| Status : Upcoming | Report Code : VRCH2017 | Industry : Chemicals & Materials | Available Format :

|

Global Battery Electrolyte Market – Analysis and Forecast (2025-2030)

Industry Insights by Battery Type and State of Electrolyte (Lead-Acid [Liquid Electrolyte, Gel Electrolyte], Lithium-Ion [Liquid Electrolyte]), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The global battery electrolyte market is expected to grow from USD 10.64 billion in 2023 to USD 25.36 billion in 2030 at a CAGR of 13.1% from 2025 to 2030.

A battery refers to the device that converts stored chemical energy to electrical energy. The main components of it are an anode, cathode, and electrolyte. The electrolyte serves as the chemical source for electricity generation. It releases ions when dissolved in a solvent or liquid. There are different chemical compounds used as electrolytes in batteries such as sodium chloride, sulfuric acid, nitric acid, chloric acid, sodium acetate, and others that help in electrochemical reactions needed by the battery to operate.

The battery electrolyte market is growing at a high rate due to higher adoption and sale of electric vehicles that essentially operate on advanced battery technologies. It is also attributed to the higher integration of alternative energy sources as well as the technological developments in electrolyte formulations.

The major hindrances to the growth of the global battery electrolyte market include the changingprices of raw materials and the regulatory uncertainties about environmental standards. However, growth opportunities are offered by the growing demand and developments in electrolyte technologies.

Battery Electrolyte Market Segmentation

Insight by Battery Type

The global battery electrolyte market is divided by battery typeinto lead-acid batteries and lithium-ion batteries. Among these two categories, the lithium-ion batteries category is expected to lead the market and grow at a higher rate during the forecast period due to the growing penetration and emphasis of various countries on electric vehicles. In addition, the growing focus of the government of various countries on lowering the carbon dioxide level in order to maintain a greener environment is also promoting the growth of this segment.

Insight by Electrolyte Type

The global battery electrolyte market is divided by electrolyte typeinto liquid, solid, and gel categories. Out of these three segments, the gel segment is expected to lead the market with a larger revenue share during the forecast period due to higher demand for advanced, high-energy-density, and safe rechargeable solid-state batteries. It is also attributed to the benefits offered in terms of the performancemaking them suitable for high-performance and innovative applications as well as the continuous development in gel electrolytes. On the other hand, the solid segment will also grow at a higher rate due to the growing demand, higher potential as next-gensolid-state batteries, improved safety, faster charging times, and durability.

Insight by Application

The global battery electrolyte market is also divided by applicationinto consumer electronics, automotive, energy storage, and other segments. Out of these the automotive segment will lead the market with a larger revenue share due to the growing environmental concerns about the harmful impacts of carbon emissions from vehicles using fossil fuels, rise in research & development activities, incentives and subsidies offered by governments of different countries to promote adoption of electric vehicles, and the easy availability of publicly accessible electric charging booths. On the other hand, the energy storage emerged will also grow faster due to the rise in environmental concerns over high carbon emissions from the global marine industry.

Global Battery Electrolyte Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 10.64 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 25.36 Billion |

|

Growth Rate |

13.1% |

|

Segments Covered in the Report |

by Battery Type and State of Electrolyte |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World |

Industry Dynamics

Industry Trends

The most notable trends of the global battery electrolyte market include the growing shift towards solid-state electrolytes and rise in the research and development efforts to design safer and high-energy-density batteries and the rise in demand for battery electrolytes due to the rapid adoption of electric vehicles worldwide. there is also a notable increase in the emphasis on sustainability and preference for environmentally friendly electrolyte formulations, advancements in lithium-ion technology, and growing deployment of battery storage solutions with renewable energy sources like solar and wind power.

