| Status : Published | Published On : Dec, 2023 | Report Code : VRHC1192 | Industry : Healthcare | Available Format :

|

Page : 113 |

U.S. Beauty Devices Market – Analysis and Forecast (2025-2030)

Industry Insights by Type (Cellulite Reduction Devices, Hair Removal Devices, Acne Devices, Cleansing Devices, Light/Led Therapy and Photo Rejuvenation Devices, Hair Growth Devices, Oxygen and Steamer Devices, Skin Dermal Rollers and Others), by End-User (Beauty Clinics, Spas and Salons, at Home, Others) and by Geography (U.S)

Industry Overview

The U.S. Beauty Devices Market is expected to grow at a CAGR of 17.0% during the forecast period with its market size predicted to reach USD 38.1 billion by 2030. The U.S. Beauty Devices market is primarily driven by technological advancements, an increasing aging population, high awareness in the country regarding the available treatment options, the high prevalence of skin disorders, and the development of hand-held devices. Hair removal devices, cleansing devices, acne devices, and light/led therapy and photo rejuvenation devices are majorly contributing to the U.S. beauty devices market.

.jpg)

The key trend in the U.S. beauty devices industry is the development and adoption of at-home beauty devices. From hair removal devices to light and led therapy devices, beauty devices have become common in U.S. households due to the technological advancements and miniaturization of large devices. These technologies are leading to increased access to beauty care for consumers at home; therefore, leading to high traction in the market.

Key Market Segmentation

Insight by Type

On the basis of type of devices, the market is categorized into cellulite reduction devices, hair removal devices, acne devices, cleansing devices, light/led therapy and photo rejuvenation devices, hair growth devices, oxygen, and steamer devices, skin dermal rollers and others. Among the various type of beauty devices, hair removal devices hold the largest share in the market the availability of a wide range of hair removal devices, such as trimmers, clippers, epilators, and shavers.

Insight by End-User

The primary end users of beauty devices in the U.S. are beauty clinics, spas and salons, and at-home users. Among all end users, the spas and salons are estimated to account for the largest share of the U.S. beauty devices market size in 2022. The demand for beauty devices is anticipated to remain the largest in the spas and salons due to the increase in the number of salon and spas on a global level. Also, the demand is anticipated to be the highest at-home users due to technological advancements, high disposable income, and high awareness of beauty treatments.

U.S. Beauty Devices Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. xx.x Billion |

|

Revenue Forecast in 2030 |

U.S.D. 38.1 Billion |

|

Growth Rate |

17.0% |

|

Segments Covered in the Report |

By Type and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

U.S. |

Industry Dynamics

Growth Drivers

Different factors driving the U.S. beauty devices market are technological advancements, the adoption of at-home LED therapy devices and acne treatment devices, the increasing prevalence of skin conditions, the increasing rate of hormonal imbalance cases, and the aging population. The U.S. has one of the highest per capita incomes in the world. In 2017, the GNI per capita income in the U.S. was USD 60,200 PPP. The high per capita income of the U.S. population illustrates the high purchasing power and affordability of technologically advanced devices. Moreover, the aging population in the country fuels the demand for beauty devices for skin care. In 2012, less than 20% of the U.S. population was over 60 years old. But by 2050, people over age 60 are expected to account for 25-29% of the U.S. population.

Challenges

The high cost of devices, health risks associated with the use of these devices, and available cheaper alternatives to the beauty devices are the key challenges faced by the beauty devices industry in the U.S.

The beauty industry, including the beauty devices market, is susceptible to counterfeit products. Counterfeit devices may not meet quality and safety standards, posing risks to consumers and damaging the reputation of genuine manufacturers. Combatting the sale of counterfeit beauty devices and protecting intellectual property rights is a continuous challenge.

Competitive Insight

Some of the key players operating in the U.S. beauty devices industry are Panasonic Corporation, L’Oreal SA, Photomedax Inc., Home Skinovations Ltd, The Proctor & Gamble Company, Koninklijke Philips N.V., Carol Cole Company, Lumenis Ltd., Syneron-Candela, and TRIA Beauty, Inc.

Industry Segmentation

The U.S. Beauty Devices Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Type

- Cleansing Devices

- Hair Removal Devices

- Skin Dermal Rollers

- Acne Devices

- Light/LED Therapy and Photo Rejuvenation Devices

- Oxygen and Steamer Devices

- Hair Growth Devices

- Cellulite Reduction Devices

- Others

- By End-User

- Beauty Clinics

- Spas and Salons

- at Home

- Others

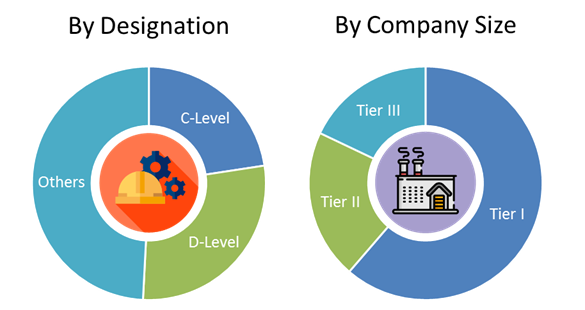

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

U.S. Beauty Devices Market