| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9029 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 290 |

Global Commercial Refrigeration Equipment Market – Analysis and Forecast (2025–2030)

Industry Insights by Equipment Type (Walk-in Coolers, Beverage Refrigeration, Transportation Refrigeration Equipment, Display Cases, Parts, Ice Making Machineries, Others), by Application (Food Service, Food and Beverage Distribution, Food and Beverage Retail, Others), by End-User (Supermarkets, Hypermarkets, Hotels/Restaurants & Catering, Convenience Stores, E-commerce, Others)

Industry Overview

The forecast period anticipates a remarkable growth of 2.9% in the Global Market For Commercial Refrigeration Equipment. By the year 2030, the market is projected to achieve a substantial market size of USD 34.5 billion. In the year 2023 the respective market was USD 12.8 billion.

The energy efficiency of commercial refrigeration has improved considerably, during the last five years. The innovations in product design, refrigerant, and improvement in overall energy consumption facilitated the introduction of the advanced and innovative commercial refrigeration products (such as multi deck display cabinets and open-front refrigeration cases) over the years. Apart from superior energy efficiency, these products also feature better temperature stability and superior visual design, due to the exclusion of doors. Open front display cases are used widely for brand promotion and attractive display of consumer products, mostly in supermarket and hypermarket retail.

According to a report published in the U.S. Department of Energy (DoE) in 2012, the refrigeration equipment accounts for about 4% to 6% of the total power consumption in all commercial buildings. In the U.S., the significant effort towards energy efficiency is also supported by the government of developed markets. The U.S. DoE and European Union have come up with stringent regulations, towards energy efficiency of the commercial refrigeration equipment.

On 28 May 2018, Cabinet approved the proposed updates to regulations for Commercial Refrigeration products. This follows approval by the Council of Australian Governments (COAG) Energy Ministers (including Energy and Resources Minister Megan Woods) agreed to the Decision Regulation Impact Statement for commercial refrigerated display and storage cabinets and accepted the following recommendations:

- - Adopt the international (ISO) test method for refrigerated display cabinets and European test methods for other refrigerated display cabinet types and storage cabinets.

- - Increase Australasian MEPS levels to align with European Commission MEPS levels.

Commercial refrigeration equipment are the freezers and refrigerators used in supermarkets, restaurants, restaurants, commercial kitchens and convenience stores. This refrigeration equipment are of two types, firstly those which can be self-contained, wherein the whole system that includes the refrigeration case and the refrigeration system are combined. Furthermore, there are reach-ins as well that are self-contained equipment and comprises of glass doors that are typically used in food-service establishments. Moreover, these equipment are also utilized as the remote condensing refrigerators that are commonly used in supermarkets thereby enhancing the growth of the global commercial refrigeration equipment market.

Commercial Refrigeration Equipment Market Segmentation

Insight by Equipment Type

Based on equipment type, the global commercial refrigeration equipment market is categorized into walk-in coolers, transportation refrigeration equipment, display cases, beverage refrigeration, ice making machinery, parts and other equipment. The global market for beverage refrigeration held the largest share among all equipment types of commercial refrigeration. During the historical period, transportation refrigeration equipment had the highest growth; however, the market for display cases is expected to evolve with the highest CAGR during the forecasted period.

Walk-in coolers is further segmented into packaged unit, remote condensing unit, and remote plant. Among different types of walk-in coolers packaged unit held the largest share in the global market in 2019. The demand for packaged units is the highest owing to the adoption among super markets and hyper markets. However, the growth in sales is anticipated to be witnessed the highest for remote condensing units during the forecast period.

Display cases category is further segmented into plug in cases and remote cases. Plug-in cases have been the larger segment in the global display cases market, as compared to remote cases. The market growth of the former is also expected to remain higher during the forecasted period.

