| Status : Published | Published On : Dec, 2023 | Report Code : VRAT9614 | Industry : Automotive & Transportation | Available Format :

|

Page : 200 |

Global Test Automation Systems for Powertrain Dynamometer Market – Analysis and Forecast (2025-2030)

Industry Insight by Communication (Mobile, FlexRay, Web, Embedded Software (Modbus, Profibus, EtherCAT, and Others), CAN Bus (Digital IO Module, Analog IO Module, Remote IO Module, ECU Connection (J1939), and TCU Connection (Linux Based), and Others), by Propulsion (Internal Combustion Engine (IC) and Electric (Battery Electric, Hybrid Electric, and Plug-In Hybrid Electric)), by Testing Type (Durability Tests, Performance Tests, Vehicle Simulations, and Others), by Vehicle Type (Passenger Vehicles, Light Commercial Vehicle, Heavy-Duty Truck, Bus & Coach, Motorcycle, Power Generation Set, Motorsports (Autocross, Hill Climb, Karting, Circuit Racing, Rallycross, and Others), Powersports (Snowmobile, Trikes, ATVs, UTVs, Jet Skis, and Others), and Agricultural Vehicle (Less Than 30HP, 30-100 HP, 101-200 HP, and More Than 200 HP), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Test Automation Systems For Powertrain Dynamometer Market is anticipated to grow from USD 0.639 billion in 2023 to USD 1.07 billion by 2030, registering a CAGR of 5.78% during the forecast period by 2030.

Powertrain dynamometer test automation systems are integrated interfaces for performing, manipulating, recording, and analyzing various tests in test rigs. These technologies help technicians, engineers, and scientists run various experiments with more precision and in less time and offer safety, durability, long life, and high performance. Continuous technical improvements in the automotive sector, which have resulted in the advent of new-age vehicles, along with constantly changing transportation rules have raised the necessity for rigorous testing. As a result, the volume of testing operations, workload, and complexity are growing, propelling the global test automation systems for the powertrain dynamometer market forward.

The COVID-19 pandemic has hindered the growth of various industry verticals globally and has posed various challenges to sustaining the market. Vehicle production has been temporarily halted owing to stringent lockdowns by the government to stop the spread of infectious coronavirus, resulting in a loss of revenue to the businesses. As a result, there is a decrease in demand and usage of test automation systems for dynamometers.

Test Automation Systems for Powertrain Dynamometer Market Segmentation

Insight by Communication

Based on communication, the global test automation systems for the powertrain dynamometer market are divided into Mobile, FlexRay, Web, Embedded Software, CAN Bus, and Others. The embedded software is subdivided into Modbus, Profibus, EtherCAT, and Others. The CAN bus is subdivided into a Digital IO Module, Analog IO Module, Remote IO Module, ECU Connection (J1939), and TCU Connection (Linux). The CAN Bus contributes to the largest share in the market owing to its lower cost, robustness, speed, and flexibility and defines the frame structure involving multiple protocol layers. Moreover, CAN (controlled area network) involves standards that specify how communication occurs, how the wiring is built, and how messages are created. Thus, the whole system is called the CAN bus. The mobile and web communication category is anticipated to grow at a high CAGR due to remote working capabilities. Moreover, the installation and commission of electric powertrain test systems and training and technical support are offered to customers remotely to achieve high test demands.

Insight by Propulsion

Based on propulsion, the test automation system for the powertrain dynamometer market is bifurcated into internal combustion engine (IC) and electric. The electricity is further divided into battery electric, hybrid electric, and plug-in hybrid electric. The electric dominates the test automation system for the powertrain dynamometer market as it tests break-in, durability, high load, transient, and steady-state temperature, and noise, vibration, and harshness. For instance, SAKOR technologies Hybrid/Electric Vehicle Powertrain Dynamometer Test System (HEViDyne) offers a complete solution for performance, efficiency, and durability testing on all-electric vehicles. Moreover, HEViDyne is power efficient and saves thousands of dollars in operating costs per year for the customers.

Insight by Testing Type

Based on testing type, the test automation systems for the powertrain dynamometer market are divided into durability tests, performance tests, vehicle simulations, and others. Performance testing contributes to a significant proportion of the global test automation systems for the powertrain dynamometer market owing to the increasing severity of vehicle regulations. For instance, the Horiba FQ series (Fuel Flow Measurement Systems) measures a vehicle’s fuel flow via a precise system that can conduct stationary and transient tests. High reproducibility and run cycle measurements in real-world settings, including WLTP, are also possible. The systems are suitable for a wide range of applications that include durability, mapping, performance testing, and climate and emissions tests and can use either the positive displacement principle or the Coriolis measurement concept.

