- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Aerial Imagery Market

| Status : Published | Published On : May, 2023 | Report Code : VRICT5020 | Industry : ICT & Media | Available Format :

|

Page : 190 |

Global Aerial Imagery Market – Analysis and Forecast (2025 - 2030)

Industry Insights by Imaging Type (Vertical, Oblique(Low Oblique and High Oblique)), by Platform (Fixed Wing, Rotary Wing, UAV/Drones, Parachutes, Airships, Balloons, Vehicle Mounted Poles, Rockets, and Others), by Application (Surveillance and Monitoring, Geospatial Mapping, Conservation and Research, Urban Planning, Disaster Management, Energy and Resource Management, and Others), by End User (Government, Oil & Gas, Military & Defense, Education & Academic Research, Energy & Power, Civil Engineering & Archaeology, Media and Entertainment, Agriculture and Forestry, and Others)

Industry Overview

The global Aerial Imagery Market size is expected to grow from USD 2.86 billion in 2023 and will reach USD 8.5 billion by 2030, witnessing a market growth rate (CAGR) of 14.8% during the forecast period.

.jpg)

Aerial imaging is the technique of taking pictures of the ground using cameras attached to vehicles like helicopters, parachutes, planes, kites, unmanned aerial vehicles (UAVs), balloons, vehicle-mounted poles, and airships. Owing to its high precision and cost-effectiveness for volume-based calculation, there is increased adoption in several applications like risk mitigation, resource planning, mapping, research & excavation, security and surveillance, urban planning, engineering, farming management, tourism, etc., which will propel the market growth of the aerial imagery.

The development of ready-to-fly (RTF) devices, soft-copy photogrammetry software, low-cost digital cameras, image processing, GPS, thermal, multispectral, hyperspectral, and LiDAR sensors has boosted the market demand for aerial imagery.

Aerial Imagery Market Industry Trends

The COVID-19 outbreak has affected the growth of the aerial imagery market owing to the slowdown in new product deliveries, reduced allocation towards R&D activities, reduced demand for new UAVs ad drones, and the temporary shutdown of manufacturing facilities.

However, UAVs have been essential in surveying and mapping regions where hospitals and COVID-19 test centers could be built, as well as monitoring such locations. Maps made with aerial imagery are often used by police forces. It is used by the department to relocate vital materials, place physical distance markers, allocate workforce, decide where to build up isolation centers, label neighboring hospitals and police stations as hotspots, and determine the shortest paths for simple transit in the event of an emergency.

Aerial imaging technologies are being used by public and government entities for archaeological purposes and to produce 360-degree panoramic interfaces. The market is growing due to an increase in the use of UAVs for data analytics, data collecting, and real-time inspection in various industrial applications. Researchers can access image data from far away because of the integration of cloud computing and satellite imagery. These are trends that will fuel market expansion in the global aerial imagery market.

Aerial Imagery Market Segmentation

Insight by Imaging Type

- Vertical

- Oblique

- High Oblique

- Low Oblique

Among these two imaging types, the oblique aerial imagery category is expected to witness the highest growth during the forecast period as it offers viewers with easy comprehensible image of grounded area and is useful to look for foreground building frontages.

Other advantages of oblique imaging include superior interpretation of elevation features and improved preciseness, which are projected to boost market demand for oblique aerial imagery systems. Moreover, oblique aerial images are useful for applications that require viewing side-views of man-made structures.

Insight by Platform

- Fixed Wing

- Rotary Wing

- UAV/Drones

- Parachutes

- Airships

- Balloons

- Vehicle Mounted Poles

- Rockets

- Others

Among these platforms, UAV segment contributes the largest share in the aerial imagery market owing to the increased adoption of UAVs for aerial mapping in the agriculture, government & defense, and forestry sector. The US military and civil government are increasing the operations of UAS also called drones. Thus, The growing use of drones in defence and homeland security to identify terrorism issues and precisely find sensitive locations is likely to boost demand for aerial imaging solutions in the sector.The aerial imagery market has witnessed significant growth in recent years due to advancements in sensor technologies, improved image resolution, and the availability of cost-effective aerial platforms. The increasing demand for geospatial data and the integration of aerial imagery with advanced technologies like artificial intelligence (AI) and machine learning (ML) are driving further innovation in this industry.