Beverage refrigeration category is further categorized into beverage cooling & dispensing units, drinking fountains, beer dispensing units, soda fountain equipment, and others. Beverage cooling and dispensing units are the most used commercial refrigeration equipment for beverages. The increasing beer industry has been augmenting the demand for specific refrigeration units. Owing to this factor, the market for beer dispensing units is expected to register the highest growth among all beverage refrigeration products, during the forecasted period.

Ice making machineries category is further categorized into cubes, flakes, and nuggets. Among different types of ice making machineries, cubes making machineries held the largest share in the global market in 2019. Ice cubes are the most commonly used across the commercial beverage industry leading to the high share of the category.

Insight by Application

The commercial refrigeration equipment market on the basis of application is categorized into food service, food and beverage retail, food and beverage distribution, and others. Food service remained the largest application for global commercial refrigeration equipment market, during historical period. All application areas witnessed increase in demand of commercial refrigeration equipment. However, food service application area has been the major segment.

Insight by End User

Based on end-user, the global commercial refrigeration equipment market is categorized into supermarkets, hotels/restaurants and catering businesses, convenience stores, e-commerce, and others. Supermarkets has very high demand for refrigeration to store goods and perishable products, which makes them one of the major end-users for commercial refrigeration equipment.

Global Commercial Refrigeration Equipment Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 12.8 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 34.5 Billion |

|

Growth Rate |

2.9% |

|

Segments Covered in the Report |

By Equipment Type, By Application and By End user |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Commercial Refrigeration Equipment Market Growth Drivers

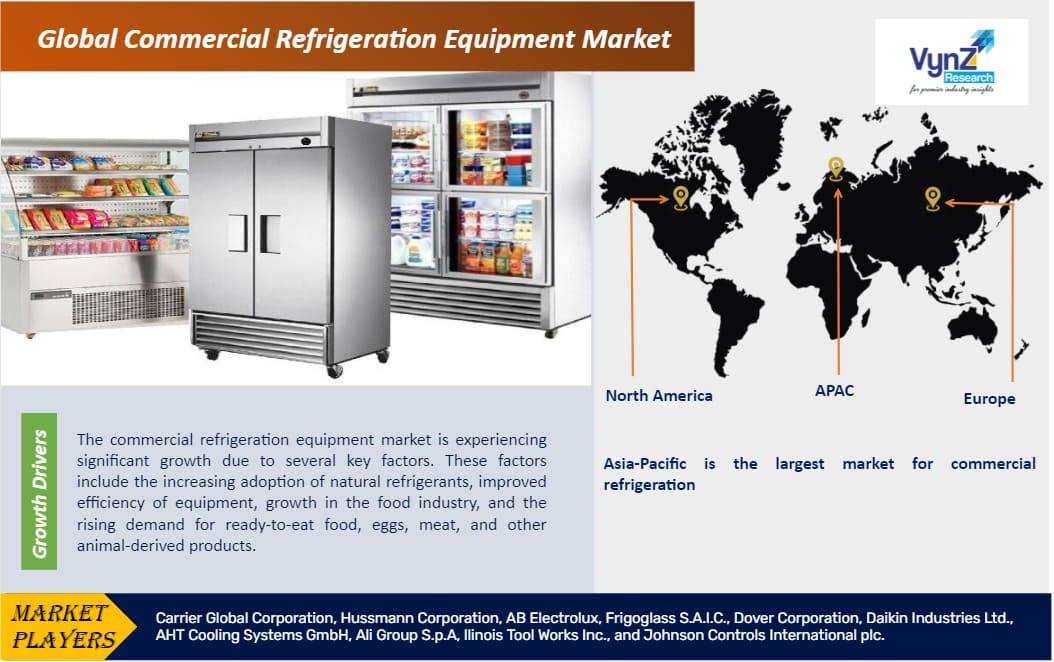

The commercial refrigeration equipment market is experiencing significant growth due to several key factors. These factors include the increasing adoption of natural refrigerants, improved efficiency of equipment, growth in the food industry, and the rising demand for ready-to-eat food, eggs, meat, and other animal-derived products. Natural refrigerants are substances used in refrigeration systems that do not contain synthetic chemicals. Their widespread utilization is driven by the global focus on environmental sustainability.

