- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Power Electronics Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9088 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 275 |

Global Power Electronics Market – Analysis and Forecast (2025-2030)

Industry Insight by Device Type (Power Discrete (Diode, Transistors, and Thyristor), Power Modules (Intelligent Power Modules and Power Integrated Modules), and Power IC (Power Management Integrated Circuit (PMIC) and Application-Specific Integrated Circuit (ASIC))), by Material (Silicon, Silicon Carbide, Sapphire, Gallium Nitride, and Others), by Voltage (Low Voltage, Medium Voltage, and High Voltage), by Industry Vertical (Consumer Electronics, Industrial, Automotive & Transportation, ICT, Aerospace & Defense, Energy & Power, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Power Electronics Market is expected to witness substantial growth in the coming years. According to market projections, it is predicted to expand from USD 30.6 billion in 2023 to USD 54.9 billion by 2030, reflecting a steady compound annual growth rate (CAGR) of 4.5% during the forecast period spanning from 2025 to 2030.

Power electronics is an application of a solid-state circuit device that transforms electrical power from one form to another using diodes, transistors, and thyristors for effective and efficient control. Power electronics regulate the unidirectional and bidirectional flow of energy which is dependent on usage and regenerated energy is sent back for utility. Power electronics manufacturers are concentrating on producing devices that can function at high power densities. The benefits provided by these devices include simplified circuits, less drive power, and optimal reverse and forward blocking capabilities, thereby improving efficiency in application areas. Automotive and transportation, industrial, renewable energy, consumer electronics, defense, and aerospace extensively use power electronics devices.

The COVID-19 outbreak has hurt the power electronics market owing to disruption in the supply chain and disruption in international trade. This has resulted in a shortage of semiconductors' raw materials and components in the initial phases of the coronavirus pandemic. However, the outbreak has driven the advancement and innovations in ADAS, self-driving cars, and the electric vehicles market and has boosted the demand for power electronics devices.

Power Electronics Market Segmentation

Insight by Device Type

The global power electronics market is divided by the device types into power discrete, power modules, and power IC segments. The power discrete segment is further divided into diode, transistors, and thyristor, the power modules segment into intelligent power modules and power integrated modules, and the power IC segment into power management integrated circuit (PMIC) and application-specific integrated circuit (ASIC). Out of all these segments and subsections, the power discrete segment is expected to contribute a larger share to the market during the forecast period due to the growing adoption of diodes, transistors, and thyristors and lower energy consumption by specific devices like BJTs, IGBTs, and MOSFETs, and others. Moreover, higher applicability in the industrial sector, low noise emission, and growing adoption of electrical power grids, industrial motor drives, power inverters, and converters bolsters the growth of this segment. On the other hand, the power IC segment will also grow during the forecast period due to increasing application in wireless and satellite communication, electronic warfare, and radio frequency.

Insight by Material

The global power electronics market is also divided by different materials into silicon, silicon carbide, sapphire, gallium nitride, and other segments. Out of these segments, the silicon power electronics segment will contribute a larger share of the market due to low power consumption and higher appropriateness in applications without needing a wide bandgap. Also, the widespread availability of silicon facilitates manufacturing on a large scale, further helping the segment to grow.

Insight by Voltage

According to the voltage, the global power electronics market is divided into low voltage, medium voltage, and high voltage segments. Out of these three segments, the high voltage segment will contribute a larger share of the market due to greater efficiency in executing operations at high current or voltage and faster switching rate.

Insight by Industry Vertical

Different industry verticals also divide the global power electronics market into consumer electronics, industrial, automotive, transportation, ICT, aerospace & defense, energy & power, and other segments. Out of these segments, the consumer electronics segment is expected to surpass others in terms of growth during the forecast period due to growing adoption in emerging economies of specific consumer electronics devices like smartphones, tablets, and smart wearables and higher usage in home appliances. The automotive sector is also expected to grow due to the notable impact on this industry during the forecast period due to the temporary shutdown of factories, supply chain disruption, and lower buyer confidence, all of which result in higher demand for energy-efficient hybrid EVs due to strict government policies.

Global Power Electronics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 30.6 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 54.9 Billion |

|

Growth Rate |

4.5% |

|

Segments Covered in the Report |

By Device Type, By Material, and By Voltage, By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Power Electronics Industry Trends

There are notable changes and trends within the power electronics market, and one of the most notable trends is the growing adoption of automation and Industry 4.0 practices. Manufacturers also invest huge amounts in research and development practices. Add to that, governments now are also more supportive and designing policies to promote market growth. Another significant change in the application of this technology is the advent of microprocessors and semiconductor devices. Furthermore, innovations are facilitated due to the development and higher usage of wide bandgap (WBG) semiconductor devices, which is the result of the growing adoption of superior materials like SiC, GaN, and others.

