- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Digital Signature Market

| Status : Published | Published On : Jan, 2023 | Report Code : VRICT5008 | Industry : ICT & Media | Available Format :

|

Page : 151 |

Global Digital Signature Market – Analysis and Forecast (2025 - 2030)

Industry Insights by Solution (Hardware, Software and Services), by Deployment Model (On-Premise and Cloud-Based), by Application (Government, Healthcare and Lifescience, Banking, Telecom, Retail, IT, and Others)

Industry Overview

A digital signature uses asymmetrical cryptography that is used for the purpose of documenting the digtal message. This technology is extremely beneficial for solving interference related problem in digital impersonation and communication. They are extensively being used for the purpose by the business organizations to certify and support contents such as word documents, emails, and PDFs. The global Digital Signature Market is projected to contribute the largest revenue of USD 6.8 billion by 2030 and is further expected to grow at a CAGR of 28.7% during the forecast period. The growth of this market is attributed towards structured workflow, greater security measures and deduced cost that leads to efficient operational efficiencies for the organizations.

.jpg)

Moreover, the extensive number of government-aided initiatives along with associations of several industries helps in developing several awareness initiatives for several industries that are further expected to bolster the growth of the digital signature industry. It has been observed that the workflow of business organizations with the use of digital signature is evolving at a rapid pace, for instance, enterprises are able to send legal and business documents via an authenticated platform that causes reduced risk.

Digital Signature Market Segmentation

Insight by Solution

On the basis of solution, the market is segmented into hardware, software, and services. Among all these segments, software segment is expected to witness the fastest growth at a CAGR of 28.5% during the forecast period. The growth of this segment is attributed towards reduced transaction time and costs associated with this technology. Furthermore, increased application of this technology across different industries in order to improve efficiencies and enhance benefit of users is expected to further fuel the growth of the digital signature market.

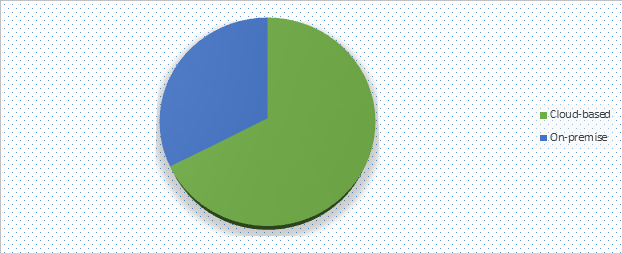

Insight by Deployment Model

On the basis of deployment, digital signature market is segmented into on-premise and cloud-based deployment. Among these segments, the cloud-based deployment model is expected to witness faster growth owing to increasing utilization of these deployments by several business enterprises across various industry verticals. Moreover, these deployments offer

Moreover, the cloud-based model is also expected to contribute the larger share in the market with revenue of around USD 3.7 billion by 2030. The users find this deployment quiet convenient and provide the options to the organizations to develop multi-dimensional signatures by deducing the operational costs and transaction time, which is ultimately driving the growth of digital signature market across the globe.

GLOBAL DIGITAL SIGNATURE MARKET SHARE, BY DEPLOYMENT MODEL

Insight by Application

On the basis of application, the digital signature market is segmented into government, healthcare and life science, telecom, banking, retail, and others. Among all these industries, the extensive demand for the digital signature market is observed in the banking industry. The demand for this technology in this sector is attributed to the increasing benefits of digital signatures such as the steady process of invoices, enriched compliances, and deducted turnaround time for a particular document.

Global Digital Signature Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. XX Billion |

|

Revenue Forecast in 2030 |

U.S.D. 6.8 Billion |

|

Growth Rate |

28.7% |

|

Segments Covered in the Report |

By Solution, By Deployment Model, and By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Digital Signature Market Growth Drivers

Increasing demand for secure transactions: With the rise of e-commerce, online banking, and digital document exchange, there is a growing need for secure and trusted transactions. Digital signatures provide a way to authenticate and verify the identity of parties involved in a transaction, ensuring the integrity and non-repudiation of documents.

Legal and regulatory requirements: Many countries have implemented legislation and regulations that recognize digital signatures as legally binding. Organizations in sectors such as finance, healthcare, and government are required to use digital signatures to comply with these regulations.

Cost and time savings: Digital signatures eliminate the need for printing, scanning, and physically signing documents, resulting in significant cost and time savings for businesses. They enable faster contract signing, reduce paperwork, and streamline business processes.

Advancements in technology: The development of advanced encryption algorithms, cloud-based solutions, and mobile devices has made digital signature solutions more accessible and user-friendly. Integration with existing business applications and platforms has also become easier, driving adoption across various industries.

