| Status : Upcoming | Report Code : VRCH2020 | Industry : Chemicals & Materials | Available Format :

|

Global Diesel Exhaust Fluid Market – Analysis and Forecast (2025-2030)

Industry Insights by Storage Solution (Bulk Storage Tanks, Portable Containers, Dispenser), by Vehicle Type (Passenger, Commercial), by Application (Original Equipment Manufacturer, Aftermarket) and by Geography (North America, Europe, Asia-Pacific, Middle East and Rest of the World)

Industry Overview

Diesel Exhaust Fluid is a fluid which consists of high purity urea and de-ionized water mixed in a 1:2 solution, as this is required for the operation of selective catalyst reduction (SCR) technology. The fluid is colorless, non-flammable, non-toxic, and is harmless to any living being, however it is not a fuel additive. The global diesel exhaust fluid market is growing at a good pace and projected to witness a significant growth in the coming years, due to the increasing production of vehicles and to reduce the environment impact.

Selective catalyst reduction technology is among the major technology which is used in this type of solutions, as it reduce the emission from exhaust system. The solution of urea is consumed through the technology, which is then sprayed into the system. After that, the solution is burnt at high temperature which reduces the nitrogen oxides produced by diesel engines.

Diesel Exhaust Fluid Market Segmentation

Insight by Storage Solution

On the basis of storage solution, the diesel exhaust fluid market is segmented into bulk storage tanks, portable containers, dispensers, and others. Among all these, bulk storage tanks hold the largest share in the overall market. These tanks can hold 300 to 4,000 gallons of fluid. They are designed to support truck fleets of different sizes which provide easy refill access at the facility. Along with that, bulk storage tanks are made up of polyethylene plastic, stainless steel or fiberglass polyester, which ensures the quality of fluid, is protected.

Insight by Vehicle Type

Based on vehicle type, the diesel exhaust fluid market is classified into passenger vehicle and commercial vehicle. Commercial vehicles hold the largest market share in the market, owing to the rise in the rise of commercial vehicle activities.

Insight by Application

On the basis of application, the diesel exhaust fluid market is classified into original equipment manufacturer (OEM), and aftermarket. Among these two, aftermarket accounted for the larger share in the market, due to the increasing production vehicles and high penetration of vehicles with selective reduction technology.

Global Diesel Exhaust Fluid Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. xx Billion |

|

Revenue Forecast in 2030 |

U.S.D. xx Billion |

|

Growth Rate |

xx% |

|

Segments Covered in the Report |

by Storage Solution (Bulk Storage Tanks, Portable Containers, Dispenser), by Vehicle Type (Passenger, Commercial), by Application (Original Equipment Manufacturer, Aftermarket |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Diesel Exhaust Fluid Market Growth Drivers

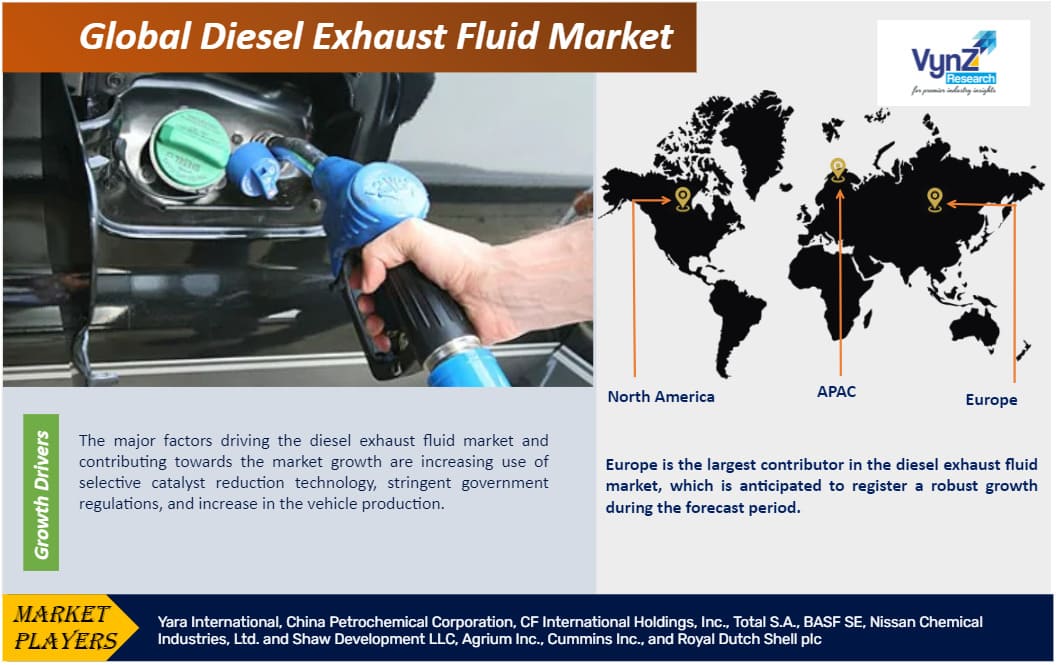

The major factors driving the diesel exhaust fluid market and contributing towards the market growth are increasing use of selective catalyst reduction technology, stringent government regulations, and increase in the vehicle production. The government of various countries has imposed various rules and regulation to encourage the use of this fluid, which is driving the market growth. For instance, American Petroleum Institute launched a diesel exhaust fluid certification program, which is designed to certify and monitor the characteristics of diesel exhaust fluid in motor vehicles and diesel engines.

Diesel Exhaust Fluid Market Challenges

Fluctuating cost of urea and diesel prices and increasing penetration of electric vehicles are the major restraints identified in the diesel exhaust fluid market. The penetration and adoption of electric vehicles is increasing at a fast pace in the developed countries such as Germany, Norway, and others, which is hindering the demand of the fluid in the market.

Diesel Exhaust Fluid Market Industry Ecosystem

With the advent of diesel exhaust fluid market, the new supply chain has been created. Firstly, there should be enough fluid to keep diesel powered vehicles running on the roads compliant with standards. Secondly, optimize the availability of the fluid to the end users, so that they can rely on it to keep their fleets complaint.

Diesel Exhaust Fluid Market Geographic Overview

Europe is the largest contributor in the diesel exhaust fluid market, which is anticipated to register a robust growth during the forecast period. According to European Automobile Manufacturers Association, more than 60% of passenger cars are run on diesel on European roads. This is attributed to the increasing demand of consumers for improved fuel efficiency which has encouraged the car buyers to invest in diesel engine vehicles, resulting in the market growth due to the increasing demand. Also, with a regulatory pressure for the improvement of air quality, manufacturers are also working toward improving the vehicle emission quality.

Diesel Exhaust Fluid Market Competitive Insight

Key players in the diesel exhaust fluid industry are investing significantly in the market in order to develop innovative solutions and capture a strong position in the market. Yara International, China Petrochemical Corporation, CF International Holdings, Inc., Total S.A., BASF SE, Nissan Chemical Industries, Ltd. and Shaw Development LLC, Agrium Inc., Cummins Inc., and Royal Dutch Shell plc are some of the major players operating in the diesel exhaust fluid market.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Diesel Exhaust Fluid Market