Insight by Application

- Surveillance and Monitoring

- Geospatial Mapping

- Conservation and Research

- Urban planning

- Disaster Management

- Energy and Resource Management

- Others

Geospatial mapping is anticipated to have a high CAGR during the forecast period. Geospatial analysis is the process of applying statistical analysis and other analytical tools to data with a geospatial or geographic element. The use of aerial imagery in geospatial mapping has been widely used in the planning, development, and management of national land.

The disaster management category is projected to grow at a faster pace owing to the increased use of aerial imaging solutions to evaluate the amount of damage caused by natural disasters. Drones are highly used in the aftermath of disasters such as storms and forest fires to immediately respond to repair and rescue needs.

Insight by End User

- Government

- Oil & Gas

- Military & Defense

- Education & Academic Research

- Energy & Power

- Civil Engineering & Archaeology

- Media and Entertainment

- Agriculture and Forestry

- Others

The defense sector contributes the largest share in the aerial imagery market outlook as they are used to safeguard border areas and prepare map structures. The information gathered through aerial imagery is used to create flight simulation scenarios. The creation of these environments allows aircraft pilots to adjust to the field's actual topographical conditions. As a result, the need for aerial imagery in the defense sector is growing.

Government segment will grow substantially during the analysis period as public and government organizations are using aerial imaging solutions for archeological and developing 360-degree panoramic interfaces.

Global Aerial Imagery Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 2.86 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 8.5 Billion |

|

Growth Rate |

14.8% |

|

Segments Covered in the Report |

By Imaging Type, By Platform, By Application, and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Aerial Imagery Market Growth Drivers

Increased Prominence of UAV and Drone Technology will Drive the growth of the market.

The regulatory authorities have gone to great lengths to regulate the use of unmanned aerial vehicles in order to ensure that safety safeguards are in place. Commercial drones are in high demand for a variety of applications, including agricultural, defense, cinematography, and weather monitoring. Furthermore, the firms are concentrating on developing applications and software to make drone use safer. Also, drone sensors are launched from the Internet of Things, thus fueling the demand for drone aerial spraying

Additionally, the wide range of applications provided by drones has prompted businesses to develop innovative new long-range UAV technology, which is likely to drive the global aerial imagery market growth over the forecast period.

Technological development like the proliferation of wireless technologies and integration of IoT-based systems will help in enhancing the image quality of ground and spaces that are somewhat inaccessible, resulting in the market growth of aerial imagery outlook. Also, increased adoption in defense, agriculture, government, civil engineering, research applications and a surge in the occurrence of natural calamities like fire, earthquakes, floods, cyclones, etc. will propel the market development further. Furthermore, adoption of aerial imaging technology to install 5G infrastructure will supplement the aerial imaging market growth.

Aerial imaging relies on GPS to determine precise locations. Farmers, for example, use GPS targeting to monitor crop health, detect potential issues, and spray fertilizer. The precision of aerial imagery aids energy and power site management since it can be repaired from weather damage and targeted more precisely.

Aerial Imagery Market Challenges

Public and national security over drone data collection are Posing challenges in the Growth.

The increased concern regarding security related to no-fly zones (NFZ), increasing strict government regulations, rising geometric distortion in images, and inaccurate data collection about unfavorable weather conditions will pose a market challenge for the growth of the aerial imaging industry.

Although drones and unmanned aerial vehicles (UAVs) are intended for commercial usage, the images captured can be misused. Using digital aerial and satellite photos, potential thieves might undertake virtual surveillance of banks, government buildings, parks, and schools. Therefore, national security may be jeopardized.

Aerial Imagery Market Opportunities

Increasing real estate demand is likely to create significant commercial prospects.

For a better picture of a property and its surroundings, aerial imagery is increasingly being used in the real estate and construction industries. Drones and unmanned aerial vehicles (UAVs) have made standalone photographs of a property obsolete in recent years. Aerial imagery can help property owners raise their home's profile and increase market demand. It is also a cost-effective and innovative solution for prospective buyers.

Also, increased R&D activities post-COVID-19 crisis and a surge in demand from developing economies will further create market opportunities for the key players to develop aerial imaging solutions.

