| Status : Published | Published On : Nov, 2024 | Report Code : VRICT5190 | Industry : ICT & Media | Available Format :

|

Page : 135 |

Global Mobile Wallet and Payment Market Size & Share | Growth Forecast Report 2030

Industry Insights By Technology (Near Field Communication (NFC), QR Code, Direct Mobile Billing, SMS, Mobile Web Payment, Mobile Apps, Interactive Voice Response System (IVRS), and Others), By Payment (B2B, B2C, B2G, and Others), By Location (Remote Payment, Proximity Payment), By End Users (BFSI, IT & Telecom, healthcare, Media & Entertainment, Transportation, Retail & Ecommerce, and Others) and By Geography (North America, Europe, Asia Pacific, Rest of the World)

Industry Overview

The global mobile wallet and payment market size was valued at USD 172.3 billion in 2023. It is likely to grow up to USD 534.4 billion by 2030 at a CAGR of 20.2% during the forecast period ranging between 2025 and 2030.

The growing preference for contactless payment through sophisticated technologies such as QR codes and NFC is a primary factor that drives the growth of the market. This rising prevalence is mainly attributed to the useful features and benefits of digital payments through mobile wallets, such as faster and more secure transactions. Such a mode of payment is more convenient for everyone, especially health-conscious people after the pandemic, to pay bills, send money online, shop, or book tickets. Hotels, transportation companies, restaurants, and e-commerce stores accept this popular mode of payment.

A digital wallet that stores money in digital form and allows payment-making as and when required by scanning QR codes is called a mobile wallet. This digital way of making payments is done conveniently and quickly using a smartphone. Advanced technologies such as QR codes and Near Field Communication (NFC), as well as different mobile apps, are used to transfer money safely and securely as these are encrypted and often need biometric authentication, such as fingerprints, to make a payment. Some of the most popular names of such mobile apps are PayPal, Google Pay, and Apple Pay. The most significant benefit of mobile payment is that consumers do not need to carry cash with them to make a purchase, big or small.

Global Mobile Wallet and Payment Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 172.3 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 534.4 Billion |

|

Growth Rate |

20.2% |

|

Segments Covered in the Report |

By Technology, By Payment, By Location, By End Users |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific and Rest of the World |

Global Mobile Wallet and Payment Market Trends/ Growth Drivers:

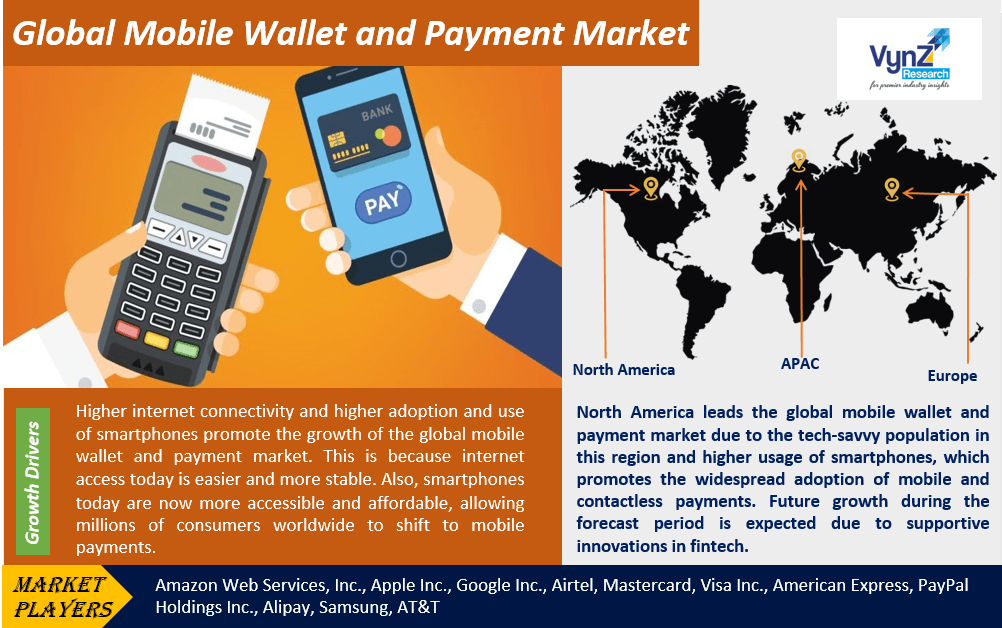

Higher internet penetration and use of smartphone

Higher internet connectivity and higher adoption and use of smartphones promote the growth of the global mobile wallet and payment market. This is because internet access today is easier and more stable. Also, smartphones today are now more accessible and affordable, allowing millions of consumers worldwide to shift to mobile payments. Internet is also available in remote regions, thereby enhancing the accessibility to this safe. secure, fast, and seamless mode of digital payment.

Moreover, significant innovations and a rise in the number of mobile wallets or apps also contribute to the market growth. These apps are very easy to integrate with the existing eCommerce platforms, further impacting their widespread adoption. Payments can be made more securely than with credit cards and bank accounts, thereby significantly enhancing user experience and convenience. In addition, significant government initiatives to promote the adoption of digital payments to support a cashless economy also influence market growth. A few other growth drivers of the market include the rising trend of online shopping, developments in digital security and technologies such as biometric authentication, the rising need for cross-border transactions, innovations and strategic partnerships between tech companies and financial institutions, along with supportive government regulations in several countries, and growing popularity of cashback incentives and loyalty programs are attracting consumers towards mobile payment and contributing to the sustained growth of the market.

