| Status : Published | Published On : Nov, 2024 | Report Code : VRAT4045 | Industry : Automotive & Transportation | Available Format :

|

Page : 113 |

China Electric Two-Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-scooters, E-bikes, E-motorcycles, Others), by Battery Type (Sealed Lead Acid, Li-ion, Ni-MH), by Battery Technology (Removable Battery, Non-removable Battery), by Voltage (24V, 36V, 48V, 60V, 72V) and By Geography (China)

Industry Overview

The Chinese electric two-wheeler market in 2023 USD 0.68 billion Units and is predicted to grow at 7.7% CAGR, with its fleet size reaching 2.2 billion Units by 2030.

The Chinese market is primarily driven by the increasing demand for electric scooters in the country, favourable government regulations, the presence of a large number of local players, and increasing investment in battery technology development. Different products including e-scooters and e-bikes are majorly contributing to the electric two-wheeler market size in China.

The market has witnessed significant demand for these products over the last few years with the increasing urbanization and increasing disposable income.

China Electric Two-Wheeler Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 0.68 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 2.2 Billion |

|

Growth Rate |

7.7% |

|

Segments Covered in the Report |

By Product, By Battery Type, By Battery Technology,By Voltage |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

China |

China Electric Two-Wheeler Industry Dynamics

China Electric Two-Wheeler Market Trends/ Growth Drivers:

The factors that fuel the growth of the of the electric-two-wheelers market in China includes the rising demand for electric scooters in the region, favorable government regulations, the presence of a large number of local players, and increasing investment in battery technology development. The Chinese Government is actively adopting policies for the replacement of its conventional fuel-operated vehicles fleet. Two-wheelers are comparatively easier to develop and manufacture at a low cost which ultimately leads to the growth of the Chinese electric-two-wheelers market.

China Electric Two-Wheeler Market Challenges:

Uncertain legislation for the regulation of electric two-wheelers s has led to uncertainty in the market. With the lack of regulations, the government in several cities of China is planning to ban or allow the usage of only licensed electric vehicles. This results in uncertainty in the market and thus hampers the manufacturing and adoption of these vehicles in the country.

Recent Developments by Key Players

Yadea Group Holdings (China) a prominent player in the electric two-wheeled vehicle industry has set its sights on the burgeoning two-wheeler market in the Philippines with plans to invest USD 1 billion in an e-motorcycle factory.

The company is planning to establish its presence in Batangas, south of Manila, with an annual production capacity of 3 to 5 million units to cater to domestic demand and explore export opportunities.

China Electric Two-Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the China Electric Two Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, battery type, battery technology and voltage.

Insight by Product

- E-scooters

- E-bikes

- E-motorcycles

- Others

Based on the product, the market is categorized into e-scooters, e-bikes, e-motorcycles, and others. E-scooters hold the largest share in the Chinese market, in terms of revenue as well as fleet size. E-scooters as indicated are electrically powered motorized vehicles, with a floorboard design that distinguishes it from e-motorbikes. The top speed of e-scooters is more than 25 km/hr and generally around 50km/hr.

Insight by Battery Type

- Sealed Lead Acid

- Li-Ion

- NiMH

On the basis of battery type, the market is segmented into sealed lead acid, Li-ion, and NiMH. Of all, sealed lead acid is the most common type of battery used in electric two-wheelers in China. The comparatively lower price of the sealed lead acid batteries and their high-power output makes them the preferable battery for the electric two-wheelers segment.

Insight by Battery Technology

- Removable Batteries

- Non-Removable Batteries

On the basis of battery technology, the market is categorized into removable batteries and non-removable batteries. Of both the categories, non-removable batteries are majorly used in the market as it is convenient for electric two-wheelers to plug in and charge batteries instead of removing and charging indoors.

Insight by Voltage

- 24V

- 36V

- 48V

- 60V

- 72V

Based on voltage, the market is segmented into 24V, 36V, 48V, 60V, and 72V. Of all, 48V electric two-wheeler holds the largest share in the Chinese electric two-wheeler market, followed by 36V two-wheelers. Most of the e-scooters run with a battery of 48V which provides it optimum power to perform better in the congested metropolitan cities of the country.

China Electric Two-Wheeler Market: Geographic Overview

Eastern China which includes economically developed provinces like Zhejiang, Jiangsu, and Shanghai dominates the market due to dense urban populations. In southern China regions like Guangdong lead in manufacturing and urban usage. Adoption of the vehicles in Northern China is driven by environmental policies in cities like Beijing. Western and Central China are the emerging markets due to government focus on rural electrification.

Competitive Insight

- Yadea Technology Group

- AIMA Technology Group Co. Ltd.

- Zhejiang Luyuan Electric Vehicle Co. Ltd

- Jiangsu Xinri E-Vehicle Co. Ltd. (SUNRA)

- Jiangsu Kingbon Vehicle Co. Ltd.

Market players in the Chinese electric two-wheeler industry are investing capital to develop low-cost electric two-wheelers with better performance to provide them with a distinctive advantage.

Jiangsu Kingbon Vehicle Co., Ltd. is a top supplier of electric three wheeler, tricycle, three wheeler auto parts in China. The supplier company is located in Xuzhou, Jiangsu and is one of the leading sellers of listed products.

AIMA Group produces and sells bicycles, electric bicycles, electric tricycles, electric four-wheeled vehicles (except automobiles), sightseeing vehicles (except automobiles), off-highway recreational vehicles, sports equipment and its parts manufacturing, research and development, processing and assembly, bicycle, electric bicycle, electric motorcycle and its parts sales and after-sales service.

The China Electric Two Wheeler Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

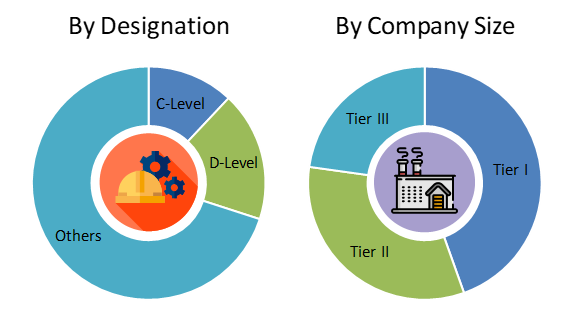

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

China Electric Two-Wheeler Market