- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Automotive Sensor Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9062 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 135 |

Global Automotive Sensor Market – Analysis and Forecast (2025-2030)

Sales Channel (OEM and After-Market), Sensor Type (LED, Image Sensor, Position Sensor, Temperature Sensor, Pressure Sensor, MEMs, Gas Sensor, and Others), Application (ADAS, Powertrain, Chassis, Safety & Control, Telematics, and Others), Vehicle Type (Fuel Based Vehicle [Passenger Car, LCV, and MHCV], and Electric Vehicle)

Industry Overview

The Electricity Transmission And Distribution EPC Market of GSA witnessed a valuation of USD 397.3 billion in 2023. It is projected to experience significant growth at a CAGR of 3.6% and is estimated to reach USD 474.7 billion by the year 2030.

Different types of sensors are used for in automotive to support and enhance its features of in terms of safety, security, comfort and performance. The number and types sensors deployed in a car has drastically grown in past decade with introduction of several advance features such as automated car, electric car, and other new car models.

Different types of sensors are used for in automotive to support and enhance its features of in terms of safety, security, comfort and performance. The number and types sensors deployed in a car has drastically grown in past decade with introduction of several advance features such as automated car, electric car, and other new car models.

Automotive Sensor Market Segmentation

Insight by Sensor Types

On the basis of sensor type, the market is bifurcated into LED, image sensor, position sensor, temperature sensor, pressure sensor, MEMs, gas sensor, and, others. Among these sensor types, position sensor segment captures highest market share in 2020 and is expected to grow at fastest rate, owing to its numerous applications in vehicle for position measurement in chassis, powertrain, safety & control, and others.

Insight by Sales Channel

On the basis of Sales Channel, the market is subdivided into OEM (Original Equipment Manufacturers) and After-Market. Among these OEM accounted for the foremost share in the automotive sensor market with most of the sensors these days in the vehicles are fitted by the manufacturers. However, after-market sales channel is growing rapidly and is expected to capture decent share of the automotive sensor market in years to come.

Insight by Application

On the basis of application, the market is subdivided into ADAS (Advanced Driver-Assistance Systems), powertrain, chassis, safety & control, telematics and others. Of all these applications, the powertrain application segment accounted for a foremost share in the automotive sensor market, owing to integration of different sensor types to track the speed, position, pressure, and temperature of the vehicle part.

Insight by Vehicle Type

On the basis of vehicle type, the market is bifurcated into fuel based vehicle and electric vehicle. The fuel based vehicle is further broken down into passenger car, light commercial vehicle (LCV) and medium & heavy commercial vehicle (MHCV). Passenger car is expected to account the highest market share in current year and is expected to grow at fastest rate with adoption of ADAS, electric and hybrid cars.

Global Automotive Sensor Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 397.3 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 474.7 Billion |

|

Growth Rate |

3.6% |

|

Segments Covered in the Report |

By Sales Channel, By Sensor Type, By Application and By Vehicle Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Automotive Sensor Industry Trends

There is a constant increase in the number of sensors integration in vehicle to improve its performance. Due to which, there is a rise in the number of partnerships and collaborations among the automotive OEMs and sensor manufacturers is one of the major trends prevailing in the automotive sensor market currently.

