- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Biometric System Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9008 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 200 |

Global Biometric System Market – Analysis and Forecast (2025-2030)

Industry Insights by Authentication Type (Single-Factor Authentication, and Multifactor Authentication), by Component (Hardware, and Software), by Functionality Type (Contact Functionality, Combined Functionality and Noncontact Functionality), by Application (Government, Healthcare, Automotive, Banking & Finance, Travel & Immigration, Military & Defense, Consumer Electronics, Security, and Others) and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The global biometric system market currently is valued at USD 41.2 billion in 2023 and is expected to reach USD 83.79 billion by 2030, at a CAGR of 13.6% during the forcast period 2025 - 2030.

A biometric system refers to a specific tool that uses biological information to identify people. It uses specific technology to read the face, fingerprints, iris, or DNA of people and even analyze typing patterns.

This tool is used in different industries such as banking, transportation, government, consumer electronics, healthcare, defence, commercial safety, and security.

The global biometric system market is expected to grow at such a high rate due to the increasing number of government initiatives for the adoption of the tool and the growing need for higher security and better surveillance. It is also influenced by different authentication mechanisms.

Due to the increasing number of government initiatives to use biometrics and the rising demand for security and surveillance, the market for biometric systems is expanding significantly on a global scale. The market size for biometric systems was influenced by various authentication mechanisms.

Biometric System Market Segmentation

Insight by Authentication Type

The global biometric system market is divided into single-factor authentication and multifactor authentication, according to the authentication type. Out of these two segments, the former is expected to account for the larger market share during the forecast period due to its affordability, simplicity, and high speed of installation.

The single-factor authentication segment can be further divided into vein recognition, voice recognition, face recognition, signature recognition, IRIS recognition, and fingerprint or palm print recognition.

Out of these SFA segments, the widespread use of fingerprint recognition technology in several areas such as e-visas, e-passports, travel and immigration, and driving licenses accounts for the largest share of it in the market. It is also attributed to its growing adoption in laptops, computers, and smartphones for security reasons.

On the other hand, the voice or speech recognition category is expected to grow at a higher rate during the forecast period due to the growing demand in the banking, finance, and healthcare industries.

As for the multifactor authentication category, it is further broken down into multimodal biometrics, a smart card with biometrics, and a pin with biometrics. Out of all these categories, the pin with the biometrics section accounts for the larger share of the market due to its low cost and safe mechanism.

Insight by Component

The biometric system market is split into hardware and software depending on the components used in their making. Out of these two segments, the hardware segment is expected to grow at a higher rate than the other during the forecast period. This is mainly attributed to its larger coverage including cameras, scanners, fingerprint readers, and others that need specific hardware for them to function.

Insight by Functionality Type

The functionality of the biometric systems helps classify the global biometric system market into integrated functionality, contact functionality, and non-contact functionality. Out of these three segments, the contact functionality segment is expected to grow at a faster rate due to the extensive acceptance and use of fingerprint recognition systems across several industry verticals.

Insight by Application

The global biometric system market is classified into government, automotive, healthcare, banking & finance, military & defense, travel & immigration, security, consumer electronics, and others based on its diverse applicability.

Out of all these categories, the travel & immigration category accounts for the largest proportion of the global biometric system market during the forecast period mainly due to the rising demand for security at the crossing points in the border region.

On the other hand, the automotive segment is expected to grow at a higher rate in the analysis period due to the significant rise in car theft incidents, which has encouraged automobile makers to equip biometric security systems in their vehicles to ensure higher client security standards.

Insight by Mobility

The global biometrics system market is split into fixed and portable categories based on the mobility factor.

Out of these two categories, the fixed category accounts for the higher growth rate and will also contribute more in terms of revenue during the forecast period. This is mainly due to the extensive use of biometric systems such as scanners in specific industry verticals like BFSI, smart homes, and other commercial and public sectors.

On the other hand, the portable biometric system category is expected to grow at a higher rate during the forecast period due to the extensive use of voice recognition and fingerprint recognition systems especially in consumer electronic goods.

