such as sealed enclosures, negative pressure ventilation systems, and antimicrobial surfaces have gained popularity to minimize the risk of cross-contamination and improve patient outcomes.

Growing healthcare infrastructure: Increasing investments in healthcare infrastructure, particularly in emerging economies, have contributed to the expansion of the isolation beds market. The development of new hospitals, clinics, and healthcare facilities has driven the demand for isolation beds.

Isolation Beds Market Growth Drivers

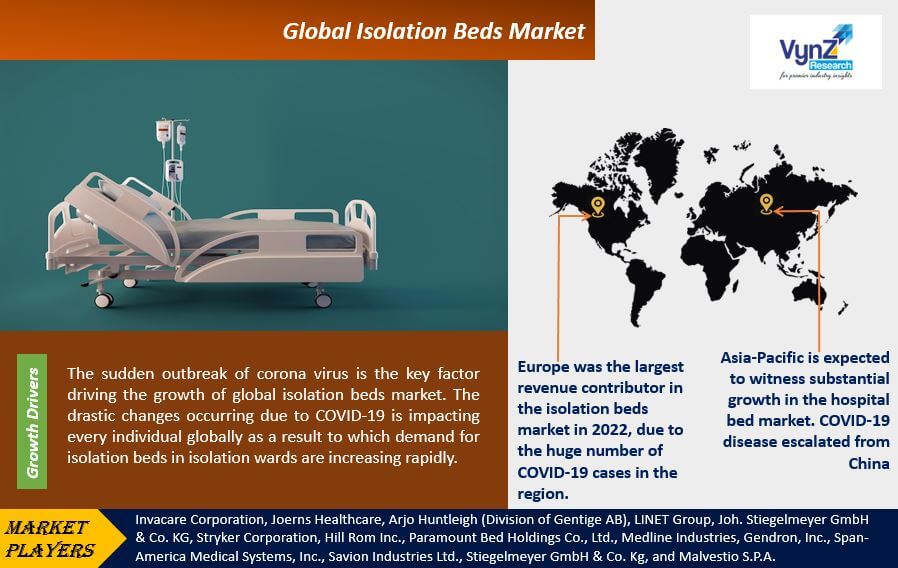

The sudden outbreak of coronavirus is the key factor driving the growth of the global isolation beds market. The drastic changes occurring due to COVID-19 are impacting every individual globally as a result to which demand for isolation beds in isolation wards is increasing rapidly. World Health Organization (WHO) has urged all the manufacturers of isolation beds globally to increase the production of this equipment on an immediate basis. According to a report by WHO in March 2020, the number of coronavirus patients exceeded 200000 and in almost after twelve days the number would exceed by 100000.

As the global epidemic spreads on a larger scale, countries other than China started experiencing a shortage of isolation beds as traditional beds can’t fulfill the requirement. For instance, Italian local authorities were told to free ICU beds for COVID-19-infected patients. By March 2020, around 80% of the hospital beds in Lombardy, Italy were occupied with COVID-19 patients.

Furthermore, all these patients along with healthcare workers and people all over the world are required to be provided with personal protective equipment as fast as possible to deal with this global pandemic. Moreover, the organization states that with the emergence of COVID-19, many other repercussions could prevail such as seroepidemiological problems, virological and clinical characteristics along with epidemiological issues of the virus and associated disease. Additionally, in order to combat this situation rapid development of personal protective equipment and isolation beds are extremely vital that is significantly contributing to the growth of the global isolation beds market.

Isolation Beds Market Challenges

However, due to the coronavirus preventive lockdown situation in several countries, the manufacturing and supply chains of the isolation beds have been critically affected. The procurement, transportation, and distribution of raw materials to the manufacturing unit and the absence of laborers in both emerging and developed nations have negatively impacted the desired production flow.

Effective utilization of isolation beds necessitates trained healthcare professionals who understand infection control protocols and can properly manage patients within isolation settings. Staffing and training requirements can be challenging, particularly during public health emergencies when there is a surge in patient volume and limited resources.