Automotive Sensor Market Growth Drivers

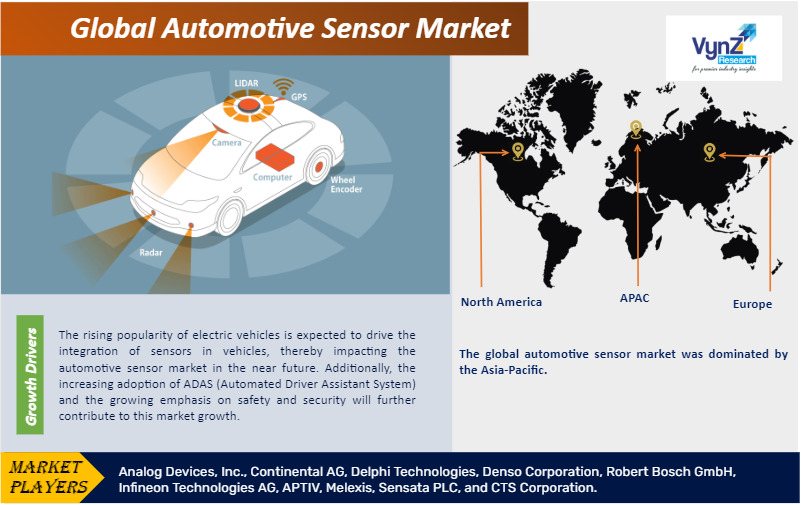

The rising popularity of electric vehicles is expected to drive the integration of sensors in vehicles, thereby impacting the automotive sensor market in the near future. Additionally, the increasing adoption of ADAS (Automated Driver Assistant System) and the growing emphasis on safety and security will further contribute to this market growth.

Automotive Sensor Market Challenges

Low awareness towards aftermarket sensor sales may obstructs the growth of the automotive sensor market. Aftermarket is one of the largest revenue contributors to the automotive industry, however, in terms of automotive sensors, the market is still in nascent stage.

Automotive Sensor Market Opportunities

Increasing demand for connected and automated cars in years to come will boost the demand of different types of sensors in the vehicle. The number of sensors integrated in the vehicle is growing up to 300 to 400 per cars. This will act as an opportunity for the global automotive sensor market in near future.

Automotive Sensor Market Geographic Overview

Geographically, APAC, mainly China is the largest automotive sensor market with largest number of electric vehicle production. Besides, the country is home for some of the major automotive manufacturers, this will further up surge the growth of the China automotive sensor market in years to come.

Further, US and Europe hold the second and third largest automotive sensor market share respectively, due to the growing electric vehicle adoption, and the increasing deployment of connected cars. In addition, some of the other developed nations in APAC and Europe are also rapidly deploying the electric vehicle, this as result is also creating a positive impact on the automotive sensor market growth globally.

Automotive Sensor Market Competitive Insight

Key players in the in the Automotive Sensor Market includes automotive OEMs who are making huge investments in development of new sensor technologies. Further, partnership and collaboration are other key strategies adopted by the vehicle OEMs. For instance, Delphi has collaborated with TomTom and Audi has Partnered with ON Semiconductor to grow their technical expertise.

Some of the key players operating in the market automotive sensor market are Analog Devices, Inc., Continental AG, Delphi Technologies, Denso Corporation, Robert Bosch GmbH, Infineon Technologies AG, APTIV, Melexis, Sensata PLC, and CTS Corporation.

Forecast Parameters

- Identifying variables and establishing market impact.

- Establishing market trends regionally.

- Analyzing opportunities and market penetration rates by understanding product commercialization, regional expansion.

- Analyzing demand and supply trends and changes in industry dynamics to establish future growth.

- Analyzing sustainability strategies adhered by market participants in an attempt to determine future course of the market.

- Analyzing historical market trends and super-imposing them on the current and future variables to determine year-on-year trend.

- Understanding adoption, production, export, import and regulatory framework.

Data Validation

- Estimated and forecasted data was validated through industry experts.

- Apart from industry experts, data triangulation methods were used for validation.

- Bottom up and top down approach has been used for estimation and forecast of market data, whereas top down approach was used for validation.

- Demand, as well as supply-side surveys, were conducted in order to understand the industry dynamics and data validation.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data and have key opinions from the industry experts. The key profiles approached within the industry includes, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behaviour.

