Industry Overview

According to market projections, the Global Distributed Antenna System (DAS) Market is poised to experience significant growth, with an estimated increase from USD 8.8 billion in 2023 to USD 13.3 billion by 2030. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 6.5% during the forecast period spanning from 2025 to 2030. The surge in demand for distributed antenna systems can be attributed to notable advancements in communication technology. These advancements have contributed to the development of high-speed connectivity, reduced power consumption of network devices, and expanded coverage of connectivity.

The distributed antenna system has helped industries overcome various problems when it comes to internet access and increased bandwidth. This is one of the reasons why it is gaining traction in a variety of other businesses and countries. One of the key elements driving the use of distributed antenna systems is the growing desire for high-speed connectivity everywhere.

This antenna system has even been proactively adopted by governments around the world as it is cost-effective. Some of the benefits that drive demand for distributed antenna systems are better-defined coverage, fewer coverage gaps, similar coverage with lower total power, and for similar coverage.

The impact of COVID-19 on the broader DAS market has been mixed. Commercial verticals such as public venues, airports & transportation hubs, and hospitality centers have been negatively impacted, whereas healthcare organizations and public safety agencies have been relatively unaffected, owing to the fact that these verticals form the backbone of mission-critical operations and emergency services.

Distributed Antenna System Market Segmentation

Insight by Offering Outlook

Based on the Offering outlook, the global distributed antenna system market is spread into Components, Services. In 2022, largest market share was held by a Services segment with significant share in terms of revenue of the total market.

Installation services play a vital role in the DAS market's overall growth. Installation services are provided by both DAS OEMs and DAS integrators. Equipment ordering, cable installation, equipment pre-staging and configuration, head-end and remote equipment installation, and coordination with wireless service providers for design approval, rebroadcast agreements, and commissioning are all major installation services.

Insight by Coverage Outlook

Based on the Coverage outlook, the global distributed antenna system market is spread into Indoor, outdoor. In 2022, outdoor dominated the market with considerable share in terms of revenue of the total market.

The DAS market for outdoor coverage is predicted to develop at the fastest rate. The need for DAS is growing in tandem with the rise in automation and adoption of wireless communication technologies in the automotive, transportation, and industrial plant sectors. Outdoor systems are used not only to increase network capacity, but also to provide coverage in regions where base station towers are difficult to reach, such as tunnels, bridges, and hilly terrains. DAS can be used to improve cellular coverage without the need for costlier base stations. Because of the ease and relative low cost of DAS installation compared to base stations, it is becoming increasingly popular.

Insight by Ownership Model Outlook

Based on the Ownership Model offering outlook, the global distributed antenna system market is spread into Carrier Ownership, Neutral-host Ownership, and Enterprise Ownership. In 2022, Carrier ownership dominated the market with considerable share in terms of revenue of the total market.

The facility owner is not required to invest, carrier companies have entire control for DAS installation and ownership. Cellular carriers are completely responsible for deciding what technology should be installed at sites, as well as for maintaining and retaining their client base. Cellular traffic generated in venues such as airports, sports stadiums, and entertainment facilities generates a significant source of revenue for cellular carriers, justifying the investment in carrier ownership models. The carrier ownership models for indoor DAS provide a significant return on investment. This form of ownership arrangement is now used by the majority of in-building industrial operations.

Insight by Vertical Outlook

Based on the Vertical outlook, the global distributed antenna system market is spread into Commercial, Public Safety. In 2022, Commercial dominated the market with considerable share in terms of revenue of the total market. Due to the rising mobile data traffic, several places such as public venues, healthcare organizations, businesses, and educational institutions are experiencing a significant need for DAS.

Global Distributed Antenna System Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 8.8 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 13.3 Billion

|

|

Growth Rate

|

6.5%

|

|

Segments Covered in the Report

|

By Offering Outlook, By Coverage Outlook and By Ownership Model Outlook, By Vertical Outlook

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Distributed Antenna System Industry Trends

The emerging trends, these systems deliver wireless coverage to buildings via an antenna system, ensuring that emergency responders can maintain wireless communications within a building structure and on-the-job in emergency circumstances. When it comes to public safety, emergency communication is critical for the men and women who are often the first on the scene.

