- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Inductor Market

| Status : Published | Published On : May, 2024 | Report Code : VRSME9150 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 198 |

Global Inductor Market – Analysis and Forecast (2025-2030)

Industry Insights By Core (Air/Ceramic Core, Ferrite Core, and Other Cores), By Inductance (Fixed Inductors and Variable Inductors), By Type (Film type, Multilayered, Wire Wound, Molded), By Shield Type (Shielded and Un-shielded), By Mounting (Surface Mount Technology and Through Hole Technology), By End-User (Automotive, Industrial, RF & Telecommunication, Military & Defense, Consumer Electronics, Transmission & Distribution and Healthcare) and By Geography (North America, Asia-Pacific, Europe and Rest of the World)

Industry Overview

The Global Inductor Market is anticipated to grow from USD 9.8 billion in 2023 to USD 14.5 billion in 2030 at a CAGR of 5.4% during the forecast period from 2025 to 2030.

Inductor refers to the electronic component that helps passively in conserving energy, typically in the form of magnetic field. These inductors come with different power capacities, which is usually measured in terms of inductance, and has a wide range of applications across different industry verticals such as power, military, defense, telecommunication, RF, consumer electronics, automotive and more. The global inductor market is growing significantly due to higher applicability, sophisticated design, higher adoption, and the growing demand for different wireless devices for boosting telecommunications and RF signals. Rising innovation is accelerating the pace of growth of the market as well as due to rapid tech developments and growing adoption of organic and inorganic growth policies by market players.

Market Segmentation

Insight by Core Type

The global inductor market is divided by its core type into aur core, ferrite or ferromagnetic core, and iron core categories. Out of these segments, the ferrite core segment is expected to grow more during the forecast period due to higher usage in electronic devices as well as different systems such as power supplies, transformers, filters, and RF circuits. It is also attributed to their higher efficiency in handling high currents, maintaining stability in performance level, wider temperature tolerance range, and higher applicability in electronics, automotive, telecommunications, and power distribution sectors. The air core segment will also grow within the same period due to higher adoption and applicability across different industry verticals such as aerospace, telecommunications, and audio equipment production, and development in material and production techniques to enhance reliability and performance level.

Insight by Inductance

The global inductor market is divided by inductance in to fixed inductors and variable inductors segments. Out of these two segments, the fixed inductor segment is expected to grow at a higher CAGR during the projected period due to sue to higher reliability, stability in performance level according to the preset value, and ability to function under different conditions. Moreover, the compact design allows using these inductors in limited spaces. The durability and suitability of critical applications such as in telecommunications, automotive, and electronics sectors. The variable inductors segment will also grow in the forecast period due to higher adaptability, flexibility, adjustability of inductance values to improve frequency response, circuit performance, and resistivity matching in specific applications such as processing of analog signals, RF tuning, and more.

Insight by Type

The global inductor market is divided by type into film type, multilayered, wire wound, and molded categories. Out of these segments, the film-type segment will grow more than the others in the forecast period due to higher reliability, and stability in performance in a broader frequency spectrum. It is also attributed to their high operational efficiency and performance level in spite of a compact size which has propelled their demand across several industries including contemporary electronic systems where reliability and performance are crucial. The multilayered inductors will also grow in the same period due to high performance and compact size resulting in a widespread use of these inductors in modern electronics and 5G technology.

Insight by Shield Type

The global inductor market is segmented by shield type into shielded and unshielded segments, where the former segment is expected to grow more during the preset period due to several advantages offered over the latter such as lower electromagnetic radiation, higher resistance to external interference, and higher noise suppression, especially required in telecommunications, medical, and automotive electronics sectors. However, the unshielded inductors segment will also grow during the projected period due to small size, simple construction, and low cost. These inductors are widely used in areas where EMI control is not the primary requirement such as in circuits for power supply, fundamental analog implementations and signal filtering of lower frequency due to their greater susceptibility to noise interference and EMI.