Increasing awareness and education: As organizations and individuals become more aware of the benefits and legal validity of digital signatures, the adoption rate continues to rise. Industry initiatives and educational programs have played a crucial role in promoting the understanding and use of digital signatures.

Digital Signature Market Challenges

Implementation of stringent norms by the government authorities leading to uncertainties regarding electronic and digital signatures is expected to hamper the growth of the digital signature market. Additionally, redundant technology adopted in the development of digital signatures along with the inconsistency among various technologies of these signatures is expected to further hinder the growth of the digital signature market.

Digital Signature Market Industry Ecosystem

Globally industry players in the digital signature market are leveraging market growth through technological advancements in upgrading the security measures of these signatures. The key players in this industry are further emphasizing new product development and launches along with entering into partnership agreements in order to expand their consumer base across the globe.

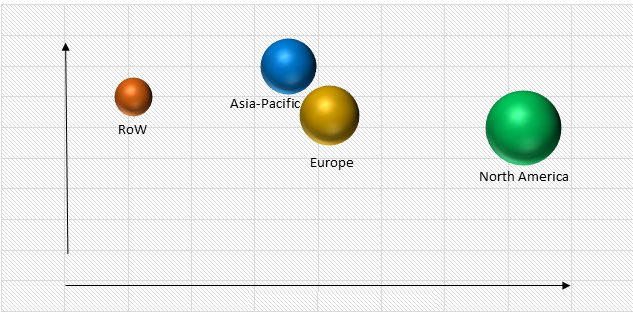

Digital Signature Market Geographic Overview

Geographically, North America is the largest digital signature market with more than 40% revenue contribution to the global market in 2022 and the market is projected to witness significant growth in the coming years, owing to extensive growth opportunities observed due to the flourishing demand of these signatures from legal and financial sector along with adhering of strict cyber regulatory reforms.

GLOBAL DIGITAL SIGNATURE MARKET, BY REGION

Furthermore, it has been observed that the Asia-Pacific digital signature market is expected to witness the highest growth owing to extensive adoption of this technology in various small and medium and large enterprises. Additionally, the government of India has implemented several measures in order to enhance the growth of the digital signature market in this region.

Digital Signature Market Competitive Insight

Some of the key players in the global digital signature industry are Adobe Systems, Inc, Ascertia, Microsoft Corporation, Docusign, Inc., Entrust Datacard Corp, Gemalto, Inc, IdenTrust, Inc, International Business Solutions LLC, Kofax Limited, Korea SYSTEM’s TECH Inc, Kotrade Inc, Right Signature LLC, Secured Signing Limited, Signix Inc and Oracle Corporation.

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Solution

1.2.2. By Deployment Type

1.2.3. By Application

1.2.4. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Size Estimations and Forecast

