| Status : Upcoming | Report Code : VRICT5080 | Industry : ICT & Media | Available Format :

|

Global Satellite Communication (SATCOM) Equipment Market – Analysis and Forecast (2025-2030)

Industry Insights by Product (Satcom Transmitter/Transponder, Satcom Antenna, Satcom Receiver, Satcom Transceiver, Satcom Modem/Router, and Others), by Vertical (Commercial and Government & Defense), by Technology (Satcom-On-The-Pause (SOTP), Satcom Vsat, Satcom Automatic Identification System, Satcom-On-The-Move (SOTM), and Satcom Telemetry), and by End User (Land Fixed Satcom Equipment, Portable Satcom Equipment, Maritime Satcom Equipment, Land Mobile Satcom Equipment, and Airborne Satcom Equipment)

Industry Overview

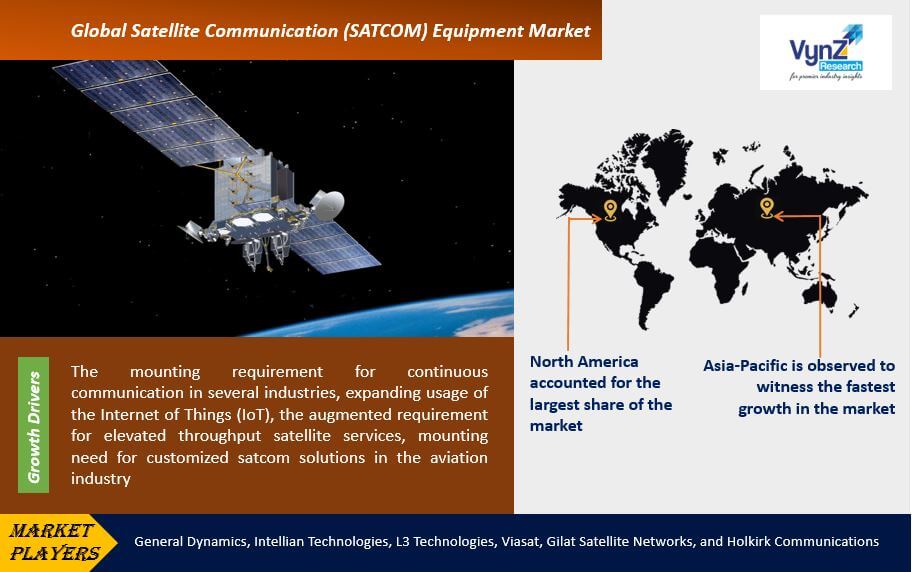

Satellite communication equipment is expended in an extensive range of applications, such as military, telecommunications, weather monitoring, and navigation. The mounting requirement for continuous communication in several industries and augmented requirement for elevated throughput satellite services are the factors driving the growth of the global satellite communication equipment.

Different products such as Satcom transmitter/transponder, satcom antenna, satcom receiver, satcom transceiver, and satcom modem/router contributed to the satellite communication equipment market size. The market has witnessed a high demand for the satcom transceiver segment due to the mounting usage of satellites for navigational purposes and surveillance by defense authorities.

Satellite Communication (SATCOM) Equipment Market Segmentation

Insight by Product

On the basis of the product, the market is subdivided into satcom transmitter/transponder, satcom antenna, satcom receiver, satcom transceiver, satcom modem/router, and others. Of all the products, the satcom transceiver segment accounted for the largest share and is expected to grow at the fastest rate in the market due to the mounting usage of satellites for navigational purposes and surveillance by defense authorities.

The satcom transmitter/transponder is further subdivided into an upconverter, encoder, modulator, and high-power amplifier. In addition, the Satcom receiver is further subdivided into a down converter, low-noise amplifier, demodulator, and decoder.

Insight by Vertical

On the basis of the vertical, the market is subdivided into commercial and government & defense. Among both verticals, the commercial segment accounted for the larger share of the market, due to the constant decrease in the price of SATCOM systems. The commercial segment is further subdivided into transportation & logistics, telecom & IT, media & entertainment, scientific research & development, and others. The telecom & IT segment accounted for the largest share of the market.

In addition, the government & defense segment is further subdivided into military, public safety, and homeland security & emergency management.

Insight by End User

On the basis of the end user, the market is subdivided into land-fixed satcom equipment, portable satcom equipment, maritime satcom equipment, land mobile satcom equipment, and airborne satcom equipment. Among all end users, the maritime satcom equipment segment accounted for the largest share in the market. In addition, the land mobile satcom equipment segment is expected to grow at the fastest rate in the market, as it is used to attain real-time data during warfare, and mounting usage by military forces to deliver improved strategic radio network competencies.

The portable satcom equipment segment is further subdivided into manpack, handheld, and deployable/flyaway. In addition, the land fixed sitcom equipment segment is further subdivided into command & control centers, and earth stations. The land mobile sitcom equipment segment is further subdivided into commercial vehicles, emergency vehicles, unmanned ground vehicles, military vehicles, and trains.

The maritime sitcom equipment segment is further subdivided into military ships, commercial ships, and unmanned maritime vehicles. Moreover, the airborne satcom equipment segment is further subdivided into military aircraft, commercial aircraft, and unmanned aerial vehicles (UAV). The portable satcom equipment segment is further subdivided into the handheld, deployable/flyaway, and manpack.