Isolation Beds Market Geographic Overview

Around the globe, Europe was the largest revenue contributor in the isolation beds market in 2019, due to the huge number of COVID-19 cases in the region. The demand for isolation beds has been exceeded by European Union in order to fight the coronavirus. The demand of isolation beds from this region is 10 times more compared to what is available in stock. According to a report published by European Union, approximately 1,563,857 cases of COVID-19 till the first week of April and the total number of deaths registered in the region has been reported as 95,044.

Additionally, countries such as Spain, Italy, Germany, France, and the United Kingdom (UK) are estimated to register the largest number of cases. Moreover, doctors are threatening to quit their jobs in Europe due to the inaccessibility of protective equipment. As a result, to which government is estimated to spend USD 265 million on personal protective equipment, including isolation beds, which is expected to bolster the growth of isolation beds market in the region.

Furthermore, the prevalence of key players manufacturing isolation beds in North America along with the aim of these companies to enhance their solution offers is the key factor driving the growth in the region. The number of COVID-19 cases in North America is also enhancing rapidly with registered cases of almost 5,04,780 and 18,763 deaths as registered in the first week of April.

Moreover, Asia-Pacific is expected to witness substantial growth in the hospital bed market. COVID-19 disease escalated in China as a result to which Chinese suppliers have contracted the supply of raw materials to the U.S. Furthermore, pandemic outbreaks lead to the worst hit in China although the country is recovering and has started exporting medical supplies to the U.S. and other affected countries. Additionally, a country such as India is witnessing an increasing number of coronavirus cases and the demand for isolation beds will enhance at a significant rate. China has also introduced the concept of Fangcang shelter hospitals, which are large-scale temporary hospitals, built on existing public venues such as stadiums and exhibition centers. The purpose of these facilities is to isolate mild to moderate COVID-19 patients to prevent community transmissions.

The government authorities globally have allotted funds towards COVID-19 in the following manner Germany is expected to incur USD 808 Billion, France USD 50 billion, Spain USD 223 Billion, and the U.K. USD 14.8 Billion are also the worst hit economies in the world from COVID-19. Furthermore, Brazil is anticipated to spend USD 144 Billion, Switzerland USD 42.6 Billion, Austria USD 42 Billion, and the Canadian government allotted USD 82 Billion towards recovering from the COVID-19 situation. As a result of huge initiatives undertaken by government authorities across the globe to fight COVID-19 is significantly attributing towards the growth of the isolation beds market.

Isolation Beds Market Competitive Insight

These players in the isolation beds market are emphasizing their efforts upon strategic acquisitions in order to strengthen capabilities of research & development that support them in providing innovative solutions to the users and thus gain a competitive advantage.

Joerns is a leading partner in long-term post-acute care (LTPAC), providing access to high-quality products with renowned efficacy and safety.

Medline Industries, LP is an American private healthcare company headquartered in Northfield, Illinois. It is a manufacturer, distributor doing business in more than 125 countries and territories around the world.

The key players operating in the global isolation beds market are Invacare Corporation, Joerns Healthcare, Arjo Huntleigh (Division of Gentige AB), LINET Group, Joh. Stiegelmeyer GmbH & Co. KG, Stryker Corporation, Hill Rom Inc., Paramount Bed Holdings Co., Ltd., Medline Industries, Gendron, Inc., Span-America Medical Systems, Inc., Savion Industries Ltd., Stiegelmeyer GmbH & Co. Kg, and Malvestio S.P.A.

Recent Developments by Key Players

Stryker announces medical device testing lab expansion in India. It is its prototype and testing facility.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data and have key opinions from industry experts. The key profiles approached within the industry include, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads, and Others. Also, end user surveys comprising consumers are also conducted to understand consumer behavior.