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Market Definition

3.1. By Solution

3.1.1. Software

3.1.2. Hardware

3.1.3. Services

3.1.3.1. Managed

3.1.3.2. Professional

3.2. By Deployment Type

3.2.1. Cloud Based

3.2.2. On-Premise

3.3. By Application

3.3.1. Government

3.3.2. IT

3.3.3. Finance

3.3.4. Telecom

3.3.5. Healthcare

3.3.6. Retail

3.3.7. Others

4. Industry Overview

4.1. Industry Dynamics

4.1.1. Major Drivers

4.1.2. Major Restraints

4.1.3. Key Trends

4.1.4. Key Opportunities

4.2. Industry Ecosystem

4.2.1. Porter’s Five Forces Analysis

4.2.2. Pricing Analysis

4.3. Competitive Insight

4.3.1. Competitive Analysis of Key Players

5. Global Market Estimate and Forecast

5.1. By Solution

5.2. By Deployment Type

5.3. By Application

5.4. By Region

6. North America Market Estimate and Forecast

6.1. By Solution

6.2. By Deployment Type

6.3. By Application

6.4. By Country

6.4.1. U.S. Market Estimate and Forecast

6.4.1.1. By Solution

6.4.1.2. By Deployment Type

6.4.1.3. By Application

6.4.2. Canada Market Estimate and Forecast

6.4.2.1. By Solution

6.4.2.2. By Deployment Type

6.4.2.3. By Application

6.4.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Solution

7.2. By Deployment Type

7.3. By Application

7.4. By Country

7.4.1. Germany Market Estimate and Forecast

7.4.1.1. By Solution

7.4.1.2. By Deployment Type

7.4.1.3. By Application

7.4.2. France Market Estimate and Forecast

7.4.2.1. By Solution

7.4.2.2. By Deployment Type

7.4.2.3. By Application

7.4.3. U.K. Market Estimate and Forecast

7.4.3.1. By Solution

7.4.3.2. By Deployment Type

7.4.3.3. By Application

7.4.4. Italy Market Estimate and Forecast

7.4.4.1. By Solution

7.4.4.2. By Deployment Type

7.4.4.3. By Application

7.4.5. Rest of Europe Market Estimate and Forecast

7.4.5.1. By Solution

7.4.5.2. By Deployment Type

7.4.5.3. By Application

8. Asia-Pacific Market Estimate and Forecast

8.1. By Solution

8.2. By Deployment Type

8.3. By Application

8.4. By Country

8.4.1. China Market Estimate and Forecast

8.4.1.1. By Solution

8.4.1.2. By Deployment Type

8.4.1.3. By Application

8.4.2. Japan Market Estimate and Forecast

8.4.2.1. By Solution

8.4.2.2. By Deployment Type

8.4.2.3. By Application

8.4.3. India Market Estimate and Forecast

8.4.3.1. By Solution

8.4.3.2. By Deployment Type

8.4.3.3. By Application

8.4.4. Australia Market Estimate and Forecast

8.4.4.1. By Solution

8.4.4.2. By Deployment Type

8.4.4.3. By Application

8.4.5. Rest of Asia-Pacific Market Estimate and Forecast

8.4.5.1. By Solution

8.4.5.2. By Deployment Type

8.4.5.3. By Application

9. Rest of the World (RoW) Systems Market Estimate and Forecast

9.1. By Solution

9.2. By Deployment Type

9.3. By Application

9.4. By Country

9.4.1. Brazil Market Estimate and Forecast

9.4.1.1. By Solution

9.4.1.2. By Deployment Type

9.4.1.3. By Application

9.4.2. U.A.E Market Estimate and Forecast

9.4.2.1. By Solution

9.4.2.2. By Deployment Type

9.4.2.3. By Application

9.4.3. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Abode Systems Incorporated

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Secured Signing Limited

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. SIGNiX Inc.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Entrust Datacard Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Ascertia

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. DocuSign, Inc.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Gemalto NV

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

11. Appendix

11.1. Abbreviations

Note: Financial insights are subject to availability of information in secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 5 Global Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 6 Global Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 7 Global Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 8 Global Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 9 Global Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 10 Global Digital Signature Market Size, by Region, 2018 - 2023 (USD Billion)

Table 11 Global Digital Signature Market Size, by Region, 2025 - 2030 (USD Billion)

Table 12 North America Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 13 North America Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 14 North America Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 15 North America Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 16 North America Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 17 North America Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 18 North America Digital Signature Market Size, by Country, 2018 - 2023 (USD Billion)

Table 19 North America Digital Signature Market Size, by Country, 2025 - 2030 (USD Billion)

Table 20 U.S. Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 21 U.S. Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 22 U.S. Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 23 U.S. Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 24 U.S. Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 25 U.S. Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 26 Canada Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 27 Canada Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 28 Canada Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 29 Canada Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 30 Canada Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 31 Canada Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 32 Mexico Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 33 Mexico Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 34 Mexico Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 35 Mexico Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 36 Mexico Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 37 Mexico Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 38 Europe Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 39 Europe Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 40 Europe Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 41 Europe Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 42 Europe Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 43 Europe Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 44 Europe Digital Signature Market Size, by Country, 2018 - 2023 (USD Billion)

Table 45 Europe Digital Signature Market Size, by Country, 2025 - 2030 (USD Billion)

Table 46 Germany Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 47 Germany Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 48 Germany Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 49 Germany Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 50 Germany Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 51 Germany Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 52 France Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 53 France Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 54 France Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 55 France Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 56 France Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 57 France Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 58 U.K. Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 59 U.K. Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 60 U.K. Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 61 U.K. Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 62 U.K. Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 63 U.K. Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 64 Italy Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 65 Italy Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 66 Italy Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 67 Italy Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 68 Italy Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 69 Italy Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 70 Rest of Europe Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 71 Rest of Europe Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 72 Rest of Europe Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 73 Rest of Europe Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 74 Rest of Europe Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 75 Rest of Europe Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 76 Asia-Pacific Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 77 Asia-Pacific Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 78 Asia-Pacific Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 79 Asia-Pacific Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 80 Asia-Pacific Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 81 Asia-Pacific Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 82 Asia-Pacific Digital Signature Market Size, by Country, 2018 - 2023 (USD Billion)

Table 83 Asia-Pacific Digital Signature Market Size, by Country, 2025 - 2030 (USD Billion)

Table 84 Japan Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 85 Japan Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 86 Japan Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 87 Japan Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 88 Japan Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 89 Japan Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 90 China Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 91 China Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 92 China Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 93 China Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 94 China Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 95 China Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 96 India Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 97 India Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 98 India Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 99 India Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 100 India Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 101 India Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 102 Australia Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 103 Australia Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 104 Australia Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 105 Australia Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 106 Australia Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 107 Australia Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 108 Rest of Asia-Pacific Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 109 Rest of Asia-Pacific Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 110 Rest of Asia-Pacific Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 111 Rest of Asia-Pacific Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 112 Rest of Asia-Pacific Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 113 Rest of Asia-Pacific Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 114 RoW Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 115 RoW Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 116 RoW Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 117 RoW Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 118 RoW Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 119 RoW Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 120 RoW Digital Signature Market Size, by Country, 2018 - 2023 (USD Billion)