Insight by Technology

On the basis of the technology, the market is subdivided into Satcom-On-The-Pause (SOTP), Satcom Vsat, Satcom Automatic Identification System, Satcom-On-The-Move (SOTM), and Satcom Telemetry.

Global Satellite Communication (SATCOM) Equipment Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. XX Billion |

|

Revenue Forecast in 2030 |

U.S.D. XX Billion |

|

Growth Rate |

XX% |

|

Segments Covered in the Report |

By Product, By Vertical, By End User, and By Technology |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

Usage of extensive v band for satellite communication, controller-pilot data link communication (CPDLC), multiband tactical communication amplifiers, expansion of satcom on the move (SOTM) antennas, growth of small satellite constellations to improve communication, usage of huge reflectors for elevated speed broadcast, and active direct radiating array technologies are the trends in the satellite communication equipment market.

The SATCOM equipment market is driven by the growing demand for reliable and high-speed communication services across various industries, including telecommunications, government and defense, aviation, maritime, oil and gas, and media and entertainment. Additionally, advancements in satellite technology, such as the deployment of high-throughput satellites (HTS), are further fueling market growth.

Satellite Communication (SATCOM) Equipment Market Growth Drivers

The mounting requirement for continuous communication in several industries, expanding usage of the Internet of Things (IoT), the augmented requirement for elevated throughput satellite services, mounting need for customized satcom solutions in the aviation industry, escalating usage of satcom equipment in space exploration, telemetry, and telecommunication, expanding requirement for customized satcom solutions in the maritime industry, and a mounting fleet of independent and connected vehicles are the primary growth drivers for satellite communication equipment market.

Growing demand for high-speed data connectivity: With the proliferation of data-intensive applications and the need for real-time communication, there is a rising demand for high-speed data connectivity across various industries. SATCOM equipment enables the transmission of large volumes of data over long distances, making it an essential component for industries that require reliable communication links.

Expansion of satellite networks: The deployment of new satellites and the expansion of existing satellite networks worldwide are creating opportunities for SATCOM equipment manufacturers. As satellite operators aim to enhance their coverage and capacity, there is a need for advanced and efficient SATCOM equipment to support these networks.

The satellite communication (SATCOM) equipment market refers to the industry involved in the manufacturing and distribution of equipment used for satellite communication systems. SATCOM equipment includes various components and devices used in satellite communication networks, such as satellite antennas, transponders, modems, amplifiers, receivers, and ground station equipment.

Satellite Communication (SATCOM) Equipment Market Challenges

Elevated development and upholding cost of earth station infrastructures to maintain Satcom devices, radio spectrum accessibility concerns, elevated satellite service price, and cybersecurity issues are the major challenges for the growth of the satellite communication equipment market.

Satellite Communication (SATCOM) Equipment Market Industry Ecosystem

Globally, manufacturing companies trying to enter the satellite communication equipment market are required to maintain stringent regulatory standards. Moreover, the high level of capital requirement also poses a major barrier to the entry of new players. This offers an edge to the established players in the industry competition.

Satellite Communication (SATCOM) Equipment Market Geographic Overview

Geographically, North America accounted for the largest share of the market, due to technological advancement. In addition, the high demand for SATCOM equipment from NASA, and the mounting requirement for continuous communication in several industries are also driving the growth of the North American satellite communication equipment market.

Asia-Pacific is observed to witness the fastest growth in the market, due to the augmented usage of satellite antennas in automobiles. In addition, the upsurge in digital TV and the escalation in the requirement for mobile broadband are also fueling the growth of the Asia-Pacific market.

Satellite Communication (SATCOM) Equipment Market Competitive Insight

General Dynamics is a global aerospace and defense company. From Gulfstream business jets and combat vehicles to nuclear-powered submarines and communications systems, people accross the world depend on their products and services for safety and security.

Intellian is the world's leading provider of satellite antennas and terminals that focuses on empowering connectivity, so connectivity can empower the world. Company is passionate for innovation and agile responsiveness to customer needs.

Key Players covered in the report

Key players in the satellite communication equipment market are catering to the demand of these devices by investing in technologically advanced products in their product portfolio across the globe. General Dynamics, Intellian Technologies, L3 Technologies, Viasat, Gilat Satellite Networks, and Holkirk Communications are the key players offering satellite communication equipment.

Recent Developments by Key Players

Intellian Technologies, Inc.(leading global technology and solutions provider for satellite communications and Inmarsat Maritime) has signed a Memorandum of Understanding (MOU) for the development of a next generation GMDSS safety terminal, designed for operation over Inmarsat’s ELERA L-band network. These safety terminals will become the standard Inmarsat Maritime product for the next generation Fleet Safety service and will fulfil the requirements and performance standards of the International Maritime Organization (IMO).

L3Harris has received a $60-million contract to deliver satellite communication (SATCOM) terminals to the US Army. The company will provide its proprietary Hawkeye III Lite Very Small Aperture Terminal (VSAT) system that provides high-speed internet connections under this agreement.

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Satellite Communication (SATCOM) Equipment Market