- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Gesture Recognition and Touchless Sensing Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9126 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 190 |

Global Gesture Recognition and Touchless Sensing Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Touchless Gesture Recognition and Touch-Based Gesture Recognition), by Product (Touchless Sanitary Equipment, Touchless Biometric, and Others) by Type (Online and Offline), by Industry Vertical (Automotive, Consumer Electronics, Healthcare, Advertisement & Communication, Defense, Finance and Banking, Government and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The forecasted period from 2025 to 2030 shows promising growth for the Global Gesture Recognition And Touchless Sensing Market. It is projected to expand significantly from USD 17.7 billion in 2023 to a staggering USD 51.5 billion, with a remarkable compound annual growth rate (CAGR) of 23.4%. These two cutting-edge technologies, namely gesture recognition and touchless sensing, play a pivotal role in facilitating seamless interactions between humans and machines. By employing advanced mathematical algorithms, this technology aims to interpret and understand human gestures more effectively.

Consumers can engage with a gadget and issue electronic commands without touching it owing to touchless sensing and gesture recognition technology. This is accomplished through the use of automated systems, where some machine functions are carried out after software analyses human behaviors. Both capacitive and infrared sensors are capable of accurately detecting the presence of any human being close to the device and carrying out various responsibilities as stated by their capability. Both the user experience and service quality are enhanced by it. The way that users interact with technology has completely changed owing to gesture recognition. The market potential for such devices is being further increased by the recent growth in research and development activity in touchless sensing technologies.

Industry Trends

The market is also anticipated to expand as a result of technological developments such as Artificial Intelligence, natural user interface (NUI), Machine Language, IoT, big data analytics, etc., as well as the increasing rate of acceptance of gesture recognition technology in end-user segments.

Like any other industry, the epidemic has had a significant detrimental impact on the market for gesture recognition and touchless sensing market. Service providers were unable to maximize their productivity because of the shutdown. But as things have returned to normal, consumer demands have grown, and market players are increasing the product's ability to satisfy these escalating needs.

Market Segmentation

Insight by Technology

- Touchless Gesture Recognition

- Touch-Based Gesture Recognition

Touchless gesture recognition dominates the market owing to less wear and tear of the devices as there is no human contact and increased awareness about their health. For instance, during medical operations, clinicians can edit digital images using hand gestures rather than touch screens or computer keyboards owing to hand-gesture recognition systems. Additionally, it can enhance customer satisfaction and streamline procedures. Simple gestures can be used by users to interact or control devices without actually touching them. The employment of different methods, including motion sensor fusion, camera-based gesture, proximity touchscreen, short-range wireless, eye-tracking, voice recognition, etc., is part of touchless gesture recognition.

2D technology is frequently utilised for gesture recognition, whereas IR technology is employed for touchless sensing. Future 3D technology growth is anticipated to be higher due to rising acceptance and advancement in 3D scanners and cameras.

Insight by Product

- Touchless Sanitary Equipment

- Touchless Faucets

- Touchless Soap Dispensers

- Touchless Towel Dispensers

- Touchless Trashcans

- Hand Dryers

- Touchless Biometric

- Touchless Fingerprint Recognition

- Iris Recognition

- Face Recognition System and Voice Recognition

- Others

Touchless sanitary equipment dominates the market owing to increased concerns about hygiene globally. Touchless biometrics market is anticipated to grow fast owing to technological development in biometric technology and reduced cost of biometric equipment. Furthermore, the rising security concerns has increased the market demand for precise and reliable biometrics systems.

Insight by Type

- Online

- Offline

The online segment is anticipated to have a high CAGR during the forecast period. Real-time machine or computer control is achieved through the use of online gesture detection to scale or rotate a physical object. The rate of recognition for offline gestures is lower than for online gestures since offline gesture recognition is a relatively recent technology.