The Isolation Beds Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Type

- Manual

- Electric

- Hydraulic

- Pneumatic

- By Usage

- Critical

- Bariatric

- Medical Surgery

- Pediatric

- Maternal

- By End Use

- General & Acute Care Hospitals

- Multi-Specialty Hospitals

- Specialized Hospitals

- Ambulatory Surgical Centers

- Others

Isolation Beds Market by Region

- North America

- By Type

- By Usage

- By End Use

- By Country – U.S., Canada, and Mexico

- Europe

- By Type

- By Usage

- By End Use

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

- Asia-Pacific (APAC)

- By Type

- By Usage

- By End Use

- By Country – China, Japan, India, South Korea, Singapore, Australia, Indonesia, and Rest of Asia-Pacific

- Rest of the World (RoW)

- By Type

- By Usage

- By End Use

- By Country – Brazil, Argentina, Saudi Arabia, South Africa, U.A.E., Iran, and Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Type

1.2.2. By Usage

1.2.3. By End Use

1.2.4. By Region

1.3. Research Phases

1.4. Limitations

1.5. Research Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Type

5.1.1. Manual

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Electric

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Hydraulic

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Pneumatic

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.2. By Usage

5.2.1. Critical

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Bariatric

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Medical Surgery

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Pediatric

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Maternal

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.3. By End Use

5.3.1. General & Acute Care Hospitals

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Multi-Specialty Hospitals

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Specialized Hospitals

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Ambulatory Surgical Centers

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Others

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Type

6.2. By Usage

6.3. By End Use

6.4. By Country

6.4.1. U.S. Market Estimate and Forecast

6.4.2. Canada Market Estimate and Forecast

6.4.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Type

7.2. By Usage

7.3. By End Use

7.4. By Country

7.4.1. Germany Market Estimate and Forecast

7.4.2. France Market Estimate and Forecast

7.4.3. U.K. Market Estimate and Forecast

7.4.4. Italy Market Estimate and Forecast

7.4.5. Spain Market Estimate and Forecast

7.4.6. Russia Market Estimate and Forecast

7.4.7. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Type

8.2. By Usage

8.3. By End Use

8.4. By Country

8.4.1. China Market Estimate and Forecast

8.4.2. Japan Market Estimate and Forecast

8.4.3. India Market Estimate and Forecast

8.4.4. South Korea Market Estimate and Forecast

8.4.5. Singapore Market Estimate and Forecast

8.4.6. Australia Market Estimate and Forecast

8.4.7. Indonesia Market Estimate and Forecast

8.4.8. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Type

9.2. By Usage

9.3. By End Use

9.4. By Country

9.4.1. Brazil Market Estimate and Forecast

9.4.2. Argentina Market Estimate and Forecast

9.4.3. Saudi Arabia Market Estimate and Forecast

9.4.4. South Africa Market Estimate and Forecast

9.4.5. U.A.E. Market Estimate and Forecast

9.4.6. Iran Market Estimate and Forecast

9.4.7. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Invacare Corporation

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Joerns Healthcare

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Arjo Huntleigh (Division of Gentige AB)

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. LINET Group

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Joh. Stiegelmeyer GmbH & Co. KG

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Stryker Corporation

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Hill Rom Inc.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Paramount Bed Holdings Co., Ltd.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Medline Industries

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Gendron, Inc.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

10.11. Span-America Medical Systems, Inc.

10.11.1. Snapshot

10.11.2. Overview

10.11.3. Offerings

10.11.4. Financial Insight

10.11.5. Recent Developments

10.12. Savion Industries Ltd.

10.12.1. Snapshot

10.12.2. Overview

10.12.3. Offerings

10.12.4. Financial Insight

10.12.5. Recent Developments

10.13. Stiegelmeyer GmbH & Co. Kg

10.13.1. Snapshot

10.13.2. Overview

10.13.3. Offerings

10.13.4. Financial Insight

10.13.5. Recent Developments

10.14. Malvestio S.P.A.

10.14.1. Snapshot

10.14.2. Overview

10.14.3. Offerings

10.14.4. Financial Insight

10.14.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to availability of information in secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Isolation Beds Market Size, by Type, 2018 - 2023 (Units)

Table 5 Global Isolation Beds Market Size, by Type, 2025 - 2030 (Units)

Table 6 Global Isolation Beds Market Size, by Type, 2018 - 2023 (USD Billion)

Table 7 Global Isolation Beds Market Size, by Type, 2025 - 2030 (USD Billion)

Table 8 Global Isolation Beds Market Size, by Usage, 2018 - 2023 (Units)

