- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Machine Vision and Vision Guided Robotics Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9035 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 210 |

Global Machine Vision and Vision Guided Robotics Market – Analysis and Forecast (2025-2030)

Industry Insights by Product (PC-Based Machine Vision Systems, Smart Camera-Based Machine Vision Systems, and Vision Guided Robotics), Offering (Hardware (Camera, Frame Grabber, Optics/Lenses, LED Lighting, and Processor), Software(Barcode Reading, Standard Algorithm, and Deep Learning Software), and Services(Integration and Solution Management)), Application (Quality Assurance & Inspection, Positioning & Guidance, Measurement, and Identification), End-Use Industry (Industrial and Non- Industrial), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

Based on market projections, the Machine Vision And Vision-Guided Robots Industry is poised for substantial growth from 2025 to 2030, with a projected compound annual growth rate (CAGR) of 9.61%. By the year 2030, the market is expected to reach a value of $13.18 billion, compared to its current valuation of $11.8 billion in 2023. This growth can be attributed to several key factors, including the increasing demand for automation and safety measures, the scarcity of skilled workers, the elevated costs of labour, and a notable uptick in research and development (R&D) investments.

With machine vision, images are captured, sent to a computer, and then handled to inspect and present the findings of the processing. Robotic vision is a technology that gives machines eyesight and uses cameras and image processing to take the place of humans performing manual inspection duties. It enables robots to carry out fundamental duties including presence detection and in-the-moment inspection. Thus, these devices have become powerful and easy to use.

The market for vision-guided robots is expanding as a result of increased industrialization in both emerging and mature nations. In the manufacture of automobiles, vision-guided robots are utilized to increase productivity and decrease complexity, production costs, and human errors.

Moreover, the global demand for machine vision has increased as a result of recent advancements in the field, including smart cameras, increased system compatibility, and vision-guided robotics. As fewer people interact with end users as a result of the COVID-19 epidemic, the development of vision-guided robots is predicted to accelerate. During the COVID-19 crisis, China is utilizing a number of food delivery, sterilizing, healthcare, and directional guidance robots using machine vision systems.

Machine Vision and Vision Guided Robotics Market Segmentation

Insight by Product

The market is divided into smart camera-based machine vision systems, PC-based machine vision systems, and vision-guided robotics, on the basis of product. Due to the rising demand for smart cameras that are affordable, compact, and simple to install as well as the expanding use of cameras for 3D imaging, it is projected that smart camera-based machine vision systems would hold the greatest market share throughout the forecast period. The updated laws and government directives make it simpler to implement advancements in IoT and smart camera technology.

Systems for machine vision use a lot of cameras. These cameras are installed above the production lines to inspect the finished goods and record data. So as to reduce errors, intelligent camera-based machine vision systems can scan labels and guide their products automatically without human intervention. The machine vision and vision-guided robotics market is expanding as a result of these factors in industrial sectors.

Insight by Offering

The market is categorized, based on offering, into three categories: services, software, and hardware. Due to the increase in demand for CMOS imaging sensors and cameras, the hardware category dominates the market.

Moreover, due to training and technological learning, the software category is predicted to increase steadily over the projection period. Because machine vision systems based on smart cameras are becoming more and more popular across a variety of business verticals, the demand for deep learning software is projected to expand at a quicker rate throughout the forecast period. Additionally, customers in the services sector use machine vision system integrators for testing, assembly, inspection, and gauging applications to meet their product needs.

Insight by Application

The market is categorized into measurement, positioning & guidance, quality assurance & inspection, and identification, based on application. Throughout the projected period, it is predicted that the quality assurance and inspection category will expand significantly. In the packaging industry, these systems are employed for inspecting and locating labels, barcodes, and texts. By doing this, packaging tasks become more efficient and human error is reduced. Moreover, the market will expand as a result of the adoption of technology in the packaging, pharmaceutical, and consumer products industries for quality assurance and inspection applications.

