Industry Overview

The global Residential Security Market size was valued at USD 55.6 billion in 2023 ad is anticipated to become USD 86.8 billion by 2030, thus expected to witness an 8.8% CAGR during the forecast period (2025–2030). Residential security is important owing to the rising number of crimes and accidents. The global residential security market is witnessing significant growth owing to a surge in demand for complex security solutions such as access control systems, IP-based video surveillance, digital CCTVs, and remote monitoring solutions as they can detect smoke and fire, burglary activities, health emergencies, etc. There is an increasing demand for residential security solutions as it provides unparalleled connectivity, control, and accessibility, as well as the ability to remotely access a several features via a PC or smartphone.

.jpg)

The COVID-19 outbreak has adversely affected the global home residential security as China and US, both are the major markets that were impacted by the COVID-19 crisis. Moreover, disruption in the supply chain from China has led to reduced demand for residential security systems. Thus, there was a decline in new construction projects and a temporary shutdown of production units which has impacted the demand in China.

Also, the advanced residential security systems are capable to run with little energy expenditure and monitoring overall energy use, which is important as developed countries seek solutions to conserve energy. Furthermore, investments and money granted by state and federal governments in developed economies to promote technological advancements in residential security are a crucial driver driving the market's global expansion.

Residential Security Market Segmentation

Insight by Product

• Security Cameras

• Smart Locks

- Electronic Door Locks

- Keypad Locks

- Wireless Locks

- Biometric Locks

• Fire Sprinklers and Extinguishers

• Sensors

• Security Alarms

Security cameras have generated the largest revenue out of all of these product categories. The growing prevalence of security cameras for generating secure and safe residential environments with the support of exceptional quality visual and audio surveillance has contributed to the segment's growing market revenue. Furthermore, users record all activity in the area, even illegal acts, resulting in market segment growth.

Furthermore, various elements like Wi-Fi connectivity, night vision, and motion detection are driving the demand for progressive security cameras in the residential security industry. Security cameras and motion detectors have been seen to deliver notifications and alerts to their users if a suspicious occurrence is spotted. It also has night vision, which allows it to record movies and photographs in low-light situations, and these cameras are incredibly effective in minimizing criminal actions that occur at night. As a result, these factors are propelling the global market forward.

Insight by Solution

• System

- Fire Protection System

- Video Surveillance System

- Access Control System

- Entrance Control System

- Intruder Alarm System

• Services

- Security System Integration Service

- Video Surveillance Servcies

- Access Control Services

- Remote Monitoring Services

- Access Control services

Video surveillance system contributes to the largest share in the global residential security market as it offers real-time detection of an event, post-event analysis, and extraction statistical data along with saving manpower costs and increasing the efficacy of surveillance system operations. Furthermore, it monitors in both densely populated and remote areas as it adopts AI and deep learning technologies to empower security, accuracy, and reliability.

Insight by Resident Type

• Independent Resident

• Apartments

Among this resident type, the apartment is anticipated to have a significant growth during the forecast period owing to rapid urbanization and increased investment in building smart cities globally.

Global Residential Security Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 55.6 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 86.8 Billion

|

|

Growth Rate

|

8.8%

|

|

Segments Covered in the Report

|

By Product, By Solution, and By Residential Type

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Residential Security Market Growth Drivers

Proliferation of Wireless Technologies and IoT Will propel the growth

Technological Advancements: Advances in security technologies have led to the development of more sophisticated and effective residential security systems. This includes features such as high-definition video surveillance, facial recognition, cloud-based storage, wireless connectivity, and remote monitoring capabilities.

Increasing Awareness and Concerns for Security: Growing concerns about personal safety and property protection have contributed to the increased demand for residential security solutions. Rising crime rates, burglary incidents, and the need for peace of mind have prompted homeowners to invest in security systems to protect their properties and loved ones.

Integration with Smart Home Systems: The integration of residential security systems with smart home platforms has been a significant driver for market growth. This allows homeowners to manage their security systems through mobile applications, voice assistants, or central control panels, providing convenience, remote access, and automation features.

Demand for Video Surveillance Systems: Video surveillance systems, including security cameras, have been witnessing strong demand in the residential sector. The availability of affordable and easy-to-install cameras, coupled with increasing awareness of their benefits, has led to their widespread adoption for monitoring homes and deterring potential intruders.

Increasing Disposable Income and Urbanization: The growth of the middle class and increasing disposable income in emerging economies have played a role in the expansion of the residential security market. Urbanization trends and the proliferation of residential complexes and gated communities have also contributed to the demand for security systems.

The extensive adoption of IoT has led to the development of miniaturized sensors and improves the quality of the product along with consistency in automation systems. Moreover, development in smart sensing and actuating devices like ZigBee, ANT, and BLE has integrated IoT in residential security systems, thus leading to the development of smart homes.

The increased adoption of smart homes, which include smart security systems, is projected to drive demand for residential security systems. Smart security breakthroughs have resulted in improved security measures. Furthermore, new smart security solutions provide end-users additional control, from adjusting the thermostat to turning on or off lights or other appliances, thus, allowing them to save even more energy. Such advantages have boosted the market demand for smart security solutions in the residential sector around the world.

Other factors attributing to the growth of the residential security market include increased awareness regarding residential security solutions, entry of multiple-system operators, and a surge in the use of IP cameras for video surveillance.