Table 9 Global Isolation Beds Market Size, by Usage, 2025 - 2030 (Units)

Table 10 Global Isolation Beds Market Size, by Usage, 2018 - 2023 (USD Billion)

Table 11 Global Isolation Beds Market Size, by Usage, 2025 - 2030 (USD Billion)

Table 12 Global Isolation Beds Market Size, by End Use, 2018 - 2023 (Units)

Table 13 Global Isolation Beds Market Size, by End Use, 2025 - 2030 (Units)

Table 14 Global Isolation Beds Market Size, by End Use, 2018 - 2023 (USD Billion)

Table 15 Global Isolation Beds Market Size, by End Use, 2025 - 2030 (USD Billion)

Table 16 Global Isolation Beds Market Size, by Region, 2018 - 2023 (Units)

Table 17 Global Isolation Beds Market Size, by Region, 2025 - 2030 (Units)

Table 18 Global Isolation Beds Market Size, by Region, 2018 - 2023 (USD Billion)

Table 19 Global Isolation Beds Market Size, by Region, 2025 - 2030 (USD Billion)

Table 20 North America Isolation Beds Market Size, by Type, 2018 - 2023 (Units)

Table 21 North America Isolation Beds Market Size, by Type, 2025 - 2030 (Units)

Table 22 North America Isolation Beds Market Size, by Type, 2018 - 2023 (USD Billion)

Table 23 North America Isolation Beds Market Size, by Type, 2025 - 2030 (USD Billion)

Table 24 North America Isolation Beds Market Size, by Usage, 2018 - 2023 (Units)

Table 25 North America Isolation Beds Market Size, by Usage, 2025 - 2030 (Units)

Table 26 North America Isolation Beds Market Size, by Usage, 2018 - 2023 (USD Billion)

Table 27 North America Isolation Beds Market Size, by Usage, 2025 - 2030 (USD Billion)

Table 28 North America Isolation Beds Market Size, by End Use, 2018 - 2023 (Units)

Table 29 North America Isolation Beds Market Size, by End Use, 2025 - 2030 (Units)

Table 30 North America Isolation Beds Market Size, by End Use, 2018 - 2023 (USD Billion)

Table 31 North America Isolation Beds Market Size, by End Use, 2025 - 2030 (USD Billion)

Table 32 North America Isolation Beds Market Size, by Country, 2018 - 2023 (Units)

Table 33 North America Isolation Beds Market Size, by Country, 2025 - 2030 (Units)

Table 34 North America Isolation Beds Market Size, by Country, 2018 - 2023 (USD Billion)

Table 35 North America Isolation Beds Market Size, by Country, 2025 - 2030 (USD Billion)

Table 36 Europe Isolation Beds Market Size, by Type, 2018 - 2023 (Units)

Table 37 Europe Isolation Beds Market Size, by Type, 2025 - 2030 (Units)

Table 38 Europe Isolation Beds Market Size, by Type, 2018 - 2023 (USD Billion)

Table 39 Europe Isolation Beds Market Size, by Type, 2025 - 2030 (USD Billion)

Table 40 Europe Isolation Beds Market Size, by Usage, 2018 - 2023 (Units)

Table 41 Europe Isolation Beds Market Size, by Usage, 2025 - 2030 (Units)

Table 42 Europe Isolation Beds Market Size, by Usage, 2018 - 2023 (USD Billion)

Table 43 Europe Isolation Beds Market Size, by Usage, 2025 - 2030 (USD Billion)

Table 44 Europe Isolation Beds Market Size, by End Use, 2018 - 2023 (Units)

Table 45 Europe Isolation Beds Market Size, by End Use, 2025 - 2030 (Units)

Table 46 Europe Isolation Beds Market Size, by End Use, 2018 - 2023 (USD Billion)

Table 47 Europe Isolation Beds Market Size, by End Use, 2025 - 2030 (USD Billion)

Table 48 Europe Isolation Beds Market Size, by Country, 2018 - 2023 (Units)

Table 49 Europe Isolation Beds Market Size, by Country, 2025 - 2030 (Units)