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Sales Channel

1.2.2. By Sensor Type

1.2.3. By Application

1.2.4. By Vehicle Type

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Sales Channel

5.1.1. Original Equipment Manufacturer (OEM)

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. After-Market

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Sensor Type

5.2.1. LED

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Image Sensor

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Position Sensor

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Temperature Sensor

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Pressure Sensor

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.2.6. MEMs

5.2.6.1. Market Definition

5.2.6.2. Market Estimation and Forecast to 2030

5.2.7. Gas Sensors

5.2.7.1. Market Definition

5.2.7.2. Market Estimation and Forecast to 2030

5.2.8. Others

5.2.8.1. Market Definition

5.2.8.2. Market Estimation and Forecast to 2030

5.3. By Application

5.3.1. ADAS(Advanced Driver-Assistance Systems)

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Powertrain

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Chassis

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Safety & Control

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Telematics

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Others

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

5.4. By Vehicle Type

5.4.1. Fuel Based Vehicle

5.4.1.1. Passenger Car

5.4.1.1.1. Market Definition

5.4.1.1.2. Market Estimation and Forecast to 2030

5.4.1.2. Light Commercial Vehicle (LCV)

5.4.1.2.1. Market Definition

5.4.1.2.2. Market Estimation and Forecast to 2030

5.4.1.3. Medium & Heavy Commercial Vehicle (MHCV)

5.4.1.3.1. Market Definition

5.4.1.3.2. Market Estimation and Forecast to 2030

5.4.2. Electric Vehicle

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Sales Channel

6.2. By Sensor Type

6.3. By Application

6.4. By Vehicle Type

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Sales Channel

7.2. By Sensor Type

7.3. By Application

7.4. By Vehicle Type

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Sales Channel

8.2. By Sensor Type

8.3. By Application

8.4. By Vehicle Type

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Sales Channel

9.2. By Sensor Type

9.3. By Application

9.4. By Vehicle Type

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Analog Devices, Inc.

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Continental AG

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Delphi Technologies

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Denso Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Robert Bosch GmbH

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Infineon Technologies AG

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. APTIV

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Melexis

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Sensata PLC

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. CTS Corporation

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Automotive Sensor Market Size, by Sales Channel, 2018-2023 (USD Billion)

Table 5 Global Automotive Sensor Market Size, by Sales Channel, 2025–2030 (USD Billion)

Table 6 Global Automotive Sensor Market Size, by Sales Channel, 2018-2023 (Billion Units)

Table 7 Global Automotive Sensor Market Size, by Sales Channel, 2025–2030 (Billion Units)

Table 8 Global Automotive Sensor Market Size, by Sensor Type, 2018-2023 (USD Billion)

Table 9 Global Automotive Sensor Market Size, by Sensor Type, 2025–2030 (USD Billion)

Table 10 Global Automotive Sensor Market Size, by Sensor Type, 2018-2023 (Billion Units)

Table 11 Global Automotive Sensor Market Size, by Sensor Type, 2025–2030 (Billion Units)

Table 12 Global Automotive Sensor Market Size, by Application, 2018-2023 (USD Billion)

Table 13 Global Automotive Sensor Market Size, by Application, 2025–2030 (USD Billion)

Table 14 Global Automotive Sensor Market Size, by Application, 2018-2023 (Billion Units)

Table 15 Global Automotive Sensor Market Size, by Application, 2025–2030 (Billion Units)

Table 16 Global Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 17 Global Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 18 Global Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 19 Global Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 20 Global Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 21 Global Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 22 Global Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 23 Global Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 24 Global Automotive Sensor Market Size, by Region, 2018-2023 (USD Billion)

Table 25 Global Automotive Sensor Market Size, by Region, 2025–2030 (USD Billion)

Table 26 Global Automotive Sensor Market Size, by Region, 2018-2023 (Billion Units)

Table 27 Global Automotive Sensor Market Size, by Region, 2025–2030 (Billion Units)

Table 28 North America Automotive Sensor Market Size, by Sales Channel, 2018-2023 (USD Billion)

Table 29 North America Automotive Sensor Market Size, by Sales Channel, 2025–2030 (USD Billion)

Table 30 North America Automotive Sensor Market Size, by Sales Channel, 2018-2023 (Billion Units)