Global Biometric System Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 41.2 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 83.79 Billion |

|

Growth Rate |

13.6% |

|

Segments Covered in the Report |

By Authentication Type, By Component, By Functionality Type, By Application. |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and the Rest of the World |

Industry Dynamics

Biometric System Industry Trends

The major players in the market are coming up with newer and better products to make the best out of the growth potential of the biometric system market on a global scale. For example, the integration of better technologies such as Artificial Intelligence and Machine learning into the biometric systems allows effective identification of unusual behavior by a user and enhances the security layer of authentication.

The key players in the market also tend to have a significant advantage due to the higher investments made in the development and adoption of these systems as well as collaboration and acquisition of the smaller companies and new entrants who face difficulty in stepping into the market due to high investment requirements.There is a growing concern over data breaches all over, which demands better, contactless, and foolproof biometric systems with multifactor authentication. This is gaining traction in the industry as well as the users which is resulting in higher investments by the major players in the industry in research and development activities to create a better and more reliable portfolio of more advanced and efficient biometric systems.

This has also widened the application areas of these sophisticated systems. This is also attributed to the growing consideration and concerns over data privacy and protection. There is also an urgency among the industry players and manufacturers to comply with regulations. The market players and stakeholders are therefore encouraged to invest more to design better solutions that will help prioritize user privacy, data storage, and transmission security, changing regulatory framework alignment, and trust-building in the regulatory authorities and users.

Also, it is noticed that there is a growing integration of biometrics into commonplace devices and applications to meet the growing demand for multimodal biometric solutions. This is mainly due to the consumers and organizations looking for different modalities in the biometric systems that will offer a comprehensive solution to identity verification and enhance security as well as user experience.

Biometric System Market Growth Drivers

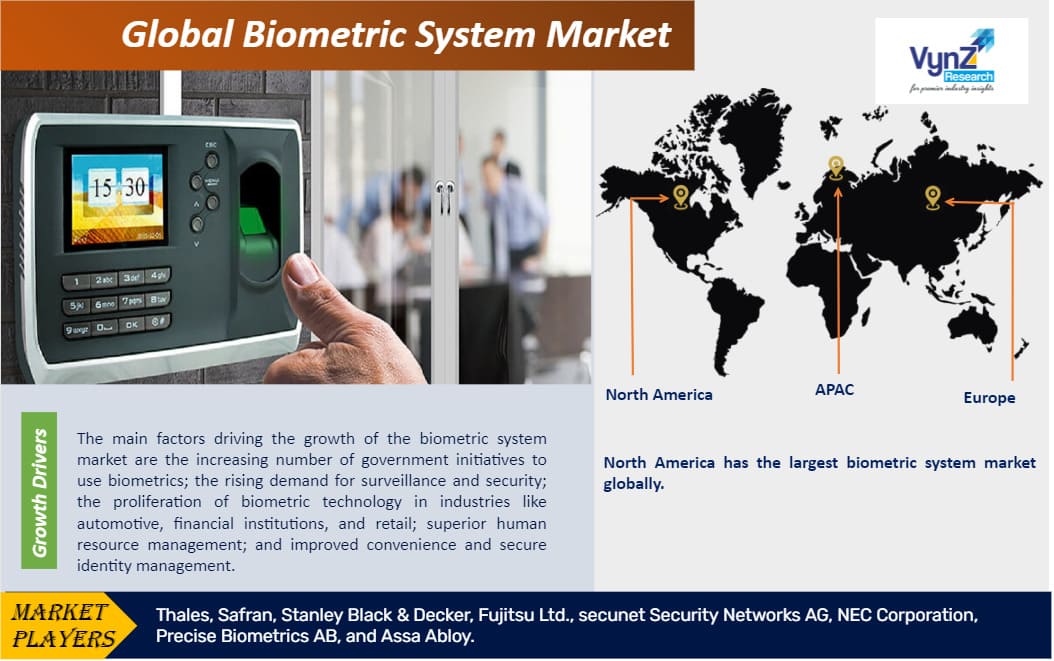

The primary growth driver of the global biometric system market is the growing initiative taken by the government for the adoption and use of biometrics.