Insight by Mounting Technique

According to the mounting type the global inductor market is split into surface mounting and through-hole mounting categories. Out of these two segments, the former is expected to grow more during the forecast period due to their efficiency in high-volume production process and assembly, lower production costs, compact and light design. On the other hand, the through-hole inductors segment will also grow during the same timeframe due to higher mechanical stability, lower susceptibility to vibration and mechanical stress, higher reliability even in hard settings across different applications such as aerospace, automotive, and a wide range of industrial equipment.

Insight by Type End User

The different types of end users also categorize the global inductor market in to automotive, industrial, rf & telecommunication, military & defense, consumer electronics, transmission & distribution, and healthcare segment. Out of all these segments, the consumer electronics end user segment will grow more during the forecast period due to the growing demand for consumer electronics products such as laptops. The automotive end user segment will also grow in the same period due to rise in demand for electric vehicles, higher integration of innovative electronics in automobiles such as powertrain systems, lighting systems, and infotainment systems due to their higher ability of storing energy in a magnetic field and releasing them as and when required.

Global Inductor Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 9.8 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 14.5 Billion |

|

Growth Rate |

5.4% |

|

Segments Covered in the Report |

By Core, By Inductance, By Type, By Shield Type, By Mounting and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia-Pacific, Europe, and Rest of the World |

Industry Dynamics

Industry Trends

The consumer electronics sector is undergoing significant transformation due to rapid development and innovations, impacting the inductor market. The compact design of the without any compromise with the electrical capacity is another notable trend within the industry. In addition, there is a rising awareness about the inductors that has encouraged corporates and governments to promote electrification. The widespread use of power inductors of higher frequency in the automotive industry to lower risks of failures and enhance reliability is also a significant trend noticed just as automation in both automotive, aerospace and other industries for a wide range of tasks.