Insight by End-Use Industry

The market is divided into industrial and non-industrial categories, based on end-use industries. Automobile, electronics, semiconductor, healthcare, food & beverage, packaging, textiles, and other industries are included in the industrial category. Biometrics, banking & postal, security & surveillance, transportation, medical imaging & lab automation, traffic management & road safety, leisure & entertainment, and the environment are all included in the non-industrial area.

In the industrial section, the automobile category dominates the market. Automakers are putting money into vision systems to raise the quality aspect. Automobile manufacturers and component suppliers employ the technology for a variety of tasks, including adhesive dispensing, material handling, error-proofing, surface inspection, robotic guidance, and traceability. Additionally, as ADAS systems become more prevalent in automobiles, other components are needed, including camera-led illumination, Lidar, and V2X, which will be crucial to automation and intelligence.

Whereas, the electronics sector is expected to expand significantly between 2022 and 2030. As the sector uses smart cameras and image processing to do measurements and inspections, machine vision technology is adopted in numerous industrial activities and replaces manual inspection.

Moreover, over the course of the projected period, the food and beverage industry is projected to expand quickly. This is because the packaging and bottling processes in the food and beverage industry make extensive use of machine vision systems.

Global Machine Vision and Vision Guided Robotics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 11.8 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 13.18 Billion |

|

Growth Rate |

9.61% |

|

Segments Covered in the Report |

By Product, By Offering, By Application, By End-Use Industry. |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and the Rest of the World |

Industry Dynamics

Machine Vision and Vision Guided Robotics Industry Trends

The machine vision and vision-guided robotics industry is fragmented, and the number of industrial companies offering cutting-edge technology is continuously rising. Companies are using tactics including competitive pricing, mergers and acquisitions, dwindling camera sensors, and offering aftersales services to stay in business and compete with their rivals. Also, due to the governments of emerging nations permitting foreign direct investments (FDI) in this industry, the market for machine vision and vision-guided robots will grow significantly during the forecast period.