Also, the growing awareness and demand for better security and surveillance among people drive the global biometric system market growth. In this regard, the increasing demand for mobile biometrics devices also promotes the growth of the global biometric system market. In addition, the proliferation of biometric technology in specific industry sectors such as automotive, retail, and financial institutions has also influenced the growth of the global biometric system market. Most importantly, the rising demand for efficient biometric solutions in the healthcare industry also influences the growth of the global biometrics system market.

The growth of e-commerce has also influenced the growth of the global biometrics system market since these services are made more convenient with the use of biometric systems making the process smoother and, at the same time, safeguarding e-commerce by increasing credibility and reducing fraud instances, especially in online shops.

Cloud computing has also impacted the growth of the global biometrics system market indirectly. This is because businesses can choose new options without needing to invest in new infrastructure and therefore can respond to market issues and changes quickly. This promotes the development of a new service ecosystem that includes all e-commerce resources.

Apart from that, other crucial factors drive the growth of the global biometric system market, which include the need for enhanced, secure, and convenient identity and human resource management, rapid technological improvements, ease of use as well as superior characteristics of biometric systems.

Biometric System Market Challenges

The growth of the global biometric system market is somewhat hindered due to the threat to data privacy, confidentiality, and the possibility of breach. In addition, the high deployment cost also hinders the expansion of the global biometric system market.

Lack of awareness about the benefits offered by biometric systems such as transparency, privacy, no piracy, and others also hinders the widespread acceptance of these systems.

Apart from that, the concerns over legal and regulatory compliance regarding data privacy, security, and individual rights also hinder the acceptance and sales of biometric systems.

Biometric System Market Opportunities

Notable progress in sensing technology and the widespread use of these systems in mobile devices and computers have created new opportunities for the global biometric system market to grow during the forecast period.

AI and ML-integrated biometric systems allow for capturing the behavioral and physiological traits of users and analyzing specific trends or anomalies with the help of relevant data. This creates new possibilities for biometric authentication and pushes the market northward.

Other factors that create new opportunities for the global expansion of the biometrics system market include a rise in mobile payments, growing adoption of cloud-based solutions that offer higher flexibility and scalability, higher smart city initiatives to offer public safety and better traffic management along with other citizen services, growing use of these systems in smart wearable devices, and growing use in educational institutions for attendance tracking and enhanced safety and accountability.

Biometric System Market Geographic Overview

North America accounts for the higher share of the global biometric system market due to higher government activities for the adoption of biometric systems. It is also attributed to the rapid technical development and progress in this field. Moreover, the growing concern over safety and security also promotes the growth of the global biometric system market in this region.

On the other hand, the APAC market is also expected to grow quickly at a higher CAGR during the forecast period due to the growth in the travel and tourism sector. It is also attributed to the growing concerns over safety and security and the expanding initiatives of the government for the adoption and use of these useful products.

Major key players in this market include Thales, Fujitsu Ltd., Safran, Secunet Security Networks AG, Precise Biometrics AB, NEC Corporation, Stanley Black & Decker, Assa Abloy

Recent Development by Key Players

HID Global and ASSA ABLOY have collaborated on a self-boarding gate system that uses facial recognition technology for passenger identification that shall focus on improving the airport experience by reducing wait times and workload for airline staff. This system shall incorporate liveness detection technology to ensure a real person is present and not a photo or video used for unauthorized access.

Fingerprints has collaborated with Thales and Garanti BBVA to launch a biometric payment card for customers in the region of Türkiye. The contactless biometric payment card has been certified by multiple major EMV payment schemes. The companies will continue to focus on meeting the needs, preferences, and expectations of customers in an ever-evolving market, while also remaining compliant with the regulatory requirements and laws of the local industry with this partnership.

