| Status : Published | Published On : Dec, 2023 | Report Code : VRAT9617 | Industry : Automotive & Transportation | Available Format :

|

Page : 250 |

Global Automotive Fabrics Market – Analysis and Forecast (2025-2030)

Industry Insight by Fabric Type (Polyester, Vinyl, Leather, Nylon, and Others), by Vehicle Type (Passenger Cars (Compact Passenger Cars, Mid-Sized Passenger Cars, Premium Passenger Cars, and Luxury Passenger Cars), Light Commercial Vehicles, Heavy Trucks, and Buses and Coaches), by Application (Pre-Assembled Interior Components (PRIC), Belts and Hoses, Car Roof, Floor Covering, Upholstery, Tires, Spray Adhesive, Airbags, Safety Belts, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Automotive Fabric Market was worth USD 33.45 billion in 2023 and is expected to reach USD 40.15 billion by 2030, growing at a CAGR of 4.9 percent by 2030.

Automotive fabrics are a special type of textiles that are woven, non-woven, knitted, coated, or composite materials and are soft, flexible, elastic, lightweight, and durable. Thus, providing an aesthetic look to the interior of the vehicle. They are also extremely strong and resistant to water, fire, and UV rays. Automotive fabrics are employed in the vehicle's acoustics to reduce noise and protect the inside from the outside environment. The four types of automotive materials most commonly used in vehicles are leather, vinyl, nylon, and polyester. Automobile industry innovations include the availability of automotive fabric in a variety of colors and textures for floor coverings, pre-assembled interior components (PRIC), and upholstery, all of which are expected to improve vehicle safety and efficiency. Furthermore, the Bharat National Car Assessment Programme (NCAP), the National Highway Traffic Safety Administration (NHTSA), and other safety agencies grade vehicles based on the safety features they contain. Such activities raise awareness of safety features, which is projected to promote the automotive fabric market's growth.

The COVID-19 epidemic had a huge influence on the automotive industry, resulting in a considerable drop in vehicle sales, a scarcity of raw materials, and other issues. Furthermore, the loss of car production around the world has had an impact on the automotive fabric market. Manufacturers have begun to diversify their businesses by producing PPE kits, face masks, and protection shields.

Automotive Fabrics Market Segmentation

Insight by Fabric Type

Based on fabric type, the global automotive fabric market is segregated into polyester, vinyl, leather, nylon, and others. Vinyl fabric type is growing at a faster pace and is an ideal alternative to the fabric as it is available in various textures and colors. While leather was once popular as an upholstery material, its weight, environmental impact, and link to animal cruelty have prompted automotive makers and consumers to look for alternatives. As a result, low-weight materials have become more popular in the market, as they are more cost-effective and have a more stunning appearance. Materials, particularly fabrics that make vehicle interiors safer, differ significantly from regular fabrics, and as a result, velour and vinyl have a substantial market share.

Insight by Vehicle Type

The global automotive fabric market is divided into four categories based on vehicle type: passenger cars, light commercial vehicles, heavy trucks, and buses and coaches. The passenger cars are divided into compact passenger cars, mid-sized passenger cars, premium passenger cars, and luxury passenger cars. Passenger cars are anticipated to contribute to the largest share in the automotive fabrics market owing to increased adoption in several applications as it offer high strength and elongation capability and are resistant to fire, water, and UV. Furthermore, the rising disposable income and increased sales post-COVID-19 pandemic as people will prefer to travel via private vehicles instead of public transport, thereby accelerating the growth of the segment.

Insight by Application

Based on application, the global automotive fabric market is segmented into pre-assembled interior components (PRIC), belts and hoses, car roofs, floor covering, upholstery, tires, spray adhesives, airbags, safety belts, and others. Floor covering contributes to the largest share owing to the increased adoption of carpets to improve the interior appearance and noise and vibration absorbing qualities of carpets along with light and cost-efficiency will expand the floor coverings application segment in the automotive fabric market. Airbags are projected to be the fastest-growing segment owing to the rising demand for safety devices in automobile applications. Furthermore, the mandatory safety features of adopting airbags in automobiles will further propel the growth of the global automotive fabrics market.

Global Automotive Fabrics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 33.45 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 40.15 Billion |

|

Growth Rate |

4.9% |

|

Segments Covered in the Report |

By Fabric Type, By Vehicle Type, and By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Automotive Fabrics Industry Trends

The stringent safety regulations to adopt safety belts, airbags, and anti-lock braking systems are the trend prevalent in the market. The rising trends in automotive fabric also include the production of technically safe and germ-free fabric to be used in vehicles.

