- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Edge Data Center Market

| Status : Published | Published On : Mar, 2022 | Report Code : VRICT5163 | Industry : ICT & Media | Available Format :

|

Page : 250 |

Global Edge Data Center Market – Analysis and Forecast (2025-2030)

Industry Insight by Component Type (Solutions (Cooling, Power (UPS), IT Racks and Enclosures, Networking Equipment, and DCIM) and Services (Integration & Implementation, Managed, and Consulting)), by Facility Size (Small and Medium Facilities and Large Facilities), by Industry Vertical (IT & Telecommunication, BFSI, Colocation, Energy & Power, Government, Industrial, Automotive, Retail & E-Commerce, Gaming and Entertainment, Healthcare, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The global Edge Data Center Market is anticipated to grow from USD 7.15 billion in 2023 and is expected to reach USD 21.78 billion by 2030, witnessing a CAGR of 22.2% during the forecast period 2025-2030. Edge data centers are defined as data storage and access systems that are situated close to the end-user to improve the efficiency of their data delivery infrastructure. It could be a single or two racks, or a small computer unit close to a 5G antenna – but it could also be a room with 100 to 200 KW of power and greater IT power. Instead of keeping data processing control in a centralized warehouse or the cloud, edge data centers carry it to the network's edge. These edge data centers have fire protection, cooling systems, and excellent security systems, as well as amazing features like uninterruptible power supplies, board cooling, and storage systems, all of which contribute to the growth of the edge data center market. As a result of the development of the IT and telecommunications, healthcare, energy, and banking industries, the edge data center market has aided enterprises in reaching small cities and places, accelerating the edge data center market.

The COVID-19 pandemic has a positive impact on the edge data center market owing to strict containment measures and health safety compliances that have enforced remote operations in several industrial verticals like manufacturing, energy and utilities, and transportation and logistics so as to enhance performance and reduce latency issues. IoT and 5G technologies, as well as edge computing, enable the company to address COVID-19-related risks and customer expectations. Medical professionals can reach their patients swiftly and efficiently using software apps, telemedicine services, and diagnostic gadgets that use patient data. Streaming services can leverage edge computing to improve their network performance for end-users.

Market Segmentation

Insight by Component Type

Based on component type, the global edge data center market is segmented into solutions and services. The solution category is sub-divided into cooling, power (UPS), IT racks and enclosures, networking equipment, and DCIM. The services category is sub-divided into integration & implementation, managed, and consulting.

The solution segment contributes to the largest share in the edge data center market. An edge data center works as a caching and data-aggregation point between users and larger data centers to alleviate the excessive IT burden in today's IT-intensive environment with massive data traffic.

In the forecasted year, in the solution category, the networking equipment solution is expected to generate significant revenue. Networking solutions assist organizations in improving data centers by allowing them to choose from a variety of innovative, industry-standard network applications, operating systems, and hardware. Users can select, deploy, and connect to various virtual network services using networking equipment that runs on a modular infrastructure platform that is geared for quick deployment and connectivity of network services. It's used to deploy network services close to cloud providers and end-users, as well as to unlock new use cases that traditional IT deployment models can't manage, such as IoT, machine learning, and AI.

The integration and implementation in the service category will dominate the edge data center market as integration service providers aims at deploying continuous integration of the platform with other tools like CRM, analytics tools, AI-powered matchmaking assistance to improve engagement, and networking opportunities of like-minded individuals

Insight by Facility Size

Based on facility size, the global edge data center market is segmented into small and medium facilities and large facilities. The large facility dominates the market as they easily support and extend the data center capabilities of organizations. They are also suitable for minimizing space, requiring minimal time for deployment, and reducing costs.

Insight by Industry Vertical

Based on industry vertical, the global edge data center market is classified into IT & telecommunication, BFSI, colocation, energy & power, government, industrial, automotive, retail & e-commerce, gaming and entertainment, healthcare, and others. The BFSI sector dominates the market owing to increased emphasis to provide rapid IT infrastructure and an increased need to store and process consumer data securely.

Global Edge Data Center Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 7.15 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 21.78 Billion |

|

Growth Rate |

22.2% |

|

Segments Covered in the Report |

By Component Type, By Facility Size, and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The increased adoption of internet services along with a surge in the number of connected devices will shift the trend towards bandwidth-intensive applications. Also, the surge in adoption of developed technology like big data, IoT, 5G deployment, cloud, and streaming devices will show a significant trend in the edge data center market.