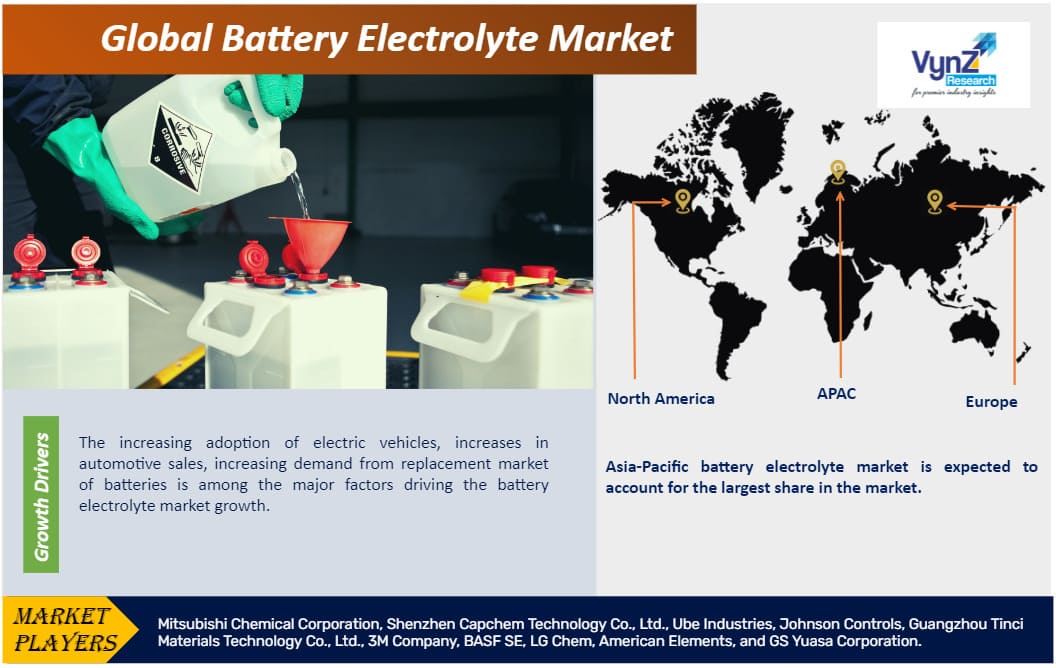

Battery Electrolyte Market Growth Drivers

The expanding deployment of energy storage solutionsis the major growth driver of the global battery electrolyte market. It is also attributed to the development and adoption of advanced technologies and spread of smart devices and their applications. In addition, the growing demand among the consumers for a compact and durable batteries also contribute to the market growth just as the favorable government initiatives to promote clean energy solutions.

Battery Electrolyte Market Challenges

The high initial cost of electric vehicles compared to traditional vehicles offer significant hindrance to the market growth. It is also attributed to the limited efficiency of the prevailing recycling technologies as well as the growing concerns over the environmental impacts. The complexity of integrating these advanced batteries into the existing infrastructure is also a reason for the sustained market expansion.

Battery Electrolyte Market Opportunities

Regulations worldwide targeting carbon emissions, safe disposal, and renewable energy goals are spurring innovation in the battery electrolyte market. These mandates drive demand for cleaner technologies, fostering new product developments. The increasing adoption of electric vehicles and energy storage systems also enhances growth prospects in the market.

Battery Electrolyte Market Geographic Overview

North America surpasses other region in terms of revenue and growth and will continue its dominance during the forecast period due to the rapid adoption of electric vehicles, supportive government incentives, higher investments in infrastructure, growing investments in renewable energy storage solutions, strict environmental and government regulations to promote clean energy technologies, growing investment in research and developments in battery technology, and strategic collaborations between industry players.

Asia-Pacific battery electrolyte market is expected to account for the largest share in the market during the forecast period due to the growing demand from end-user industries, and the growing number of telecom towers. It is also attributed to the increasing electrification in developing countries such as India and China are also driving the market growth in the region.

Battery Electrolyte Market Competitive Insight

Key companies are adopting various strategies such as acquisitions, expansions, mergers, research and development, and joint ventures in order to meet the increasing demand for battery electrolyte and also to expand their market presence and footprint.

Mitsubishi Chemical Group Corporation is a Japanese company formed in October 2005 from the merger of Mitsubishi Chemical Corporation and Mitsubishi Pharma Corporation. Mitsubishi Chemical America imports products developed and produced in Japan. Company cater to auto, aerospace, packaging, energy, and industrial industries.

Shenzhen Capchem Technology Co.,Ltd. develops, manufactures and sells electronic chemicals. The Company's products include electric capacitor chemicals and lithium ion battery chemicals.

Some of the key players operating in the global battery electrolyte industry are Mitsubishi Chemical Corporation, Shenzhen Capchem Technology Co., Ltd., Ube Industries, Johnson Controls, Guangzhou Tinci Materials Technology Co., Ltd., 3M Company, BASF SE, LG Chem, American Elements, and GS Yuasa Corporation.

Recent Developments by Key Players

Guangzhou Tinci Materials Technology (a China-based chemical manufacturing company that develops, manufactures and sells fine chemicals and new materials) has invested USD 280m to open a new plant in Morocco. The new factory will produce and sell lithium-ion (Li-ion) battery materials.

American Elements has launched AE Fusion Energy, a new production facility to meet growing demand for advanced materials associated with R&D & scaled production at its fusion energy partner customers.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Battery Electrolyte Market