| Status : Published | Published On : Dec, 2023 | Report Code : VRFB11025 | Industry : Food & Beverage | Available Format :

|

Page : 225 |

Global Cheese Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (processed and natural), Source (animal and plants), Product Type (cheddar, mozzarella, parmesan, feta, and others), Form (block, spreadable, and others), Distribution Channel (supermarkets/hypermarkets, specialty stores, convenience stores, and online retail) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

Cheese is a dairy product crafted through a process of curdling milk, typically sourced from cows, goats, or sheep. Enzymes or acids are employed to coagulate the milk, separating it into solid curds and liquid whey. The curds undergo further processing, including pressing and aging, to develop distinct textures and flavors. Varied cheese types arise from differences in milk type, processing methods, and aging durations. Boasting a rich cultural history, cheese serves as a versatile culinary ingredient, elevating dishes globally. Its diverse profiles range from soft and creamy to hard and pungent, contributing to the gastronomic tapestry worldwide.

Global Cheese Market was worth USD 159 billion in 2023 and is expected to reach USD 215 billion by 2030 with a CAGR of 5.03% during the forecast period, i.e., 2025-2030. Growing demand for cheese is propelled by factors like its versatility in culinary applications, rising global population and urbanization, increased disposable incomes, and a burgeoning food industry. Additionally, evolving consumer tastes, preferences for convenient and ready-to-eat options, and the popularity of diverse cheese varieties contribute to sustained and expanding market demand.

Geographically, the global cheese market is expanding rapidly in North America, Europe, and the Asia Pacific due to changing dietary habits, increasing urbanization, rising incomes, and a growing preference for diverse and international cuisines. These regions witness a surge in demand for convenient, ready-to-eat, and high-quality cheese products; however, the market confronts constraints such as health concerns related to saturated fats, lactose intolerance, and dietary restrictions. Additionally, economic downturns, fluctuations in milk prices, and environmental concerns linked to dairy production contribute to consumer hesitancy. Overall, the cheese market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including food and beverages, hospitality, and other industries.

Market Segmentation

Insight by Type

Based on the type, the global cheese market is segmented into processed and natural. Processed segment dominated the global cheese market in 2023 due to its convenience, longer shelf life, and versatility. Consumers seek convenient, ready-to-use options, making processed cheese popular. Leading examples include Kraft Singles and Laughing Cow, known for consistent quality and easy use in various recipes. Processed cheese aligns with modern lifestyles, offering convenience without compromising taste. Its appeal in fast-food chains and packaged snacks further propels the segment, reflecting a preference for easily manageable, flavorful cheese products that cater to contemporary consumption patterns.

Insight by Source

Based on source, the global cheese market is segmented into animal and plants. Animal segment dominated the global cheese market in 2023 owing to its established popularity and traditional role in culinary practices. While plant-based alternatives are gaining traction, the majority of consumers still prefer the authenticity and taste of animal-based cheese. Recent product launches, like GOOD PLANeT’s olive oil-based cheese launch in September 2023, underscore the significance of animal-based cheese. Despite the rise of alternatives, the industry witnesses the substantial investments and innovations in enhancing traditional cheese, indicating sustained consumer demand and market dominance for animal-based cheese products.

Insight by Product Type

Based on product type, the global cheese market is segmented into cheddar, mozzarella, parmesan, feta, and others. Mozzarella dominated the global cheese market in 2023 due to its versatility and widespread use in popular dishes like pizza. Major pizza chains, such as Domino's and Pizza Hut, continue to drive mozzarella demand. A notable example is the strategic partnership between New Culture, an animal-free dairy company, and James Beard Award-winning chef Nancy Silverton, to launch the first-ever animal-free, dairy mozzarella to be available to consumers. While cheddar, parmesan, and feta have their niches, mozzarella's broad applicability and consistent demand in the thriving pizza industry contribute to its prominence, making it a key player in the global cheese market.

Insight by Form

Based on form, the global cheese market is segmented into block, spreadable, and others. Block cheese dominated the global cheese market in 2023 due to its versatility in culinary applications and extended shelf life. Major dairy companies, including Kraft Heinz and Arla, continually invest in block cheese production. For instance, Arla launched a range of block cheddar cheeses to meet diverse consumer preferences. While spreadable cheeses have their appeal, the enduring popularity of block cheese, its suitability for various recipes, and consistent demand contribute to its market dominance, reflecting consumer preferences for traditional and multipurpose cheese options.