Growth Drivers

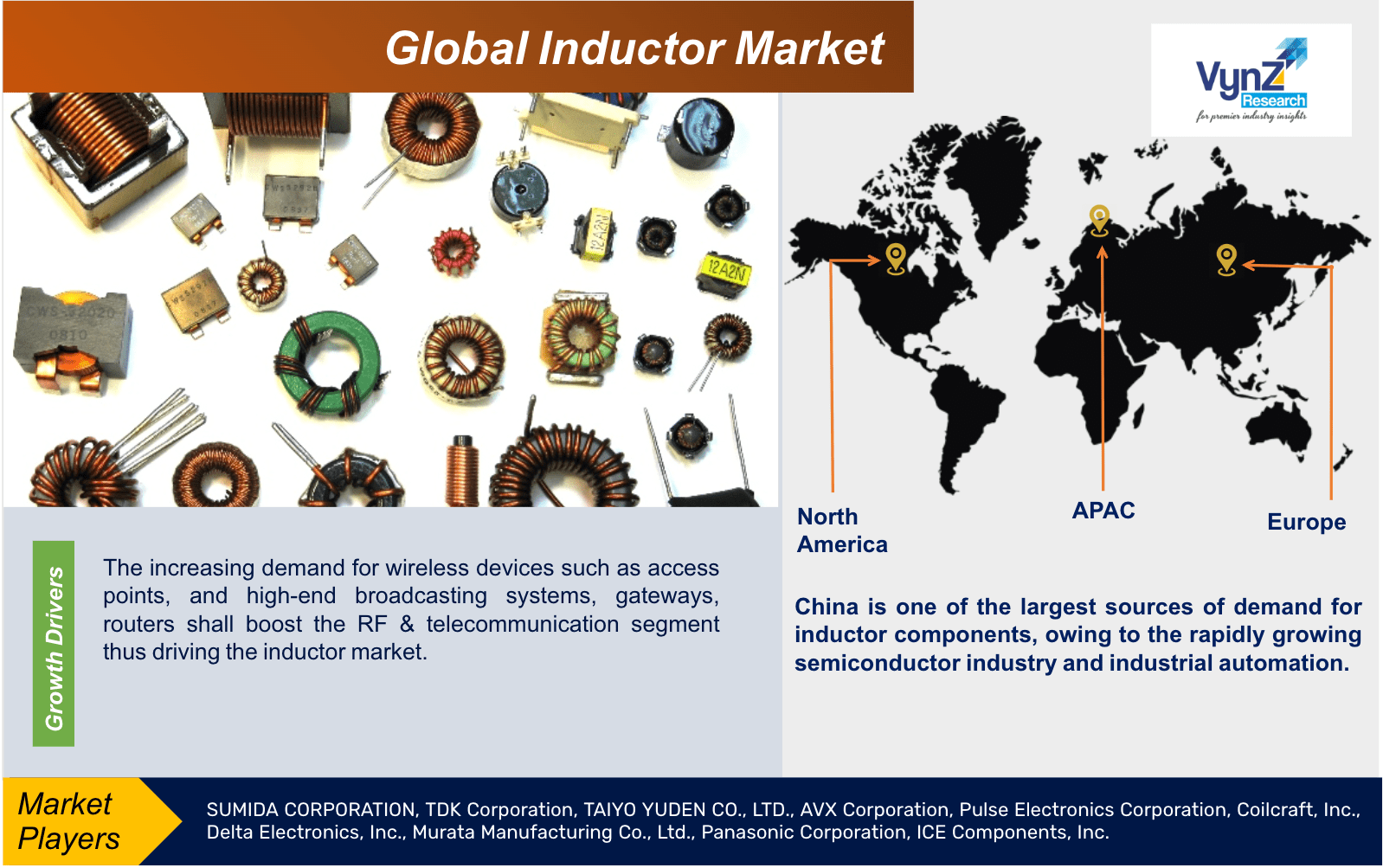

The global inductor market is mainly growing due to its advanced design and efficiency that enhances its applicability manifolds. It is also attributed to the growing demand for wireless devices among consumers which needs such inductors to facilitate RF signal output and telecommunication. Rapid innovation and tech development in this filed is also a significant growth factor for the market. Another significant growth factor is that the market players are implementing organic and inorganic strategies to ensure growth. This includes every aspect from product launches to market expansions, collaborations, partnerships, mergers, and acquisitions.

Challenges

The varying prices of raw materials, inflation and rising interest rates affecting consumer spending, complexity in design due to miniaturization, maintaining DC resistance level, dimensional tolerance and reliability are significant hindrances to the growth of the global inductor market. Strict safety and other regulations along with availability of product substitutes also hider the market growth.

Opportunities

The rise in demand for electric vehicles and their production needing such inductors offer new growth opportunities for the global inductor market. Technological advancements, design innovations, and increase in efficiency and applications also presents growth opportunities to the market.

Geographics Overview

North America leads the market due to higher demand for electric vehicles, consumer electronic products, and telecommunications and growing industrial applications, while the South & Central American market will grow due to widespread use if consumer electronics.

The Canadian market will grow due to tech progress, favorable industrial landscape, supportive regulatory environment, growth in telecommunication and 5G infrastructure.

The Asia-Pacific market will contribute the largest revenue due to rise in demand for automotive and consumer electronics products, existence of several major players, growing preference for more efficient wireless communication and smartphones.

The European market will grow due to growing demand in automotive sector, while the Middle East & African market will grow due to rapid urbanization, industrialization, and tech development.

Key Players Covered in the Report

Key players in the Inductor Market are SUMIDA CORPORATION, TDK Corporation, TAIYO YUDEN CO., LTD., AVX Corporation, Pulse Electronics Corporation, Coilcraft, Inc., Delta Electronics, Inc., Murata Manufacturing Co., Ltd., Panasonic Corporation, ICE Components, Inc.