The Biometric System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Authentication Type

- Single-Factor Authentication

- Multifactor Authentication

- By Component

- Hardware

- scanners

- fingerprint readers

- cameras

- other

- Software

- Hardware

- By Functionality Type

- Contact Functionality

- Combined Functionality

- Non-Contact Functionality

- By Application

- Government

- Healthcare

- Automotive

- Banking & Finance

- Travel & Immigration

- Military & Defense

- Consumer Electronics

- Security

- Others

Region Covered in the Report

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Authentication Type

1.2.2. By Component

1.2.3. By Functionality Type

1.2.4. By Application

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. India Market Estimate and Forecast

4.1. India Market Overview

4.2. India Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Authentication Type

5.1.1. Single-Factor Authentication

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Multifactor Authentication

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Component

5.2.1. Hardware

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.1.2.1. Scanner

5.2.1.2.1.1. Market Definition

5.2.1.2.1.2. Market Estimation and Forecast to 2030

5.2.1.2.2. Camera

5.2.1.2.2.1. Market Definition

5.2.1.2.2.2. Market Estimation and Forecast to 2030

5.2.1.2.3. Fingerprint Readers

5.2.1.2.3.1. Market Definition

5.2.1.2.3.2. Market Estimation and Forecast to 2030

5.2.1.2.4. Others

5.2.1.2.4.1. Market Definition

5.2.1.2.4.2. Market Estimation and Forecast to 2030

5.2.2. Software

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Functionality Type

5.3.1. Contact Functionality

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Combined Functionality

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Non-Contact Functionality

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.4. By Application

5.4.1. Government

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Healthcare

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Automotive

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Banking & Finance

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Travel & Immigration

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Military & Defense

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Consumer Electronics

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

5.4.8. Security

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2030

5.4.9. Others

5.4.9.1. Market Definition

5.4.9.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Authentication Type

6.2. By Component

6.3. By Functionality Type

6.4. By Application

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Authentication Type

7.2. By Component

7.3. By Functionality Type

7.4. By Application

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Authentication Type

8.2. By Component

8.3. By Functionality Type

8.4. By Application

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Authentication Type

9.2. By Component

9.3. By Functionality Type

9.4. By Application

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Thales

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Fujitsu Ltd.

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Safran

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Secunet Security Networks AG

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Precise Biometrics AB

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. NEC Corporation

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Stanley Black & Decker

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Assa Abloy

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Biometric System Market Size, By Authentication Type, 2018-2023 (USD Billion)

Table 5 Global Biometric System Market Size, By Authentication Type, 2025-2030 (USD Billion)

Table 6 Global Biometric System Market Size, By Component, 2018-2023 (USD Billion)

Table 7 Global Biometric System Market Size, By Component, 2025-2030 (USD Billion)

Table 8 Global Biometric System Market Size, By Functionality Type, 2018-2023 (USD Billion)

Table 9 Global Biometric System Market Size, By Functionality Type, 2025-2030 (USD Billion)

Table 8 Global Biometric System Market Size, By Application, 2018-2023 (USD Billion)

Table 9 Global Biometric System Market Size, By Application, 2025-2030 (USD Billion)

Table 10 Global Biometric System Market Size, by Region, 2018-2023 (USD Billion)

Table 11 Global Biometric System Market Size, by Region, 2025-2030 (USD Billion)

Table 12 North America Biometric System Market Size, By Authentication Type, 2018-2023 (USD Billion)

Table 13 North America Biometric System Market Size, By Authentication Type, 2025-2030 (USD Billion)

Table 14 North America Biometric System Market Size, By Component, 2018-2023 (USD Billion)

Table 15 North America Biometric System Market Size, By Component, 2025-2030 (USD Billion)

Table 16 North America Biometric System Market Size, By Functionality Type, 2018-2023 (USD Billion)

Table 17 North America Biometric System Market Size, By Functionality Type, 2025-2030 (USD Billion)

Table 18 North America Biometric System Market Size, By Application, 2018-2023 (USD Billion)

Table 19 North America Biometric System Market Size, By Application, 2025-2030 (USD Billion)