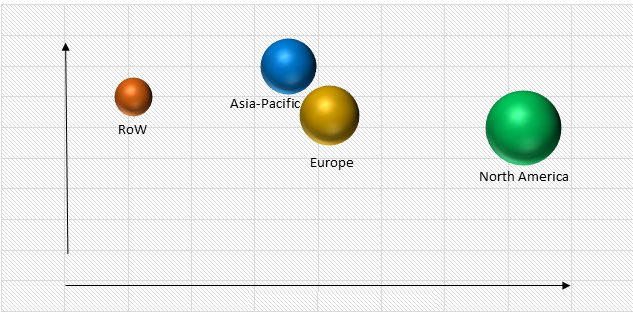

Aerial Imagery Market Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Global Aerial Imagery Market, By Region

North America contributes the largest share in the global aerial imaging market owing to the increase in the development of UAVs and PAMS, mounting adoption in defense, energy, agriculture sector, increased government spending in the construction industry, rising investment in smart city projects and rapid urbanisation will further bolster the growth of aerial imagery in the region.

Moreover, The aerial imaging market in Europe is expected to grow significantly during the forecast period owing to increased development in imagery intelligence solutions and rising use to monitor aquatic vegetation. Commercial drones are becoming accepted in the defense, agriculture, disaster management, and energy sectors in Europe, which is expected to increase the accuracy of aerial surveys and successfully stimulate regional demand.

Aerial Imagery Market Competitive Insight

Globally, aerial imagery industry players are maximizing market growth through partnerships, product launches, R&D activities, and acquisitions. Moreover, increased investment in new aerial imagery businesses, mainly drones, has emerged as a market potential for aerial imagery industry. Thus, the global market for aerial imagery is highly fragmented and players are focusing on integrating advanced competences in their imaging solutions via modern analytics and image processing platforms.

EagleView is one of the prominent market leader in aerial imagery, machine learning-derived data analytics, and software, assisting customers across a variety of industries in utilising property insights for better planning, constructing, and living. It possesses the world's largest multi-modal image database, covering 98 percent of the United States' population. With highly detailed orthomosaic and oblique imagery and 360-degree views, EagleView Reveal offers a comprehensive virtual solution to make accurate planning decisions without the time, expense, and safety risk of on-site visits.

Getmapping plc is a prominent global leader in geospatial survey solutions and a pioneer in gathering aerial photographs and data in the United Kingdom. Getmapping is the premier provider of aerial survey services in the UK, including vertical, oblique, and LiDAR data, as well as ground-based survey services using cutting-edge Mobile Mapping devices. It can lead the development of the next generation 3D geospatial data, KEPLER 5, which provides True Digital Twins of the built environment.

Getmapping serves a wide range of businesses, including the public sector, emergency services, utilities, transportation and infrastructure, property, technology developers, financial services, telecommunications, tourism, and gaming.

Recent Development by Key Players

In October 2021, EagleView, a major provider of aerial imaging and data analytics, and Cityworks, a Trimble Company, have announced the availability of an asset management workflow integration in the United States. For the first time, users in the United States and Canada may access EagleView's Integrated Pictometry Application (IPA) directly from the Cityworks Esri map viewer, allowing them to view EagleView's high-resolution aerial imagery in an integrated view.

This interface streamlines the project workflow for public works and asset management workers, saving time and money by minimising field trips. Personnel can evaluate assets in the field, such as signs and traffic lights, using EagleView's proprietary oblique imaging, which provides a 45-degree angle view of a property.

In October 2021, Nearmap, one of the pioneers in aerial imagery company revealed its next steps in a growing partnership with the state of New Jersey to help streamline decision-making in isolated locations by taking aerial photographs of the whole Garden State. Nearmap previously only flew a portion of the state, excluding woods and wetlands, but will now fly the areas of the state required by government agencies to make informed decisions regarding environmental conservation and other government planning.

Key Players Covered in the Report

Key players in the aerial imagery market include satellite imaging companies, drone service providers, geospatial data providers, and software developers specializing in image processing and analysis. They offer a variety of services and products related to aerial imagery, including data acquisition, processing, analysis, and distribution.