Insight by Vehicle Type

Based on vehicle type, the test automation systems for the powertrain dynamometer market are divided into passenger vehicles, light commercial vehicles, heavy-duty trucks, buses & coaches, motorcycles, power generation sets, motorsports, Powersports, and agricultural vehicles. The motorsports are subdivided into autocross, hill climbing, karting, circuit racing, rallycross, and others. The Powersports are subdivided into a snowmobiles, trikes, ATVs, UTVs, jet skis, and others. The agriculture vehicle is subdivided into less than 30 HP, 30-100 HP, 101-200 HP, and more than 200 HP. The passenger vehicle dominates the global test automation systems for the powertrain dynamometer market owing to the increased production, continuous development of next-generation vehicles, and R&D activities on passenger vehicles. Furthermore, there will be significant growth in the sale of agricultural vehicles owing to the surging demand for food and a relative decrease in agricultural land, resulting in the mechanization of the agricultural sector and propelling the sale of tractors, harvesters, and other farm machinery.

Global Test Automation Systems for Powertrain Dynamometer Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 0.639 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 1.07 Billion |

|

Growth Rate |

5.78% |

|

Segments Covered in the Report |

By Communication, By Propulsion, By Testing Type, and By Vehicle Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Test Automation Systems for Powertrain Dynamometer Industry Trends

The mounting regulations and stringent guidelines by transport regulation agencies have propelled the performance and emission testing level of vehicles. For example, in 2021, China and India introduced new emission standards, China 6 and BS-VI, respectively, the US Environmental Protection Agency has recommended strengthening federal greenhouse gas (GHG) emissions regulations for passenger cars.

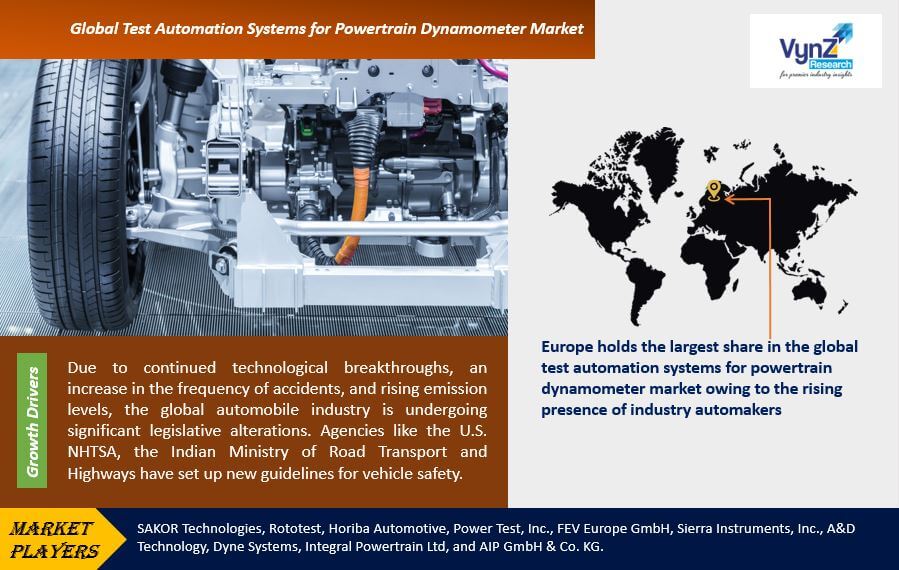

Test Automation Systems for Powertrain Dynamometer Market Growth Drivers

Due to continued technological breakthroughs, an increase in the frequency of accidents, and rising emission levels, the global automobile industry is undergoing significant legislative alterations. Agencies like the U.S. NHTSA, and the Indian Ministry of Road Transport and Highways have set up new guidelines for vehicle safety. This has resulted in the rising demand for sophisticated powertrain variants by automotive companies. Also, the test volumes that include extensive and complex test cycles have increased owing to the stringent global legislation. This resulted in the adoption of automated test systems to perform repetitive and complex tests. Several powertrain dynamometer manufacturers, like Horiba and AVL, are equipping their test cells with cutting-edge automation systems that give operators real-time data and test control. As a result, the requirement for testing infrastructure optimization to comply with changing laws is propelling the global test automation systems for the powertrain dynamometer market forward. Furthermore, automakers are constantly updating their vehicle models by incorporating cutting-edge technologies. The continuing development of new-generation automobiles with innovative powertrains adds to the testing demand and increases the test complexity. As a result, automotive firms, as well as regulatory agencies, research institutes, and service stations, are implementing test automation systems to keep up with the increase in the number and complexity of vehicle tests.

