| Status : Published | Published On : Apr, 2024 | Report Code : VRAT9598 | Industry : Automotive & Transportation | Available Format :

|

Page : 110 |

Global Automotive Ambient Lighting Market – Analysis and Forecast (2025-2030)

Industry Insights by Technology (Halogen, LED, Xenon), by Vehicle Type (Passenger Car, Light Commercial Vehicle (LCV), Bus, Truck) and By Geography (North America, Asia Pacific, Europe and Rest of the World)

Industry Overview

The global automotive ambient lighting market was valued at USD 4.1 billion in 2023 and is expected to reach USD 7.2 billion by 2030, growing at a CAGR of 8.5% during 2025-2030. The rapidly growing selling of ultra-luxury vehicles as a result of rising disposable income among the population is attributed to the growth of the automotive ambient lighting industry. The market's development is also aided by the easy availability of aftermarket solutions.

Automotive Ambient Lighting Market Segmentation

By Technology

• Halogen

• LED

• Xenon

By technology, LED is expected to dominate the global market. LED's rise can be attributed to a variety of factors, including a larger number of features such as improved energy efficiency when compared to previous lighting technology and the phase-out of commonly used halogen bulbs.

By Vehicle Type

• Passenger Car

• Light Commercial Vehicle (LCV)

• Bus

• Truck

In contrast to other vehicles such as LCVs, buses, and trucks, the passenger vehicle category has a higher penetration of advanced lighting. The automotive lighting market in this segment is expected to be driven by increasing passenger vehicle sales and consumers' willingness to pay more for cars. The segment's growth is likely to be fueled by year-over-year production growth.

By Region

• North America

• Asia Pacific

• Europe

• Rest of the World (RoW)

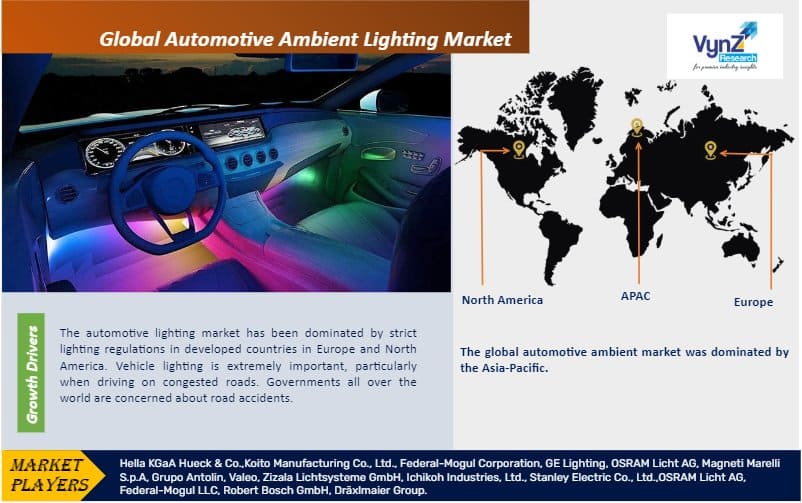

Due to rapid customer adoption and strong vehicle sales, Asia Pacific is expected to be the largest market in the global automotive lighting market. Because of their high domestic vehicle output and sales, China and Japan have the largest market shares. Furthermore, manufacturers in these countries place a high priority on technical advances, which include lighting, resulting in increased demand for automotive lighting. The demand will be pushed even further by rising customer per capita income and high SUV sales in emerging economies like India.

Global Automotive Ambient Lighting Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 4.1 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 7.2 Billion |

|

Growth Rate |

8.5% |

|

Segments Covered in the Report |

By Technology, By Vehicle Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe and Rest of the World |

Automotive Ambient Lighting Market Trends

During the forecast period, the dashboard ambient lighting market is expected to expand at the fastest CAGR in terms of volume. The market for center console ambient lighting is being driven by rising demand for ambient lighting and luxury vehicles.

The automotive ambient lighting industry has a bright future ahead of it, with prospects in passenger cars, light commercial vehicles, and hybrid vehicles.

Automotive Ambient Lighting Market Growth Drivers

The automotive lighting market has been dominated by strict lighting regulations in developed countries in Europe and North America. Vehicle lighting is extremely important, particularly when driving on congested roads. Governments all over the world are concerned about road accidents. Road traffic accidents kill 1.3 million people a year, according to the World Health Organization (WHO). The majority of countries lose 3% of their GDP due to traffic accidents. As a result, it's critical to improve driving conditions, which can be done in part by upgrading the lighting system. The European Union required daytime running lights (DRLs) on all new models of motor vehicles in 2011, with the aim of increasing road safety. According to the US Department of Transportation's National Highway Traffic Safety Administration (NHTSA), DRL has decreased fatal road accidents by around 14.2 percent. This type of regulatory regulation is expected to have an effect on the automotive lighting industry.

Automotive Ambient Lighting Market Opportunity

For automotive lighting manufacturers, matrix LED, OLED, and laser lighting are some of the latest and promising technologies. The high-beam assembly in matrix LED headlights is made up of 25 individual segments. The small LEDs operate with lenses, and reflectors linked in series are individually enabled, deactivated, or dimmed depending on the situation. As a result, the device is able to respond precisely to other vehicles. It uses a camera to identify other vehicles and brightly illuminates the lane. Audi's Matrix LED headlights, for example, get their data from a camera, the navigation system, and other sensors.

Automotive Ambient Lighting Market Challenges

Every day, commercial vehicles such as freight trucks travel thousands of miles. As a result, advanced lighting systems could be impractical. The high cost of advanced lighting systems deters manufacturers from offering them in this vehicle segment. As a result, only a few commercial vehicle manufacturers have equipped their vehicles with sophisticated lighting systems.

Automotive Ambient Lighting Market Competitive Insights

Hella GmbH & Co. KGaA is a German automotive parts supplier with headquarters in Lippstadt, North Rhine-Westphalia. The company develops and manufactures lighting, electronic systems and components for the automotive industry.

Federal-Mogul Corporation is an American manufacturer, developer and supplier of products for automotive, marine, commercial, aerospace, rail, and off-road vehicles along with agricultural, industrial and power-generation applications.

Key Players

• Hella KGaA Hueck & Co.

• Koito Manufacturing Co., Ltd.

• Federal-Mogul Corporation

• GE Lighting

• OSRAM Licht AG

• Magneti Marelli S.p.A

• Grupo Antolin

• Valeo

• Zizala Lichtsysteme GmbH

• Ichikoh Industries, Ltd.

• Stanley Electric Co., Ltd.

• OSRAM Licht AG

• Federal-Mogul LLC

• Robert Bosch GmbH

• Dräxlmaier Group

Recent Development by Key Players

KOITO MANUFACTURING CO., LTD. has acquired Cepton, Inc. (a Silicon Valley innovator and leader in high performance lidar solutions) to accelerate the commercialization of Cepton’s lidar technology through increased financial scalability and stability.

GE Lighting has collaboration with SmartThings to enhance home experiences by expanding connected smart lighting options for consumers to help revolutionize the connected kitchen experience creating customizable lighting that integrates seamlessly into users lifestyles.

The Automotive Ambient Lighting Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Technology

- Halogen

- LED

- Xenon

- By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Bus

- Truck

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Ambient Lighting Market