Some of the foremost players in the aerial imagery industry are EagleView Technologies, Inc., High Eye Aerial Imaging Inc., Fugro N.V., Digital Aerial Solutions LLC, Google Inc., Kucera International Inc., NRC Group ASA, Blom ASA, Getmapping PLC, and Nearmap Ltd, Dell Boomi Inc.

The Aerial imagery Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Imaging Type

- Vertical

- Oblique

- High Oblique

- Low Oblique

- By Platform

- Fixed Wing

- Rotary Wing

- UAV/Drones

- Parachutes

- Airships

- Balloons

- Vehicle Mounted Poles

- Rockets

- Others

- By Application

- Surveillance and Monitoring

- Geospatial Mapping

- Conservation and Research

- Urban planning

- Disaster Management

- Energy and Resource Management

- Others

- By End-User

- Government

- Oil & Gas

- Military & Defense

- Education & Academic Research

- Energy & Power

- Civil Engineering & Archaeology

- Media and Entertainment

- Agriculture and Forestry

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Imaging Type

1.2.2. By Platform

1.2.3. By Application

1.2.4. By End User

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Research Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Imaging Type

5.1.1. Vertical

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Oblique

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.2.2.1. Low Oblique

5.1.2.2.2. High Oblique

5.2. By Platform

5.2.1. Fixed Wing

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Rotary Wing

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. UAV/Drones

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Parachutes

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Airships

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.2.6. Balloons

5.2.6.1. Market Definition

5.2.6.2. Market Estimation and Forecast to 2030

5.2.7. Vehicle Mounted Poles

5.2.7.1. Market Definition

5.2.7.2. Market Estimation and Forecast to 2030

5.2.8. Rockets

5.2.8.1. Market Definition

5.2.8.2. Market Estimation and Forecast to 2030

5.2.9. Others

5.2.9.1. Market Definition

5.2.9.2. Market Estimation and Forecast to 2030

5.3. By Application

5.3.1. Surveillance and Monitoring

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Geospatial Mapping

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Conservation and Research

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Urban Planning

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Disaster Management

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Energy and Resource Management

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

5.3.7. Others

5.3.7.1. Market Definition

5.3.7.2. Market Estimation and Forecast to 2030

5.4. By End User

5.4.1. Government

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Oil & Gas

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Military & Defense

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Education & Academic Research

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Energy & Power

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Civil Engineering & Archaeology

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Media and Entertainment

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

5.4.8. Agriculture and Forestry

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2030

5.4.9. Others

5.4.9.1. Market Definition

5.4.9.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Imaging Type

6.2. By Platform

6.3. By Application

6.4. By End User

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Imaging Type

7.2. By Platform

7.3. By Application

7.4. By End User

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Russia Market Estimate and Forecast

7.5.7. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Imaging Type

8.2. By Platform

8.3. By Application

8.4. By End User

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Imaging Type

9.2. By Platform

9.3. By Application

9.4. By End User

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. U.A.E. Market Estimate and Forecast

9.5.5. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. EagleView Technologies, Inc.

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. High Eye Aerial Imaging Inc.

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Fugro N.V.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Digital Aerial Solutions LLC

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Google Inc.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Kucera International Inc.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. NRC Group ASA

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Blom ASA

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Getmapping PLC

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Nearmap Ltd.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Aerial Imagery Market Size, by Imaging Type, 2018 - 2023 (USD Billion)

Table 5 Global Aerial Imagery Market Size, by Imaging Type, 2025 - 2030 (USD Billion)

Table 6 Global Aerial Imagery Market Size, by Platform, 2018 - 2023 (USD Billion)

Table 7 Global Aerial Imagery Market Size, by Platform, 2025 - 2030 (USD Billion)

Table 8 Global Aerial Imagery Market Size, by Application, 2018 - 2023 (USD Billion)

Table 9 Global Aerial Imagery Market Size, by Application, 2025 - 2030 (USD Billion)

Table 10 Global Aerial Imagery Market Size, by End User, 2018 - 2023 (USD Billion)

Table 11 Global Aerial Imagery Market Size, by End User, 2025 - 2030 (USD Billion)

Table 12 Global Aerial Imagery Market Size, by Region, 2018 - 2023 (USD Billion)

Table 13 Global Aerial Imagery Market Size, by Region, 2025 - 2030 (USD Billion)