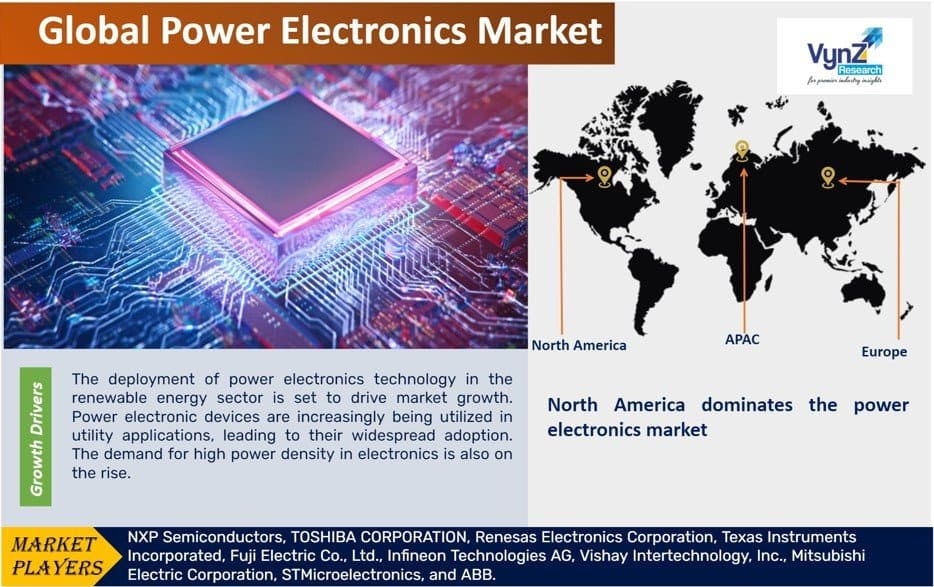

Power Electronics Market Growth Drivers

The most significant growth driver of the global power electronics market is the higher deployment of technology in the renewable energy sector and utility applications. The wide adoption of this technology due to the growing need for high power density in electronics, as well as the growing demand for SiC-based photovoltaic cells in developing economies such as India, China, and Brazil, are also promoting market growth. Furthermore, the rise in the number of hyper-scale data centers that need more efficient power solutions further boosts market expansion. Also, the significant benefits of using power electronic devices include high performance, higher electrical stability, and efficient energy consumption, as well as promoting market growth, allowing electrified vehicle applications and battery-powered portable devices to contribute to market growth.

Power Electronics Market Challenges

The primary factor hindering the market growth is the complexities involved in the integration process of advanced electronic devices, which raises the implementation costs significantly due to requirements of specific expertise, methodology, skills, and toolsets. Some other notable challenges include leakage of current, especially at high temperatures, the high cost of infrastructure deployment, and the frequent changes in demand for more efficient and compact devices at low cost, which the manufacturers find difficult to cope with.

Power Electronics Market Opportunities

The growth opportunities lie in the growing demand for plug-in electric vehicles (PEVs) and rapid industrialization drives in developing economies. Growth opportunities are also offered by usage of power devices by smart grids to promote energy conservation and the development of power MOSFET.

Power Electronics Market Geographic Overview

North America is expected to dominate the global power electronics market due to strong 5G infrastructure and its further development, growing industrial automation practices, and rising number of networks of charging stations in the region.

The APAC market, on the other hand, is expected to grow fast due to a large number of consumer electronics, automotive, ICT, and industrial sectors in developing countries like China, Japan, and South Korea. It is also attributed to the growing demand for power generation, rising population in developing countries like India and China, supportive government initiatives to promote renewable energy infrastructure, higher deployment of communication infrastructure, and presence of industry majors like BYD, Huawei, Mitsubishi Electric, Fuji Electric, Toshiba and others.

Power Electronics Market Competitive Insight

The industry players are focusing on novel product development and innovations in power electronics to have a competitive edge in the market. They are emphasizing enhancing device packaging, growing current density, enhancing energy efficiency, and accomplishing low noise operations. The industry players are focusing on strategies like acquisitions, market analysis, partnerships, collaborations, and new ventures to remain competitive in the market.

Toshiba provides a diverse range of semiconductor products and designs that are innovative, high-quality, and efficient. Toshiba manufactures an extensive range of single-phase and three-phase uninterruptible power supply (UPS) solutions and accessories that provide superior performance. For renewable energy applications, TIC Power Electronics is a home for SCiB Rechargeable Battery and the E1000 Energy Management System.