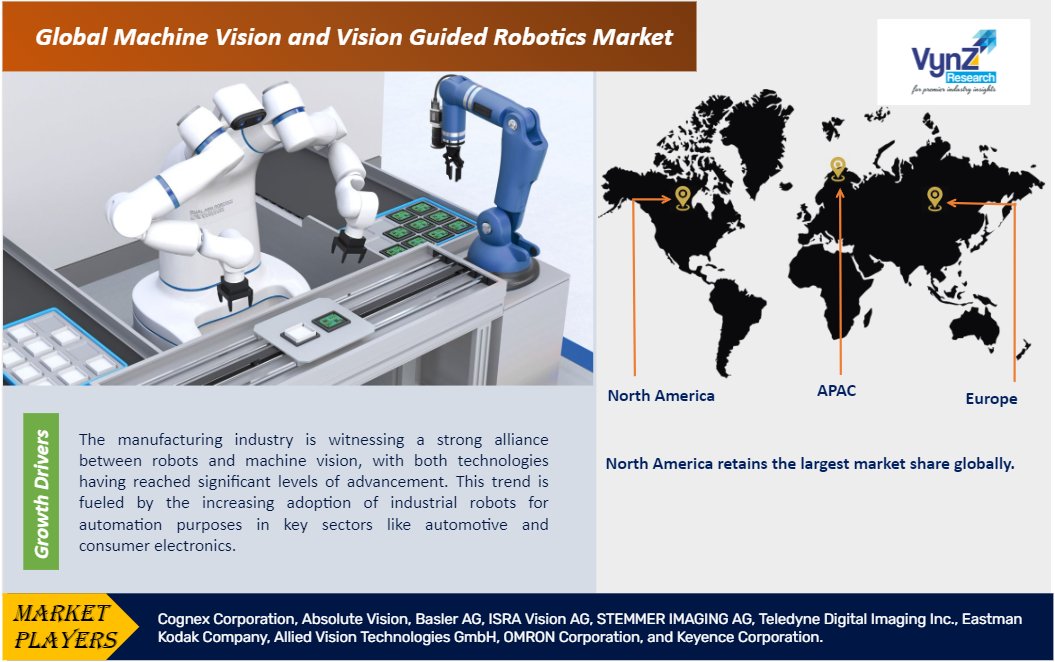

Machine Vision and Vision Guided Robotics Market Growth Drivers

The manufacturing industry is witnessing a strong alliance between robots and machine vision, with both technologies having reached significant levels of advancement. This trend is fueled by the increasing adoption of industrial robots for automation purposes in key sectors like automotive and consumer electronics. Consequently, the integration of machine vision systems with vision-guided robot controllers has become imperative. Moreover, the implementation of stringent worker safety regulations has led to the utilization of robots in hazardous workplace environments. The market for machine vision and vision-guided robotics is experiencing remarkable growth due to the emergence of innovative technologies such as smart cameras and enhanced interfaces. These advancements contribute to simplified operations, cost reduction, and overall market expansion.

Machine Vision and Vision Guided Robotics Market Geographic Overview

Due to their early adoption of robots across a variety of industries, North America retains the largest market share globally. The federal government has made significant investments to expand the manufacture of machine vision systems, which will fuel the market's expansion throughout the forecast period.

Whereas, during the forecast period of 2022–2030, the APAC market is expected to expand significantly. This can be ascribed to the growing manufacturing sector in emerging countries and the surging implementation of cutting-edge technologies in the region. Furthermore, as a result of price deflation, increasing urbanization, rising disposable income, upgraded workflow infrastructure, and the surging adoption of novel technologies, there is also a growth in consumer electronics demand, which will support the APAC market.

In addition, the market for industrial robotics is expanding as a result of labor scarcity issues brought on by an aging population in nations like Japan. The governments of nations like South Korea, India, Taiwan, and Singapore have made investments, reaped operational benefits, and taken actions that have made it possible for many industry players to set up production facilities in the region.

Machine Vision and Vision Guided Robotics Market Competitive Insight

The machine vision market is being improved by investments made by major industry players in R&D and product development. The market for machine vision and vision-guided robotics will expand as a result of numerous strategic activities, including distribution alliances, mergers and acquisitions, partnerships, and joint ventures.

Cognex Corporation designs, manufactures, develops and markets a wide range of image-based products which use artificial intelligence (AI) techniques that give them the human-like ability to make decisions on what they see. Cognex products include machine vision sensors, machine vision systems and barcode readers that are used in factories and distribution centers around the world where they eliminate production and shipping errors.

Basler is a leading international supplier of products for computer vision applications, including frame grabbers, cameras, lighting, lenses and image processing software.

Some of the major competitors in the market for robotic vision and machine vision are Cognex Corporation, Absolute Vision, Basler AG, ISRA Vision AG, STEMMER IMAGING AG, Teledyne Digital Imaging Inc., Eastman Kodak Company, Allied Vision Technologies GmbH, OMRON Corporation, and Keyence Corporation.

Recent Developments by Key Players

Cognex has Launched DataMan 380 to Increase Throughput for Logistics and Manufacturing. Cognex Corporation, a world leader in industrial machine vision, introduced the DataMan® 380 fixed-mount barcode reader, which uses advanced optics and integrated AI to accelerate throughput across logistics and manufacturing applications. The DataMan 380 is a versatile image-based barcode reader that uses a high-resolution imager to capture more codes in a single image for maximum traceability.

Basler and Siemens Join Forces to Enhance Machine Vision and Factory Automation Capabilities. The cooperation between Basler and Siemens will bring significant benefits to customers. System integrators, machine builders, and professional end users looking to use computer vision will have easy access to innovative, automated, and easy-to-integrate solutions through this partnership. This will allow them to streamline their production process, increase efficiency, lower costs, as well as improving transparency and quality control, aimed at maximizing overall productivity.