Growth Drivers

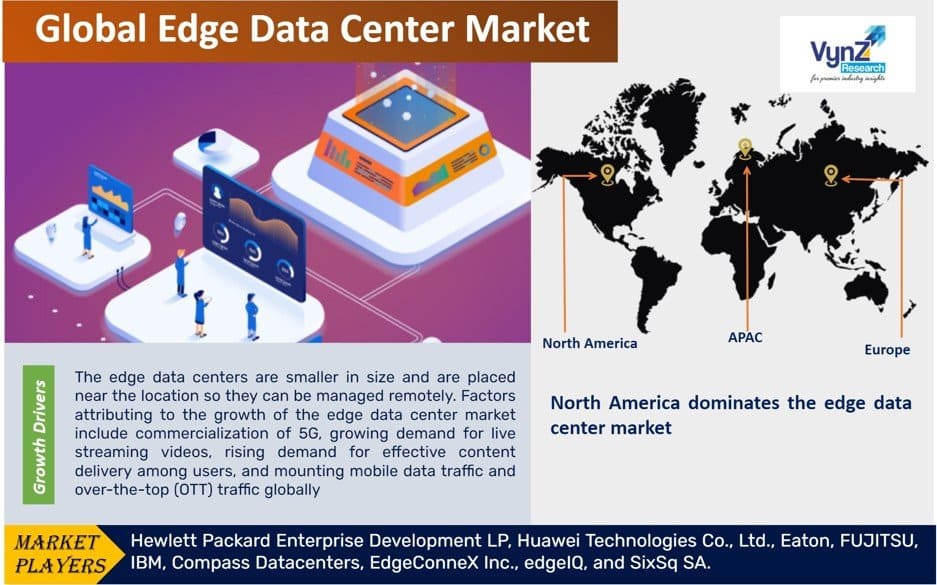

The edge data centers are smaller in size and are placed near the location so they can be managed remotely. Factors attributing to the growth of the edge data center market include commercialization of 5G, growing demand for live streaming videos, rising demand for effective content delivery among users, and mounting mobile data traffic and over-the-top (OTT) traffic globally. Furthermore, the rising adoption of smartphones and IoT devices will lead to an increase in mobile data traffic, resulting in managing the increased amount of data by edge data centers will propel its growth. Also, the increased espousal of IoT devices like sensors, actuators, self-driven cars, robots in-home or industrial settings will enable service providers to manage large amounts of data, thereby propelling the growth in the market. During the forecast period, the rising need for increased channel capacity, quality, and compatibility is expected to push the global edge data center market.

Challenges

The rising need for massive capital investment, increased infrastructure cost, high maintenance cost, high-speed network connection in remote areas, and security concerns in green storage technologies will restrain the growth of the edge data center market globally, though, with development and ongoing investment in R&D activities, the edge technology cost might reduce soon.

Opportunities

The growing demand for high computational power is prompting service providers to host data centers at edge locations for low-latency connectivity, which is further driving lucrative opportunities in the edge data center market. Furthermore, the commercialization of 5G technology and advancement in AR so as to develop new edge facilities will further accelerate the growth opportunities in the market.

Geographic Overview

North America dominates the edge data center market owing to the increasing deployment, commercialization of 5G networks, increased penetration of mobile services, and mounting demand for IT infrastructure will propel the growth in the region.

Europe is anticipated to have significant growth as it has a strong manufacturing sector that adopts developed technology like 5G, robotics, and IoT devices. Europe has a large automotive industry that provides developed vehicles that require fast processing of a large amount of data in real-time, thereby driving growth in the European region.

Competitive Insight

The edge data center industry is highly consolidated, and manufacturers are pursuing growth tactics such as purchasing smaller vendors to diversify their product offerings and compete. Because there are so many industry competitors, such as Microsoft Corporation, IBM Corporation, 365 Operating LLC, and EdgeConnecX Inc., the edge data center market is very competitive. Several edge data center vendors have introduced new products in recent years in order to supply consumers with technologically superior solutions. Furthermore, the companies are entering into partnerships, collaborations, mergers & acquisitions, and joint ventures to support their foothold in the global edge data center market.

The HPE Edge Center is a fully self-contained, single-cabinet modular, software-defined data center that allows any IT infrastructure to operate at the edge. It secures computing, network, and storage infrastructure while also enabling edge management automation with an industry-first edge management control system. The HPE Edge Center gives freedom to quickly and efficiently deploy computing where and when consumers need it. Industrial IoT, as well as other enterprise edge or AI applications, will benefit from this solution.