Table 50 Europe Isolation Beds Market Size, by Country, 2018 - 2023 (USD Billion)

Table 51 Europe Isolation Beds Market Size, by Country, 2025 - 2030 (USD Billion)

Table 52 Asia-Pacific Isolation Beds Market Size, by Type, 2018 - 2023 (Units)

Table 53 Asia-Pacific Isolation Beds Market Size, by Type, 2025 - 2030 (Units)

Table 54 Asia-Pacific Isolation Beds Market Size, by Type, 2018 - 2023 (USD Billion)

Table 55 Asia-Pacific Isolation Beds Market Size, by Type, 2025 - 2030 (USD Billion)

Table 56 Asia-Pacific Isolation Beds Market Size, by Usage, 2018 - 2023 (Units)

Table 57 Asia-Pacific Isolation Beds Market Size, by Usage, 2025 - 2030 (Units)

Table 58 Asia-Pacific Isolation Beds Market Size, by Usage, 2018 - 2023 (USD Billion)

Table 59 Asia-Pacific Isolation Beds Market Size, by Usage, 2025 - 2030 (USD Billion)

Table 60 Asia-Pacific Isolation Beds Market Size, by End Use, 2018 - 2023 (Units)

Table 61 Asia-Pacific Isolation Beds Market Size, by End Use, 2025 - 2030 (Units)

Table 62 Asia-Pacific Isolation Beds Market Size, by End Use, 2018 - 2023 (USD Billion)

Table 63 Asia-Pacific Isolation Beds Market Size, by End Use, 2025 - 2030 (USD Billion)

Table 64 Asia-Pacific Isolation Beds Market Size, by Country, 2018 - 2023 (Units)

Table 65 Asia-Pacific Isolation Beds Market Size, by Country, 2025 - 2030 (Units)

Table 66 Asia-Pacific Isolation Beds Market Size, by Country, 2018 - 2023 (USD Billion)

Table 67 Asia-Pacific Isolation Beds Market Size, by Country, 2025 - 2030 (USD Billion)

Table 68 RoW Isolation Beds Market Size, by Type, 2018 - 2023 (Units)

Table 69 RoW Isolation Beds Market Size, by Type, 2025 - 2030 (Units)

Table 70 RoW Isolation Beds Market Size, by Type, 2018 - 2023 (USD Billion)

Table 71 RoW Isolation Beds Market Size, by Type, 2025 - 2030 (USD Billion)

Table 72 RoW Isolation Beds Market Size, by Usage, 2018 - 2023 (Units)

Table 73 RoW Isolation Beds Market Size, by Usage, 2025 - 2030 (Units)

Table 74 RoW Isolation Beds Market Size, by Usage, 2018 - 2023 (USD Billion)

Table 75 RoW Isolation Beds Market Size, by Usage, 2025 - 2030 (USD Billion)

Table 76 RoW Isolation Beds Market Size, by End Use, 2018 - 2023 (Units)

Table 77 RoW Isolation Beds Market Size, by End Use, 2025 - 2030 (Units)

Table 78 RoW Isolation Beds Market Size, by End Use, 2018 - 2023 (USD Billion)

Table 79 RoW Isolation Beds Market Size, by End Use, 2025 - 2030 (USD Billion)

Table 80 RoW Isolation Beds Market Size, by Country, 2018 - 2023 (Units)

Table 81 RoW Isolation Beds Market Size, by Country, 2025 - 2030 (Units)

Table 82 RoW Isolation Beds Market Size, by Country, 2018 - 2023 (USD Billion)

Table 83 RoW Isolation Beds Market Size, by Country, 2025 - 2030 (USD Billion)

Table 84 Snapshot – Invacare Corporation

Table 85 Snapshot – Joerns Healthcare

Table 86 Snapshot – Arjo Huntleigh (Division of Gentige AB)

Table 87 Snapshot – LINET Group

Table 88 Snapshot – Joh. Stiegelmeyer GmbH & Co. KG

Table 89 Snapshot – Stryker Corporation

Table 90 Snapshot – Hill Rom Inc.

Table 91 Snapshot – Paramount Bed Holdings Co., Ltd.