Teledyne has announced newest version of the Sapera Vision software including Rotated Object Detection, This includes enhanced versions of its AI training graphical tool Astrocyte™ 1.50, and its image processing and AI libraries Sapera Processing 9.50. Teledyne DALSA’s Sapera Vision Software provides field-proven image acquisition, control, image processing, and artificial intelligence functions to design, develop and deploy high-performance machine vision applications such as surface inspection on metal plates, location and identification of hardware parts, plastic sorting, and PCB inspection.

The Machine Vision and Vision Guided Robotics Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Product

- PC-based Machine Vision Systems

- Smart Camera-Based Machine Vision systems

- Vision Guided Robotics

- By Offering

- Hardware

- Camera

- Frame Grabber

- Optics/Lenses

- LED Lighting

- Processor

- Software

- Barcode Reading

- Standard Algorithm

- Deep Learning Software

- Hardware

- Services

- Integration

- Solution Management

- By Application

- Quality Assurance & Inspection

- Positioning & Guidance

- Measurement

- Identification

- By End-Use Industry

- Industrial

- Non-Industrial

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Product

1.2.2. By Offering

1.2.3. By Application

1.2.4. By End-Use Industry

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Product

5.1.1. PC-Based Machine Vision Systems

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Smart Camera-Based Machine Vision Systems

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Vision Guided Robotics

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.2. By Offering

5.2.1. Hardware

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.1.2.1. Camera

5.2.1.2.2. Frame Grabber

5.2.1.2.3. Optics/ Lenses

5.2.1.2.4. LED Lighting

5.2.1.2.5. Processor

5.2.2. Software

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.2.2.1. Barcode Reading

5.2.2.2.2. Standard Algorithm

5.2.2.2.3. Deep Learning Software

5.2.3. Services

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.3.2.1. Integration

5.2.3.2.2. Solution Management

5.3. By Application

5.3.1. Quality Assurance & Inspection

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Positioning & Guidance

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Measurement

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Identification

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.4. By End-Use Industry

5.4.1. Industrial

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Non-Industrial

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Product

6.2. By Offering

6.3. By Application

6.4. By End-Use Industry

6.5. By Country

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Product

7.2. By Offering

7.3. By Application

7.4. By End-Use Industry

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Product

8.2. By Offering

8.3. By Application

8.4. By End-Use Industry

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Product

9.2. By Offering

9.3. By Application

9.4. By End-Use Industry

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Cognex Corporation

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Basler AG

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Absolute Vision

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. ISRA Vision AG

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Teledyne Digital Imaging Inc.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. STEMMER IMAGING AG

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Eastman Kodak Company

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. OMRON Corporation

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Allied Vision Technologies GmbH

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Keyence Corporation

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Machine Vision and Vision Guided Robotics Market Size, By Product, 2018-2023 (USD Billion)

Table 5 Global Machine Vision and Vision Guided Robotics Market Size, By Product, 2025– 2030 (USD Billion)

Table 6 Global Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018-2023 (USD Billion)

Table 7 Global Machine Vision and Vision Guided Robotics Market Size, By Offering, 2025– 2030 (USD Billion)

Table 8 Global Machine Vision and Vision Guided Robotics Market Size, By Application, 2018-2023 (USD Billion)

Table 9 Global Machine Vision and Vision Guided Robotics Market Size, By Application, 2025– 2030 (USD Billion)

Table 10 Global Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018-2023 (USD Billion)

Table 11 Global Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2025– 2030 (USD Billion)

Table 12 Machine Vision and Vision Guided Robotics Market Size, by Region, 2018-2023 (USD Billion)

Table 13 Machine Vision and Vision Guided Robotics Market Size, by Region, 2025– 2030 (USD Billion)