Table 31 North America Automotive Sensor Market Size, by Sales Channel, 2025–2030 (Billion Units)

Table 32 North America Automotive Sensor Market Size, by Sensor Type, 2018-2023 (USD Billion)

Table 33 North America Automotive Sensor Market Size, by Sensor Type, 2025–2030 (USD Billion)

Table 34 North America Automotive Sensor Market Size, by Sensor Type, 2018-2023 (Billion Units)

Table 35 North America Automotive Sensor Market Size, by Sensor Type, 2025–2030 (Billion Units)

Table 36 North America Automotive Sensor Market Size, by Application, 2018-2023 (USD Billion)

Table 37 North America Automotive Sensor Market Size, by Application, 2025–2030 (USD Billion)

Table 38 North America Automotive Sensor Market Size, by Application, 2018-2023 (Billion Units)

Table 39 North America Automotive Sensor Market Size, by Application, 2025–2030 (Billion Units)

Table 40 North America Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 41 North America Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 42 North America Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 43 North America Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 44 North America Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 45 North America Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 46 North America Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 47 North America Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 48 North America Automotive Sensor Market Size, by Country, 2018-2023 (USD Billion)

Table 49 North America Automotive Sensor Market Size, by Country, 2025–2030 (USD Billion)

Table 50 North America Automotive Sensor Market Size, by Country, 2018-2023 (Billion Units)

Table 51 North America Automotive Sensor Market Size, by Country, 2025–2030 (Billion Units)

Table 52 Europe Automotive Sensor Market Size, by Sales Channel, 2018-2023 (USD Billion)

Table 53 Europe Automotive Sensor Market Size, by Sales Channel, 2025–2030 (USD Billion)

Table 54 Europe Automotive Sensor Market Size, by Sales Channel, 2018-2023 (Billion Units)

Table 55 Europe Automotive Sensor Market Size, by Sales Channel, 2025–2030 (Billion Units)

Table 56 Europe Automotive Sensor Market Size, by Sensor Type, 2018-2023 (USD Billion)

Table 57 Europe Automotive Sensor Market Size, by Sensor Type, 2025–2030 (USD Billion)

Table 58 Europe Automotive Sensor Market Size, by Sensor Type, 2018-2023 (Billion Units)

Table 59 Europe Automotive Sensor Market Size, by Sensor Type, 2025–2030 (Billion Units)

Table 60 Europe Automotive Sensor Market Size, by Application, 2018-2023 (USD Billion)

Table 61 Europe Automotive Sensor Market Size, by Application, 2025–2030 (USD Billion)

Table 62 Europe Automotive Sensor Market Size, by Application, 2018-2023 (Billion Units)

Table 63 Europe Automotive Sensor Market Size, by Application, 2025–2030 (Billion Units)

Table 64 Europe Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 65 Europe Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 66 Europe Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 67 Europe Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 68 Europe Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 69 Europe Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 70 Europe Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 71 Europe Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 72 Europe Automotive Sensor Market Size, by Country, 2018-2023 (USD Billion)

Table 73 Europe Automotive Sensor Market Size, by Country, 2025–2030 (USD Billion)

Table 74 Europe Automotive Sensor Market Size, by Country, 2018-2023 (Billion Units)

Table 75 Europe Automotive Sensor Market Size, by Country, 2025–2030 (Billion Units)

Table 76 Asia-Pacific Automotive Sensor Market Size, by Sales Channel, 2018-2023 (USD Billion)

Table 77 Asia-Pacific Automotive Sensor Market Size, by Sales Channel, 2025–2030 (USD Billion)

Table 78 Asia-Pacific Automotive Sensor Market Size, by Sales Channel, 2018-2023 (Billion Units)

Table 79 Asia-Pacific Automotive Sensor Market Size, by Sales Channel, 2025–2030 (Billion Units)

Table 80 Asia-Pacific Automotive Sensor Market Size, by Sensor Type, 2018-2023 (USD Billion)