Recent Development by Key Players

Abracon (a provider of RF and Antenna solutions) has introduced its new "ATL-series" Trans-Inductor Voltage Regulator (TLVR) Inductors with the potential to transform the landscape of power delivery with reliability and high performance. The company is investing in its product portfolio expansion to address the requirements of complex systems and work closely with customers to change the landscape of power supply design.

TDK Corporation has launched its newest addition to the inductor lineup, the KLZ2012-A series. These multilayer inductors are specifically designed for automotive audio bus (A2B) applications. The KLZ2012-A series is well-suited for high-temperature automotive environments with a wide operation range, the KLZ2012-A series is well-suited for high-temperature automotive environments, exceptional durability, and superior inductance tolerance.

The global Inductor Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- Film Type

- Multi-Layered

- Wire Wound

- Molded

- By Core

- Air/Ceramic Core

- Ferrite Core

- Other Cores

- By Shield

- Shielded

- Unshielded

- By Mounting

- Surface Mount Technology

- Through hole technology

- By End-User

- Aerospace and Defense

- Consumer Electronics

- Information and Communication

- Industrial and Manufacturing

- Automotive

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- Rest of the World

- Brazil

- Saudi Arabia

- South Africa

- U.A.E

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Type

1.2.2. By Core

1.2.3. By Shield Type

1.2.4. By Mounting

1.2.5. By End-User

1.2.6. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. End-user Type Overview

3.1. End-user Type Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. End-user Type Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of End-user Type Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Type

5.1.1. Film Type

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2 Multilayered

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Wire Wound

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.1.4. Molded

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2030

5.2. By Core

5.2.1. Air/Ceramic Core

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Ferrite Core

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Other Cores

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.3 By Shield Type

5.3.1. Shielded

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Un-shielded

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Mounting

5.4.1. Surface Mount Technology

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Through Hole Technology

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.5. By End-User

5.5.1. Automotive

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2030

5.5.2. Industrial

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2030

5.5.3. RF & Telecommunication

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2030

5.5.4. Military & Defense

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2030

5.5.5. Consumer Electronics

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2030

5.5.6. Transmission & Distribution

5.5.6.1. Market Definition

5.5.6.2. Market Estimation and Forecast to 2030

5.5.7. Healthcare

5.5.6.1. Market Definition

5.5.6.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Type

6.2. By Core

6.3. By Shield Type

6.4. By Mounting

6.5. By End-User

6.6. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

6.6.1. U.S. Market Estimate and Forecast

6.6.2. Canada Market Estimate and Forecast

6.6.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Type

7.2. By Core

7.3. By Shield Type

7.4. By Mounting

7.5. By End-User

7.6. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

7.6.1. Germany Market Estimate and Forecast

7.6.2. France Market Estimate and Forecast

7.6.3. U.K. Market Estimate and Forecast

7.6.4. Italy Market Estimate and Forecast

7.6.5. Spain Market Estimate and Forecast

7.6.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Type

8.2. By Core

8.3. By Shield Type

8.4. By Mounting

8.5. By End-User

8.6. By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

8.6.1. China Market Estimate and Forecast

8.6.2. Japan Market Estimate and Forecast

8.6.3. India Market Estimate and Forecast

8.6.4. South Korea Market Estimate and Forecast

8.6.5. Singapore Market Estimate and Forecast

8.6.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Type

9.2. By Core

9.3. By Shield Type

9.4. By Mounting

9.5. By Material Type

9.6. By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

9.6.1. Brazil Market Estimate and Forecast

9.6.2. Saudi Arabia Market Estimate and Forecast

9.6.3. South Africa Market Estimate and Forecast

9.6.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. SUMIDA CORPORATION

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. TDK Corporation

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. TAIYO YUDEN CO., LTD.