Infineon Technologies offers an extensive variety of products and includes microcontrollers, LED drivers, sensors, and Automotive & Power Management ICs. With the addition of gallium nitride, Infineon now has the sole full-spectrum portfolio of all power technologies – silicon (Si), silicon carbide (SiC), and gallium nitride (GaN). They provide highly reliable IGBTs, power MOSFETs, GaN e-mode HEMTs, power discrete, protected switches, Si drivers, GaN drivers, IGBT modules, intelligent power modules (IPMs), linear regulators, motor control solutions, LED drivers, and all forms of AC-DC, DC-DC, and digital power conversion from microamps to megawatts.

The prominent players in the power electronics market include NXP Semiconductors, TOSHIBA CORPORATION, Renesas Electronics Corporation, Texas Instruments Incorporated, Fuji Electric Co., Ltd., Infineon Technologies AG, Vishay Intertechnology, Inc., Mitsubishi Electric Corporation, STMicroelectronics, and ABB.

Recent Developments by Key Players

Renesas Electronics Corporation (a premier supplier of advanced semiconductor solutions) has acquired Transphorm, Inc. (a global leader in gallium nitride (GaN)) to offer GaN-based power products and related reference designs to meet the rising demand for wide bandgap (WBG) semiconductor products.

Mitsubishi Electric Corporation has partnered with Nexperia B.V. to develop silicon carbide (SiC) power semiconductors for the power electronics market. Industry sources added that Mitsubishi Electric will leverage its wide-bandgap semiconductor technologies to develop and supply SiC MOSFET chips that Nexperia will use to develop SiC discrete devices.

The Power Electronics Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Device Type

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Modules

- Power Integrated Modules

- Power IC

- Power Management Integrated Circuit (PMIC)

- Application-Specific Integrated Circuit (ASIC)

- Power Discrete

- By Material

- Silicon

- Silicon Carbide

- Sapphire

- Gallium Nitride

- Others

- By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- By Industry Vertical

- Consumer Electronics

- Industrial

- Automotive & Transportation

- ICT

- Aerospace & Defense

- Energy & Power

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Device Type

1.2.2. By Material

1.2.3. By Voltage

1.2.4. By Industry Vertical

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Device Type

5.1.1. Power Discrete

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Power Modules

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.1.3. Power IC

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2030

5.2. By Material

5.2.1. Silicon

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Silicon Carbide

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Sapphire

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.2.4. Gallium Nitride

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2030

5.2.5. Others

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2030

5.3. By Voltage

5.3.1. Low Voltage

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Medium Voltage

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. High Voltage

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.4. By Industry Vertical

5.4.1. Consumer Electronics

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Industrial

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. Automotive & Transportation

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.4.4. ICT

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2030

5.4.5. Aerospace & Defense

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2030

5.4.6. Energy & Power

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2030

5.4.7. Others

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Device Type

6.2. By Material

6.3. By Voltage

6.4. By Industry Vertical

6.5. By Country – U.S., Canada, and Mexico

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Device Type

7.2. By Material

7.3. By Voltage

7.4. By Industry Vertical

7.5. By Country

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Device Type

8.2. By Material

8.3. By Voltage

8.4. By Industry Vertical

8.5. By Country

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Device Type

9.2 By Material

9.3. By Voltage

9.4. By Industry Vertical

9.5. By Country

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. NXP Semiconductors

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. TOSHIBA CORPORATION

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Renesas Electronics Corporation

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Texas Instruments Incorporated

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Fuji Electric Co., Ltd.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Infineon Technologies AG

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Vishay Intertechnology, Inc.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Mitsubishi Electric Corporation

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. STMicroelectronics

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. STMicroelectronics

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Power Electronics Market, By Device Type, 2018 - 2023 (USD Billion)

Table 5 Global Power Electronics Market, By Device Type, 2025 - 2030 (USD Billion)

Table 6 Global Power Electronics Market, By Material, 2018 - 2023 (USD Billion)

Table 7 Global Power Electronics Market, By Material, 2025 - 2030 (USD Billion)

Table 8 Global Power Electronics Market, By Voltage, 2018 - 2023 (USD Billion)

Table 9 Global Power Electronics Market, By Voltage, 2025 - 2030 (USD Billion)

Table 10 Global Power Electronics Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 11 Global Power Electronics Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 12 Global Power Electronics Market, By Region, 2018 - 2023 (USD Billion)

Table 13 Global Power Electronics Market, By Region, 2025 - 2030 (USD Billion)