Eaton, a leader in edge computing technology, provides distributed IT edge settings with power management solutions to keep mission-critical apps and devices functioning longer and minimize data loss. Uninterruptible power supplies (UPS), power distribution units (PDU), and intelligent power management with environmental monitoring, sophisticated notifications, remote control, and automatic reactions for smooth shutdown are among these instruments. Eaton is focusing on four primary edge environments for deployments outside of physical data center edge solutions I.e., computer edge, local data center edge, industrial IoT edge, and gateway edge.

In June 2021, Eaton, a global power management firm, recently unveiled the iCube 2.0 and the 9PX lithium-ion UPS, two new additions to its micro data center (MDC) and 9PX uninterruptible power supply (UPS) line. These new regional solutions enable businesses to achieve information and operational technology excellence while positioning their enterprise for success in the ongoing energy transition and are tailored to address the unique needs and pain points of Asian organizations looking to future-proof their data center infrastructure.

In June 2021, HPE announced at HPE Discover that it is extending its hybrid cloud leadership with a comprehensive set of innovations to the HPE GreenLake edge to cloud platform, the industry's most robust and proven platform for cloud services in the data center, colocation center, and at the edge. With automated, cloud-native capabilities that can be performed in just a few clicks and maintained in a unified platform, innovations cover applications, security, silicon, and software.

Some of the industry players in the global edge data center market include 365 Data Centers, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Eaton, FUJITSU, IBM, Compass Datacenters, EdgeConneX Inc., edgeIQ, and SixSq SA.

The Edge Data Center Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Component Type

- Solutions

- Cooling

- Power (UPS)

- IT Racks and Enclosure

- Networking Equipment

- DCIM

- Services

- Integration & Implementation

- Managed

- Consulting

- Solutions

- By Facility Size

- Small and Medium Facilities

- Large Facilities

- By Industry Vertical

- IT & Telecommunication

- BFSI

- Colocation

- Energy & Power

- Government

- Industrial,

- Automotive

- Retail & E-Commerce

- Gaming and Entertainment

- Healthcare

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Component Type

1.2.2. By Facility Size

1.2.3. By Industry Vertical

1.2.4. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Component Type

5.1.1. Solutions

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.1.2.1. Cooling

5.1.1.2.2. Power (UPS)

5.1.1.2.3. IT Racks and Enclosure

5.1.1.2.4. Networking Equipment

5.1.1.2.5. DCIM

5.1.2. Services

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.2.2.1. Integration & Implementation

5.1.2.2.2. Managed

5.1.2.2.3. Consulting

5.2. By Facility Size

5.2.1. Small and Medium Facilities

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Large Facilities

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Industry Vertical

5.3.1. IT & Telecommunication

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. BFSI

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Colocation

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Energy & Power

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Government

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Industrial

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

5.3.7. Automotive

5.3.7.1. Market Definition

5.3.7.2. Market Estimation and Forecast to 2030

5.3.8. Retail & E-Commerce

5.3.8.1. Market Definition

5.3.8.2. Market Estimation and Forecast to 2030

5.3.9. Gaming and Entertainment

5.3.9.1. Market Definition

5.3.9.2. Market Estimation and Forecast to 2030

5.3.10. Healthcare

5.3.10.1. Market Definition

5.3.10.2. Market Estimation and Forecast to 2030

5.3.11. Others

5.3.11.1. Market Definition

5.3.11.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Component Type

6.2. By Facility Size

6.3. By Industry Vertical

6.4. By Country

6.4.1. U.S. Market Estimate and Forecast

6.4.2. Canada Market Estimate and Forecast

6.4.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Component Type

7.2. By Facility Size

7.3. By Industry Vertical

7.4. By Country

7.4.1. Germany Market Estimate and Forecast

7.4.2. France Market Estimate and Forecast

7.4.3. U.K. Market Estimate and Forecast

7.4.4. Italy Market Estimate and Forecast

7.4.5. Spain Market Estimate and Forecast

7.4.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Component Type

8.2. By Facility Size

8.3. By Industry Vertical

8.4. By Country

8.4.1. China Market Estimate and Forecast

8.4.2. Japan Market Estimate and Forecast

8.4.3. India Market Estimate and Forecast

8.4.4. South Korea Market Estimate and Forecast

8.4.5. Singapore Market Estimate and Forecast

8.4.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Component Type

9.2. By Facility Size

9.3. By Industry Vertical

9.4. By Country

9.4.1. Brazil Market Estimate and Forecast

9.4.2. Saudi Arabia Market Estimate and Forecast

9.4.3. South Africa Market Estimate and Forecast

9.4.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. 365 Data Centers

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Hewlett Packard Enterprise Development LP