Test Automation Systems for Powertrain Dynamometer Market Challenges

The increasing cost and complexity of maintaining extra components will add to the cost of test rigs and hamper the growth of the global test automation systems for the powertrain dynamometer market.

The electronic chip shortage amid the COVID-19 outbreak has affected the vehicle's production and test automation systems, thus hurting the global test automation systems for the powertrain dynamometer market.

Test Automation Systems for Powertrain Dynamometer Market Opportunities

The continuous novelties in sensor systems cohesive of high-frequency telemetry technology that aids remote monitoring, recording, or controlling of dynamometer test cells and sophisticated computing technologies like artificial intelligence, Big Data, and cloud improve the analytical performance of automation systems will provide significant growth and investment opportunities for auto manufacturers to develop automation testing for powertrain dynamometers.

Test Automation Systems for Powertrain Dynamometer Market Geographic Overview

Europe holds the largest share in the global test automation systems for powertrain dynamometer market owing to the rising presence of industry automakers, rigorous emission & safety regulations for vehicles, and their research and development laboratories in the region. Moreover, the development of the motorsports industry and motorsports events like rallycross and circuit racing will fuel the growth in the region. These motorsports events have led to increasing testing on vehicles by the teams, resulting in increased demand for test automation systems for powertrain dynamometers

Test Automation Systems for Powertrain Dynamometer Market Competitive Insight

The industry players are making innovations to perform rapid, flexible, customizing, and tailoring according to the needs of testing applications. They are evolving platforms that aid operational personnel in recording data, analyzing and compiling the test programs, and automatically protecting the test facility against out-of-limit operations.

HORIBA has experience in offering automotive test system solutions. They are evaluating vehicle powertrain components such as the engine, transmission, clutch, torque converter, axles, and brakes and include the entire vehicle. Actuators, sensors, controllers, and simulation and automation software make up these systems.

Some of the key players operating in the global test automation systems for the powertrain dynamometer market: SAKOR Technologies, Rototest, Horiba Automotive, Power Test, Inc., FEV Europe GmbH, Sierra Instruments, Inc., A&D Technology, Dyne Systems, Integral Powertrain Ltd, and AIP GmbH & Co. KG.

Recent Developments by Key Players

SAKOR Technologies (a provider of high-performance dynamometer systems) has provided its Electric Motor Efficiency Testing Dynamometer system to TÜV SÜD for testing and verifying the level of efficiency of electric motors in accordance with a variety of national and international standards, including IEC 60034-2-1; IEEE 112B; Canadian standard C390-93; and IS 12615.

Rototest has set a new standard for Powertrain Dynamometers. The business has offered time-saving and cost-effective solutions without compromising quality and measurement accuracy and is providing R&D to offer unprecedented flexibility to handle tomorrow's challenges. They are offering solutions in various applications including driveability, ADAS, EV/PHEV/HEV, RDE (Real Driving Emission), Road-to-lab, Intelligent Vehicle, HiL/ViL, and Powertrain Functional Testing.

The Test Automation Systems for Powertrain Dynamometer Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Communication

- Mobile

- FlexRay

- Web

- Embedded Software

- Modbus

- Profibus

- EtherCAT

- Others

- CAN Bus

- Digital IO Module

- Analog IO Module

- Remote IO Module

- ECU Connection (J1939)

- TCU Connection (Linux Based)

- Others

- By Propulsion

- Internal Combustion Engine

- Electric

- Battery Electric

- Hybrid Electric

- Plug-in Hybrid Electric

- By Testing Type

- Durability Test

- Performance Test

- Vehicle Simulation

- Others

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Duty Truck

- Bus & Coach

- Motorcycle

- Power Generation Set

- Motorsports

- Autocross

- Hill climb

- Karting

- Circuit Racing

- RallyCross

- Others

- Powersports

- Snowmobile

- Trikes

- ATVs

- UTVs

- Jet Skis

- Others

- Agricultural Vehicle

- Less than 30 HP

- 30-100 HP

- 101-200 HP

- More Than 200 HP

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Frequently Asked Questions

what are the challenges in the global test automation systems for the powertrain dynamometer market?

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com