Table 14 North America Machine Vision and Vision Guided Robotics Market Size, By Product, 2018-2023 (USD Billion)

Table 15 North America Machine Vision and Vision Guided Robotics Market Size, By Product, 2025– 2030 (USD Billion)

Table 16 North America Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018-2023 (USD Billion)

Table 17 North America Machine Vision and Vision Guided Robotics Market Size, By Offering, 2025– 2030 (USD Billion)

Table 18 North America Machine Vision and Vision Guided Robotics Market Size, By Application, 2018-2023 (USD Billion)

Table 19 North America Machine Vision and Vision Guided Robotics Market Size, By Application, 2025– 2030 (USD Billion)

Table 20 North America Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018-2023 (USD Billion)

Table 21 North America Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2025– 2030 (USD Billion)

Table 22 North America Machine Vision and Vision Guided Robotics Market Size, by Region, 2018-2023 (USD Billion)

Table 23 North America Machine Vision and Vision Guided Robotics Market Size, by Region, 2025– 2030 (USD Billion)

Table 24 Europe Machine Vision and Vision Guided Robotics Market Size, By Product, 2018-2023 (USD Billion)

Table 25 Europe Machine Vision and Vision Guided Robotics Market Size, By Product, 2025– 2030 (USD Billion)

Table 26 Europe Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018-2023 (USD Billion)

Table 27 Europe Machine Vision and Vision Guided Robotics Market Size, By Offering, 2025– 2030 (USD Billion)

Table 28 Europe Machine Vision and Vision Guided Robotics Market Size, By Application, 2018-2023 (USD Billion)

Table 29 Europe Machine Vision and Vision Guided Robotics Market Size, By Application, 2025– 2030 (USD Billion)

Table 30 Europe Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018-2023 (USD Billion)

Table 31 Europe Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2025– 2030 (USD Billion)

Table 32 Europe Machine Vision and Vision Guided Robotics Market Size, by Region, 2018-2023 (USD Billion)

Table 33 Europe Machine Vision and Vision Guided Robotics Market Size, by Region, 2025– 2030 (USD Billion)

Table 34 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Product, 2018-2023 (USD Billion)

Table 35 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Product, 2025– 2030 (USD Billion)

Table 36 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018-2023 (USD Billion)

Table 37 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Offering, 2025– 2030 (USD Billion)

Table 38 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Application, 2018-2023 (USD Billion)

Table 39 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Application, 2025– 2030 (USD Billion)

Table 40 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018-2023 (USD Billion)

Table 41 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2025– 2030 (USD Billion)

Table 42 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, by Region, 2018-2023 (USD Billion)

Table 43 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, by Region, 2025– 2030 (USD Billion)

Table 44 RoW Machine Vision and Vision Guided Robotics Market Size, By Product, 2018-2023 (USD Billion)

Table 45 RoW Machine Vision and Vision Guided Robotics Market Size, By Product, 2025– 2030 (USD Billion)

Table 46 RoW Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018-2023 (USD Billion)

Table 47 RoW Machine Vision and Vision Guided Robotics Market Size, By Offering, 2025– 2030 (USD Billion)

Table 48 RoW Machine Vision and Vision Guided Robotics Market Size, By Application, 2018-2023 (USD Billion)

Table 49 RoW Machine Vision and Vision Guided Robotics Market Size, By Application, 2025– 2030 (USD Billion)

Table 50 RoW Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018-2023 (USD Billion)

Table 51 RoW Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2025– 2030 (USD Billion)

Table 52 RoW Machine Vision and Vision Guided Robotics Market Size, by Region, 2018-2023 (USD Billion)

Table 53 RoW Machine Vision and Vision Guided Robotics Market Size, by Region, 2025– 2030 (USD Billion)

Table 54 Snapshot – Cognex Corporation

Table 55 Snapshot – Basler AG

Table 56 Snapshot – Absolute Vision

Table 57 Snapshot – ISRA Vision AG

Table 58 Snapshot – Teledyne Digital Imaging Inc.

