- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Inspection Management Software Market

| Status : Published | Published On : Apr, 2022 | Report Code : VRICT5164 | Industry : ICT & Media | Available Format :

|

Page : 250 |

Global Inspection Management Software Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Solution and Services), by Organization Size (Large Enterprises and SMEs), by Deployment Model (Cloud and On-Premises), by Industry Vertical (Aerospace and Defense, Manufacturing, Automotive, Energy and Utilities, Transport and Logistics, Consumer Goods and Retail, Telecom, Healthcare and Lifesciences, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

From 57 billion in 2023, the global Inspection Management Software Market size will grow to USD 86 billion by 2030, thus registering a CAGR of 9.86% during the forecast period 2025-2030. Inspection management is a quality control process that entails an automated inspection procedure which measures, examines, and reviews data against standard requirements to guarantee that the data entered is up to date and secure. Inspection Management maintains the uniformity of an organization, product, or service. Quality management, quality assurance, quality control, and quality improvement are the four primary components. Quality management is concerned not only with the quality of products and services but also with the methods by which they are achieved. In order to achieve more consistent quality, Inspection Management employs quality assurance and control of both processes and products. Thus, the software helps in saving time for SMEs which can be used to improve productive customer engagement.

The COVID-19 pandemic has had a favorable impact on the inspection management software market as it offers virtual assistance for inspection. Thus, it has made the inspection process easier as it aids in inspecting employees’ performance virtually and manually.

Market Segmentation

Insight by Component

Based on component, the global inspection management software market is bifurcated into solution and services. The solution segment dominates the market. A planned examination or formal evaluation process is referred to as an inspection. It's a cost-effective method of ensuring product quality by comparing it to pre-determined norms and requirements. It improves quality control, reduces manufacturing costs, eliminates scrap losses, and pinpoints the source of defective work.

Quality Management Software includes inspection management software. Audit management, complaint management, document control, supplier quality management, statistical process control, employee training management, corrective and preventive action, non-conformance management, QMS extensions, e-Signatures, analytics and reporting, design reviews, email notifications, traceability matrix, role-based security, and user dashboard are just a few of the features provided by QMS.

Insight by Organization Size

Based on organization size, the global inspection management software market is bifurcated into large enterprises and SMEs. The SMEs are anticipated to have a high CAGR during the forecast period 2021-2030 as inspection management software offer features such as accounts management, inventory management, production management, document management, audit trail, etc. These features will provide real-time business data to the investors. Also, it increased productivity, decreases cost, and keeps track of crowdsourced ideas.

Insight by Deployment Model

Based on the deployment model, the global inspection management software market is bifurcated into cloud and on-premise. The on-premise is anticipated to witness the highest share in the market as it provides increased speed, is highly scalable, flexible, and is secured. Also, all the data gets stored within enterprise premises.

Insight by Industry Vertical

Aerospace and defense, manufacturing, automotive, energy and utilities, transport and logistics, consumer goods and retail, telecom, healthcare and lifesciences, and others are the industrial verticals in which the global inspection management software market is split. The telecom segment is anticipated to witness the largest market share during the forecast period 2022-2030 as inspection software is important for audit and inspection tasks. Also, it will address crucial service challenges and increases the visibility of service quality and user experiences.

Global Inspection Management Software Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 57 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 86 Billion |

|

Growth Rate |

9.86% |

|

Segments Covered in the Report |

By Component, By Organization Size, By Deployment Model, and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

Mobile phone applications are being developed by inspection management software companies along with an emphasis to install inspection management software for laptops, desktops, and tablets. End-users of inspection management software can monitor data from a remote location and analyze results more effectively using mobile phone applications for Android and iOS. These are the trends that will drive the market growth for inspection management software during the analysis period.