Residential Security Market Challenges

The lack of accessibility and awareness about selecting the right solution, the threat to users' privacy, and the high installation and ownership cost of residential security systems are all important challenges impeding the growth of the residential security industry internationally.

Continuous monitoring and maintenance of digital data, as well as time-consuming analytic processes and experienced staff, are tough to come by. Time and energy are wasted due to faulty hardware and poor maintenance. Alarms that are falsely triggered and misleading interpretations are two of the most significant difficulties that the Residential Security market faces.

Residential Security Market Opportunities

Increased acceptance of Artificial Intelligence (AI) and machine learning in residential security systems

Artificial Intelligence (AI) has the ability to create market opportunities in the residential security and monitoring market. Furthermore, AI integrated with machine learning has the potential to reduce false alarms, improve anomaly detection and video analytics performance, and improve video verification and surveillance capabilities. This combination of security and monitoring systems has the opportunity to attract more customers.

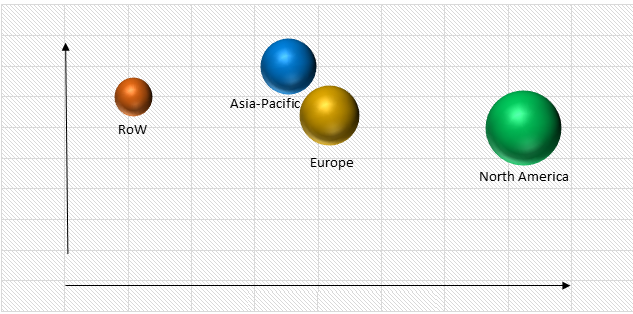

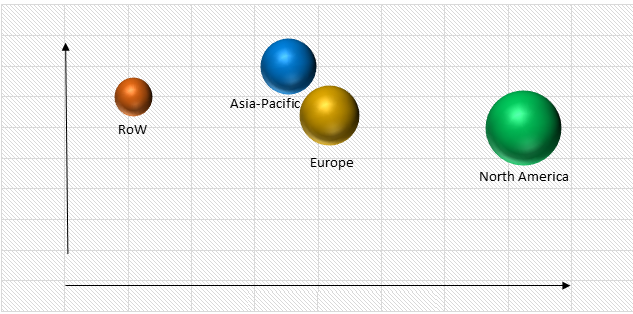

Residential Security Market Geographic Overview

Geographically, North America contributes the largest share in the residential security market owing to upgradation of infrastructure development in the video management sector, and the increased adoption of technologies such as IoT and cloud-based platforms. Massive investment in smart cities and the region beig hoem to prominent industry players will proliferate the market development of residential security solutions in the region.

Global Residential Security Market, By Region

Residential Security Market Competitive Insight

The global residential security market is extremely competitive owing to the presence of a large number of regional and international players. With such fierce rivalry, key players are continuously improving their products and services to satisfy increasing client demands. Moreover, To have a competitive edge, key players in the residential security market are forming strategic collaborations, launching new products, and expanding geographically.

Alarm.com is one of the prominent industry leader in smart home security systems, offering solutions to protect, monitor, and automate home. Alarm.com's technology allows millions of individuals and companies to manage and control their property from anywhere, thus the most popular platform for smart connected devices. Through their apps and interfaces, the platform integrates with an increasing number of IoT devices. Their network of thousands of professional service providers in North America and worldwide can provide security, video, access control, intelligent automation, energy management, and wellness solutions.

With renowned brands including CISA®, Interflex®, LCN®, Schlage®, SimonsVoss®, and Von Duprin®, Allegion is a global pioneer in seamless access. Allegion secures people and assets with a range of solutions for homes, businesses, schools, and organizations that focus on security surrounding the door and nearby areas.

Recent Development by Key Players

In April 2022, Stanley Access Technologies LLC ("Access Technologies") and assets linked to the automatic entrance solutions business from Stanley Black & Decker, Inc. have been acquired by Allegion plc, prominent worldwide security products, and solutions supplier, for $900 million in cash.

Ambient Insights for alarm response is a new solution offered by Alarm.com in August 2021 that detects activities surrounding the property and sends contextual information to monitoring stations in the event of an alarm. This real-time data can help monitoring stations prioritize alarms and send police, fire, and emergency medical services to properties faster. Ambient Insights also provides for a larger spectrum of emergency responses and lowers false alarm dispatches.

Key Players Covered in the Report

Some of the major industry players functioning in the global residential security industry are Bosch Security Systems Inc, Allegion PLC, Control4 Corporation, Honeywell Security Group, Alarm.Com, Nortek Security & Control LLC, United Technologies Corporation, Ingersoll Rand, and Godrej & Boyce Mfg. Co. Ltd.

The Residential Security Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Product

- Smart Locks

- Security Cameras

- Fire Sprinklers & Extinguishers

- Sensors

- Security Alarms

- By Solution

- System

- Fire Protection System

- Video Surveillance System

- Access Control System

- Entrance Control System

- Intruder Alarm System

- Services

- Security System Integration Services

- Remote Monitoring Services

- Fire Protection Services

- Video Surveillance Services

- Access Control Services

- By Residential Type

- Independent Residential

- Apartment

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.jpg)

.png)