Table 20 North America Biometric System Market Size, by Region, 2018-2023 (USD Billion)

Table 21 North America Biometric System Market Size, by Region, 2025-2030 (USD Billion)

Table 22 Europe Biometric System Market Size, By Authentication Type, 2018-2023 (USD Billion)

Table 23 Europe Biometric System Market Size, By Authentication Type, 2025-2030 (USD Billion)

Table 24 Europe Biometric System Market Size, By Component, 2018-2023 (USD Billion)

Table 25 Europe Biometric System Market Size, By Component, 2025-2030 (USD Billion)

Table 26 Europe Biometric System Market Size, By Functionality Type, 2018-2023 (USD Billion)

Table 27 Europe Biometric System Market Size, By Functionality Type, 2025-2030 (USD Billion)

Table 28 Europe Biometric System Market Size, By Application, 2018-2023 (USD Billion)

Table 29 Europe Biometric System Market Size, By Application, 2025-2030 (USD Billion)

Table 30 Europe Biometric System Market Size, by Region, 2018-2023 (USD Billion)

Table 31 Europe Biometric System Market Size, by Region, 2025-2030 (USD Billion)

Table 32 Asia-Pacific Biometric System Market Size, By Authentication Type, 2018-2023 (USD Billion)

Table 33 Asia-Pacific Biometric System Market Size, By Authentication Type, 2025-2030 (USD Billion)

Table 34 Asia-Pacific Biometric System Market Size, By Component, 2018-2023 (USD Billion)

Table 35 Asia-Pacific Biometric System Market Size, By Component, 2025-2030 (USD Billion)

Table 36 Asia-Pacific Biometric System Market Size, By Functionality Type, 2018-2023 (USD Billion)

Table 37 Asia-Pacific Biometric System Market Size, By Functionality Type, 2025-2030 (USD Billion)

Table 38 Asia-Pacific Biometric System Market Size, By Application, 2018-2023 (USD Billion)

Table 39 Asia-Pacific Biometric System Market Size, By Application, 2025-2030 (USD Billion)

Table 40 Asia-Pacific Biometric System Market Size, by Region, 2018-2023 (USD Billion)

Table 41 Asia-Pacific Biometric System Market Size, by Region, 2025-2030 (USD Billion)

Table 42 RoW Biometric System Market Size, By Authentication Type, 2018-2023 (USD Billion)

Table 43 RoW Biometric System Market Size, By Authentication Type, 2025-2030 (USD Billion)

Table 44 RoW Biometric System Market Size, By Component, 2018-2023 (USD Billion)

Table 45 RoW Biometric System Market Size, By Component, 2025-2030 (USD Billion)

Table 46 RoW Biometric System Market Size, By Functionality Type, 2018-2023 (USD Billion)

Table 47 RoW Biometric System Market Size, By Functionality Type, 2025-2030 (USD Billion)

Table 48 RoW Biometric System Market Size, By Application, 2018-2023 (USD Billion)

Table 49 RoW Biometric System Market Size, By Application, 2025-2030 (USD Billion)

Table 50 RoW Biometric System Market Size, by Region, 2018-2023 (USD Billion)

Table 51 RoW Biometric System Market Size, by Region, 2025-2030 (USD Billion)

Table 52 Snapshot – Thales

Table 53 Snapshot – Fujitsu Ltd.

Table 54 Snapshot – Safran

Table 55 Snapshot – secunet Security Networks AG

Table 56 Snapshot – Precise Biometrics AB

Table 57 Snapshot – NEC Corporation

Table 58 Snapshot – Stanley Black & Decker

Table 59 Snapshot – Assa Abloy

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Biometric System Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Biometric System Market Highlight

Figure 12 Global Biometric System Market Size, By Authentication Type, 2018 - 2030 (USD Billion)

Figure 13 Global Biometric System Market Size, By Component, 2018 - 2030 (USD Billion)

Figure 14 Global Biometric System Market Size, By Functionality Type, 2018 - 2030 (USD Billion)