Insight by Industry Vertical

- Automotive

- Consumer Electronics

- Healthcare

- Advertisement & Communication

- Defense

- Finance and Banking

- Government

- Others

The consumer electronics segment contributes the largest market revenue and is anticipated to grow at a higher pace during the forecast period and includes gaming consoles, interactive gadgets, digital signage, and commercial automation. Since it eventually saves time while interacting with a device, gesture recognition technology has been hailed as a highly successful technology. The Internet of Things (IoT) is a sophisticated version of the Internet that links computers, smartphones, tablets, and other embedded systems with sensors, consumer electrical products, and other devices for data collection and sharing. The development of a smart home idea using IoT technology is also possible and can include Gesture Recognition Smart TVs, which offer intelligence and comfort and thus enhance the quality of life.

The demand for gesture recognition is being driven by the desire for smart electronics, which is in turn being driven by population growth, rising purchasing power, and technical improvements.

Global Gesture Recognition and Touchless Sensing Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2023 |

U.S.D. 17.7 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 51.5 Billion |

|

Growth Rate |

23.4% |

|

Segments Covered in the Report |

By Technology, by Product, by Type, and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Growth Drivers

Upsurge in Demand for Safety and Security in Automotive Sector will Lead to Deployment of Gesture Recognition Technology

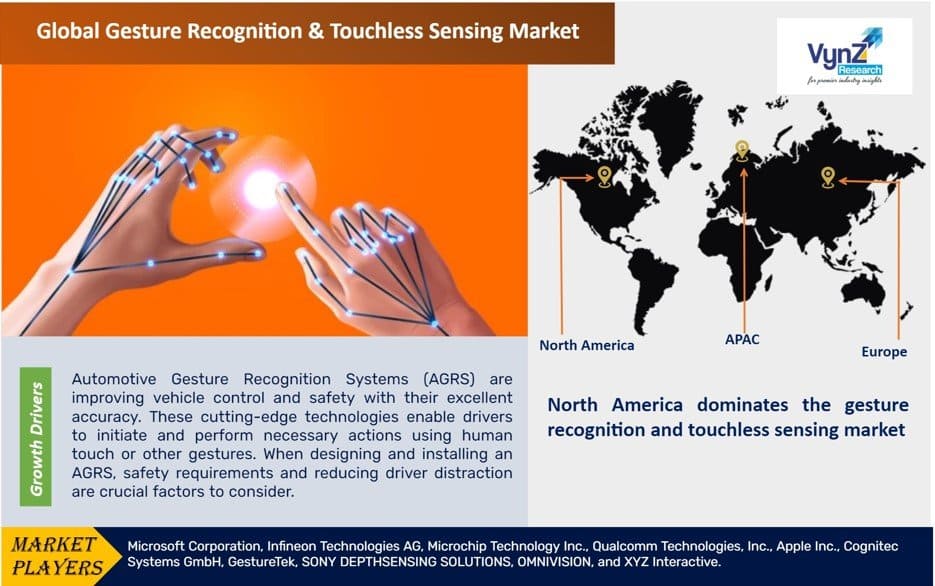

Automotive Gesture Recognition Systems (AGRS) are improving vehicle control and safety with their excellent accuracy. These cutting-edge technologies enable drivers to initiate and perform necessary actions using human touch or other gestures. When designing and installing an AGRS, safety requirements and reducing driver distraction are crucial factors to consider.

The integration of electronics in automobiles has increased due to the growing demand for additional infotainment and safety features. With automotive gesture recognition technology, drivers and passengers can control the infotainment system without touching any buttons or screens in the car, as the sensors scan and interpret hand movements and commands. This technology is in high demand, especially among consumers who prefer contemporary entertainment systems, intelligent driving assistance, new safety features, and electronics control units.

The global gesture recognition and touchless sensing industry are experiencing market growth due to the growing end-use in automation, automotive, gaming, consumer electronics, healthcare, and more. Key drivers are supporting the growth of the advanced sensing market, and the rising need for sensing PCs, personal navigation devices, laptops, and mobile handsets is driving significant demand for the global gesture recognition and touchless sensing market.

As automakers concentrate on adding new capabilities to their vehicles, gesture recognition is becoming a crucial addition. The development of the gesture recognition sector is heavily reliant on market drivers, and its growth is expected to continue as the demand for premium vehicles with advanced technology features increases.