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. AVX Corporation

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Pulse Electronics Corporation

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Coilcraft, Inc.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Delta Electronics, Inc.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Murata Manufacturing Co., Ltd.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Panasonic Corporation

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. ICE Components, Inc.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Type s

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Inductor Market Size, by Type, 2018-2023 (USD Billion)

Table 5 Global Inductor Market Size, by Type, 2025-2030 (USD Billion)

Table 6 Global Inductor Market Size, by Core, 2018-2023 (USD Billion)

Table 7 Global Inductor Market Size, by Core, 2025-2030 (USD Billion)

Table 8 Global Inductor Market Size, by Shield Type, 2018-2023 (USD Billion)

Table 9 Global Inductor Market Size, by Shield Type, 2025-2030 (USD Billion)

Table 10 Global Inductor Market Size, by Mounting, 2018-2023 (USD Billion)

Table 11 Global Inductor Market Size, by Mounting, 2025-2030 (USD Billion)

Table 12 Global Inductor Market Size, by End-Use, 2018-2023 (USD Billion)

Table 13Global Inductor Market Size, by End-Use, 2025-2030 (USD Billion)

Table 14 Global Inductor Market Size, by Region, 2018-2023 (USD Billion)

Table 15 Global Inductor Market Size, by Region, 2025-2030 (USD Billion)

Table 16 North America Inductor Market Size, by Type, 2018-2023 (USD Billion)

Table 17 North America Inductor Market Size, by Type, 2025-2030 (USD Billion)

Table 18 North America Inductor Market Size, by Core, 2018-2023 (USD Billion)

Table 19 North America Inductor Market Size, by Core, 2025-2030 (USD Billion)

Table 20 North America Inductor Market Size, by Shield Type, 2018-2023 (USD Billion)

Table 21 North America Inductor Market Size, by Shield Type, 2025-2030 (USD Billion)

Table 22 North America Inductor Market Size, by Mounting, 2018-2023 (USD Billion)

Table 23 North America Inductor Market Size, by Mounting, 2025-2030 (USD Billion)

Table 24 North America Inductor Market Size, by End-Use, 2018-2023 (USD Billion)

Table 25 North America Inductor Market Size, by End-Use, 2025-2030 (USD Billion)

Table 26 North America Inductor Market Size, by Country, 2018-2023 (USD Billion)

Table 27 North America Inductor Market Size, by Country, 2025-2030 (USD Billion)

Table 28 Europe Inductor Market Size, by Type, 2018-2023 (USD Billion)

Table 29 Europe Inductor Market Size, by Type, 2025-2030 (USD Billion)

Table 30 Europe Inductor Market Size, by Core, 2018-2023 (USD Billion)

Table 31 Europe Inductor Market Size, by Core, 2025-2030 (USD Billion)

Table 32 Europe Inductor Market Size, by Shield Type, 2018-2023 (USD Billion)

Table 33 Europe Inductor Market Size, by Shield Type, 2025-2030 (USD Billion)

Table 34 Europe Inductor Market Size, by Mounting, 2018-2023 (USD Billion)

Table 35 Europe Inductor Market Size, by Mounting, 2025-2030 (USD Billion)

Table 36 Europe Inductor Market Size, by End-Use, 2018-2023 (USD Billion)

Table 37 Europe Inductor Market Size, by End-Use, 2025-2030 (USD Billion)

Table 38 Europe Inductor Market Size, by Country, 2018-2023 (USD Billion)

Table 39 Europe Inductor Market Size, by Country, 2025-2030 (USD Billion)

Table 38 Asia-Pacific Inductor Market Size, by Type, 2018-2023 (USD Billion)

Table 40 Asia-Pacific Inductor Market Size, by Type, 2025-2030 (USD Billion)

Table 41 Asia-Pacific Inductor Market Size, by Core, 2018-2023 (USD Billion)

Table 42 Asia-Pacific Inductor Market Size, by Core, 2025-2030 (USD Billion)

Table 43 Asia-Pacific Inductor Market Size, by Shield Type, 2018-2023 (USD Billion)

