| Status : Published | Published On : Dec, 2023 | Report Code : VRHC1203 | Industry : Healthcare | Available Format :

|

Page : 200 |

Global Minimally Invasive Gastrointestinal Surgical Systems Market – Analysis and Forecast (2025-2030)

Industry Insight by Product Type (Conventional Minimally Invasive Gastrointestinal Surgical Systems (MISS) (Endoscopes and Endoscopy Systems (Rigid Endoscopes, Flexible Endoscopes, and Capsule Endoscopy), Videoscopes, Endoscopic Ultrasound, Therapeutic Energy Devices) and Surgical Robots (Robotic Systems, Robotic Surgery Instruments and Accessories, and Services)), by Surgery Type (Adrenalectomy, Appendectomy, Bariatric Surgery, Cholecystectomy, Colon, and Rectal Surgery, Foregut Surgery, and Hernia Repair), by End-User (Specialty Clinics, Hospitals, and Ambulatory Surgical Centers), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Minimally Invasive Gastrointestinal Surgical Systems Market refers to the market for surgical systems and devices used in minimally invasive gastrointestinal (GI) procedures. Minimally invasive surgery, also known as laparoscopic surgery, involves performing surgical procedures through small incisions instead of large open incisions. The global minimally invasive gastrointestinal surgical systems market is witnessing substantial growth i.e., from USD 5.02 billion in 2023 to USD 9.34 billion by 2030, registering a CAGR of 6.7% during the forecast period 2025-2030.

The mounting cases of GI disorders, advantages offered by minimally invasive gastrointestinal surgery, mounting R&D investment, technological development in MIS and robotics-based surgeries, rising number of surgical processes owing to the rising geriatric population, and rising prevalence of chronic diseases are the factors that are the factors that bolster the growth of the global minimally invasive gastrointestinal surgical system market. Moreover, the rising geriatric population requires minimally invasive surgeries owing to less blood loss, postoperative mobilization, and reduced stay at hospitals and provides high precision and control during surgical procedures, resulting in the growth of the minimally invasive gastrointestinal surgical system market.

The COVID-19 pandemic has had an adverse effect on the global economy and public health. The virus has forced organizations to change the way businesses operate. Robotic assistance can be adopted in the Minimally Invasive Gastrointestinal Surgical System during the pandemic. Moreover, the rising pressure to hospitalize COVID-19 patients has led to the re-profiling of various hospitals and departments to treat COVID-19 patients. This led to the cancellation or postponement of elective surgeries owing to limited capacities and resources.

Market Segmentation

Insight by Product Type

Based on product type, the minimally invasive gastrointestinal surgical systems market is divided into conventional minimally invasive gastrointestinal surgical systems (MISS) and surgical robots. The conventional minimally invasive gastrointestinal surgical systems (MISS) are subdivided into endoscopes and endoscopy systems, video scopes, endoscopic ultrasounds, and therapeutic energy devices. The endoscopes and endoscopy systems are further subdivided into rigid endoscopes, flexible endoscopes, and capsule endoscopy. The surgical robots are subdivided into robotic systems, robotic surgery instruments, and accessories, and services. Endoscopes and Endoscopy are widely used in Minimally Invasive Gastrointestinal Surgical Systems (MISS) and have significant growth as it allows clinicians to examine the structure inside the body like urethra, GI tract, esophagus, stomach, small intestine, and colon. Moreover, the provides clinicians to perform keyhole surgeries and make small precision through Minimally Invasive surgery.

Insight by Surgery Type

Based on surgery type, the minimally invasive gastrointestinal surgical systems market is divided into adrenalectomy, appendectomy, bariatric surgery, cholecystectomy, colon, and rectal surgery, foregut surgery, and hernia repair. Appendectomy is a surgery that is done when the appendix becomes infected and inflamed, there is a need to remove it, and is anticipated to grow at a faster pace owing to the rising prevalence of appendicitis and growing demand for diagnostic and treatment options for appendicitis. The colon and rectal surgery segment is also anticipated to grow at a high CAGR as it treats conditions of the larger intestine (colon, rectum, and anus). Moreover, rising incidences of colorectal cancer due to unhealthy food habits and odd food consumption timings, rising number of clinical trials to innovate new drugs, and growing geriatric population are the factors for the growth of the colon and rectal surgery segment.

Insight by End-User

Based on end-user, the global minimally invasive gastrointestinal surgery market is categorized into specialty clinics, hospitals, and ambulatory surgical centers. The ambulatory surgical center is an imperative part as it provides a safe, patient-friendly, and cost-effective environment for the establishment of healthcare services such as colorectal cancer screening coloscopy.

Global Minimally Invasive Gastrointestinal Surgical Systems Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 5.02 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 9.34 Billion |

|

Growth Rate |

6.7% |

|

Segments Covered in the Report |

By Product Type, By Surgery Type and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Growth Drivers