Global Mobile Wallet and Payment Market Challenges

Growing concerns about fraud and digital security

Chances of fraud are a growing concern along with apprehensions about digital security, which are two significant challenges that are hindering the growth of the global mobile wallet and payment market. Consumers fail to be safe while sharing sensitive personal or financial information due to the growing number of fraud cases, phishing, hacking, and data breaches all over the world despite advanced encryption and biometric authentication requirements. Other growth challenges include unstable internet connection in developing regions, limited access to smartphones in specific demographics, complex guidelines across countries, lack of interoperability due to the absence of universal standards, and rising competition among different mobile wallet providers.

Global Mobile Wallet and Payment Market opportunities

Growing adoption in developing markets

There is a significant rise in the adoption of mobile payments in developing countries, which is a significant growth opportunity for the global mobile wallet and payment market. Easier internet accessibility and stable connectivity in most regions, as well as supportive government initiatives to promote mobile payment solutions in these regions, are also offering novel growth opportunities to the market. Other avenues of growth are offered by the expanding eCommerce sector, and higher acceptance of digital payments by the small business sector added digital security due to advanced technologies like blockchain and cryptocurrencies, cost-effectiveness, ability to make faster transactions beyond geographical limits, and innovative fraud detection systems based on AI. Furthermore, the ability to integrate mobile wallets with wearable devices, temping cashback and loyalty programs, and partnerships with fintech companies enhances consumer engagement creating better avenues for growth.

Recent Developments By the Key Players

Amazon Web Services (AWS) and Atlassian Corporation (leading provider of team collaboration and productivity software) have collaborated to expedite cloud transformation and deliver advanced AI and security capabilities to enterprise customers.

Vipps (Norwegian payments provider) has introduced the Apple Pay alternative for iPhone users along with its availability on Android devices too. The Vipps payment solution extends to various transactions that enables the users to transfer money.

Global Mobile Wallet and Payment Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the Global Mobile Wallet and Payment Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on Technology, Payment, Location, and End Users.

Insight by Technology

- Near Field Communication (NFC)

- QR Code

- Direct Mobile Billing

- SMS

- Mobile Web Payment

- Mobile Apps

- Interactive Voice Response System (IVRS)

- Others

The Near Field Communication (NFC) segment rules due to higher security

The global mobile wallet and payment market is divided by technology into Near Field Communication (NFC), QR Code, Direct Mobile Billing, SMS, Mobile Web Payment, Mobile Apps, Interactive Voice Response System (IVRS), and other categories. Out of these, the Near Field Communication (NFC) segment rules the market due to higher security, speed, and seamless transactions. This convenient mode is expected to grow even more during the forecast period due to seamless integration with smart devices and phones as well as higher adoption in retail, wearables, public transport, and other sectors in developed countries.

Insight by Payment

- B2B

- B2C

- B2G

- Others

The B2C segment leads due to a rise in e-commerce

According to the payment type, the global mobile wallet and payment market is segregated into B2B, B2C, B2G, and other categories. Among all these categories, the B2C segment leads the market due to a rise in e-commerce and industry growth along with the growing preference among consumers for faster and secure transactions. This section is expected to grow even more during the study period due to tempting loyalty programs, cashback offers, and seamless integration of a diverse range of mobile wallets with shopping platforms, adding to its convenience.

Insight by Location

- Remote Payment

- Proximity Payment

Remote Payment dominates due to the rising preference for online shopping

Based on the location, the global mobile wallet and payment market is divided into Remote Payment and Proximity Payment segments, where the former dominates the market due to the rising preference for online shopping, the need for faster and more secure payment solutions, and the ability to purchase from anywhere. It is also attributed to the growing reliability and trust in its security due to advanced encryption and integration with mobile apps.

Insight by End Users

- BFSI

- IT & Telecom

- Healthcare

- Media & Entertainment

- Transportation

- Retail & Ecommerce

- Others

The retail & e-commerce section dominates due to the growing trend of mobile shopping

The global mobile wallet and payment market is split by end users into BFSI, IT & Telecom, healthcare, Media & Entertainment, Transportation, Retail & Ecommerce, and other categories. Among them, the retail& e-commerce section is more dominating due to the growing trend of mobile shopping, seamless wallet integration, and preference for faster and secure checkout.

Global Mobile Wallet and Payment Market: Geographic Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America leads the global mobile wallet and payment market due to the tech-savvy population in this region and higher usage of smartphones, which promotes the widespread adoption of mobile and contactless payments. Future growth during the forecast period is expected due to supportive innovations in fintech.

The market in Europe is also promising due to robust regulations and support for mobile payments and sophisticated digital infrastructure. Led by Germany and the UK, further market growth is expected due to the rising adoption of mobile banking and eCommerce.

The Asia Pacific region of the market is, however, most promising and is expected to grow at a higher rate during the forecast period as a result of the significant rise in smartphone penetration, rise in the number of popular mobile apps, and supportive government initiatives in developing countries like India and China.

Competitive Insights of Global Mobile Wallet and Payment Market:

- Amazon Web Services Inc.

- Apple Inc.

- Google Inc.

- Airtel

- Mastercard

- Visa Inc.

- American Express

- PayPal Holdings Inc.

- Alipay

- Samsung

- AT&T

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Mobile Wallet and Payment Market