Growth Drivers

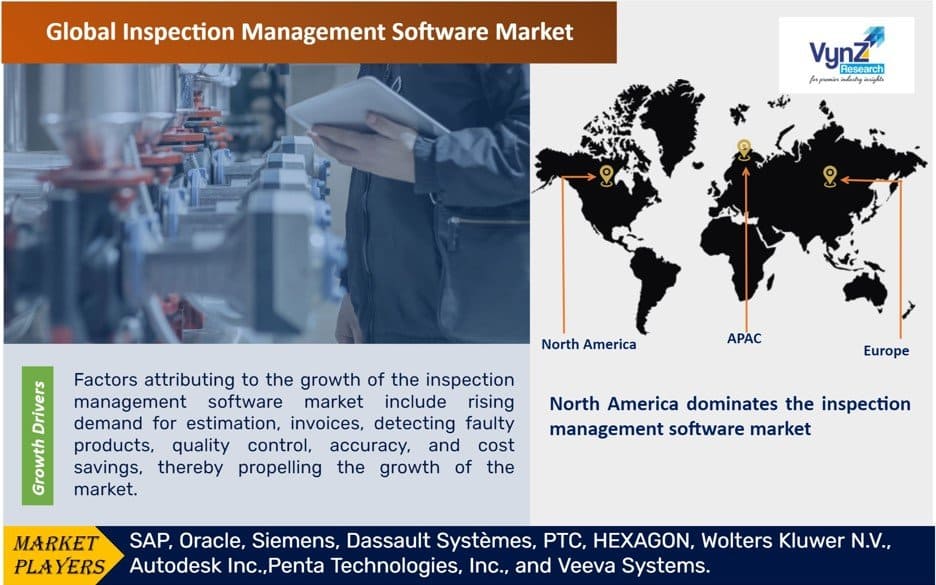

Factors attributing to the growth of the inspection management software market include rising demand for estimation, invoices, detecting faulty products, quality control, accuracy, and cost savings, thereby propelling the growth of the market. Furthermore, increased demand for hassle-free streamlining of all inspection tasks, such as scheduling, preparing forms and checklists, scheduling, recording results, tracking a task, and reporting corrective measures will spur the market growth of the inspection management software market. Also, when challenged with excessively high production demands, industrial operators are turning to automated inspection management solutions. As a result, inspection management software implementation is projected to increase over the projection period.

Inspection management software is likely to see considerable growth in demand over the projected timeframe, owing to its easy-to-use and sophisticated features that assist businesses with anything from quick inspection overviews to thorough information on concerns and non-compliance. Furthermore, inspection management software allows consumers to receive reports and images, which is a significant benefit, thus driving the growth of the market.

Challenges

The challenges faced by the inspection management software industry include data integrity risks, particularly security lapses within the production process, massive costs involved in the installation, technical issues associated with inspection management software, and difficulty in understanding the significance to invest in the ‘operation-essential’ inspection management software. Thus, lack of adequate resources to manage inspection management software may stymie the growth of the market.

Opportunities

The increased adoption of IoT, artificial intelligence, and cloud technologies will create growth opportunities in the inspection management software market. They can look through task instructions, checklists, and troubleshooting methods, as well as seek real-time video help from remote specialists. AR technology, provides on-premises, hybrid, and SaaS solutions and creates a closed-loop between the digital and real-world and are used by businesses to transform engineering, production, and services. Manufacturing execution, ERP, quality, supply chain planning and management, Industrial IoT, and analytics are all solutions that companies use to connect people, systems, machines, and supply chains, allowing them to lead with precision, efficiency, and agility.

Geographic Overview

North America dominates the inspection management software market owing to the rising number of customers, increasing number of SMEs, ad massive expenditure on IT will proliferate the growth in the region. Moreover, the industries are implementing automated solutions in the business execution process.

Europe is anticipated to have considerable growth during the forecast period 20222-2030 due to the need to enhance the product quality, eliminate data porting, and reduce paperwork.

Asia-Pacific is anticipated to have a high CAGR during the forecast period 2022-2028 owing to the rising need to automate solutions that saves time and reduces operational cost.

Competitive Insight

The industry players are emphasizing on organic strategies like product approvals, product launch, patents, and events and inorganic strategies like M&A, partnerships, collaborations, and joint ventures to expand their business and customer base globally.