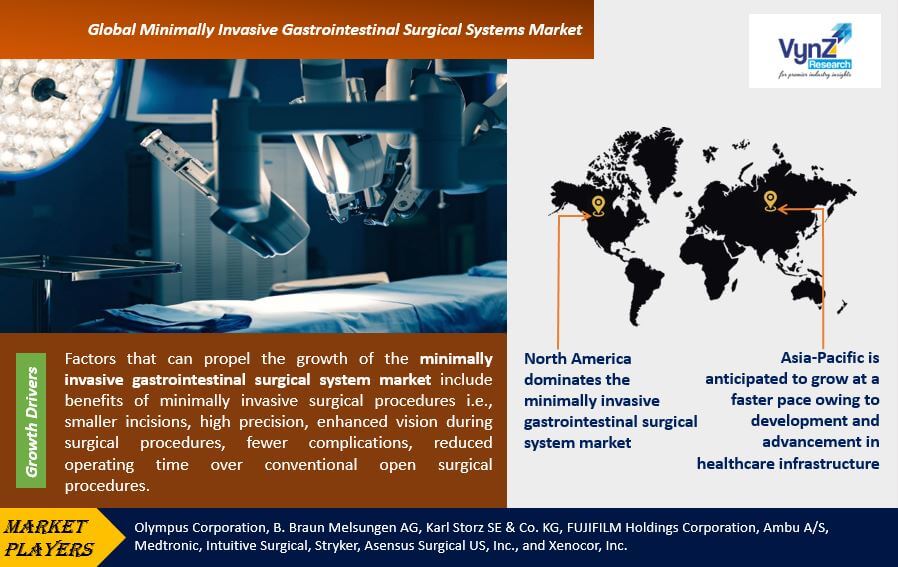

Factors that can propel the growth of the minimally invasive gastrointestinal surgical system market include benefits of minimally invasive surgical procedures i.e., smaller incisions, high precision, enhanced vision during surgical procedures, fewer complications, reduced operating time over conventional open surgical procedures. Moreover, accessibility of technologically developed products in the field of GI surgical procedures, mounting spending on healthcare, rising complexities in clinical decision-making, increasing workload of radiologists, and increasing adoption of robotics in GI surgical procedures are the other factors that have bolstered the growth of minimally invasive gastrointestinal surgical system market.

Challenges

Lack of trained professionals, the huge cost involved in minimally invasive GI surgical procedures, restraining reimbursement framework are the challenges that have hampered the growth of the minimally invasive gastrointestinal surgical system market.

High cost: Minimally invasive surgical systems often involve sophisticated technology and specialized equipment, which can be expensive to acquire and maintain. The high cost of these systems can pose a challenge for healthcare providers and limit their adoption in some healthcare settings.

Training and expertise: Performing minimally invasive gastrointestinal surgeries requires specialized skills and training. Surgeons need to be proficient in using the surgical systems and interpreting the visual feedback provided by the imaging technologies. Training a sufficient number of surgeons to perform these procedures can be time-consuming and may lead to slower adoption rates.

Limited availability and access: The availability of minimally invasive gastrointestinal surgical systems may be limited in certain regions or healthcare facilities, particularly in resource-constrained settings. This can result in uneven access to these advanced technologies and procedures, leading to disparities in patient care.

Technical limitations: Although minimally invasive surgical systems have made significant advancements, they still have some technical limitations. For example, the systems may have restricted range of motion or limited dexterity compared to traditional open surgeries. These limitations can make certain complex procedures challenging or impractical to perform using minimally invasive techniques.

Opportunities

The increasing mergers & acquisitions to expand surgical robotic systems, advancement of long-distance teleoperated surgical robotic systems, rising investment geographically, and technological development of surgical robotic systems will create lucrative opportunities in the minimally invasive gastrointestinal surgical system market.

Geographic Overview

North America dominates the minimally invasive gastrointestinal surgical system market owing to the rising prevalence of GI disorders, advantages of minimally invasive GI surgery, massive R&D investment, technological development in MIS, and robot-based surgeries.

Asia-Pacific is anticipated to grow at a faster pace owing to development and advancement in healthcare infrastructure, promising results in surgery assistance will fuel the growth of the minimally invasive gastrointestinal surgical system market in the region.

Competitive Insight

The industry players are focusing on collaboration, alliances, business expansion, mergers & acquisitions, and partnerships with companies and universities, and research institutes to develop and innovate minimally invasive gastrointestinal surgical systems and strengthen their position in the market.

Ambu Inc. has received approval from Health Canada for aScope 4 Cysto, a single-use endoscopes platform for urology.

FUJIFILM Medical Systems U.S.A., Inc., announced the launch of the new ELUXEO Surgical System, an innovative equipment tower comprised of products from the company’s endoscopy and minimally invasive surgery portfolios.

Some of the key players operating in the minimally invasive gastrointestinal surgical system market: Olympus Corporation, B. Braun Melsungen AG, Karl Storz SE & Co. KG, FUJIFILM Holdings Corporation, Ambu A/S, Medtronic, Intuitive Surgical, Stryker, Asensus Surgical US, Inc., and Xenocor, Inc.

The Minimally Invasive Gastrointestinal Surgical Systems Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Product Type

- Conventional Minimally Invasive Gastrointestinal Surgical Systems (MISS)

- Endoscopes and Endoscopy Systems

- Rigid Endoscopes

- Flexible Endoscopes

- Capsule Endoscopy

- Endoscopes and Endoscopy Systems

- Videoscopes

- Endoscopic Ultrasound

- Therapeutic Energy Devices

- Surgical Robots

- Robotic Systems

- Robotic Surgery Instruments and Accessories

- Services

- Surgical Robots

- Conventional Minimally Invasive Gastrointestinal Surgical Systems (MISS)

- By Surgery Type

- Adrenalectomy

- Appendectomy

- Bariatric Surgery

- Cholecystectomy

- Colon and Rectal Surgery

- Foregut Surgery

- Hernia Repair

- By End-User

- Specialty Clinics

- Hospitals

- Ambulatory Surgical Centers

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Minimally Invasive Gastrointestinal Surgical Systems Market