Table 59 Snapshot – STEMMER IMAGING AG

Table 60 Snapshot – Eastman Kodak Company

Table 61 Snapshot – OMRON Corporation

Table 62 Snapshot – Allied Vision Technologies GmbH

Table 63 Snapshot – Keyence Corporation

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Machine Vision and Vision Guided Robotics Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Machine Vision and Vision Guided Robotics Market Highlight

Figure 12 Global Machine Vision and Vision Guided Robotics Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 13 Global Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018 - 2030 (USD Billion)

Figure 14 Global Machine Vision and Vision Guided Robotics Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 15 Global Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018 - 2030 (USD Billion)

Figure 16 Global Machine Vision and Vision Guided Robotics Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 17 North America Machine Vision and Vision Guided Robotics Market Highlight

Figure 18 North America Machine Vision and Vision Guided Robotics Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 19 North America Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018 - 2030 (USD Billion)

Figure 20 North America Machine Vision and Vision Guided Robotics Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 21 North America Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018 - 2030 (USD Billion)

Figure 22 North America Machine Vision and Vision Guided Robotics Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Machine Vision and Vision Guided Robotics Market Highlight

Figure 24 Europe Machine Vision and Vision Guided Robotics Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 25 Europe Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018 - 2030 (USD Billion)

Figure 26 Europe Machine Vision and Vision Guided Robotics Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 27 Europe Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018 - 2030 (USD Billion)

Figure 28 Europe Machine Vision and Vision Guided Robotics Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Machine Vision and Vision Guided Robotics Market Highlight

Figure 30 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Machine Vision and Vision Guided Robotics Market Size, by Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Machine Vision and Vision Guided Robotics Market Highlight

Figure 36 RoW Machine Vision and Vision Guided Robotics Market Size, By Product, 2018 - 2030 (USD Billion)

Figure 37 RoW Machine Vision and Vision Guided Robotics Market Size, By Offering, 2018 - 2030 (USD Billion)

Figure 38 RoW Machine Vision and Vision Guided Robotics Market Size, By Application, 2018 - 2030 (USD Billion)

Figure 39 RoW Machine Vision and Vision Guided Robotics Market Size, By End-Use Industry, 2018 - 2030 (USD Billion)

Figure 40 RoW Machine Vision and Vision Guided Robotics Market Size, by Region, 2018 - 2030 (USD Billion)

Machine Vision and Vision Guided Robotics Market Coverage

Product Insight and Forecast 2025-2030

- PC-based Machine Vision Systems

- Smart Camera-Based Machine Vision systems

- Vision Guided Robotics

Offering Insight and Forecast 2025-2030

- Hardware

- Camera

- Frame Grabber

- Optics/Lenses

- LED Lighting

- Processor

- Software

- Barcode Reading

- Standard Algorithm

- Deep Learning Software

- Services

- Integration

- Solution Management

Application Insight and Forecast 2025-2030

- Quality Assurance & Inspection

- Positioning & Guidance

- Measurement

- Identification

End-Use Industry Insight and Forecast 2025-2030

- Industrial

- Non-Industrial

Geographical Segmentation

Machine Vision and Vision Guided Robotics Market by Region

North America

- By Product

- By Offering

- By Application

- By End-Use Industry

- By Country – U.S., Canada, and Mexico

Europe

- By Product

- By Offering

- By Application

- By End-Use Industry

- By Country – Germany, U.K., France, Italy, Spain, and the Rest of Europe

Asia-Pacific (APAC)

- By Product

- By Offering

- By Application

- By End-Use Industry

- By Country – China, Japan, India, South Korea, Singapore, and the Rest of Asia-Pacific

- Machine Vision and Vision Guided Robotics Market Coverage

Rest of the World (RoW)

- By Product

- By Offering

- By Application

- By End-Use Industry

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Machine Vision and Vision Guided Robotics Market