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Huawei Technologies Co., Ltd.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Eaton

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. FUJITSU

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. IBM

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Compass Datacenters

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. EdgeConneX Inc.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. edgeIQ

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. SixSq SA

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Viral and Edge Data Center Market Size, By Component Type, 2018-2021 (USD Billion)

Table 5 Global Viral and Edge Data Center Market Size, By Component Type, 2022-2030 (USD Billion)

Table 6 Global Viral and Edge Data Center Market Size, By Facility Size, 2018-2021 (USD Billion)

Table 7 Global Viral and Edge Data Center Market Size, By Facility Size, 2022-2030 (USD Billion)

Table 8 Global Viral and Edge Data Center Market Size, By Industry Vertical, 2018-2021 (USD Billion)

Table 9 Global Viral and Edge Data Center Market Size, By Industry Vertical, 2022-2030 (USD Billion)

Table 10 Global Viral and Edge Data Center Market Size, By Region, 2018-2021 (USD Billion)

Table 11 Global Viral and Edge Data Center Market Size, By Region, 2022-2030 (USD Billion)

Table 12 North America Viral and Edge Data Center Market Size, By Component Type, 2018-2021 (USD Billion)

Table 13 North America Viral and Edge Data Center Market Size, By Component Type, 2022-2030 (USD Billion)

Table 14 North America Viral and Edge Data Center Market Size, By Facility Size, 2018-2021 (USD Billion)

Table 15 North America Viral and Edge Data Center Market Size, By Facility Size, 2022-2030 (USD Billion)

Table 16 North America Viral and Edge Data Center Market Size, By Industry Vertical, 2018-2021 (USD Billion)

Table 17 North America Viral and Edge Data Center Market Size, By Industry Vertical, 2022-2030 (USD Billion)

Table 18 North America Viral and Edge Data Center Market Size, By Region, 2018-2021 (USD Billion)

Table 19 North America Viral and Edge Data Center Market Size, By Region, 2022-2030 (USD Billion)

Table 20 Europe Viral and Edge Data Center Market Size, By Component Type, 2018-2021 (USD Billion)

Table 21 Europe Viral and Edge Data Center Market Size, By Component Type, 2022-2030 (USD Billion)

Table 22 Europe Viral and Edge Data Center Market Size, By Facility Size, 2018-2021 (USD Billion)

Table 23 Europe Viral and Edge Data Center Market Size, By Facility Size, 2022-2030 (USD Billion)

Table 24 Europe Viral and Edge Data Center Market Size, By Industry Vertical, 2018-2021 (USD Billion)

Table 25 Europe Viral and Edge Data Center Market Size, By Industry Vertical, 2022-2030 (USD Billion)

Table 26 Europe Viral and Edge Data Center Market Size, By Region, 2018-2021 (USD Billion)

Table 27 Europe Viral and Edge Data Center Market Size, By Region, 2022-2030 (USD Billion)

Table 28 Asia-Pacific Viral and Edge Data Center Market Size, By Component Type, 2018-2021 (USD Billion)

Table 29 Asia-Pacific Viral and Edge Data Center Market Size, By Component Type, 2022-2030 (USD Billion)

Table 30 Asia-Pacific Viral and Edge Data Center Market Size, By Facility Size, 2018-2021 (USD Billion)

Table 31 Asia-Pacific Viral and Edge Data Center Market Size, By Facility Size, 2022-2030 (USD Billion)

Table 32 Asia-Pacific Viral and Edge Data Center Market Size, By Industry Vertical, 2018-2021 (USD Billion)

Table 33 Asia-Pacific Viral and Edge Data Center Market Size, By Industry Vertical, 2022-2030 (USD Billion)

Table 34 Asia-Pacific Viral and Edge Data Center Market Size, By Region, 2018-2021 (USD Billion)

Table 35 Asia-Pacific Viral and Edge Data Center Market Size, By Region, 2022-2030 (USD Billion)

Table 36 RoW Viral and Edge Data Center Market Size, By Component Type, 2018-2021 (USD Billion)

Table 37 RoW Viral and Edge Data Center Market Size, By Component Type, 2022-2030 (USD Billion)

Table 38 RoW Viral and Edge Data Center Market Size, By Facility Size, 2018-2021 (USD Billion)