Table 121 RoW Digital Signature Market Size, by Country, 2025 - 2030 (USD Billion)

Table 122 Brazil Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 123 Brazil Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 124 Brazil Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 125 Brazil Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 126 Brazil Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 127 Brazil Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 128 U.A.E. Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 129 U.A.E. Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 130 U.A.E. Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 131 U.A.E. Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 132 U.A.E. Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 133 U.A.E. Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 134 Other Countries Digital Signature Market Size, by Solution, 2018 - 2023 (USD Billion)

Table 135 Other Countries Digital Signature Market Size, by Solution, 2025 - 2030 (USD Billion)

Table 136 Other Countries Digital Signature Market Size, by Deployment Model, 2018 - 2023 (USD Billion)

Table 137 Other Countries Digital Signature Market Size, by Deployment Model, 2025 - 2030 (USD Billion)

Table 138 Other Countries Digital Signature Market Size, by Application, 2018 - 2023 (USD Billion)

Table 139 Other Countries Digital Signature Market Size, by Application, 2025 - 2030 (USD Billion)

Table 140 Snapshot – Abode Systems Incorporated

Table 141 Snapshot – Secured Signing Limited

Table 142 Snapshot – SIGNiX Inc.

Table 143 Snapshot – Entrust Datacard Corporation

Table 144 Snapshot – Ascertia

Table 145 Snapshot – DocuSign, Inc.

Table 146 Snapshot – Gemalto NV

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Executive Summary

Figure 9 Global Digital Signature Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Digital Signature Market Highlight

Figure 12 Global Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 13 Global Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 14 Global Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 15 Global Digital Signature Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 16 North America Digital Signature Market Highlight

Figure 17 North America Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 18 North America Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 19 North America Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 20 North America Digital Signature Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 21 U.S. Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 22 U.S. Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 23 U.S. Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 24 Canada Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 25 Canada Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 26 Canada Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 27 Mexico Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 28 Mexico Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 29 Mexico Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 30 Europe Digital Signature Market Highlight

Figure 31 Europe Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 32 Europe Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 33 Europe Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 34 Europe Digital Signature Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 35 Germany Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 36 Germany Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 37 Germany Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 38 France Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 39 France Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 40 France Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 41 U.K. Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 42 U.K. Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 43 U.K. Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 44 Italy Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 45 Italy Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 46 Italy Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 47 Rest of Europe Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 48 Rest of Europe Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 49 Rest of Europe Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 50 Asia-Pacific Digital Signature Market Highlight

Figure 51 Asia-Pacific Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 52 Asia-Pacific Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 53 Asia-Pacific Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 54 Asia-Pacific Digital Signature Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 55 Japan Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 56 Japan Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 57 Japan Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 58 China Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 59 China Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 60 China Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 61 India Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 62 India Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 63 India Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 64 Australia Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 65 Australia Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 66 Australia Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 67 Rest of Asia-Pacific Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 68 Rest of Asia-Pacific Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 69 Rest of Asia-Pacific Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 70 RoW Digital Signature Market Highlight

Figure 71 RoW Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 72 RoW Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 73 RoW Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 74 RoW Digital Signature Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 75 Brazil Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 76 Brazil Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 77 Brazil Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 78 U.A.E Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 79 U.A.E Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 80 U.A.E Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 81 Other Countries Digital Signature Market Size, by Solution, 2018 - 2030 (USD Billion)

Figure 82 Other Countries Digital Signature Market Size, by Deployment Model, 2018 - 2030 (USD Billion)

Figure 83 Other Countries Digital Signature Market Size, by Application, 2018 - 2030 (USD Billion)

Global Digital Signature Market Coverage

Solution Insight and Forecast 2025 - 2030

- Hardware

- Software

- Services

- Managed

- Professional

Deployment Model Insight and Forecast 2025 - 2030

- On-Premise

- Cloud-Based

Application Insight and Forecast 2025 - 2030

- Government

- Healthcare and Lifescience

- Finance

- Retail

- Telecom

- IT

- Others

Geographical Segmentation

Digital Signature Market by Region

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- U.K.

- France

- Italy

- Rest of Europe

Asia-Pacific

- Japan

- China

- India

- Australia

- Rest of Asia-Pacific

Rest of the World (RoW)

- Brazil

- U.A.E

- Others

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Abode Systems Incorporated

- Secured Signing Limited

- SIGNiX Inc.

- Entrust Datacard Corporation

- Ascertia

- DocuSign, Inc.

- Gemalto NV

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com