Table 14 North America Aerial Imagery Market Size, by Imaging Type, 2018 - 2023 (USD Billion)

Table 15 North America Aerial Imagery Market Size, by Imaging Type, 2025 - 2030 (USD Billion)

Table 16 North America Aerial Imagery Market Size, by Platform, 2018 - 2023 (USD Billion)

Table 17 North America Aerial Imagery Market Size, by Platform, 2025 - 2030 (USD Billion)

Table 18 North America Aerial Imagery Market Size, by Application, 2018 - 2023 (USD Billion)

Table 19 North America Aerial Imagery Market Size, by Application, 2025 - 2030 (USD Billion)

Table 20 North America Aerial Imagery Market Size, by End User, 2018 - 2023 (USD Billion)

Table 21 North America Aerial Imagery Market Size, by End User, 2025 - 2030 (USD Billion)

Table 22 North America Aerial Imagery Market Size, by Country, 2018 - 2023 (USD Billion)

Table 23 North America Aerial Imagery Market Size, by Country, 2025 - 2030 (USD Billion)

Table 24 Europe Aerial Imagery Market Size, by Imaging Type, 2018 - 2023 (USD Billion)

Table 25 Europe Aerial Imagery Market Size, by Imaging Type, 2025 - 2030 (USD Billion)

Table 26 Europe Aerial Imagery Market Size, by Platform, 2018 - 2023 (USD Billion)

Table 27 Europe Aerial Imagery Market Size, by Platform, 2025 - 2030 (USD Billion)

Table 28 Europe Aerial Imagery Market Size, by Application, 2018 - 2023 (USD Billion)

Table 29 Europe Aerial Imagery Market Size, by Application, 2025 - 2030 (USD Billion)

Table 30 Europe Aerial Imagery Market Size, by End User, 2018 - 2023 (USD Billion)

Table 31 Europe Aerial Imagery Market Size, by End User, 2025 - 2030 (USD Billion)

Table 32 Europe Aerial Imagery Market Size, by Country, 2018 - 2023 (USD Billion)

Table 33 Europe Aerial Imagery Market Size, by Country, 2025 - 2030 (USD Billion)

Table 34 Asia-Pacific Aerial Imagery Market Size, by Imaging Type, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific Aerial Imagery Market Size, by Imaging Type, 2025 - 2030 (USD Billion)

Table 36 Asia-Pacific Aerial Imagery Market Size, by Platform, 2018 - 2023 (USD Billion)

Table 37 Asia-Pacific Aerial Imagery Market Size, by Platform, 2025 - 2030 (USD Billion)

Table 38 Asia-Pacific Aerial Imagery Market Size, by Application, 2018 - 2023 (USD Billion)

Table 39 Asia-Pacific Aerial Imagery Market Size, by Application, 2025 - 2030 (USD Billion)

Table 40 Asia-Pacific Aerial Imagery Market Size, by End User, 2018 - 2023 (USD Billion)

Table 41 Asia-Pacific Aerial Imagery Market Size, by End User, 2025 - 2030 (USD Billion)

Table 42 Asia-Pacific Aerial Imagery Market Size, by Country, 2018 - 2023 (USD Billion)

Table 43 Asia-Pacific Aerial Imagery Market Size, by Country, 2025 - 2030 (USD Billion)

Table 44 RoW Aerial Imagery Market Size, by Imaging Type, 2018 - 2023 (USD Billion)

Table 45 RoW Aerial Imagery Market Size, by Imaging Type, 2025 - 2030 (USD Billion)

Table 46 RoW Aerial Imagery Market Size, by Platform, 2018 - 2023 (USD Billion)

Table 47 RoW Aerial Imagery Market Size, by Platform, 2025 - 2030 (USD Billion)

Table 48 RoW Aerial Imagery Market Size, by Application, 2018 - 2023 (USD Billion)

Table 49 RoW Aerial Imagery Market Size, by Application, 2025 - 2030 (USD Billion)

Table 50 RoW Aerial Imagery Market Size, by End User, 2018 - 2023 (USD Billion)

Table 51 RoW Aerial Imagery Market Size, by End User, 2025 - 2030 (USD Billion)

Table 52 RoW Aerial Imagery Market Size, by Country, 2018 - 2023 (USD Billion)

Table 53 RoW Aerial Imagery Market Size, by Country, 2025 - 2030 (USD Billion)

Table 54 Snapshot – EagleView Technologies, Inc.