Table 39 RoW Viral and Edge Data Center Market Size, By Facility Size, 2022-2030 (USD Billion)

Table 40 RoW Viral and Edge Data Center Market Size, By Industry Vertical, 2018-2021 (USD Billion)

Table 41 RoW Viral and Edge Data Center Market Size, By Industry Vertical, 2022-2030 (USD Billion)

Table 42 RoW Viral and Edge Data Center Market Size, By Region, 2018-2021 (USD Billion)

Table 43 RoW Viral and Edge Data Center Market Size, By Region, 2022-2030 (USD Billion)

Table 44 Snapshot – 365 Data Centers

Table 45 Snapshot – Hewlett Packard Enterprise Development LP

Table 46 Snapshot – Huawei Technologies Co., Ltd.

Table 47 Snapshot – Eaton

Table 48 Snapshot – FUJITSU

Table 49 Snapshot – IBM

Table 50 Snapshot – Compass Datacenters

Table 51 Snapshot – EdgeConneX Inc.

Table 52 Snapshot – edgeIQ

Table 53 Snapshot – SixSq SA

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Viral and Edge Data Center Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Viral and Edge Data Center Market Highlight

Figure 12 Global Viral and Edge Data Center Market Size, By Service, 2018 - 2030 (USD Billion)

Figure 13 Global Viral and Edge Data Center Market Size, By Facility Size, 2018 - 2030 (USD Billion)

Figure 14 Global Viral and Edge Data Center Market Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 15 Global Viral and Edge Data Center Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 16 North America Viral and Edge Data Center Market Highlight

Figure 17 North America Viral and Edge Data Center Market Size, By Service, 2018 - 2030 (USD Billion)

Figure 18 North America Viral and Edge Data Center Market Size, By Facility Size, 2018 - 2030 (USD Billion)

Figure 19 North America Viral and Edge Data Center Market Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 20 North America Viral and Edge Data Center Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 21 Europe Viral and Edge Data Center Market Highlight

Figure 22 Europe Viral and Edge Data Center Market Size, By Service, 2018 - 2030 (USD Billion)

Figure 23 Europe Viral and Edge Data Center Market Size, By Facility Size, 2018 - 2030 (USD Billion)

Figure 24 Europe Viral and Edge Data Center Market Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 25 Europe Viral and Edge Data Center Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 26 Asia-Pacific Viral and Edge Data Center Market Highlight

Figure 27 Asia-Pacific Viral and Edge Data Center Market Size, By Service, 2018 - 2030 (USD Billion)

Figure 28 Asia-Pacific Viral and Edge Data Center Market Size, By Facility Size, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Viral and Edge Data Center Market Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 30 Asia-Pacific Viral and Edge Data Center Market Size, By Region, 2018 - 2030 (USD Billion)

Figure 31 RoW Viral and Edge Data Center Market Highlight

Figure 32 RoW Viral and Edge Data Center Market Size, By Service, 2018 - 2030 (USD Billion)

Figure 33 RoW Viral and Edge Data Center Market Size, By Facility Size, 2018 - 2030 (USD Billion)

Figure 34 RoW Viral and Edge Data Center Market Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 35 RoW Viral and Edge Data Center Market Size, By Region, 2018 - 2030 (USD Billion)

Global Edge Data Center Market Coverage

Component Type Insight and Forecast 2025-2030

- Solutions

- Cooling

- Power (UPS)

- IT Racks and Enclosure

- Networking Equipment

- DCIM

- Services

- Integration & Implementation

- Managed

- Consulting

Facility Size Insight and Forecast 2025-2030

- Small and Medium Facilities

- Large Facilities

Industry Vertical Insight and Forecast 2025-2030

- IT & Telecommunication

- BFSI

- Colocation

- Energy & Power

- Government

- Industrial,

- Automotive

- Retail & E-Commerce

- Gaming and Entertainment

- Healthcare

- Others

Geographical Segmentation

Edge Data Center Market by Region

North America

- By Component Type

- By Facility Size

- By Industry Vertical

- By Country – U.S., Canada, and Mexico

Europe

- By Component Type

- By Facility Size

- By Industry Vertical

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Component Type

- By Facility Size

- By Industry Vertical

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Component Type

- By Facility Size

- By Industry Vertical

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- 365 Data Centers

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- Eaton

- FUJITSU

- IBM

- Compass Datacenters

- EdgeConneX Inc.

- edgeIQ

- SixSq SA

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com