Challenges

Increased replacement costs, trade tensions between the United States and China, the absence of haptic sensory detection capabilities with these technologies, and customer aversion to new goods are all issues in the global gesture recognition and touchless sensing business. Moreover, the increased power consumption, unnecessary object overlapping with 3D gesture recognition, and incorrect object extraction may stymie the market expansion for gesture recognition and touchless sensing industry.

Opportunities

The rising adoption of smart homes, and usage of Virtual Reality in video games, will create lucrative opportunities for the global gesture recognition and touchless sensing market.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

North America dominates the gesture recognition and touchless sensing market owing to the presence of prominent industry players, increased demand for biometric technologies, support from government, security operation, strengthening regulatory activities, and rapid technological development in the region.

APAC is anticipated to have a high CAGR during the forecast period owing to technological development, awareness about hygiene and safety amidst COVID-19 outbreak, advancement in security standards, rising digitalization, increased consumption from consumer electronics and smart phones, and changing consumer demand in emerging markets like China, Japan, South Korea, and India.

Competitive Insight

The global gesture recognition and touchless sensing market is growing owing to the presence of some of the biggest and most well-known technology brands in the world, the market is characterized by intense research and development activity and a significant inflow of investment. Innovative and cutting-edge gesture recognition features and applications have been continuously introduced to the market with the aim of enhancing human-machine interaction. Major techniques used by important players include product portfolio diversification and mergers and acquisitions. Moreover, to target untapped markets and product developments, businesses are implementing partnership strategies.

One of the leading provider of semiconductor products that improve quality of life, safety, and sustainability is offered by Infineon Technologies AG. With a touchless interface, Infineon's most recent generation of capacitive sensing products can further improve user experience by offering an intuitive, hygienic, and comfortable user experience. Infineon's proximity sensing technology can recognize hand gestures and perform touchless predictive touch capabilities without actually contacting the surface when combined with machine learning.

For business and governmental clients all over the world, Cognitec creates industry-leading facial recognition systems. Products for border control, ICAO compliant photo taking, recorded video investigation, real-time video screening and people analytics, and face image database search are all part of Cognitec's portfolio.

Recent Development by Key Players

In October 2021, the new XENSIVTM TLE4972, introduced by Infineon Technologies AG, is the company's first automobile current sensor. For accurate and reliable current measurements, the coreless current sensor makes use of Infineon's tried-and-true Hall technology. The TLE4972 is perfect for xEV applications including traction inverters used in hybrid and battery-powered vehicles as well as battery main switches owing to its compact form and diagnosis modes.

In November 2021, Corum announced Qualcomm has acquired its client Clay AIR, a leading provider of AI-powered hand tracking and gesture recognition technology. With the inclusion of Clay AIR's extremely precise and power-efficient hardware-agnostic technology and industry-leading team of computer vision, interaction design, and machine learning professionals, the purchase boosts Qualcomm's XR technology stack.

Key Players Covered in the Report

Some of the major players operating in the Gesture Recognition and Touchless Sensing Market include Microsoft Corporation, Infineon Technologies AG, Microchip Technology Inc., Qualcomm Technologies, Inc., Apple Inc., Cognitec Systems GmbH, GestureTek, SONY DEPTHSENSING SOLUTIONS, OMNIVISION, and XYZ Interactive.

The Gesture Recognition and Touchless Sensing Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Technology

- Touchless Gesture Recognition

- Touch-Based Gesture Recognition

- By Product

- Touchless Sanitary Equipment

- Touchless Faucets

- Touchless Soap Dispensers

- Touchless Towel Dispensers

- Touchless Trashcans

- Hand Dryers

- Touchless Biometric

- Touchless Fingerprint Recognition

- Iris Recognition

- Face Recognition System and Voice Recognition

- Others

- By Type

- Online

- Offline

- By Industry Vertical

- Automotive

- Consumer Electronics

- Healthcare

- Advertisement & Communication

- Defense

- Finance and Banking

- Government

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Technology

1.2.2. By Product

1.2.3. By Type

1.2.4. By Industry Vertical

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Technology

5.1.1. Touchless Gesture Recognition

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Touch-Based Gesture Recognition

