Industry Overview

The Position Sensor Market is projected to achieve a significant milestone, reaching a valuation of USD 9.8 billion by 2030. This growth is attributed to its expanding presence in the manufacturing industry, driven by the increasing need for precise measurements and comprehensive inspection. Furthermore, the adoption of position sensors in the aviation, aerospace, and automotive sectors is rapidly gaining momentum. With their widespread usage across various industry verticals, the demand for position sensors is poised to experience a substantial surge, contributing to the market's upward trajectory.

Now a day’s multiple sensor types are used in products to enhance their functioning and get more accurate results. The position sensor is used in a device to measure the distance traveled by a device from a certain reference position. The sensor measures both linear as well as angular position. Also, the sensor can be used to sense the presence or absence of an entity.

Now a day’s multiple sensor types are used in products to enhance their functioning and get more accurate results. The position sensor is used in a device to measure the distance traveled by a device from a certain reference position. The sensor measures both linear as well as angular position. Also, the sensor can be used to sense the presence or absence of an entity.

Position Sensor Market Segmentation

Insight by Types

On the basis of type, the market is segmented as linear sensor and rotary sensor. The linear sensor is further broken down into linear encoders, linear variable differential transformers (LVDT), magnetostrictive sensors, linear potentiometers, laser position sensors. Whereas, the rotary sensor is segmented as rotary encoders, rotary potentiometers, rotary variable differential transformers, and resolvers. Among these types, the rotary position sensor segment captures a higher market share in 2022 and is expected to grow at the fastest rate during the forecast period, owing to its numerous applications in automotive, aviation, healthcare, consumer electronics, and other emerging areas.

Insight by Contact Type

On the basis of contact type, the market is subdivided into contact and non-contact. Among these, non-contact type sensor accounted for the foremost share in the position sensor market in 2019 due to high precision and adoption in multiple industries.

Insight by Application

On the basis of application, the market is subdivided into machine tools, robotics, motion systems, material handling, and test equipment. Of all these applications, the machine tools segment accounted for a foremost share in the position sensor market in 2023, owing to the integration of these sensor types in multiple tools used in manufacturing such as an automated guided vehicles, robots, cobots, and processing machines.

Global Position Sensor Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. xx.x Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 9.8 Billion

|

|

Growth Rate

|

8.5%

|

|

Segments Covered in the Report

|

By Type, By Contact Type, By Application and By End-User Industry

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Position Sensor Industry Trends

IoT and device automation are two major trends driving the position sensor market in current phase. The growing adoption of autonomous vehicles with enhanced features promotes the use of different sensors including position sensor in the automotive industry.

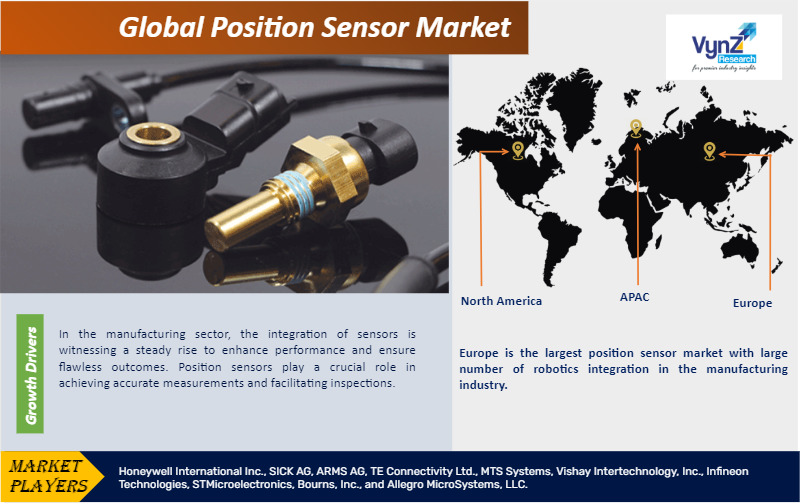

Position Sensor Market Growth Drivers

In the manufacturing sector, the integration of sensors is witnessing a steady rise to enhance performance and ensure flawless outcomes. Position sensors play a crucial role in achieving accurate measurements and facilitating inspections. Moreover, these sensors find extensive utilization in the aviation and aerospace industry to ensure precise distance measurement.

Position Sensor Market Challenges

High cost of ownership of position sensors may obstruct the growth of the sensor market in several industries such as consumer electronics, processing industry and so on.

Position Sensor Market Geographic Overview

Geographically, Europe is the largest position sensor market with large number of robotics integration in the manufacturing industry. Besides, the region is home to some of the major automotive manufacturers, this will further up surge the growth of the position sensor market in years to come.

Further, North America and APAC hold the second and third largest position sensor market share respectively, due to the growing automotive production, and the increasing deployment of robotics in industries, this as result is also creating a positive impact on the position sensor market growth globally.

Position Sensor Market Competitive Insight

Key players in the in the position sensor market are regularly focusing on new product development and existing product enhancement to sustain and grow in the market. Further, merger & acquisition are other key strategies adopted by the players in the ecosystem. For instance, in January 2020, HLD Europe, an investment holding firm with 12 companies in Europe acquired Exxelia, the Europe based manufacturer of high reliability passive components and electromechanical systems to enhance its product portfolio and global each

Some of the key players operating in the position sensor market are Honeywell International Inc., SICK AG, ARMS AG, TE Connectivity Ltd., MTS Systems, Vishay Intertechnology, Inc., Infineon Technologies, STMicroelectronics, Bourns, Inc., and Allegro MicroSystems, LLC.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data and have key opinions from the industry experts. The key profiles approached within the industry includes, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behaviour.

The Position Sensor Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- Linear Sensor

- Rotary Sensor

- By Contact Type

- By Application

- Machine Tools

- Robotics

- Motion Systems

- Material Handling

- Test Equipment

- By End-User Industry

- Manufacturing

- Automotive

- Aviation & Aerospace

- Electronics

- Healthcare

- Other

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Now a day’s multiple sensor types are used in products to enhance their functioning and get more accurate results. The position sensor is used in a device to measure the distance traveled by a device from a certain reference position. The sensor measures both linear as well as angular position. Also, the sensor can be used to sense the presence or absence of an entity.

Now a day’s multiple sensor types are used in products to enhance their functioning and get more accurate results. The position sensor is used in a device to measure the distance traveled by a device from a certain reference position. The sensor measures both linear as well as angular position. Also, the sensor can be used to sense the presence or absence of an entity..png)