Figure 15 Global Biometric System Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 16 Global Biometric System Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Biometric System Market Highlight

Figure 18 North America Biometric System Market Size, By Authentication Type, 2018 - 2030 (USD Billion)

Figure 19 North America Biometric System Market Size, By Component, 2018 - 2030 (USD Billion)

Figure 20 North America Biometric System Market Size, By Functionality Type, 2018 - 2030 (USD Billion)

Figure 21 North America Biometric System Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 22 North America Biometric System Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Biometric System Market Highlight

Figure 24 Europe Biometric System Market Size, By Authentication Type, 2018 - 2030 (USD Billion)

Figure 25 Europe Biometric System Market Size, By Component, 2018 - 2030 (USD Billion)

Figure 26 Europe Biometric System Market Size, By Functionality Type, 2018 - 2030 (USD Billion)

Figure 27 Europe Biometric System Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 28 Europe Biometric System Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Biometric System Market Highlight

Figure 30 Asia-Pacific Biometric System Market Size, By Authentication Type, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Biometric System Market Size, By Component, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Biometric System Market Size, By Functionality Type, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Biometric System Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Biometric System Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Biometric System Market Highlight

Figure 36 RoW Biometric System Market Size, By Authentication Type, 2018 - 2030 (USD Billion)

Figure 37 RoW Biometric System Market Size, By Component, 2018 - 2030 (USD Billion)

Figure 38 RoW Biometric System Market Size, By Functionality Type, 2018 - 2030 (USD Billion)

Figure 39 RoW Biometric System Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 40 RoW Biometric System Market Size, by Region, 2018 - 2030 (USD Billion)

Global Biometric System Market Coverage

Authentication Type Insight and Forecast 2025-2030

- Single-Factor Authentication

- Multifactor Authentication

Component Insight and Forecast 2025-2030

- Hardware

- Software

Functionality Type Insight and Forecast 2025-2030

- Contact Functionality

- Combined Functionality

- Non-Contact Functionality

Application Insight and Forecast 2025-2030

- Government

- Healthcare

- Automotive

- Banking & Finance

- Travel & Immigration

- Military & Defense

- Consumer Electronics

- Security

- Others

Geographical Segmentation

Biometric System Market by Region

North America

- By Authentication Type

- By Component

- By Functionality Type

- By Application

- By Country – U.S., Canada, and Mexico

Europe

- By Authentication Type

- By Component

- By Functionality Type

- By Application

- By Country – Germany, U.K., France, Italy, Spain, Russia, and the Rest of Europe

Asia-Pacific (APAC)

- By Authentication Type

- By Component

- By Functionality Type

- By Application

- By Country – China, Japan, India, South Korea, and the Rest of Asia-Pacific

Rest of the World (RoW)

- By Authentication Type

- By Component

- By Functionality Type

- By Application

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Biometric System Market – Analysis and Forecast (2025-2030)

- The global biometric system market is anticipated to grow from USD 41.2 billion to USD 83.79 billion by 2030, achieving a CAGR of 13.6%.

- Single-factor authentication, particularly fingerprint recognition, dominates due to its widespread use in various applications. Among multifactor authentication methods, pin with biometrics leads, driven by its cost-effectiveness and safety. Hardware components lead the market, with contact functionality, especially fingerprint recognition, experiencing significant growth.

- Government initiatives, increasing demand for security, and adoption in sectors like healthcare and e-commerce are primary growth drivers. Cloud computing integration and technological advancements further stimulate market growth. Rising demand for convenient identity management and HR solutions also propels market expansion.

- Data privacy concerns and deployment costs hinder market growth, but progress in sensing technology and AI integration present new opportunities. Lack of awareness and regulatory compliance issues are challenges, while mobile payments and smart city initiatives offer growth prospects. Biometrics' growing adoption in wearables, educational institutions, and smart city projects contribute to market expansion.

- North America leads due to government initiatives and technological advancements. Asia-Pacific is poised for rapid growth, driven by the travel and tourism sector and government initiatives for safety and security.