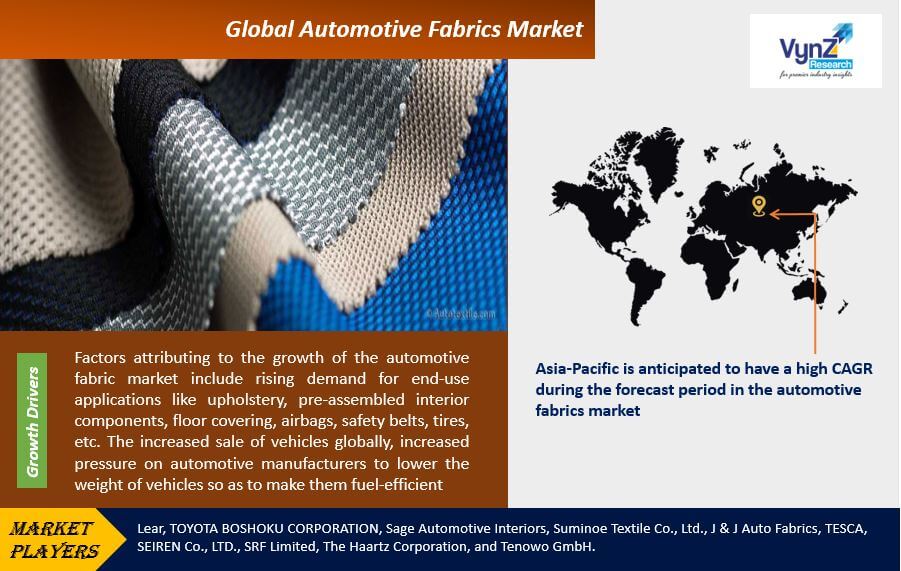

Automotive Fabrics Market Growth Drivers

Factors attributing to the growth of the automotive fabric market include rising demand for end-use applications like upholstery, pre-assembled interior components, floor covering, airbags, safety belts, tires, etc. The increased sale of vehicles globally, increased pressure on automotive manufacturers to lower the weight of vehicles to make them fuel-efficient, and rising demand for safety measures in automotive applications will drive the growth of the automotive fabrics market. Also, consumers demand technologically developed features that require less cost and maintenance and have a maximum number of interior applications, resulting in the growth of fabrics in vehicles. Furthermore, rising R&D activities associated with developed features like resistance to breakage & wear and elasticity will drive the demand for automobile accessories, resulting in the growth of the automotive fabrics market. Thus, the automotive fabric is resistant to UV radiation, and cold cracking, durable, easy to clean, and helps to reduce tiredness.

Automotive Fabrics Market Challenges

The increased raw material cost and mounting opposition to the use of leather will hamper the growth of the automotive fabrics market. Furthermore, the rising availability of substitute counterparts like PVC, natural leather, and synthetic leather and excessive HAP emissions will pose a challenge to the growth of the automotive fabric market.

Automotive Fabrics Market Opportunities

The rising demand for environment-friendly fabric material and lightweight automotive fabrics will decrease vehicle pollution and increased demand for safety and comfort among consumers will create opportunities for growth in the global automotive fabrics market. Moreover, there is an increase in the sale of automated vehicles worldwide and innovative technological growth in the automotive fabrics industry will further offer growth opportunities for the automotive fabric market during the forecast period.

Automotive Fabrics Market Geographic Overview

Asia-Pacific is anticipated to have a high CAGR during the forecast period in the automotive fabrics market owing to the rising population and rapid urbanization along with increased demand for automobiles will accelerate the growth of the automotive fabrics market. The increased economic growth, massive investment in industries such as automobiles, and rising passenger cars will drive the growth of the market. The region's demand for automotive fabric is expected to be boosted by the establishment of production bases, growth of manufacturing facilities, easy availability of raw materials, inexpensive labor, and low production costs.

Automotive Fabrics Market Competitive Insight

Automobile manufacturers and suppliers are striving to strengthen the safety features of various systems in automobiles. Furthermore, leather manufacturing companies are growing their operations and R&D facilities to take advantage of the most recent technological advancements. The global automotive fabric market has a limited number of players and is adopting strategies like M&A, Partnerships, new product launches, expansion, and agreements to sustain its position In the market.

Seiren has extended its automotive upholstery materials business by planning, developing, manufacturing, and distributing materials for automotive interior covers, decorative parts, airbags, and other applications under the concept of "Human and Earth Friendly Car Manufacturing." Their diverse goods span from fabric to artificial leather, synthetic leather, decorative parts, and functional, and airbag materials, and may be found not only in car seat coverings, but also in instrument panels, doors, console boxes, and ceilings.

SRF offers a comprehensive range of products for a wide range of applications in many industries such as architecture, lifestyle, sports, advertising, military, mines, food & agriculture, automobile, and transportation as a developer of PVC synthetic coated fabrics in India. Their coated fabrics are resistant to fire, weather, and UV stabilized, as well as abrasion and tear-resistant. These are waterproof, easy to build, install, and maintain, and are made of high-tenacity polyester yarn with a unique PVC formulation.

Toyota Boshoku Corporation designed the seats and other interior components for Toyota Motor Corporation's all-new Aqua, which was released last month.

Some of the industry players in the global automotive fabric market include Lear, TOYOTA BOSHOKU CORPORATION, Sage Automotive Interiors, Suminoe Textile Co., Ltd., J & J Auto Fabrics, TESCA, SEIREN Co., LTD., SRF Limited, The Haartz Corporation, and Tenowo GmbH.

Recent Developments by Key Players

Sage Automotive Interiors, Inc. and Asahi Kasei has decided to invest in NFW (US-based start-up ) a producer of non-petroleum-based leather alternative for car interiors. Based in Peoria, Illinois, NFW has developed the only platform capable of producing precision-engineered natural (non-petroleum-based) leather, foam, and textiles to replace animal and petrochemical-based materials. This investment shall enable to support global automotive OEMs in reducing the environmental burden of automobiles.

Lear Corporation (a Southfield, Mich.) specializing in automotive seating and e-systems has introduced a fully recyclable sueded material for seating and door panel applications.

The Automotive Fabrics Market report offers a comprehensive market segmentation analysis and estimates for the forecast period 2025–2030.

Segments Covered in the Report

- By Fabric Type

- Polyester

- Vinyl

- Leather

- Nylon

- Others

- By Vehicle Type

- Passenger Cars

- Compact Passenger Cars

- Mid-Sized Passenger Cars

- Premium Passenger Cars

- Luxury Passenger Cars

- Light Commercial Vehicles

- Heavy Trucks

- Buses and Coaches

- Passenger Cars

- By Application

- Pre-Assembled Interior Components (PRIC)

- Belts and Hoses

- Car Roof

- Floor Covering

- Upholstery

- Tires

- Spray Adhesive

- Airbags

- Safety Belts

- Others

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Fabrics Market