Table 81 Asia-Pacific Automotive Sensor Market Size, by Sensor Type, 2025–2030 (USD Billion)

Table 82 Asia-Pacific Automotive Sensor Market Size, by Sensor Type, 2018-2023 (Billion Units)

Table 83 Asia-Pacific Automotive Sensor Market Size, by Sensor Type, 2025–2030 (Billion Units)

Table 84 Asia-Pacific Automotive Sensor Market Size, by Application, 2018-2023 (USD Billion)

Table 85 Asia-Pacific Automotive Sensor Market Size, by Application, 2025–2030 (USD Billion)

Table 86 Asia-Pacific Automotive Sensor Market Size, by Application, 2018-2023 (Billion Units)

Table 87 Asia-Pacific Automotive Sensor Market Size, by Application, 2025–2030 (Billion Units)

Table 88 Asia-Pacific Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 89 Asia-Pacific Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 90 Asia-Pacific Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 91 Asia-Pacific Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 92 Asia-Pacific Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 93 Asia-Pacific Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 94 Asia-Pacific Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 95 Asia-Pacific Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 96 Asia-Pacific Automotive Sensor Market Size, by Country, 2018-2023 (USD Billion)

Table 97 Asia-Pacific Automotive Sensor Market Size, by Country, 2025–2030 (USD Billion)

Table 98 Asia-Pacific Automotive Sensor Market Size, by Country, 2018-2023 (Billion Units)

Table 99 Asia-Pacific Automotive Sensor Market Size, by Country, 2025–2030 (Billion Units)

Table 100 RoW Automotive Sensor Market Size, by Sales Channel, 2018-2023 (USD Billion)

Table 101 RoW Automotive Sensor Market Size, by Sales Channel, 2025–2030 (USD Billion)

Table 102 RoW Automotive Sensor Market Size, by Sales Channel, 2018-2023 (Billion Units)

Table 103 RoW Automotive Sensor Market Size, by Sales Channel, 2025–2030 (Billion Units)

Table 104 RoW Automotive Sensor Market Size, by Sensor Type, 2018-2023 (USD Billion)

Table 105 RoW Automotive Sensor Market Size, by Sensor Type, 2025–2030 (USD Billion)

Table 106 RoW Automotive Sensor Market Size, by Sensor Type, 2018-2023 (Billion Units)

Table 107 RoW Automotive Sensor Market Size, by Sensor Type, 2025–2030 (Billion Units)

Table 108 RoW Automotive Sensor Market Size, by Application, 2018-2023 (USD Billion)

Table 109 RoW Automotive Sensor Market Size, by Application, 2025–2030 (USD Billion)

Table 110 RoW Automotive Sensor Market Size, by Application, 2018-2023 (Billion Units)

Table 111 RoW Automotive Sensor Market Size, by Application, 2025–2030 (Billion Units)

Table 112 RoW Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 113 RoW Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 114 RoW Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 115 RoW Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 116 RoW Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (USD Billion)

Table 117 RoW Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (USD Billion)

Table 118 RoW Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018-2023 (Billion Units)

Table 119 RoW Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2025–2030 (Billion Units)

Table 120 RoW Automotive Sensor Market Size, by Country, 2018-2023 (USD Billion)

Table 121 RoW Automotive Sensor Market Size, by Country, 2025–2030 (USD Billion)

Table 122 RoW Automotive Sensor Market Size, by Country, 2018-2023 (Billion Units)

Table 123 RoW Automotive Sensor Market Size, by Country, 2025–2030 (Billion Units)

Table 124 Snapshot – Analog Devices, Inc.