Table 14 North America Power Electronics Market, By Device Type, 2018 - 2023 (USD Billion)

Table 15 North America Power Electronics Market, By Device Type, 2025 - 2030 (USD Billion)

Table 16 North America Power Electronics Market, By Material, 2018 - 2023 (USD Billion)

Table 17 North America Power Electronics Market, By Material, 2025 - 2030 (USD Billion)

Table 18 North America Power Electronics Market, By Voltage, 2018 - 2023 (USD Billion)

Table 19 North America Power Electronics Market, By Voltage, 2025 - 2030 (USD Billion)

Table 20 North America Power Electronics Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 21 North America Power Electronics Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 22 North America Power Electronics Market, By Region, 2018 - 2023 (USD Billion)

Table 23 North America Power Electronics Market, By Region, 2025 - 2030 (USD Billion)

Table 24 Europe Power Electronics Market, By Device Type, 2018 - 2023 (USD Billion)

Table 25 Europe Power Electronics Market, By Device Type, 2025 - 2030 (USD Billion)

Table 26 Europe Power Electronics Market, By Material, 2018 - 2023 (USD Billion)

Table 27 Europe Power Electronics Market, By Material, 2025 - 2030 (USD Billion)

Table 28 Europe Power Electronics Market, By Voltage, 2018 - 2023 (USD Billion)

Table 29 Europe Power Electronics Market, By Voltage, 2025 - 2030 (USD Billion)

Table 30 Europe Power Electronics Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 31 Europe Power Electronics Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 32 Europe Power Electronics Market, By Region, 2018 - 2023 (USD Billion)

Table 33 Europe Power Electronics Market, By Region, 2025 - 2030 (USD Billion)

Table 34 Asia-Pacific Power Electronics Market, By Device Type, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific Power Electronics Market, By Device Type, 2025 - 2030 (USD Billion)

Table 36 Asia-Pacific Power Electronics Market, By Material, 2018 - 2023 (USD Billion)

Table 37 Asia-Pacific Power Electronics Market, By Material, 2025 - 2030 (USD Billion)

Table 38 Asia-Pacific Power Electronics Market, By Voltage, 2018 - 2023 (USD Billion)

Table 39 Asia-Pacific Power Electronics Market, By Voltage, 2025 - 2030 (USD Billion)

Table 40 Asia-Pacific Power Electronics Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 41 Asia-Pacific Power Electronics Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 42 Asia-Pacific Power Electronics Market, By Region, 2018 - 2023 (USD Billion)

Table 43 Asia-Pacific Power Electronics Market, By Region, 2025 - 2030 (USD Billion)

Table 44 RoW Power Electronics Market, By Device Type, 2018 - 2023 (USD Billion)

Table 45 RoW Power Electronics Market, By Device Type, 2025 - 2030 (USD Billion)

Table 46 RoW Power Electronics Market, By Material, 2018 - 2023 (USD Billion)

Table 47 RoW Power Electronics Market, By Material, 2025 - 2030 (USD Billion)

Table 48 RoW Power Electronics Market, By Voltage, 2018 - 2023 (USD Billion)

Table 49 RoW Power Electronics Market, By Voltage, 2025 - 2030 (USD Billion)

Table 50 RoW Power Electronics Market, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 51 RoW Power Electronics Market, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 52 RoW Power Electronics Market, By Region, 2018 - 2023 (USD Billion)

Table 53 RoW Power Electronics Market, By Region, 2025 - 2030 (USD Billion)

Table 54 Snapshot – NXP Semiconductors

Table 55 Snapshot – TOSHIBA CORPORATION

Table 56 Snapshot – Renesas Electronics Corporation

Table 57 Snapshot – Texas Instruments Incorporated

Table 58 Snapshot – Fuji Electric Co., Ltd.

Table 59 Snapshot – Infineon Technologies AG

Table 60 Snapshot – Vishay Intertechnology, Inc.