Table 92 Snapshot – Medline Industries

Table 93 Snapshot – Gendron, Inc.

Table 94 Snapshot – Span-America Medical Systems, Inc.

Table 95 Snapshot – Savion Industries Ltd.

Table 96 Snapshot – Stiegelmeyer GmbH & Co. Kg

Table 97 Snapshot – Malvestio S.P.A.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Isolation Beds Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Isolation Beds Market Highlight

Figure 12 Global Isolation Beds Market Size, by Type, 2018 - 2030 (Units)

Figure 13 Global Isolation Beds Market Size, by Usage, 2018 - 2030 (Units)

Figure 14 Global Isolation Beds Market Size, by End Use, 2018 - 2030 (Units)

Figure 15 Global Isolation Beds Market Size, by Region, 2018 - 2030 (Units)

Figure 16 North America Isolation Beds Market Highlight

Figure 17 North America Isolation Beds Market Size, by Type, 2018 - 2030 (Units)

Figure 18 North America Isolation Beds Market Size, by Usage, 2018 - 2030 (Units)

Figure 19 North America Isolation Beds Market Size, by End Use, 2018 - 2030 (Units)

Figure 20 North America Isolation Beds Market Size, by Country, 2018 - 2030 (Units)

Figure 21 Europe Isolation Beds Market Highlight

Figure 22 Europe Isolation Beds Market Size, by Type, 2018 - 2030 (Units)

Figure 23 Europe Isolation Beds Market Size, by Usage, 2018 - 2030 (Units)

Figure 24 Europe Isolation Beds Market Size, by End Use, 2018 - 2030 (Units)

Figure 25 Europe Isolation Beds Market Size, by Country, 2018 - 2030 (Units)

Figure 26 Asia-Pacific Isolation Beds Market Highlight

Figure 27 Asia-Pacific Isolation Beds Market Size, by Type, 2018 - 2030 (Units)

Figure 28 Asia-Pacific Isolation Beds Market Size, by Usage, 2018 - 2030 (Units)

Figure 29 Asia-Pacific Isolation Beds Market Size, by End Use, 2018 - 2030 (Units)

Figure 30 Asia-Pacific Isolation Beds Market Size, by Country, 2018 - 2030 (Units)

Figure 31 RoW Isolation Beds Market Highlight

Figure 32 RoW Isolation Beds Market Size, by Type, 2018 - 2030 (Units)

Figure 33 RoW Isolation Beds Market Size, by Usage, 2018 - 2030 (Units)

Figure 34 RoW Isolation Beds Market Size, by End Use, 2018 - 2030 (Units)

Figure 35 RoW Isolation Beds Market Size, by Country, 2018 - 2030 (Units)

Global Isolation Beds Market Coverage

Type Insight and Forecast 2025-2030

- Manual

- Electric

- Hydraulic

- Pneumatic

Usage Insight and Forecast 2025-2030

- Critical

- Bariatric

- Medical Surgery

- Pediatric

- Maternal

End Use Insight and Forecast 2025-2030

- General & Acute Care Hospitals

- Multi-Specialty Hospitals

- Specialized Hospitals

- Ambulatory Surgical Centers

- Others

Geographical Segmentation

Isolation Beds Market by Region

North America

- By Type

- By Usage

- By End Use

- By Country – U.S., Canada, and Mexico

Europe

- By Type

- By Usage

- By End Use

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Type

- By Usage

- By End Use

- By Country – China, Japan, India, South Korea, Singapore, Australia, Indonesia, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Type

- By Usage

- By End Use

- By Country – Brazil, Argentina, Saudi Arabia, South Africa, U.A.E., Iran, and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Invacare Corporation

- Joerns Healthcare

- Arjo Huntleigh (Division of Gentige AB)

- LINET Group

- Joh. Stiegelmeyer GmbH & Co. KG

- Stryker Corporation

- Hill Rom Inc.

- Paramount Bed Holdings Co. Ltd.

- Medline Industries Gendron Inc.

- Span-America Medical Systems Inc.

- Savion Industries Ltd.

- Stiegelmeyer GmbH & Co. Kg

- Malvestio S.P.A.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com