HEXAGON Quality Inspection system is ideal for mobilizing quality inspection teams. Hexagon has designed created a fully mobile solution for technicians' inspection plans and workflow tasks. Everything is covered, from evaluating finished goods on the final inspection line or doing an in-process inspection. This workflow solution is ideal for standardizing inspection plans, doing more in-depth root cause analyses, and incorporating additional business functions into the quality process.

Veeva Systems Inc. is one of the prominent provider of cloud-based software for the life sciences industry. Veeva QualityOne, a single cloud-based solution, ensures compliance and agility by allowing real-time collaboration and transparency across the whole supply chain. QualityOne is a cloud-based Quality, Health, Safety, and Environmental (QHSE) management software solution that allow to manage document control and training, quality procedures, and HSE events all in one place.

Recent Development by Key Players

In March 2022, Oracle Cloud Infrastructure (OCI) has added 11 new compute, networking, and storage services and capabilities, allowing customers to execute operations faster, more securely, and at lower costs. Customers can now get completely flexible core infrastructure services that automatically optimize resources to match application requirements and cut expenses substantially. OCI is being adopted by several global companies like Vodafone, Samsung Securities, GoTo, and Cox Automotive to execute a variety of workloads ranging from microservices to AI.

In January 2022, Siemens is pleased to announce the release of Teamcenter Quality 6.0, the latest edition of Siemens quality management software. Failure Mode and Effects Analysis (FMEA), Control and Inspection Planning, Quality Project Management, Problem Solving, Quality Issue Management, and Quality Action Management are all upgraded in Teamcenter® Quality software version 6.0.

Key Players Covered in the Report

Some of the major players in the global inspection management software market include SAP, Oracle, Siemens, Dassault Systèmes, PTC, HEXAGON, Wolters Kluwer N.V., Autodesk Inc.,Penta Technologies, Inc., and Veeva Systems.

The Inspection Management Software Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Component

- Solution

- Services

- By Organization Size

- Large Enterprises

- SMEs Biometric Readers

- By Deployment Model

- Cloud

- On-Premises

- By Industry Vertical

- Aerospace and Defense

- Manufacturing

- Automotive

- Energy and Utilities

- Transport and Logistics

- Consumer Goods and Retail

- Telecom

- Healthcare and Lifesciences

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source:VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Component

1.2.2. By Organization Size

1.2.3. By Deployment Model

1.2.4. By Industry Vertical

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. Solution

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Services

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Organization Size

5.2.1. Large Enterprises

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. SMEs Biometric Readers

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Deployment Model

5.3.1. Cloud

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. On-Premises

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Industry Vertical

5.4.1. Aerospace and Defense

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Manufacturing

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Automotive

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Aerospace and Defense

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Manufacturing

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Automotive

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Aerospace and Defense

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

5.4.8. Manufacturing

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2030

5.4.9. Automotive

5.4.9.1. Market Definition

5.4.9.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Component

6.2. By Organization Size

6.3. By Deployment Model

6.4. By Industry Vertical

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Component

7.2. By Organization Size

7.3. By Deployment Model

7.4. By Industry Vertical

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Component

8.2. By Organization Size

8.3. By Deployment Model

8.4. By Industry Vertical

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Component

9.2. By Organization Size

9.3. By Deployment Model

9.4. By Industry Vertical

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. SAP

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Oracle

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Siemens

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Dassault Systèmes

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. PTC

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. HEXAGON

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Wolters Kluwer N.V.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Autodesk Inc.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Penta Technologies, Inc.

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Penta Technologies, Inc.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Inspection Management Software Market, By Component, 2018 - 2023 (USD Billion)

Table 5 Global Inspection Management Software Market, By Component, 2022 - 2030 (USD Billion)

Table 6 Global Inspection Management Software Market, By Organization Size, 2018 - 2023 (USD Billion)

Table 7 Global Inspection Management Software Market, By Organization Size, 2022 - 2030 (USD Billion)

Table 8 Global Inspection Management Software Market, By Deployment Model, 2018 - 2023 (USD Billion)

Table 9 Global Inspection Management Software Market, By Deployment Model, 2022 - 2030 (USD Billion)

