Industry Overview

The projected growth of the Global Printed Electronics Industry is poised to be significant, with an estimated increase from USD 9.78 billion in 2023 to a remarkable USD 28.3 billion by 2030. This forecast period, spanning from 2025 to 2030, anticipates a compound annual growth rate (CAGR) of 18.4%.

Printed electronics refers to a specialized and more advanced printing technology. It is primarily used in making electronic devices by printing or substrates. The effectiveness of this technology increases its applicability across a wide range of industry verticals such as consumer electronics, automotive, healthcare, and others. Ideally, the growth in consumer demand and its extensive use across different industries have forced the manufacturers of these devices to produce more efficient and lightweight devices of better quality. These include products like smart TVs, antennas, keyboards, and more.

Printed Electronics Market Segmentation

Insight by Material

The global printed electronics market is divided by material type into inks and substrates segments, where the segment is further divided into conductive inks, dielectric inks, and more. The conductive inks subsection is further split into conductive silver inks, conductive copper inks, transparent conductive inks, silver copper inks, and carbon inks. On the other hand, the substrates segment is further divided into organic and inorganic substrates, where the organic substrates segment is further segmented into polymers (polyimides, polyethylene naphtholate, and polyethylene terephthalate), paper (polyacrylate, polystyrene, polyvinylpyrrolidone (PVP), and polyvinyl alcohol), and others. The inorganic substrates are further segmented into glass and other inorganic substrates. Out of all these segments and subsegments, the inks segment will dominate the market. It will grow at a high CAGR during the forecast period due to higher usage and adoption in the fabrication process of printed electronics, along with the rise in demand for advanced printing technologies to design compact devices.

Insight by Printing Technology

According to the printing technology, the global printed electronics market is divided into inkjet printing, screen printing, flexographic printing, gravure printing, and other segments. The inkjet printing segment has other segments like continuous and drop-on-demand inkjet printing, where the latter is further split into thermal, piezo, and electrostatic drop-on-demand inkjet printing. The screen-printing segment has other divisions like flatbed and rotary screen printing. Screen printing segment will dominate the market due to widespread adoption to produce sensors and displays, commercialized devices like laptops and smartphones, to produce photovoltaic (PV) cells, and easy application on multiple flexible and durable inks and dyes. However, inkjet printing will grow significantly due to flexible features, compactness, less material consumption, and lower setup cost.

Insight by Resolution

The global printed electronics market is also divided by resolutions into below 100 lines/cm, 100 To 200 lines/cm, and above 200 lines/cm. Out of these, the latter will grow more during the forecast period at a higher CAGR due to growing adoption to develop new and more functional printed electronics.

Insight by Application

Diverse applications also divide the global printed electronics market into displays, RFID tags, batteries, photovoltaic cells, lighting, and other segments. The displays segment is divided further into e-paper displays and electroluminescent (EL) displays, and the former is further split into electrochromic displays, electrophoretic displays, and others. The electroluminescent (EL) displays segment is also subdivided into OLED, flexible OLED, and LCDs. The PV cells are subdivided into sensors, touch sensors, gas sensors, humidity sensors, pressure sensors, image sensors, temperature sensors, and others. The lighting segment is further subdivided into electroluminescent lighting and OLED lighting. Out of these, the lighting segment will grow more since it will replace expensive halogen, tungsten, and fluorescent lamps. The OLED displays will also grow due to higher demand for customized, energy-efficient, and economical lighting and higher investments by the government to develop printed OLED-based lighting. The sensor segment will also grow during the forecast period due to the growing demand for IoT devices across several industry verticals.

Insight by End-User

Different end users divide the global printed electronics market into automotive, transportation, healthcare, consumer electronics, aerospace, defense, construction, architecture, retail, packaging, and other segments. Among all these segments, the aerospace and defense sector is expected to grow more during the forecast period at a higher CAGR due to lightweight design, higher reliability, simplicity, and fewer maintenance requirements.

Global Printed Electronics Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 9.78 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 28.3 Billion

|

|

Growth Rate

|

18.4%

|

|

Segments Covered in the Report

|

By Material, By Printing Technology, By Resolution, Application, and By End User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Printed Electronics Industry Trends

There is a significant growth noticed in the electronics industry across the globe. Another significant trend noticed in this industry is the growing demand for next-gen flexible and energy-efficient products. Furthermore, the growing prominence of advanced technologies like IoT and the rise in demand for more sophisticated and feature-rich OLED displays and printed RFID devices have also been noticed, prompting higher usage of this technology.