Additionally, it has been observed that the commercial refrigeration equipment was not as efficient as they are in the present scenario. Since the use of LED lighting systems, high performance glass doors and high-efficiency motors is expanding, thereby making these equipment more efficient and saves a lot of energy which is considered to be a crucial factor for driving the growth of the commercial refrigeration equipment market across the globe.

The growth in the food industry has led to incorporation of many restaurant chains and development of dining restaurants globally thereby enhancing the demand for commercial refrigeration equipment. On the other hand, increasing disposable income of population in various developed and developing economies, increasing demand for ready to eat food and other food like egg, milk and meat are other factors driving the growth demand of the commercial refrigeration market exponentially worldwide.

Commercial Refrigeration Equipment Market Challenges

There have been certain alternative cooling systems launched in the market that is hampering the growth of commercial refrigeration equipment market. Moreover, it has been observed that small enterprises across the globe are unable to adopt this system due to high utilization of energy that is further expected to restrict the growth of commercial refrigeration equipment market worldwide.

Recent Developments by the Key Players

Daikin Industries Ltd. partnered with Rechi Precision to design, manufacture, and distribute rotary compressors in India and abroad. The partnership leverages the use of Rechi Precision’s rotary compressor technology that adds reliability, India-made, affordable solutions to Daikin India offerings. The production facility for the venture would be in Sri City, Andhra Pradesh that will comprehensively cater to the manufacturing and distribution requirements within the region.

Nexans (a leader in the global energy transition) has acquired La Triveneta Cavi, which is one of the European leader in medium- and low-voltage cables. The acquisition is a significant leap forward in Nexans’ strategy to become an electrification pure player.

Commercial Refrigeration Equipment Industry Ecosystem

Globally industry players are leveraging market growth through the development of innovative solutions in commercial refrigeration equipment market. The vendors of these equipment are providing various solutions to the users such as energy efficiency, natural refrigerants and customization according to the customer’s demand at rapid pace.

Commercial Refrigeration Equipment Market Geographic Overview

Geographically, Asia-Pacific is the largest market for commercial refrigeration. The increasing disposable income, improving infrastructure, and large population base are the major factor leading to the largest share of the region. North America is the second largest market for commercial refrigeration equipment due to the advancement in technology, adoption of premium products and developed retail industry infrastructure.

Commercial Refrigeration Equipment Market Competitive Insight

The high market share of United Technologies Corporation (Carrier) is attributed to the global presence of the company. Over the past few years, the brand image of United Technologies Corporation (Carrier) has grown significantly, owing to its superior power efficient commercial refrigeration equipment and well diversified post-sale servicers of the company.

- United Technologies Corporation

- Johnson Controls International PLC

- Daikin Industries Ltd.

- Dover Corporation

- AB Electrolux

- Illinois Tool Works Inc.

- Hussmann Corporation

- Frigoglass S.A.I.C.

- AHT Cooling Systems GmbH

- Ali Group S.p.A.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data and have key opinions from the industry experts. The key profiles approached within the industry includes, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behavior.

The Commercial Refrigeration Equipment Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Equipment Type

- Walk-in Coolers

- Packaged Unit

- Remote Condensing Unit

- Remote Plant

- Display Cases

- Plug in Cases

- Remote Cases

- Beverage Refrigeration

- Beverage Cooling & Dispensing Units

- Drinking Fountains

- Beer Dispensing Units

- Soda Fountain Equipment

- Others

- Ice Making Machineries

- Cubes

- Flakes

- Nuggets

- Transportation Refrigeration Equipment

- Parts

- Other Equipment

- Walk-in Coolers

- By Application

- Food Service

- Food and Beverage Retail

- Food and Beverage Distribution

- Others

- By End User

- Supermarkets

- Hotels/Restaurants and Catering Businesses

- Hypermarkets

- Convenience Stores

- E-Commerce

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Commercial Refrigeration Equipment Market