Table 61 Snapshot – Mitsubishi Electric Corporation

Table 62 Snapshot – STMicroelectronics

Table 63 Snapshot – ABB

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Power Electronics Market- Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Power Electronics Market Highlight

Figure 12 Global Power Electronics Market, By Device Type, 2018 - 2030 (USD Billion)

Figure 13 Global Power Electronics Market, By Material, 2018 - 2030 (USD Billion)

Figure 14 Global Power Electronics Market, By Voltage, 2018 - 2030 (USD Billion)

Figure 15 Global Power Electronics Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 16 Global Power Electronics Market, By Region, 2018 - 2030 (USD Billion)

Figure 17 North America Power Electronics Market Highlight

Figure 18 North America Power Electronics Market, By Device Type, 2018 - 2030 (USD Billion)

Figure 19 North America Power Electronics Market, By Material, 2018 - 2030 (USD Billion)

Figure 20 North America Power Electronics Market, By Voltage, 2018 - 2030 (USD Billion)

Figure 21 North America Power Electronics Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 22 North America Power Electronics Market, By Region, 2018 - 2030 (USD Billion)

Figure 23 Europe Power Electronics Market Highlight

Figure 24 Europe Power Electronics Market, By Device Type, 2018 - 2030 (USD Billion)

Figure 25 Europe Power Electronics Market, By Material, 2018 - 2030 (USD Billion)

Figure 26 Europe Power Electronics Market, By Voltage, 2018 - 2030 (USD Billion)

Figure 27 Europe Power Electronics Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 28 Europe Power Electronics Market, By Region, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Power Electronics Market Highlight

Figure 30 Asia-Pacific Power Electronics Market, By Device Type, 2018 - 2030 (USD Billion)

Figure 31 Asia-Pacific Power Electronics Market, By Material, 2018 - 2030 (USD Billion)

Figure 32 Asia-Pacific Power Electronics Market, By Voltage, 2018 - 2030 (USD Billion)

Figure 33 Asia-Pacific Power Electronics Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 34 Asia-Pacific Power Electronics Market, By Region, 2018 - 2030 (USD Billion)

Figure 35 RoW Power Electronics Market Highlight

Figure 36 RoW Power Electronics Market, By Device Type, 2018 - 2030 (USD Billion)

Figure 37 RoW Power Electronics Market, By Material, 2018 - 2030 (USD Billion)

Figure 38 RoW Power Electronics Market, By Voltage, 2018 - 2030 (USD Billion)

Figure 39 RoW Power Electronics Market, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 40 RoW Power Electronics Market, By Region, 2018 - 2030 (USD Billion)

Global Power Electronics Market Coverage

Device Type Insight and Forecast 2025-2030

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Modules

- Power Integrated Modules

- Power IC

- Power Management Integrated Circuit (PMIC)

- Application-Specific Integrated Circuit (ASIC)

Material Insight and Forecast 2025-2030

- Silicon

- Silicon Carbide

- Sapphire

- Gallium Nitride

- Others

Voltage Insight and Forecast 2025-2030

- Low Voltage

- Medium Voltage

- High Voltage

Industry Vertical Insight and Forecast 2025-2030

- Consumer Electronics

- Industrial

- Automotive & Transportation

- ICT

- Aerospace & Defense

- Energy & Power

- Others

Geographical Segmentation

Power Electronics Market by Region

North America

- By Device Type

- By Material

- By Voltage

- By Industry Vertical

- By Country – U.S., Canada, and Mexico

Europe

- By Device Type

- By Material

- By Voltage

- By Industry Vertical

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Device Type

- By Material

- By Voltage

- By Industry Vertical

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Device Type

- By Material

- By Voltage

- By Industry Vertical

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- NXP Semiconductors

- TOSHIBA CORPORATION

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Fuji Electric Co. Ltd.

- Infineon Technologies AG

- Vishay Intertechnology Inc.

- Mitsubishi Electric Corporation

- STMicroelectronics

- ABB

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Global Power Electronics Market – Analysis and Forecast (2025-2030)

- The global power electronics market will grow from USD 30.6 billion to reach USD 54.9 billion at a CAGR of 4.5%.

- The market is segmented by the type of devices, material, voltage, and industry verticals, and each segment has a different subsection. These segments, or their subsections, have significant growth potential during the forecast period.

- The market is segmented by the type of devices, material, voltage, and industry verticals, and each segment has a different subsection. These segments, or their subsections, have significant growth potential during the forecast period.

- The growth drivers of the market include higher adoption in the renewable energy sector, utility applications, growing demand for high power density in the electronics sector, rise in the number of hyper-scale data centers, and the significant benefits offered.

- The growth drivers of the market include higher adoption in the renewable energy sector, utility applications, growing demand for high power density in the electronics sector, rise in the number of hyper-scale data centers, and the significant benefits offered.

- The market growth is hindered by the complexity of the integration, which needs specific expertise, tools, and methods to simplify, thereby increasing the cost. Growth opportunities lie in the growing demand for PEVs and rapid industrialization in emerging countries.

- North America leads the market due to robust 5G infrastructure, further development, higher industrial automation, and growing networks of charging stations. The APAC market will grow fast due to rising demand and growing consumer electronics, ICT, and automotive sectors.