Table 44 Asia-Pacific Inductor Market Size, by Shield Type, 2025-2030 (USD Billion)

Table 45 Europe Inductor Market Size, by Mounting, 2018-2023 (USD Billion)

Table 46 Europe Inductor Market Size, by Mounting, 2025-2030 (USD Billion)

Table 47 Europe Inductor Market Size, by End-Use, 2018-2023 (USD Billion)

Table 48 Europe Inductor Market Size, by End-Use, 2025-2030 (USD Billion)

Table 49 Asia-Pacific Inductor Market Size, by Country, 2018-2023 (USD Billion)

Table 50 Asia-Pacific Inductor Market Size, by Country, 2025-2030 (USD Billion)

Table 51 RoW Inductor Market Size, by Type, 2018-2023 (USD Billion)

Table 52RoW Inductor Market Size, by Type, 2025-2030 (USD Billion)

Table 53 RoW Inductor Market Size, by Core, 2018-2023 (USD Billion)

Table 54 RoW Inductor Market Size, by Core, 2025-2030 (USD Billion)

Table 55 RoW Inductor Market Size, by Shield Type, 2018-2023 (USD Billion)

Table 56 RoW Inductor Market Size, by Shield Type, 2025-2030 (USD Billion)

Table 57 RoW Inductor Market Size, by Mounting, 2018-2023 (USD Billion)

Table 58 RoW Inductor Market Size, by Mounting, 2025-2030 (USD Billion)

Table 59 RoW Inductor Market Size, by End-Use, 2018-2023 (USD Billion)

Table 60 RoW Inductor Market Size, by End-Use, 2025-2030 (USD Billion)

Table 61 RoW Inductor Market Size, by Country, 2018-2023 (USD Billion)

Table 62 RoW Inductor Market Size, by Country, 2025-2030 (USD Billion)

Table 63 Snapshot – SUMIDA CORPORATION

Table 64 Snapshot – TDK Corporation

Table 65 Snapshot – TAIYO YUDEN CO., LTD.

Table 66 Snapshot – AVX Corporation

Table 67 Snapshot – Pulse Electronics Corporation

Table 68 Snapshot – Coilcraft, Inc.

Table 69 Snapshot – Delta Electronics, Inc.

Table 70 Snapshot – Murata Manufacturing Co., Ltd.

Table 71 Snapshot – Panasonic Corporation

Table 72 Snapshot – ICE Components, Inc

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Type s for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Inductor Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Inductor Market Highlight

Figure 12 Global Inductor Market Size, by Type , 2018 – 2030 (USD Billion)

Figure 13 Global Inductor Market Size, by Core 2018 – 2030 (USD Billion)

Figure 14 Global Inductor Market Size, by Shield Type 2018 – 2030 (USD Billion)

Figure 15 Global Inductor Market Size, by Mounting 2018 – 2030 (USD Billion)

Figure 16 Global Inductor Market Size, by End-User 2018 – 2030 (USD Billion)

Figure 17 Global Inductor Market Size, by Region, 2018 – 2030 (USD Billion)

Figure 18 North America Inductor Market Highlight

Figure 19 North America Inductor Market Size, by Type , 2018 – 2030 (USD Billion)

Figure 20 North America Inductor Market Size, by Core 2018–2030 (USD Billion)

Figure 21 North America Inductor Market Size, by Shield Type 2018–2030 (USD Billion)

Figure 22 North America Inductor Market Size, by Mounting 2018–2030 (USD Billion)

Figure 23 Global Inductor Market Size, by End-User 2018 – 2030 (USD Billion)

Figure 24 North America Inductor Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 25Europe Inductor Market Highlight

Figure 26 Europe Inductor Market Size, by Type , 2018 – 2030 (USD Billion)

Figure 27 Europe Inductor Market Size, by Core 2018 – 2030 (USD Billion)

Figure 28 Europe Inductor Market Size, by Shield Type 2018 – 2030 (USD Billion)