Table 55 Snapshot – High Eye Aerial Imaging Inc.

Table 56 Snapshot – Fugro N.V.

Table 57 Snapshot – Digital Aerial Solutions LLC

Table 58 Snapshot – Google Inc.

Table 59 Snapshot – Kucera International Inc.

Table 60 Snapshot – NRC Group ASA

Table 61 Snapshot – Blom ASA

Table 62 Snapshot – Getmapping PLC

Table 63 Snapshot – Nearmap Ltd.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Aerial Imagery Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Aerial Imagery Market Highlight

Figure 12 Global Aerial Imagery Market Size, by Imaging Type, 2018 - 2030 (USD Billion)

Figure 13 Global Aerial Imagery Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 14 Global Aerial Imagery Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 15 Global Aerial Imagery Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 16 Global Aerial Imagery Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Aerial Imagery Market Highlight

Figure 18 North America Aerial Imagery Market Size, by Imaging Type, 2018 - 2030 (USD Billion)

Figure 19 North America Aerial Imagery Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 20 North America Aerial Imagery Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 21 North America Aerial Imagery Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 22 North America Aerial Imagery Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 23 Europe Aerial Imagery Market Highlight

Figure 24 Europe Aerial Imagery Market Size, by Imaging Type, 2018 - 2030 (USD Billion)

Figure 25 Europe Aerial Imagery Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 26 Europe Aerial Imagery Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 27 Europe Aerial Imagery Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 28 Europe Aerial Imagery Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Aerial Imagery Market Highlight

Figure 30 Asia-Pacific Aerial Imagery Market Size, by Imaging Type, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Aerial Imagery Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Aerial Imagery Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Aerial Imagery Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Aerial Imagery Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 35 RoW Aerial Imagery Market Highlight

Figure 36 RoW Aerial Imagery Market Size, by Imaging Type, 2018 - 2030 (USD Billion)

Figure 37 RoW Aerial Imagery Market Size, by Platform, 2018 - 2030 (USD Billion)

Figure 38 RoW Aerial Imagery Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 39 RoW Aerial Imagery Market Size, by End User, 2018 - 2030 (USD Billion)

Figure 40 RoW Aerial Imagery Market Size, by Country, 2018 - 2030 (USD Billion)

Global Aerial Imagery Market Coverage

Imaging Type Insight and Forecast 2025-2030

- Vertical

- Oblique

- High Oblique

- Low Oblique

Platform Insight and Forecast 2025-2030

- Fixed Wing

- Rotary Wing

- UAV/Drones

- Parachutes

- Airships

- Balloons

- Vehicle Mounted Poles

- Rockets

- Others

Application Insight and Forecast 2025-2030

- Surveillance and Monitoring

- Geospatial Mapping

- Conservation and Research

- Urban Planning

- Disaster Management

- Energy and Resource Management

- Others

End-User Insight and Forecast 2025-2030

- Government

- Oil & Gas

- Military & Defense

- Education & Academic Research

- Energy & Power

- Civil Engineering & Archaeology

- Media and Entertainment

- Agriculture and Forestry

- Others

Geographical Segmentation

Aerial Imagery Market by Region

North America

- By Imaging Type

- By Platform

- By Application

- By End User

- By Country – U.S., Canada, and Mexico

Europe

- By Imaging Type

- By Platform

- By Application

- By End User

- By Country – Germany, U.K., France, Italy, Spain, Russia, and the Rest of Europe

Asia-Pacific (APAC)

- By Imaging Type

- By Platform

- By Application

- By End User

- By Country – China, Japan, India, South Korea, and the Rest of Asia-Pacific

Rest of the World (RoW)

- By Imaging Type

- By Platform

- By Application

- By End User

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- EagleView Technologies, Inc.

- Fugro N.V.

- Dell Boomi Inc.

- Digital Aerial Solutions LLC

- Google Inc.

- Kucera International Inc.

- Blom ASA

- Getmapping PLC

- Nearmap Ltd.

- High Eye Aerial Imaging Inc.

- NRC Group ASA

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com