Insight by Distribution Channel

Based on distribution channel, the global cheese market is segmented into supermarkets/hypermarkets, specialty stores, convenience stores, and online retail. Supermarkets/hypermarkets dominated the global cheese market in 2023, offering a diverse range of cheese varieties in a one-stop-shop setting. Major retail players like Walmart and Tesco contribute to this dominance through expansive selections and private-label offerings. Online retail is gaining traction, with Amazon Fresh and other platforms offering convenient access. The rise of specialty stores, such as Murray's Cheese, enhances consumer experiences but caters to niche markets. While convenience stores play a role in on-the-go consumption, the vast product availability, discounts, and convenience of supermarkets/hypermarkets sustain their leadership in the global cheese market.

Global Cheese Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2023 |

U.S.D. 159 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 253 Billion |

|

Growth Rate |

5.03% |

|

Segments Covered in the Report |

By Type, By Source, By Product Type, By Form, and By Distribution Channel |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Growth Drivers

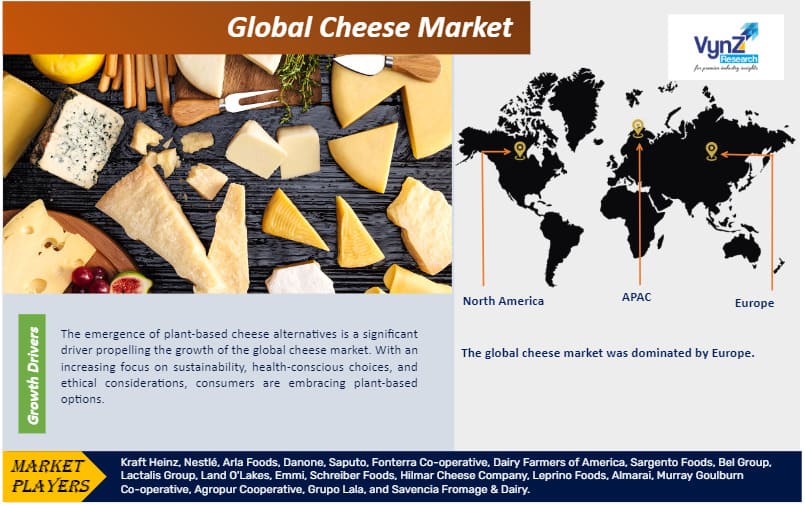

Emergence of Plant-Based Cheese Alternatives

The emergence of plant-based cheese alternatives is a significant driver propelling the growth of the global cheese market. With an increasing focus on sustainability, health-conscious choices, and ethical considerations, consumers are embracing plant-based options. Notable product launches, such as the introduction of Miyoko's Creamery's vegan mozzarella and cheddar, demonstrate the expanding market for plant-based cheeses. Investments in this sector are also evident, with companies like Beyond Meat partnering with various establishments such as PepsiCo and Pizza Hut, to offer plant-based cheese alternatives. In November 2023, Beyond Meat extended its partnership with Pizza Hut in the UK with the launch of its pepperoni in the country, which features in the Big New Yorker and Beyond Pepperoni Feast pizzas, as well as the Beyond Pepperoni Melt.

Moreover, strategic partnerships, like Violife partnering with Starbucks to introduce vegan cream cheese, showcase the integration of plant-based options into mainstream consumer outlets. The trend is indicative of a broader shift towards more sustainable and cruelty-free choices, influencing traditional cheese market dynamics. As plant-based alternatives become more accessible, innovative, and aligned with consumer values, they play a pivotal role in driving the overall expansion and diversification of the global cheese market.

Rising Demand for Gourmet and Artisanal Cheese

Escalating demand for gourmet and artisanal cheeses, fueled by evolving consumer preferences for unique flavors and high-quality products is a major driver for the growth of the global cheese market. The increasing interest in culinary exploration has prompted notable product launches and partnerships. For instance, in November 2023, Treeline, a plant-based cheese producer, launched Treeline Reserve – a new line of artisanal, “ultra gourmet” non-dairy cheeses with wo varieties – True Blue and Bloomy Rind. " targeting the premium market.

Additionally, investment trends highlight the industry's growth, with artisanal cheese producers securing funding for expansion. The sustained popularity of specialty cheese shops and exclusive partnerships underscores the premiumization trend, revealing a robust consumer inclination towards sophisticated, artisanal cheese varieties, propelling the global cheese market forward.