Figure 29 Europe Inductor Market Size, by Mounting 2018 – 2030 (USD Billion)

Figure 30 Global Inductor Market Size, by End-User 2018 – 2030 (USD Billion)

Figure 31 Europe Inductor Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 32 Asia-Pacific Inductor Market Highlight

Figure 33 Asia-Pacific Inductor Market Size, by Type , 2018 – 2030 (USD Billion)

Figure 34 Asia-Pacific Inductor Market Size, by Core 2018 – 2030 (USD Billion)

Figure 35 Asia-Pacific Inductor Market Size, by Shield Type 2018 – 2030 (USD Billion)

Figure 36 Asia-Pacific Inductor Market Size, by Mounting 2018 – 2030 (USD Billion)

Figure 37 Global Inductor Market Size, by End-User 2018 – 2030 (USD Billion)

Figure 38 Asia-Pacific Inductor Market Size, by Country, 2018 – 2030 (USD Billion)

Figure 39 RoW Inductor Market Highlight

Figure 40 RoW Inductor Market Size, by Type , 2018 – 2030 (USD Billion)

Figure 41 RoW Inductor Market Size, by Core 2018 – 2030 (USD Billion)

Figure 42 RoW Inductor Market Size, by Shield Type 2018 – 2030 (USD Billion)

Figure 43 RoW Inductor Market Size, by Mounting 2018 – 2030 (USD Billion)

Figure 44 Global Inductor Market Size, by End-User 2018 – 2030 (USD Billion)

Figure 45 RoW Inductor Market Size, by Country, 2018 – 2030 (USD Billion)

Inductor Market Coverage

Type Insight and Forecast 2025-2030

- Film Type

- Multilayered

- Wire Wound

- Molded

Core and Forecast 2025-2030

- Air/Ceramic Core

- Ferrite Core

- Other Cores

Shield Type Insight and Forecast 2025-2030

- Shielded

- Un-shielded

Mounting Insight and Forecast 2025-2030

- Surface Mount Technology

- Through Hole Technology

End-User Insight and Forecast 2025-2030

- Automotive

- BFSI

- Industrial

- RF & Telecommunication

- Military & Defense

- Consumer Electronics

- Transmission & Distribution

- Healthcare

Global Inductor Market by Region

North America

- By Type

- By Core

- By Shield Type

- By Mounting

- By End-User

- By Country – U.S., Canada, and Mexico

Europe

- By Type

- By Core

- By Shield Type

- By Mounting

- By End-User

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Type

- By Core

- By Shield Type

- By Mounting

- By End-User

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Type

- By Core

- By Shield Type

- By Mounting

- By End-User

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- SUMIDA CORPORATION

- TDK Corporation

- TAIYO YUDEN CO. LTD.

- AVX Corporation

- Pulse Electronics Corporation

- Coilcraft Inc.

- Delta Electronics Inc.

- Murata Manufacturing Co. Ltd.

- Panasonic Corporation

- ICE Components Inc.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Inductor Market – Analysis and Forecast (2025-2030)

- The global Inductor Market promises a growth from USD 9.8 billion in 2023 to USD 14.5 billion by 2030 at a rate of 5.4%.

- The market is segmented by inductance, type, core type, shield type, mounting technique, and by end user with each segment having different subsections. Each of these sections and subsections display significant growth potential during the forecast period.

- The factors driving market growth include rapid technological progress, revolutions in consumer electronics, preference and growth of smart cities and smart homes, progress in telecommunications, better design, higher applicability, and more.

- The price fluctuations of raw materials, reduced consumer spending, design complexity are some common hindrances to the market growth. However, growing production of electric vehicles offer, tech developments, and higher applicability offer novel growth opportunities.

- North America, Canada, Europe, Middle East, and Asia Pacific, all markets will grow due to a variety of factors ranging from demand for EVs to consumer electronic products, higher applications in telecommunications to automotive industries, supportive regulatory environment and more.