Table 10 Global Inspection Management Software Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 11 Global Inspection Management Software Market, By Industry Vertical, 2022 - 2030 (USD Billion)

Table 12 Global Inspection Management Software Market, by Region, 2018 - 2023 (USD Billion)

Table 13 Global Inspection Management Software Market, by Region, 2022 - 2030 (USD Billion)

Table 14 North America Inspection Management Software Market, By Component, 2018 - 2023 (USD Billion)

Table 15 North America Inspection Management Software Market, By Component, 2022 - 2030 (USD Billion)

Table 16 North America Inspection Management Software Market, By Organization Size, 2018 - 2023 (USD Billion)

Table 17 North America Inspection Management Software Market, By Organization Size, 2022 - 2030 (USD Billion)

Table 18 North America Inspection Management Software Market, By Deployment Model, 2018 - 2023 (USD Billion)

Table 19 North America Inspection Management Software Market, By Deployment Model, 2022 - 2030 (USD Billion)

Table 20 North America Inspection Management Software Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 21 North America Inspection Management Software Market, By Industry Vertical, 2022 - 2030 (USD Billion)

Table 22 North America Inspection Management Software Market, by Region, 2018 - 2023 (USD Billion)

Table 23 North America Inspection Management Software Market, by Region, 2022 - 2030 (USD Billion)

Table 24 Europe Inspection Management Software Market, By Component, 2018 - 2023 (USD Billion)

Table 25 Europe Inspection Management Software Market, By Component, 2022 - 2030 (USD Billion)

Table 26 Europe Inspection Management Software Market, By Organization Size, 2018 - 2023 (USD Billion)

Table 27 Europe Inspection Management Software Market, By Organization Size, 2022 - 2030 (USD Billion)

Table 28 Europe Inspection Management Software Market, By Deployment Model, 2018 - 2023 (USD Billion)

Table 29 Europe Inspection Management Software Market, By Deployment Model, 2022 - 2030 (USD Billion)

Table 30 Europe Inspection Management Software Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 31 Europe Inspection Management Software Market, By Industry Vertical, 2022 - 2030 (USD Billion)

Table 32 Europe Inspection Management Software Market, by Region, 2018 - 2023 (USD Billion)

Table 33 Europe Inspection Management Software Market, by Region, 2022 - 2030 (USD Billion)

Table 34 Asia-Pacific Inspection Management Software Market, By Component, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific Inspection Management Software Market, By Component, 2022 - 2030 (USD Billion)

Table 36 Asia-Pacific Inspection Management Software Market, By Organization Size, 2018 - 2023 (USD Billion)

Table 37 Asia-Pacific Inspection Management Software Market, By Organization Size, 2022 - 2030 (USD Billion)

Table 38 Asia-Pacific Inspection Management Software Market, By Deployment Model, 2018 - 2023 (USD Billion)

Table 39 Asia-Pacific Inspection Management Software Market, By Deployment Model, 2022 - 2030 (USD Billion)

Table 40 Asia-Pacific Inspection Management Software Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 41 Asia-Pacific Inspection Management Software Market, By Industry Vertical, 2022 - 2030 (USD Billion)

Table 42 Asia-Pacific Inspection Management Software Market, by Region, 2018 - 2023 (USD Billion)

Table 43 Asia-Pacific Inspection Management Software Market, by Region, 2022 - 2030 (USD Billion)

Table 44 RoW Inspection Management Software Market, By Component, 2018 - 2023 (USD Billion)

Table 45 RoW Inspection Management Software Market, By Component, 2022 - 2030 (USD Billion)

Table 46 RoW Inspection Management Software Market, By Organization Size, 2018 - 2023 (USD Billion)

Table 47 RoW Inspection Management Software Market, By Organization Size, 2022 - 2030 (USD Billion)

Table 48 RoW Inspection Management Software Market, By Deployment Model, 2018 - 2023 (USD Billion)

Table 49 RoW Inspection Management Software Market, By Deployment Model, 2022 - 2030 (USD Billion)

Table 50 RoW Inspection Management Software Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 51 RoW Inspection Management Software Market, By Industry Vertical, 2022 - 2030 (USD Billion)

Table 52 RoW Inspection Management Software Market, by Region, 2018 - 2023 (USD Billion)

Table 53 RoW Inspection Management Software Market, by Region, 2022 - 2030 (USD Billion)

Table 54 Snapshot – SAP

Table 55 Snapshot – Oracle

Table 56 Snapshot – Siemens

Table 57 Snapshot – Dassault Systèmes

Table 58 Snapshot – PTC

Table 59 Snapshot – HEXAGON

Table 60 Snapshot – Wolters Kluwer N.V.