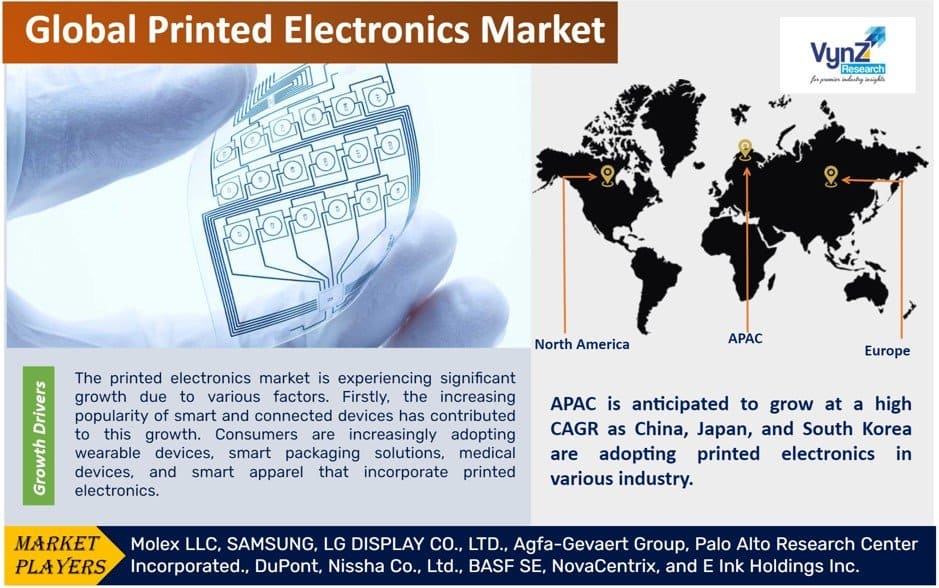

Printed Electronics Market Growth Drivers

The primary growth factor of the global printed electronics market is the growing popularity of smart connected devices. Consumers today prefer smart packaging solutions, wearable and medical devices, and smart apparel, all of which incorporate printed electronics, thereby promoting its growth. The benefits gained in the form of higher adaptability and lightweight design push the market forward as do the innovations in this field. Advanced technologies in screen printing and additive production process along with the growing usage of printed panels and sensors in navigation systems in different vehicles promote market growth. These are also extremely useful for a wide range of automotive applications, which promotes the overall growth of the printed electronics market.

Printed Electronics Market Challenges

The significant challenges to the growth of the global printed electronics market include high installation costs and a lack of awareness regarding development of inks and substrates to enhance the performance of printed electronics. It is also attributed to the commercialization of novel and cost-effective inks.

Printed Electronics Market Opportunities

The 3D manufacturing process and the adoption of novel applications present growth opportunities. There is also a huge amount of money invested in R&D by the market players to improve their functionalities and higher integration into several products, which also offers notable growth opportunities.

Printed Electronics Market Geographic Overview

The APAC market is expected to grow more during the forecast period due to a higher concentration of industries, their development, and increased activities in developing countries like China, Japan, and South Korea that need to use printed electronics. The rise in demand for electronic gadgets such as mobile phones and tablets, along with wearable devices like AR headsets and fitness trackers, propel market growth in this region.

Printed Electronics Market Competitive Insight

The manufacturers are adopting technology into different products based on the requirement and supply it to the retailers or distributors for sales. The industry players are entering into various strategies like M&A, partnerships, and product launches, and focusing on R&D activities to enhance printing capabilities and establish an edge against the competitors.

PARC is one of the leading innovators in printed electronics and has experience in electronics and provides new and current printing technology according to industrial specifications. They are developing printing multi-material 3D objects with electronic and mechanical functionality.

Molex is one of the leading providers of connectors and interconnect components. Molex offers a wide range of innovative PE designs to develop customer programs from concept to commercialization, aiding customers to fulfill their design dreams. Molex is one of the market leaders in three industrial areas: fine-line printing, large-format printing, and high-speed and roll-to-roll printing.

Some of the industry players in the printed electronics market include Molex LLC, SAMSUNG, LG DISPLAY CO., LTD., Agfa-Gevaert Group, Palo Alto Research Center Incorporated., DuPont, Nissha Co., Ltd., BASF SE, NovaCentrix, and E Ink Holdings Inc.

Recent Developments by Key Players

Molex has opened a new 23,000-square-meter facility in Poland for expanding its medical device output for Philips-Medisize.

Agfa and EFI have entered into a collaboration to leverage each other's cutting edge technologies.

The Printed Electronics Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Material

- Inks

- Conductive Inks

- Conductive Silver Inks

- Conductive Copper Inks

- Transparent Conductive Inks

- Silver Copper Inks

- Carbon Inks

- Dielectric Inks

- Others

- Substrates

- Organic Substrates

- Polymers

- Polyimides

- Polyethylene naphthalate,

- Polyethylene Terephthalate

- Paper

- Polyacrylate

- Polystyrene

- Polyvinylpyrrolidone (PVP)

- Polyvinyl Alcohol

- Other Organic Substrates

- Inorganic Substrates

- Glass

- Other Inorganic Substrates

- By Printing Technology

- Inkjet Printing

- Continuous Inkjet Printing

- Drop-On-Demand Inkjet Printing

- Thermal Drop-On-Demand Inkjet Printing

- Piezo Drop-On-Demand Inkjet Printing

- Electrostatic Drop-On-Demand Inkjet Printing

- Screen Printing

- Flatbed Screen Printing

- Rotary Screen Printing

- Flexographic Printing

- Gravure Printing

- Others

- By Resolution

- Below 100 Lines/cm

- 100 To 200 Lines/cm

- Above 200 Lines/cm

- By Application

- Displays

- E-Paper Displays

- Electrochromic Displays

- Electrophoretic Displays

- Other E-Paper Displays

- Electroluminescent (EL) Displays

- OLED Displays

- Flexible OLED Displays

- LCD

- RFID Tags

- Batteries

- Photovoltaic Cells

- Sensors

- Touch Sensors

- Gas Sensors

- Humidity Sensors

- Pressure Sensors

- Image Sensors

- Temperature Sensors

- Others

- Lighting

- Electroluminescent Lighting

- OLED Lighting

- Others

- By End-User

- Automotive and Transportation

- Healthcare

- Consumer Electronics

- Aerospace and Defense

- Construction and Architecture

- Retail and Packaging

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)