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Product

5.2.1. Touchless Sanitary Equipment

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Touchless Biometric

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Others

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.3. By Type

5.3.1. Online

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Offline

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Industry Vertical

5.4.1. Automotive

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Consumer Electronics

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Healthcare

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. Automotive

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Consumer Electronics

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Healthcare

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Automotive

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

5.4.8. Consumer Electronics

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Technology

6.2. By Product

6.3. By Type

6.4. By Industry Vertical

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Technology

7.2. By Product

7.3. By Type

7.4. By Industry Vertical

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Technology

8.2. By Product

8.3. By Type

8.4. By Industry Vertical

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Technology

9.2. By Product

9.3. By Type

9.4. By Industry Vertical

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Microsoft Corporation

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Infineon Technologies AG

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Microchip Technology Inc.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Qualcomm Technologies, Inc.

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Apple Inc.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Cognitec Systems GmbH

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. GestureTek

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. SONY DEPTHSENSING SOLUTIONS

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. OMNIVISION

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. XYZ Interactive

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2023 (USD Billion)

Table 5 Global Gesture Recognition and Touchless Sensing Market, By Technology, 2025 - 2030 (USD Billion)

Table 6 Global Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2023 (USD Billion)

Table 7 Global Gesture Recognition and Touchless Sensing Market, By Product, 2025 - 2030 (USD Billion)

Table 8 Global Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2023 (USD Billion)

Table 9 Global Gesture Recognition and Touchless Sensing Market, By Type, 2025 - 2030 (USD Billion)

Table 10 Global Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 11 Global Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 12 Global Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2023 (USD Billion)

Table 13 Global Gesture Recognition and Touchless Sensing Market, by Region, 2025 - 2030 (USD Billion)

Table 14 North America Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2023 (USD Billion)

Table 15 North America Gesture Recognition and Touchless Sensing Market, By Technology, 2025 - 2030 (USD Billion)

Table 16 North America Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2023 (USD Billion)

Table 17 North America Gesture Recognition and Touchless Sensing Market, By Product, 2025 - 2030 (USD Billion)

Table 18 North America Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2023 (USD Billion)

Table 19 North America Gesture Recognition and Touchless Sensing Market, By Type, 2025 - 2030 (USD Billion)

Table 20 North America Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 21 North America Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 22 North America Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2023 (USD Billion)

Table 23 North America Gesture Recognition and Touchless Sensing Market, by Region, 2025 - 2030 (USD Billion)

Table 24 Europe Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2023 (USD Billion)

Table 25 Europe Gesture Recognition and Touchless Sensing Market, By Technology, 2025 - 2030 (USD Billion)

Table 26 Europe Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2023 (USD Billion)

Table 27 Europe Gesture Recognition and Touchless Sensing Market, By Product, 2025 - 2030 (USD Billion)

Table 28 Europe Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2023 (USD Billion)

Table 29 Europe Gesture Recognition and Touchless Sensing Market, By Type, 2025 - 2030 (USD Billion)

Table 30 Europe Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 31 Europe Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 32 Europe Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2023 (USD Billion)

Table 33 Europe Gesture Recognition and Touchless Sensing Market, by Region, 2025 - 2030 (USD Billion)

Table 34 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Technology, 2025 - 2030 (USD Billion)

Table 36 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2023 (USD Billion)

Table 37 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Product, 2025 - 2030 (USD Billion)

Table 38 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2023 (USD Billion)

Table 39 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Type, 2025 - 2030 (USD Billion)

Table 40 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 41 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 42 Asia-Pacific Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2023 (USD Billion)

Table 43 Asia-Pacific Gesture Recognition and Touchless Sensing Market, by Region, 2025 - 2030 (USD Billion)

Table 44 RoW Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2023 (USD Billion)

Table 45 RoW Gesture Recognition and Touchless Sensing Market, By Technology, 2025 - 2030 (USD Billion)