Table 61 Snapshot – Autodesk Inc.

Table 62 Snapshot – Penta Technologies, Inc.

Table 63 Snapshot – Veeva Systems.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Inspection Management Software Market- Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Inspection Management Software Market Highlight

Figure 12 Global Inspection Management Software Market, By Component, 2018 - 2030 (USD Billion)

Figure 13 Global Inspection Management Software Market, By Organization Size, 2018 - 2030 (USD Billion)

Figure 14 Global Inspection Management Software Market, By Deployment Model, 2018 - 2030 (USD Billion)

Figure 15 Global Inspection Management Software Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 16 Global Inspection Management Software Market, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Inspection Management Software Market Highlight

Figure 18 North America Inspection Management Software Market, By Component, 2018 - 2030 (USD Billion)

Figure 19 North America Inspection Management Software Market, By Organization Size, 2018 - 2030 (USD Billion)

Figure 20 North America Inspection Management Software Market, By Deployment Model, 2018 - 2030 (USD Billion)

Figure 21 North America Inspection Management Software Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 22 North America Inspection Management Software Market, by Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Inspection Management Software Market Highlight

Figure 24 Europe Inspection Management Software Market, By Component, 2018 - 2030 (USD Billion)

Figure 25 Europe Inspection Management Software Market, By Organization Size, 2018 - 2030 (USD Billion)

Figure 26 Europe Inspection Management Software Market, By Deployment Model, 2018 - 2030 (USD Billion)

Figure 27 Europe Inspection Management Software Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 28 Europe Inspection Management Software Market, by Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Inspection Management Software Market Highlight

Figure 30 Asia-Pacific Inspection Management Software Market, By Component, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Inspection Management Software Market, By Organization Size, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Inspection Management Software Market, By Deployment Model, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Inspection Management Software Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Inspection Management Software Market, by Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Inspection Management Software Market Highlight

Figure 36 RoW Inspection Management Software Market, By Component, 2018 - 2030 (USD Billion)

Figure 37 RoW Inspection Management Software Market, By Organization Size, 2018 - 2030 (USD Billion)

Figure 38 RoW Inspection Management Software Market, By Deployment Model, 2018 - 2030 (USD Billion)

Figure 39 RoW Inspection Management Software Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 40 RoW Inspection Management Software Market, By Region, 2018 - 2030 (USD Billion)

Global Inspection Management Software Market Coverage

Component Insight and Forecast 2025-2030

- Solution

- Services

Organization Size Insight and Forecast 2025-2030

- Large Enterprises

- SMEs Biometric Readers

Deployment Model Insight and Forecast 2025-2030

- Cloud

- On-Premises

Industry Vertical Insight and Forecast 2025-2030

- Aerospace and Defense

- Manufacturing

- Automotive

- Energy and Utilities

- Transport and Logistics

- Consumer Goods and Retail

- Telecom

- Healthcare and Lifesciences

- Others

Geographical Segmentation

Inspection Management Software Market by Region

North America

- By Component

- By Organisation Size

- By Deployment Model

- By Industry Vertical

- By Country – U.S., Canada, and Mexico

Europe

- By Component

- By Organisation Size

- By Deployment Model

- By Industry Vertical

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Component

- By Organisation Size

- By Deployment Model

- By Industry Vertical

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Component

- By Organisation Size

- By Deployment Model

- By Industry Vertical

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- SAP

- Oracle

- Siemens

- Dassault Systèmes

- PTC

- HEXAGON

- Wolters Kluwer N.V.

- Autodesk Inc.

- Penta Technologies Inc.

- Veeva Systems.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Inspection Management Software Market