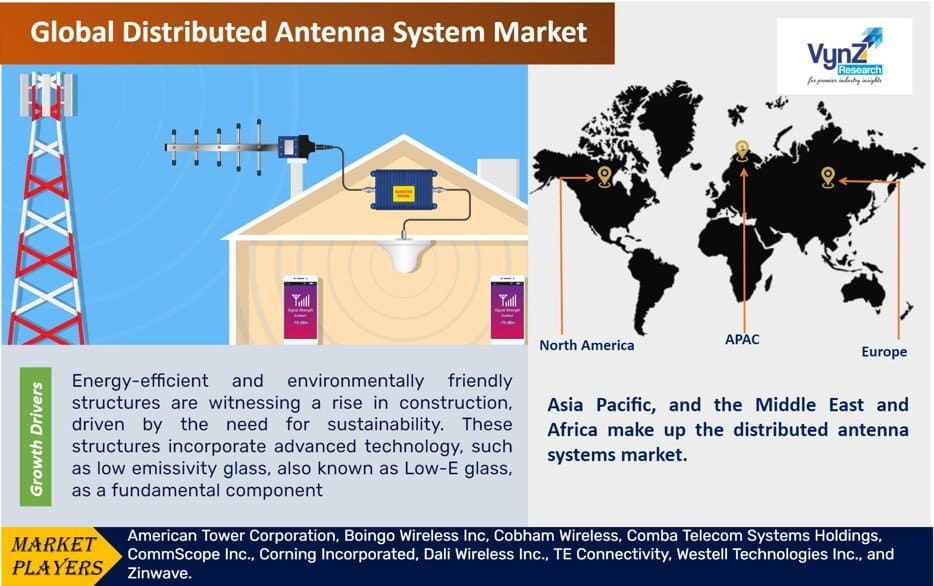

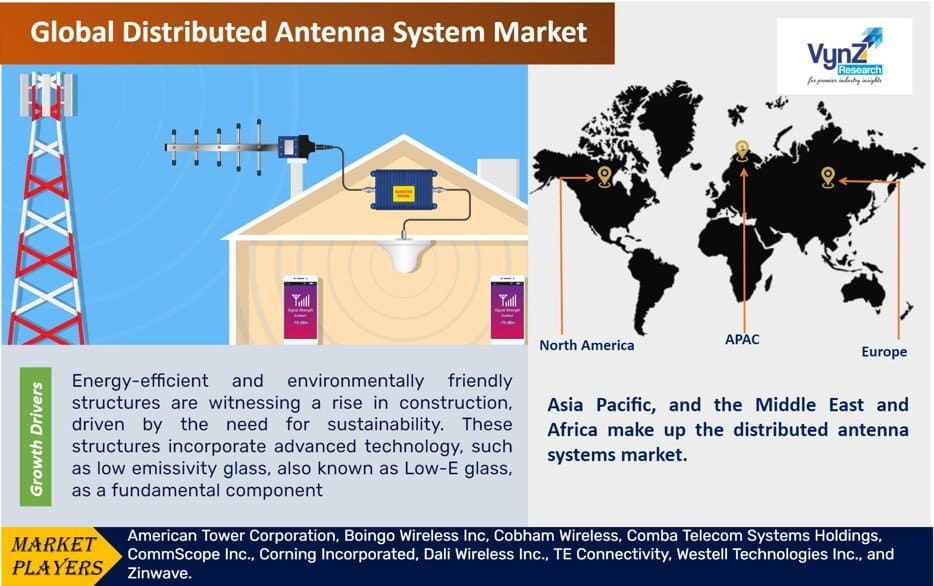

Distributed Antenna System Market Growth Drivers

"Energy-efficient and environmentally friendly structures are witnessing a rise in construction, driven by the need for sustainability. These structures incorporate advanced technology, such as low emissivity glass, also known as Low-E glass, as a fundamental component. Low-E glass plays a crucial role in modern construction, particularly due to the escalating global temperatures. With the ability to reject 30-45% of solar heat, depending on the level of Low-E glazing, it becomes essential for contemporary structures to embrace this innovative solution."

Distributed Antenna System Market Challenges

The installation of iDAS or oDAS is a time-consuming task. Many regulatory restrictions, as well as infrastructure concerns such as the size and location of the facilities, must be taken into account before DAS may be installed. A typical DAS contract comprising simply hardware (hubs, remote radio heads, nodes, and antennas, among other things) costs around USD 5–10 million right now. The cost of active and passive DAS installation is decided by factors like the worth of the systems to be installed, the world of the power where the system is to be installed, the kind of cable (coaxial or fiber optic) used, and the system's power demand.

Distributed Antenna System Market Opportunities

Public safety networks can be found in high-rise buildings, tunnels, retail malls, parking garages, and airports, among other places. Legislative regulations and new public safety building norms enacted by the International Code Council (ICC) and the National Fire Protection Association (NFPA) are driving demand for in-building wireless solutions for public safety, including repeaters, bidirectional amplifiers, and active DAS (NFPA).

Distributed Antenna System Market Geographic Overview

North America, Latin America, Western Europe, Eastern Europe, China, Japan, SEA and Others in Asia Pacific, and the Middle East and Africa make up the distributed antenna systems market.

Since the high penetration of advanced technologies such as IoT, connected devices, and high infrastructural development for the implementation of indoor distributed antenna systems in the region, North America is expected to dominate the global distributed antenna systems market during the forecast period. Distributed antenna systems market, Asia Pacific (including Japan and China) and Europe are likely to trail North America.

China, on the other hand, is expected to grow at the fastest rate in the global indoor distributed antenna systems market over the forecast period, owing to rising smartphone and tablet adoption, rising demand for uninterrupted connectivity, rising demand for smart city adoption, and rising establishment of enterprises requiring a continuous connected environment.

Distributed Antenna System Market Competitive Insight

The global Distributed antenna system market is moderately competitive and few players holds the largest market share. Owing to technological development and quality facility provision, many mid-size and smaller firms are entering the market by providing new services at less prices. Companies, like American Tower Corporation, Boingo Wireless Inc, Cobham Wireless hold the substantial market share in the Distributed antenna system market.

SOLiD will release edgeROU, a fiber-to-the-edge remote unit for the ALLIANCE DAS product family.edgeROU was created by SOLiD primarily to address the issues faced by mobile users within a building. EdgeROU, based on proven ALLIANCE technology, delivers seamless, always-on-everywhere service that customers expect while building owners try to improve user experience and maximize revenue.

Some of the players in Distributed antenna system market are: American Tower Corporation, Boingo Wireless Inc, Cobham Wireless, Comba Telecom Systems Holdings, CommScope Inc., Corning Incorporated, Dali Wireless Inc., TE Connectivity, Westell Technologies Inc., and Zinwave.

The Distributed Antenna System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Offering

- By Coverage

- By Ownership Model

- Carrier Ownership

- Neutral-host Ownership

- Enterprise Ownership

- By Vertical

- Commercial

- Public Venues

- Healthcare Organizations

- Hospitality Centers

- Enterprise

- Transportation Hubs

- Educational Institutions

- Industrial Plants

- Retail Stores

- Government Offices

- Public Safety

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)