Table 125 Snapshot – Continental AG

Table 126 Snapshot – Delphi Technologies

Table 127 Snapshot – Denso Corporation

Table 128 Snapshot – Robert Bosch GmbH

Table 129 Snapshot – Infineon Technologies AG

Table 130 Snapshot – APTIV

Table 131 Snapshot – Melexis

Table 132 Snapshot – Sensata PLC

Table 133 Snapshot – CTS Corporation

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sales Channels for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Automotive Sensor Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Automotive Sensor Market Highlight

Figure 12 Global Automotive Sensor Market Size, by Sales Channel, 2018 - 2030 (USD Billion)

Figure 13 Global Automotive Sensor Market Size, by Sensor Type, 2018 - 2030 (USD Billion)

Figure 14 Global Automotive Sensor Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 15 Global Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 16 Global Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 17 Global Automotive Sensor Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 18 North America Automotive Sensor Market Highlight

Figure 19 North America Automotive Sensor Market Size, by Sales Channel, 2018 - 2030 (USD Billion)

Figure 20 North America Automotive Sensor Market Size, by Sensor Type, 2018 - 2030 (USD Billion)

Figure 21 North America Automotive Sensor Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 22 North America Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 23 North America Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 24 North America Automotive Sensor Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 25 Europe Automotive Sensor Market Highlight

Figure 26 Europe Automotive Sensor Market Size, by Sales Channel, 2018 - 2030 (USD Billion)

Figure 27 Europe Automotive Sensor Market Size, by Sensor Type, 2018 - 2030 (USD Billion)

Figure 28 Europe Automotive Sensor Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 29 Europe Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 30 Europe Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 31 Europe Automotive Sensor Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Automotive Sensor Market Highlight

Figure 33 Asia-Pacific Automotive Sensor Market Size, by Sales Channel, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Automotive Sensor Market Size, by Sensor Type, 2018 - 2030 (USD Billion)

Figure 35 Asia-Pacific Automotive Sensor Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 36 Asia-Pacific Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 37 Asia-Pacific Fuel Based Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 38 Asia-Pacific Automotive Sensor Market Size, by Country, 2018 - 2030 (USD Billion)

Figure 39 RoW Automotive Sensor Market Highlight

Figure 40 RoW Automotive Sensor Market Size, by Sales Channel, 2018 - 2030 (USD Billion)

Figure 41 RoW Automotive Sensor Market Size, by Sensor Type, 2018 - 2030 (USD Billion)

Figure 42 RoW Automotive Sensor Market Size, by Application, 2018 - 2030 (USD Billion)

Figure 43 RoW Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 44 RoW Automotive Sensor Market Size, by Vehicle Type, 2018 - 2030 (USD Billion)

Figure 45 RoW Automotive Sensor Market Size, by Country, 2018 - 2030 (USD Billion)

Global Automotive Sensor Market Coverage

Sales Channel Insight and Forecast 2025-2030

- Original Equipment Manufacturer (OEM)

- Aftermarket

Sensor Type Insight and Forecast 2025-2030

- LED

- Image Sensor

- Position Sensor

- Temperature Sensor

- Pressure Sensor

- MEMs

- Gas Sensor

- Others

Application Insight and Forecast 2025-2030

- ADAS

- Powertrain

- Chassis

- Safety & Control

- Telematics

- Others

Vehicle Type Insight and Forecast 2025-2030

- Fuel Based Vehicle

- Passenger Car

- LCV

- MHCV

- Electric Vehicle

Geographical Segmentation

Automotive Sensor Market by Region

North America

- By Sales Channel

- By Sensor Type

- By Application

- By Vehicle Type

- By Country – U.S., Canada, and Mexico

Europe

- By Sales Channel

- By Sensor Type

- By Application

- By Vehicle Type

- By Country – Germany, U.K., France, Spain, Italy, and Rest of Europe

Asia-Pacific (APAC)

- By Sales Channel

- By Sensor Type

- By Application

- By Vehicle Type

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Sales Channel

- By Sensor Type

- By Application

- By Vehicle Type

- By Country – Brazil, South Africa, Saudi Arabia, and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Analog Devices Inc.

- Continental AG

- Delphi Technologies

- Denso Corporation

- Robert Bosch GmbH

- Infineon Technologies AG

- APTIV

- Melexis

- Sensata PLC

- CTS Corporation

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com