Table 46 RoW Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2023 (USD Billion)

Table 47 RoW Gesture Recognition and Touchless Sensing Market, By Product, 2025 - 2030 (USD Billion)

Table 48 RoW Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2023 (USD Billion)

Table 49 RoW Gesture Recognition and Touchless Sensing Market, By Type, 2025 - 2030 (USD Billion)

Table 50 RoW Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 51 RoW Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 52 RoW Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2023 (USD Billion)

Table 53 RoW Gesture Recognition and Touchless Sensing Market, by Region, 2025 - 2030 (USD Billion)

Table 54 Snapshot – Microsoft Corporation

Table 55 Snapshot – Infineon Technologies AG

Table 56 Snapshot – Microchip Technology Inc.

Table 57 Snapshot – Qualcomm Technologies, Inc.

Table 58 Snapshot – Apple Inc.

Table 59 Snapshot – Cognitec Systems GmbH

Table 60 Snapshot – GestureTek

Table 61 Snapshot – SONY DEPTHSENSING SOLUTIONS

Table 62 Snapshot – OMNIVISION

Table 63 Snapshot – XYZ Interactive

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Gesture Recognition and Touchless Sensing Market- Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Gesture Recognition and Touchless Sensing Market Highlight

Figure 12 Global Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2030 (USD Billion)

Figure 13 Global Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2030 (USD Billion)

Figure 14 Global Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2030 (USD Billion)

Figure 15 Global Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 16 Global Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Gesture Recognition and Touchless Sensing Market Highlight

Figure 18 North America Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2030 (USD Billion)

Figure 19 North America Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2030 (USD Billion)

Figure 20 North America Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2030 (USD Billion)

Figure 21 North America Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 22 North America Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Gesture Recognition and Touchless Sensing Market Highlight

Figure 24 Europe Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2030 (USD Billion)

Figure 25 Europe Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2030 (USD Billion)

Figure 26 Europe Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2030 (USD Billion)

Figure 27 Europe Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 28 Europe Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Gesture Recognition and Touchless Sensing Market Highlight

Figure 30 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Gesture Recognition and Touchless Sensing Market, by Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Gesture Recognition and Touchless Sensing Market Highlight

Figure 36 RoW Gesture Recognition and Touchless Sensing Market, By Technology, 2018 - 2030 (USD Billion)

Figure 37 RoW Gesture Recognition and Touchless Sensing Market, By Product, 2018 - 2030 (USD Billion)

Figure 38 RoW Gesture Recognition and Touchless Sensing Market, By Type, 2018 - 2030 (USD Billion)

Figure 39 RoW Gesture Recognition and Touchless Sensing Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 40 RoW Gesture Recognition and Touchless Sensing Market, By Region, 2018 - 2030 (USD Billion)

Global Gesture Recognition and Touchless Sensing Market Coverage

Technology Insight and Forecast 2025-2030

- Touchless Gesture Recognition

- Touch-Based Gesture Recognition

Product Insight and Forecast 2025-2030

- Touchless Sanitary Equipment

- Touchless Faucets

- Touchless Soap Dispensers

- Touchless Towel Dispensers

- Touchless Trashcans

- Hand Dryers

- Touchless Biometric

- Touchless Fingerprint Recognition

- Iris Recognition

- Face Recognition System and Voice Recognition

- Others

Type Insight and Forecast 2025-2030

- Online

- Offline

Industry Vertical Insight and Forecast 2025-2030

- Automotive

- Consumer Electronics

- Healthcare

- Advertisement & Communication

- Defense

- Finance and Banking

- Government

- Others

Geographical Segmentation

Gesture Recognition and Touchless Sensing Market by Region

North America

- By Technology

- By Product

- By Type

- By Industry Vertical

- By Country – U.S., Canada, and Mexico

Europe

- By Technology

- By Product

- By Type

- By Industry Vertical

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Technology

- By Product

- By Type

- By Industry Vertical

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Technology

- By Product

- By Type

- By Industry Vertical

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Gesture Recognition and Touchless Sensing Market