Challenge

Rising Obesity Around The Global

Growing obesity poses a significant challenge for the global cheese market as consumers increasingly prioritize health-conscious choices. High-fat content in cheese, often contributing to calorie-dense diets, aligns with concerns about weight management and obesity-related health issues. According to the World Obesity Atlas 2023, currently, 1 in 4 people (25%) have obesity and if the current trend continues, 51% of the global population will be living with either overweight or obesity by 2035. Therefore, changing consumer preferences towards healthier alternatives and dietary patterns challenge traditional cheese consumption. This trend impacts purchasing decisions, prompting a shift towards reduced-fat or plant-based cheese options. As public awareness of obesity-related health risks continues to rise, the cheese market faces the challenge of adapting to evolving dietary preferences to address the global health crisis associated with excessive calorie and fat intake.

Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global cheese market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global cheese market was dominated by Europe in 2023 due to its rich culinary traditions and diverse cheese varieties. Recent examples include French company Bel Group's investment in expanding its cheese production capacity, emphasizing the region's commitment to quality and innovation. Europe's strong cheese culture, coupled with the popularity of specialty cheeses, positions it as a key market player. Additionally, strategic partnerships, like Arla Foods collaborating with Starbucks in Europe to offer premium cheeses, showcase the region's significance in shaping global cheese trends and reinforcing its dominance in the market.

Competitive Insight

Kraft Heinz, is a major player in the global cheese market and is known for its continuous innovation and iconic product lines. Kraft Heinz consistently expands its product line to meet diverse consumer demands, as seen in the launch of its innovative cheese products like the "Big Box of Macaroni & Cheese." The company's investments in sustainable sourcing practices also align with evolving consumer values. Furthermore, strategic partnerships, such as the collaboration with a leading online grocery platform, highlight Kraft Heinz's commitment to adapting to changing market dynamics, solidifying its position as a forward-thinking industry leader in the global cheese market.

Arla Foods, another leading company in the global cheese market, positions itself as a key player through a commitment to sustainability and product innovation. The company launched a range of block cheddar cheeses, showcasing a response to evolving consumer preferences. Arla's significant investments in sustainable dairy farming and renewable energy further bolster its market standing. Strategic partnerships, such as the ongoing partnership with Starbucks since 2010, underline Arla's focus on premiumization and market expansion. Through a combination of sustainable practices, innovative product offerings, and strategic collaborations, Arla Foods strengthens its position as a socially responsible and forward-thinking leader in the global cheese industry.

Recent Development by Key Players

In December 2023, Saputo launched innovative cheese products under Montchevre and Frigo Cheese Heads brands. Montchevre unveiled Thai Sweet Chili Topped Goat Cheese, blending sweet red peppers, lime, garlic, and spices for a spicy goat cheese variant. Frigo Cheese Heads launched a new whole milk string cheese variety, providing a calcium source and 5g of protein. Both products will be available nationwide from January 2024 in select retailers, including Harris Teeter, Hannaford, HEB, and Stop & Shop, contributing to Saputo's diverse and appealing cheese product portfolio in the US market.

In December 2023, Rave Coffee and Paxton & Whitfield collaborated to create Kaldi, a unique coffee-matured goat's cheese. Aged in Paxton & Whitfield's Cotswolds maturation rooms near Rave's UK headquarters, Kaldi blends fruity and floral notes from Rave's coffee beans with the nutty flavor of goat's cheese. The innovative cheese, originating from Somerset Cheese Company, undergoes brine-washing, coffee coating, and approximately ten weeks of maturation. Kaldi is selected as Paxton & Whitfield's inaugural flavor-added cheese, showcasing a distinctive fusion of coffee and goat's cheese flavors.

Key Players Covered in the Report

Kraft Heinz, Nestlé, Arla Foods, Danone, Saputo, Fonterra Co-operative, Dairy Farmers of America, Sargento Foods, Bel Group, Lactalis Group, Land O'Lakes, Emmi, Schreiber Foods, Hilmar Cheese Company, Leprino Foods, Almarai, Murray Goulburn Co-operative, Agropur Cooperative, Grupo Lala, and Savencia Fromage & Dairy.

The Cheese Market Report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Source

-

Animal-Based

-

Cattle

-

Sheep

-

Goat

-

Camel

-

-

Plant-Based

-

Soya

-

Almond

-

Cashew

-

Others

-

-

By Type

-

Processed

-

Natural

-

By Product Type

-

Cheddar

-

Mozzarella

-

Parmesan

-

Feta

-

Others

-

By Form

-

Block

-

Hard

-

Soft

-

-

Spreadable

-

Others

-

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online Retail

Geographical Segmentation

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Cheese Market